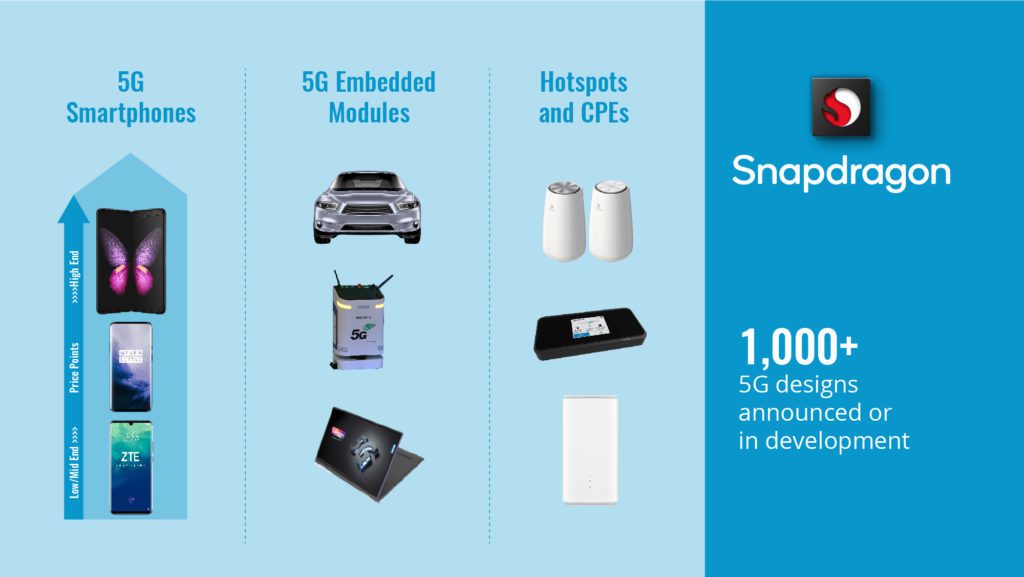

The benefits brought about by the introduction of 5G are clearly identified, notably offering higher data throughput, enhanced signal reliability and lower latency, but it is the use of 5G beyond the mobile devices ecosystem that makes this generation so distinct from the others. Indeed, the market under 2G/3G and 4G was viewed as a technology-led evolution, with smartphones at the forefront of this change, but this is not the case for 5G. The promise of 5G is designed to unlock innovative use cases and democratize the experience for growth beyond mobile phones, reaching new form factors and market segments to exponentially expand 5G device types.

Through the addition of 5G, the device User Experience (UX) can be improved immeasurably from previous generations, making integration highly desirable and advantageous, offering the chance to better unleash its full capabilities. This has led many across the 5G value chain to build and enhance their spheres of influence, with Original Equipment Manufacturers (OEMs), chipset vendors and webscalers alike expanding their offerings to incorporate new device types while addressing other market adjacencies such as the Internet of Things (IoT), connected personal computers and notebooks, smart home gateways, fixed wireless Computer Premises Equipment (CPEs) and automotive.

Figure 1: Democratizing 5G Adoption—Qualcomm Continues Expanding Non-Smartphone Design Wins

