When it comes to small cell densification in the U.S., markets can be segmented by their current stage of deployment

Mobile wireless data traffic in the U.S. hit another record high in 2020, topping 42 trillion MBs, which represents a 208% increase since 2016, according to industry trade group CTIA. As result, mobile network operators (MNOs) are prioritizing network densification, which will increase the capacity of their networks, helping them deliver the consistent, reliable and speedy service that 5G has promised.

Densification will involve new deployments and upgrades at the macro level, as well as large-scale deployments of small cells, particularly for those carriers and MNOs interested in making significant use of higher frequency bands like millimeter wave (mmWave).

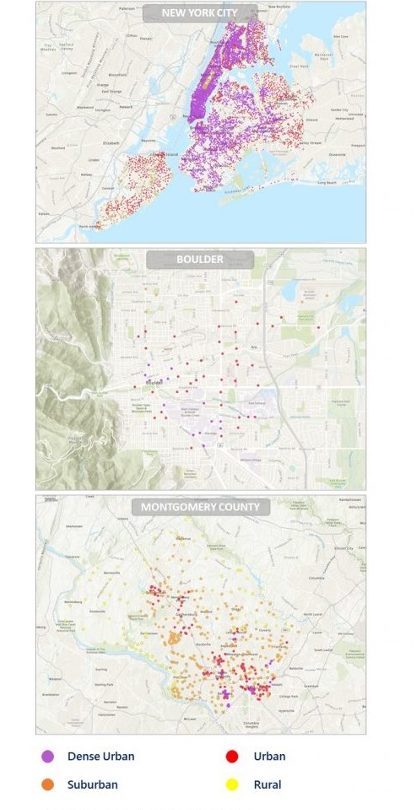

When it comes to small cell deployment in the U.S., the markets, according to data from Altman Solon, can be segmented by their current stage of deployment:

- Dense metropolitan cities such as New York, Boston and Chicago are typically the leaders in small cell growth in the U.S. They have had small cells deployed for at least four to five years and have established franchise agreements with major carriers.

- Growth locations such as Boulder or Fort Worth, with mid-size population densities, often have deployments in a “Central Business District” and have a small cell deployment history of about three to five years. These environments are continuing to evolve and mature.

- Early-stage areas of suburbia, where small cells and outdoor Distributed Antenna Systems (DAS) are proliferating, such as Montgomery County, MD.

In early 2021, Verizon, which already operates around 14,000 small cells, announced plans to deploy 15,000 additional Crown Castle small cells over the next four years in currently unspecified U.S. locations. The operator expects this number to grow to around 30,000 by the end of 2021.

In contrast, T-Mobile US believes it has too many small cells on its hands. During a Wells Fargo event this past June, T-Mobile US’ President of Technology Neville Ray shared that because it merged with Sprint, the operator has “in the 70,000-plus range on small cells” because “both companies were building out small cells to supplement limited spectrum in certain areas, certain coverage hotspots and so on” prior to the deal.

“Some of them,” he said, “not a huge volume, but some of them are in areas where clearly now either T-Mobile or Sprint has a tower base that makes the requirement for the small cell go away because of that macro strength and capacity.”

So, while small cells will remain a “key part of the [T-Mobile] strategy,” Ray reiterated earlier statements that the operator will focus on scaling that number down to 50,000.

For AT&T, the approach to small cell deployment “depends on the bands and needs of [its] network,” according to the carrier’s VP of Mobility and Access Architecture Gordon Mansfield.

In an email correspondence with RCR Wireless News, Mansfield said: “For mid bands, our focus is densification in high traffic and hard to cover areas to help ensure that we provide connectivity with the right level of capacity for our customers. For high bands, our strategy is targeted at locations and venues where customers can get the most benefit of new experiences delivered over this spectrum — think venues like AT&T Stadium, where we can deliver immersive experiences to fans; airports, where our customers can download their favorite content in seconds prior to boarding a plane; and campuses and entertainment districts where value can be derived.”

For more on small cell densification, check out What are the top small cell use cases and places? and Is powering small cells the greatest densification challenge?