September greetings from the Midwest and Southeast. Rather than show a picture of rural America (I am building up a considerable collection), this week’s opening picture is a throwback rediscovered during our recent move back to Kansas City – the Georgetown University Sprint Leadership sessions I attended in 2006-2007 (see top row, second from right, next to current Ligado CEO Doug Smith). Gratuates of this particular class now lead and manage some of the leading wireless and wireline communications companies in the world. A testimony to the focus on management development at that time.

This week, we will attempt to estimate the magnitude of the Apple iPhone launch on each of the market providers. While it is nuanced, we think that when a telecom CEO talks about operating software related to iOS and Android, it deserves some analysis.

Prior to that, a quick shoutout to Davis Hebert at CreditSights for allowing me some time to share my thoughts with several dozen of you on rural broadband and the overall state of telecom. We had a terrific discussion that spanned the spectrum. Sorry to say, there is not a recorded copy.

The Week That Was

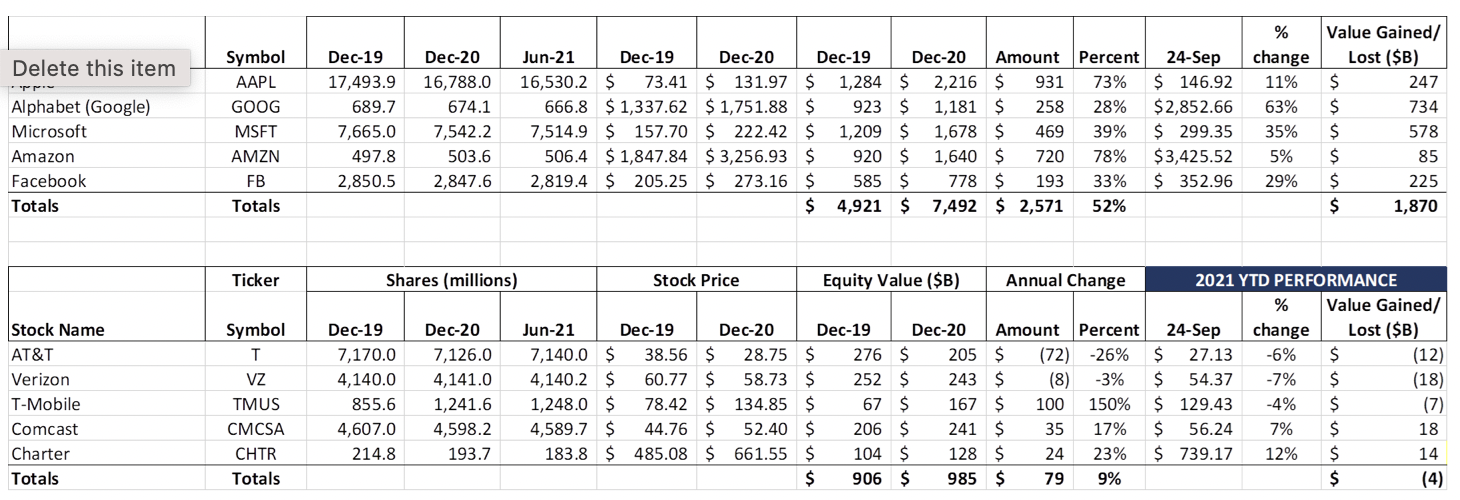

September has been unkind to stocks in the past, and this year is no exception. $132 billion in market cap has been lost in the last two weeks across the ten stocks that we cover – $92 of that with the Fab Five, and the remaining $40 billion across the Telco Top Five. Only Google and Microsoft managed to increase value over the last two weeks, and the best performer in the Telco Top Five was AT&T — with no gain.

There has been a lot of focus on third quarter earnings quality, much of it coming from investor conferences. Comcast CFO Michael Cavanaugh made the following comment at the Bank of America Communications and Entertainment Conference:

“…COVID has been a big disruption to the business. I mean, it’s really disrupted the patterns of our customers in terms of move patterns, seasonal activity, back-to-school and the like. And especially with the Delta wave that we’ve been facing, especially in the last couple of months, we’re not settled down post the kind of disruptions caused by COVID. So what we’re seeing in the most recent past, like the tail end of August, is a little bit of a slowdown in the net adds in the Cable business.