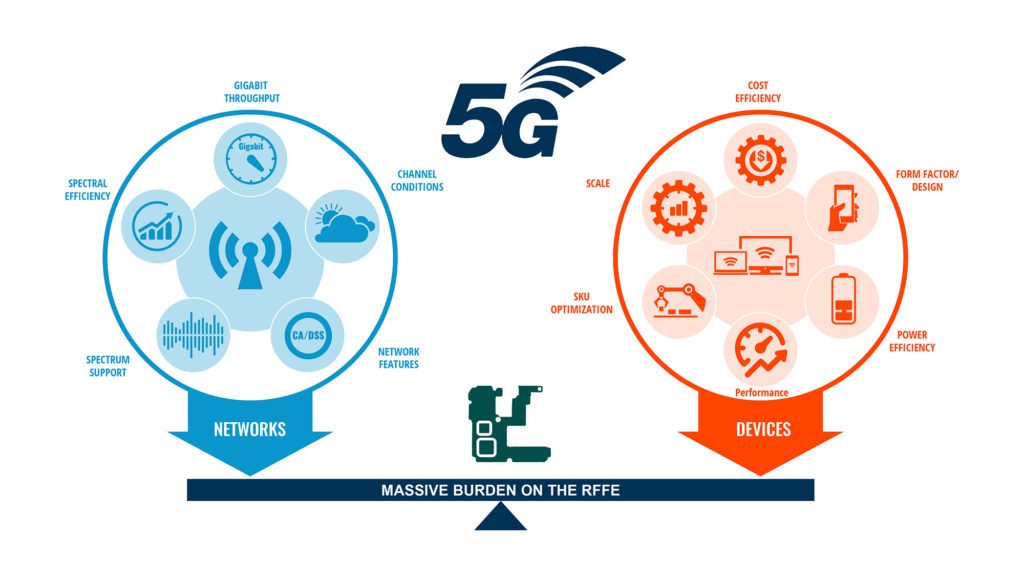

With such an explosive interest in the expansion of 5G across both devices and networks, there are expected pain points which will be significantly enhanced by the industry’s fast transformation. Chief among these difficulties is the massive burden placed on the Radio Frequency Front End (RFFE), caused by the need to address the main features and functionalities inherent to both networks and devices that are manifested as the market drives toward 5G. These characteristics will all need to be resolved if the industry is to reap the full benefits of implementing 5G and fulfill its massive market potential.

Figure 2: 5G Networks and Devices Transformation Causing Massive Burden to the RFFE

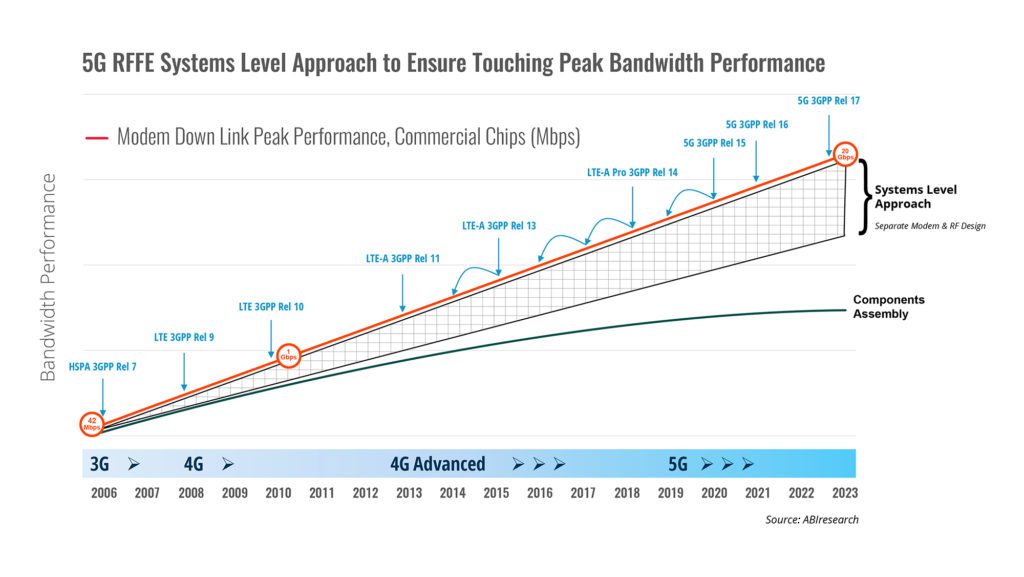

With the market continuing its rapid transition to 5G, and despite the solid roadmaps for 5G chipset designs to help bolster the delivery of 5G mobile devices across price tiers, it is becoming increasingly obvious that Radio Frequency (RF) systems and the exploding quantities and choice of appropriate RF Front End components will become fundamental differentiators. This is particularly challenging for OEMs, as it makes their components procurement process and system design far more complex, which could lead to lengthy product development cycles, more expensive devices, and put huge constraints on device industrial designs.

This is even more challenging for traditional non-smartphone OEMs, who want to differentiate by adding “always-on” connectivity to device types beyond the traditional mobile phone. These players have expertise in building connectivity solutions and rely on the help of radio technology experts so that they can focus on what they are good at: Bringing premium experiences to their customers.

As a result, and to overcome these challenges, smartphone and non-smartphone OEMs will now have to move away from component assembly and adopt system-level designs from the antenna to the modem, solving the integration of the whole 5G cellular system design into their devices, from the antenna to the modem.

It is here that the use of RFFE system design and help from End-to-End specialized RF solutions providers will offer welcome support to OEMs, which will help greatly in tapping into and unlocking modem peak performance. In addition, the RFFE system design will enable OEMs to reduce overall device power consumption and lower costs while accelerating time to market. The stark reality is that as OEMs delegate the RF front end to a third party, without compromising the efficiency of the RFFE system designs and the overall device form factor, they can rarely afford to wait or else risk facing market lag of two to three years, losing time-to-market and, consequently, market share.

