The latest IDC report revealed that global smartphone shipments are down 6.7% as a result of the ongoing chip shortage

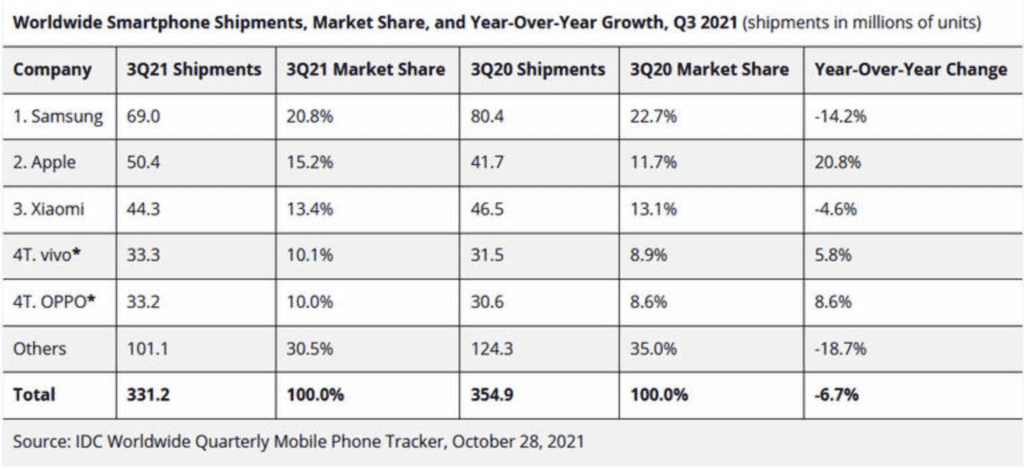

Despite a double-digit annual growth rate in the first half of 2021— 25% in the first quarter of 2021 and more than 13% in the second quarter — the latest International Data Corporation (IDC) report revealed that global smartphone shipments are down 6.7% as a result of the ongoing chip shortage. The decline is almost double the 2.9% descent that IDC forecasted for the period. During the third quarter of 2021, shipments dropped to 331.2 million, according to the report.

Blaming this downfall primarily on supply chain constraints, Nabila Popal, research director with IDC’s Mobility and Consumer Device Trackers, commented, “The supply chain and component shortage issues have finally caught up to the smartphone market, which until now seemed almost immune to this issue despite its adverse impact on many other adjacent industries.”

Different regions suffered varying levels of shipment declines. Central and Eastern Europe and Asia/Pacific — excluding Japan and China — reported the biggest drops at -23.2% and -11.6%, respectively. The U.S., on the other hand, experienced a setback of just -0.2%, followed by Western Europe with a -4.6% downturn and China with a -4.4% fall.

While Samsung suffered a 14.2% decline in smartphone shipments, the biggest of any vendor, it still came out on top with 69 million phones shipped, according to IDC. During the same period last year, however, the vendor shipped a staggering 80.4 million units.

Apple came in at number two as iPhone shipments hit about 50 million thanks to strong pre-order numbers for the iPhone 13. The rest of the top 5 was occupied by Chinese vendors Xiaomi, OPPO and Vivo. Xiaomi, which came in third even saw shipments fall in the third quarter, while OPPO and Vivo both had an increase in shipments.

Last month, research firm Canalys reported a nearly identical decline in smartphone shipments last month, also laying the blame on global chip shortages.

However, IDC commented that challenges for smartphone vendors go beyond the supply chain as they are also facing stricter testing and quarantining policies that were implemented to control the spread of the coronavirus. Further, in China, power supply constraints have limited the industry’s ability to manufacture core components.

IDC’s Popal added that when it comes to the supply challenge, in particular, the research firm does not anticipate shipment issues to improve until “well into next year.”