Speaking yesterday (November 15) with Enterprise IoT Insights about a new deal to supply BLE-based trackers to France-based aerospace manufacturer Safran Aircraft Engines, Orange Business Services portrayed itself as the orchestrator, practically, of Industry 4.0. It is a telling assessment, and an interesting case: the system integrator (SI) division of a mobile operator compiling a short-range IoT solution with nary a whiff of cellular anywhere.

Instead, the solution – composed in direct response to an enterprise problem – incorporates sundry tech from other providers: tracker tags from French firm ELA Innovation; network gear from Finnish outfit Quuppa; management platform from UK-based Ubisense. Speaking separately on a webinar with analyst house Omdia last week, about its work with operators at the edge, Google Cloud made the same point: that Industry 4.0 is a team sport.

“One of the biggest revelations is there isn’t a single entity that can build out the entire edge by themselves,” said Amol Phadke, its managing director for global telecom industry solutions. “It is just impossible,” he said. Actually, this is not such a revelation, of course; most of the low-power end of the IoT market – outside of sections of the cellular community, anyway – have been in desperate collaboration for years to make ‘massive IoT’ work somehow.

The likes of ELA, Quuppa, and Ubisense have been oriented as team players from the start; it is the same with the twin IT/OT teams variously engaged in industrial IoT crossover for Industry 4.0. The hyperscalers know it, too; they certainly know about “ecosystems”, and Google Cloud is essentially looking to replicate in industrial machines what its parent did in smartphones with Android, and create a springboard for Industry 4.0 to jump.

In fact, it is only a revelation for telecoms, actually; one should assume that Phadke – selling to telecoms companies with Google Cloud, addressing them in Omdia webinar – is only presenting these market dynamics through their eyes. It is a revelation for them, generally speaking – for a sector that is characterised as slow to grasp change. Except there are exceptions, too, of course; Orange Business Services appears to be one.

Nokia told Enterprise IoT Insights recently operators with dedicated SI divisions – like Orange, it said – are doing better at the industrial edge than others, positioned to play ‘point’ with enterprises, nominally for the supply of private LTE and 5G, but also for low-power cellular and non-cellular elements. Orange agrees, of course; it is “uniquely positioned” with Orange Business Services, it repeats during conversation (to be covered later this / next week).

Its deal with Safran shows some operators – Google Cloud would commend AT&T, Telefónica, Verizon (its partners), alongside; Deutsche Telekom has an SI unit in T-Systems; Vodafone talks a good game; there are others, too – are used to the ‘master builder’ role, as the foreman that cajoles the bricklayer, the plumber, the ‘sparky’. The ‘run’ phase, to manage 5G-based edge services, is less well developed, but most carriers reckon they are in with a shout.

But we have been trapped, again, by the entangled narrative around the role of mobile operators in Industry 4.0; they are not everything, clearly, especially as spectrum is liberated in international markets for enterprise operations, and cellular networking equipment is simplified and standardised. The point of this article is to define – or offer a single definition of – the ecosystem that is starting to pull together at the industrial edge. And Google Cloud has the baton.