“So in the third quarter, I think we’ll trend in line for third quarter net adds with historical averages for third quarter, but we’ll be behind the third quarter 2019, which was a record third quarter. But when you put the second and third quarter together of this year, where we kind of saw the flip side of it in the second quarter, we expect to be about 10% better combined for over the trailing 6 months versus 2019. And we continue to see ourselves ahead of 2019 for the full year. And sooner or later, we’re going to see COVID get behind us and see this quarterly volatility that we see as just COVID-driven fall away and which gets us to really what happens after COVID, which hopefully is 2022 and beyond. And I think that will be the case.”

That comment resulted in a 5.4% loss in the company’s market cap (roughly $13 billion). All because the last 70 days were not behaving in the same manner as 24 months ago. That’s the craziness of today’s market (for more craziness, check out the market’s reaction following comments made at the Goldman Sachs Communicopia conference last week – over a 20% drop in value from Tuesday’s close).

If that isn’t crazy enough, Facebook introduced an updated version of their Portal+ hardware (see nearby picture). In their September 21 announcements (here and here), they highlighted Facebook’s focus on business collaboration (not a misprint) and their inclusion of Teams on all Portal devices starting at the end of December. We don’t have a lot of visibility into Portal’s quantities, but the inclusion of small business collaboration is interesting (there’s information in the release on how to create a Facebook Work Account in the article link above). We are interested in the Portal from a consumer perspective and believe that the smart camera functionality (12 MP today, but we see 20+ MP by next year) creates an application advantage for fiber providers who are looking for a proof positive differentiator versus upstream-constrained cable competitors.

Continuing the crazy theme, Walmart, the parent company of the StraightTalk MVNO (run by Tracfone, who is soon to be owned by Verizon) announced that T-Mobile and Metro by T-Mobile will be launching in 2,300 Walmart stores starting October 18 (full announcement here). While this will take time to get momentum, creating a buzz at Walmart will accelerate T-Mobile’s ability to scale in rural America. This includes the availability of T-Mobile’s Home Internet product which is mentioned in the link above.

Finally, T-Mobile is returning to Sprint’s roots with the reintroduction of in-store repairs (announcement here). This time, the person doing the work will be an Assurant employee (not T-Mobile). 500 stores will start with more on the way. Device protection is becoming even more important as prices go up and Equipment Installment Plans are extended. An interesting way to improve store value without undertaking significant labor expense.

The Iconic Device Effect

There is no other event as important to the wireless industry as the iPhone launch. This is the chance for companies worth hundreds of billions of dollars to associate themselves with a global company worth 2.4 trillion dollars. It’s bigger than Christmas, Mother’s Day, and Back to School combined.

Apple launches cement the co-dependence between the carriers and Cupertino. While they complain privately about how Apple device sales create no profit, each of the carriers has devised plans that entice customers who have already purchased an iPhone (net of the trade-in costs) to enter into a 24, 30 or 36-month device purchase agreement which depends on trade-in credits that expire if customers leave early.

Consider the case of AT&T. Here’s what happens with a transaction:

- Customer decides to upgrade to the iPhone 13

- They have an eligible trade-in and elect to pay off their device in 36 monthly installments. Note: AT&T is requiring the 36 months for the trade-in credit

- They purchase the device (and pay sales taxes at time of sale)

- They also select an umlinited plan

Basically, the customer receives the net of device value versus Apple retail costs, and this is applied to the unlimited rate. If an AT&T customer is already on an unlimited plan, no issues, but if the customer is converting from a legacy plan, the ARPU increase could be $15-20/ mo.

AT&T, while they have an upfront cost (reminiscent of the subsidy model that existed prior to Equipment Installment Plans), receives a 36-month relationship (note: Verizon and T-Mobile have shorter intervals on their equipment installment palns). For T-Mobile to create a switching event, they would need to buy out the remaining credit stream due to the customer from AT&T.

If this is not head spinning enough, Apple is competing against the carriers for financing, offering generous trade-in values that net upfront against the value of the device. This enables the customer to finance through Apple (and Citizens Financial or Goldman Sachs, depending on whether the financing source is Apple Card or not) and not be subject to a plan upgrade that many carriers are requiring (considering that customers can also lower their monthly payments by 3% using the Apple Card, it’s two trips instead of one, but the Apple route appears to be the more financially attractive path all things considered).

There was a time when hardware and service were difficult to bifurcate. AT&T as Ma Bell combined phone leases with home and business phone service. The gas grill we owned in Brookside (small, but wonderfully efficient) was sold to the previous owner in the late 1960s by the gas company. Few folks purchase their own cable modems rather than lease one from our broadband provider (one cannot imagine leasing multiple 4K TVs from our satellite or cable provider or even YouTube TV). Bifurcation of hardware from service has been the rule generally speaking, until the advent of the smartphone.

