Private 5G network revenues are still a tiny fraction of the overall revenues in the telecom network market, but activity is on the rise and companies around the world are reporting hundreds of engagements with companies to deploy such networks, according to new analysis.

In a blog post, Stefan Pongratz, VP and analyst for the Radio Access Network market at Dell’Oro Group, takes a fresh look at the market potential of private 5G networks, versus the reality of where they stand currently in revenues.

“While there are already thousands of commercial private networks in service across the globe, it would be a stretch to suggest the commercial private 5G RAN market has surprised on the upside from a revenue perspective,” Pongratz wrote.

It’s a bit tricky to parse out the particulars of the private wireless market, because while there is general consensus among customers on what private wireless means, it can be achieved by “hundreds of deployment options”, Pongratz says, when you take into account all the various architecture, spectrum, RAN, core and business implementation models that are available.

“For end-users, private wireless typically means consistent, reliable, and secure connectivity, not accessible by the public, to foster efficiency improvements. For industrial sites, private wireless typically means low latency and high reliability,” Pongratz writes. “It is less about the underlying technology, spectrum, or business model and more about solving the connectivity challenge. In other words, end-users don’t care what is under the hood.”

But operators and network equipment manufacturers do care very much about what technology, spectrum and partners that enterprises use to achieve their private networks, because they are aiming to make private networks a new source of revenue. At this point, though, the hundreds of private networks that RAN vendors say they are building haven’t translated into inspiring revenue figures.

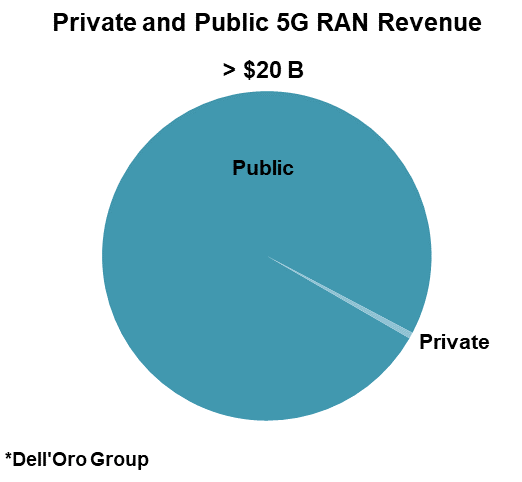

Pongratz writes that RAN vendors report private 5G revenues are “still negligible relative to the overall public and private 5G RAN market,” which continues to be dominated by investments in mobile broadband and Fixed Wireless Access. Technology-wise, private networks also are still primarily LTE affairs.

“We continue to believe that it will take some time for enterprises to fully conceptualize the value of 5G relative to Wi-Fi,” Pongratz writes. “And as much as we want 5G to be as easy to deploy and manage as Wi-Fi, the reality is that we are not yet there. … Still, the uptick in the activity adds confidence the industry is moving in the right direction.” He adds that private 5G New Radio revenues are still on track to pass the $1 billion mark by 2025.

Read Pongratz’s blog post here.