Subscribe now to get the daily newsletter from RCR Wireless News

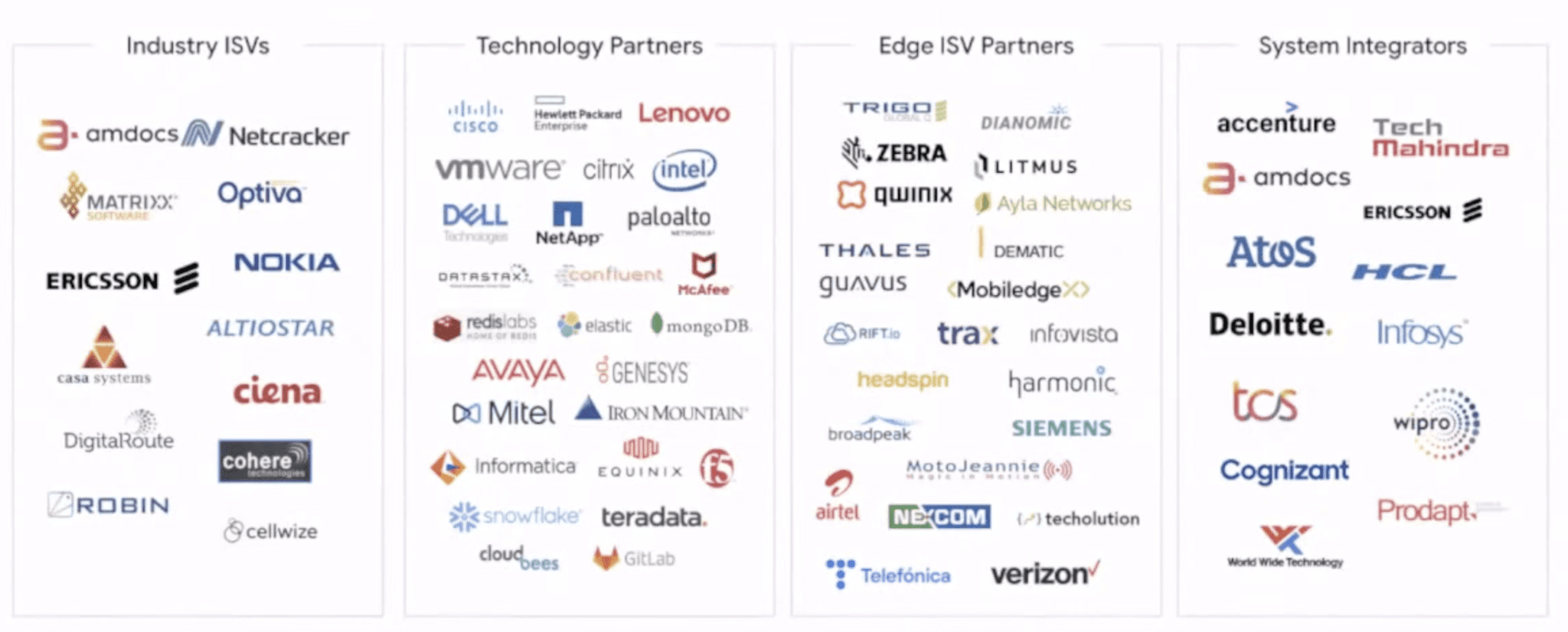

The hyperscaler-view is there are at least five key players – the famous five in the headline – in the Industry 4.0 mixer. It divides the technology ‘stack’ into three main parts (see image below): network vendors (effectively; or ‘industry ISVs’), compute vendors (‘technology partners’), and domain specialists (‘edge ISV partners’). More or less, this reflects Orange’s SI model with Safran, incorporating (in order) Quuppa, ELA, and Ubisense.

Cloud hyperscalers are in there too, alongside, as a fourth function. In the case of Google Cloud, it has just unveiled its new Google Distributed cloud (GDC) offer to extend cloud workloads to the network (MEC) and enterprise (private on-prem; private data-centre) edges. It goes up against Azure’s Edge Zones and AWS’s Wavelength. The fifth element, according to Phadke, is the system integrator, tasked with knocking heads and leading the negotiation.

Curiously (incidentally?), Google Cloud appears to place the operator set, bringing some of the 5G expertise, within its list of edge ISV partners, otherwise tasked with domain knowhow. Orange Business Services, and most other carriers, would probably prefer to be positioned with the system integrators, or / and adjacent old familiars like Ericsson and Nokia in the network supply-side. Either way, that is the core group, reckons Phadke.

He explains: “Broadly speaking, to enable any [Industry 4.0] use cases, we see there are at least four constituents, as a minimum, in addition to a cloud player. There is always going to be some sort of industry specific networking capability that we need to be enabled, which is what you see on the left hand side of the chart. In addition, you need a basic technology partner that enables your computing or storage or infrastructure or networking.

“The third pillar is the edge ISV itself – [which] is critical to create applications on top of that infrastructure. So you have these three very important ecosystem constituents… and this universe continues to expand. Think of it like a big bang moment, where you get this universe of partners that we have to onboard in that ecosystem. And finally, global integrators… stitch the whole solution together, in partnership with the [operator].”

See the other entries in this series:

Latency, but not as we know it – plus other industry drivers for the move to the edge

Five on treasure island – the key players sharing the spoils at the industrial edge

‘A thousand flowers will bloom’ – should carriers climb into bed with hyperscalers?