The traditional postpaid model (purchase a device for some amount down, but pay a higher MRC to cover the subsidy over a 24-month contract life) worked well when the subsidies were manageable (no subsidy in the case of some lower-end smartphones). But, as the Apple ecosystem has taken hold, up front payments were less attractive. Enter Equipment Installment Plans, now accompanied by trade-in credits over a period of time (24 months for most iPhones except for AT&T). Can this model be reversed?

The simple answer is “probably not.” Customers wll gladly hold on to their devices for longer periods of time and may even buy the Pro Model to ensure that their obsolescense is minimized (interesting takeaway from this CNET review is that the iPhone 12 Pro Max camera now forms the base of the iPhone 13. There is logic to the argument that higher-end purchases reduce obsolescense risk).

Are there ways beyond unlimited plan conversion to create carrier value (and perhaps some differentiation)? John Stankey had a very interesting comment this week at the Goldman Sachs Communicopia conference (transcript here) which sheds some insight on where AT&T might be headed (video here – comments below at ~ 40 minute mark):

“… we’ve now started doing some things quietly behind the scenes, we have another muscle to build here, which is how do we begin to work on software to differentiate our products and services in a way that makes our product better than what our competitors can do because we do have a different asset base, and we are able to serve every corner of the market from the largest of enterprises to the smallest apartment somewhere in the United States. And I don’t think we’ve done as much as we can do in that vein to actually make that real for our customers and the right products and the right services and the right offers. And so rebuilding that product engine that we can do that and begin to differentiate allows us to do things that won’t necessarily just hinge on, can I get an attractive handset.”

There is a lot to unpack from this statement, but it speaks to where the #3 provider might be looking to challenge Verizon and T-Mobile. To capture what this means with respect to Apple (also a very strong software provider), it means that iOS and AT&T’s on-phone communications software (the section is called the connection manager) will need to work more closely together. Creating more efficient handoffs and using alternate spectrum, whether it’s the Generally Authorized Access (GAA) section of the CBRS band, or unutilized capacity within their new wholesale partner Dish (which might be auctioned to them on a real-time basis) creates differentiation. We don’t think it’s going to cause a lot of customers to move to AT&T because of it, but that AT&T is thinking about it is significant.

We also think that this software focus could extend to how certain applications function. We started to see a glimpse of where this is headed with Google’s YouTube TV 4K product announcement. While we love YouTube’s user interface and easy identification of 4K programming, our eye was drawn to the ability for YouTube TV users to download recorded content (re: YouTube TV allows all content to be recorded and viewed for a year. There are no capacity limitations).

The issue with this is that users have to plan (and planning is quickly becoming a lost art in an increasingly work from home environment) to download content to their devices. Once you are on the plane (or on a train with poor Wi-Fi coverage), it’s too late. What if AT&T automatically provided the first 30 minutes of all saved content to YouTube TV 4K customers (or DirecTV streaming customers with the same feature, or HBO Max customers)? Where AT&T can control the default settings (or have them quickly accessible in an edge server), they can forge new and different partnerships.

Getting serious about network integration with applications (carrier customized cloud) creates differentiation. It might allow many AT&T DSL customers to be less frustrated about their abysmal service because the content did not need to come through the copper pipe (at least right away). It could alleviate network congestion during peak busy hours and therefore force less traffic prioritization (impacting Cricket and many reseller base customer satisfaction).

The other asset we wish AT&T would attempt to coordinate with Apple is their in-car Wi-Fi. How can all of that connnectedness improve the customer experience? If an unlimited connected car experience were included in all family plans, how would that change AT&T’s competitiveness? We have talked about this in a previous brief a while back on AT&T but the failure to integrate tens of millions of connected vehicles via software will go down as one of the great missed opportunities in Ma Bell’s history.

Software has been an attractive value generator to many companies over the past decades. It’s allure might present well in the boardroom but must be matched by a focused release commitment. AT&T’s ambitions, translated into reality, could produce unique differentiation over time. It’s ability to discover, deliver, and communicate value sources to customers has to be proven. But John Stankey’s comments show the importance of new hardware releases to AT&T along with the need to create competitive differentiation.

That’s it for this week’s Brief. In two weeks, we will be fully absorbed with 3Q earnings insights. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals and Go Royals, Go Sporting KC and Go Chiefs!