Figure 3: 5G RFFE Systems Level Approach to Ensure Touching Peak Bandwidth Performance

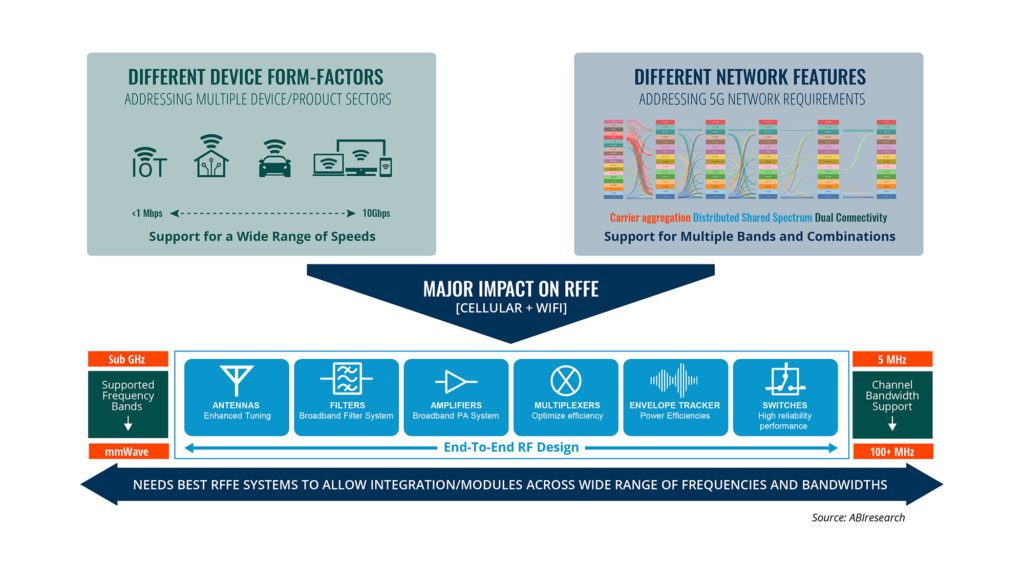

To help alleviate the burden of RF system designs, bundled and monolithically integrated components such as filters, Power Amplifiers (PAs), duplexers and switches have continued apace. These have been supplied from the likes of Murata, Skyworks, Avago, Broadcom, Qorvo and Qualcomm, to help OEMs. The technology characteristics of these components often depend on the operating frequencies of the network, the carrier channel bandwidth and the device type targeted in terms of cost and bands supported. This means OEMs will have to pick and choose from a variety of technologies to be able to cover all their product portfolio.

However, while the offer of these high-performance, monolithically integrated modules is necessary, such an approach is not enough for overall 5G performance. Additionally, there is an imminent need for modem-RF system design to further enhance the overall solution while lowering power consumption.

Moreover, an important aspect to tackle in the 5G RFFE is filters, which have been an integral part of mobile devices by shaping a signal with a specific frequency and reducing interference. Filters are essential as the market moves to 5G, unlocking high bandwidth as well as next generation Wi-Fi co-integration. With such a wide array of frequencies and bandwidths to support across 2G/3G/4G and 5G, as well as Wi-Fi, Bluetooth and Global Navigation Satellite Systems (GNSS), the sheer number of filters needed in a device has grown exponentially — up to 100 filters in one device — while the pressure on them to perform has become even more important. In addition, with this growing number of filter chips, their gains need to meet commercial benchmarks across multiple frequency bands and bandwidths. They must also remain low cost and very small so as to not impact on the overall device form factor.

A variety of filters are available to the market, notably acoustic-based filter technologies such as Surface Acoustic Wave (SAW) and Bulk Acoustic Wave (BAW), each of which have their strengths in distinct frequency bands and come with varying levels of complexity and costs. However, as OEMs want to minimize regional Stock Keeping Units (SKUs), the ability to pack so many filters into a device becomes a challenge as they attempt to strike a balance between achieving the best gain and power consumption against the use of these differing, competing filter technologies.

Indeed, devices that support 5G can range from those designated for low spectrum carriers operating in low bands to others that support mmWave and operate with 100MHz carriers. The OEMs have to select the best technology that can help create filters that are most optimal across the various frequencies. This needs to be one filter type as it is difficult to integrate across technologies and adds complexity to the procurement process. In addition, filters are added to other components, e.g., PA Module integrated Duplexers (PAMids), so there will need to be some harmonization of the technology as they use different processes. Implementing harmonization of a filter technology helps to create scale and lowers the cost of filter systems, while also helping miniaturization.

Figure 4: Major Market Impacts on 5G RFFE Unveil Filters to be the Most Challenging to Address

Ultimately, device democratization of 5G will be constrained by the RFFE and, in turn, it is the filters within the RF that will be the most challenging area to address. Available filter technologies have their strengths in specific bands and channels, but OEMs will want to implement a technology that allows integration as best as possible across the whole spectrum. But as no one filter technology fits all, the debate over which is the one best technology that will rule them all, and what companies will lead the market, continues to rage on.

Moreover, the shift to 5G has stimulated a growing need for higher performance filters, which are needed to serve higher frequencies above 3GHz, meaning that BAW looks to be the most likely beneficiary, although with more competition expected from the introduction of new players and filter technologies, the expanding filter market is far from settled.