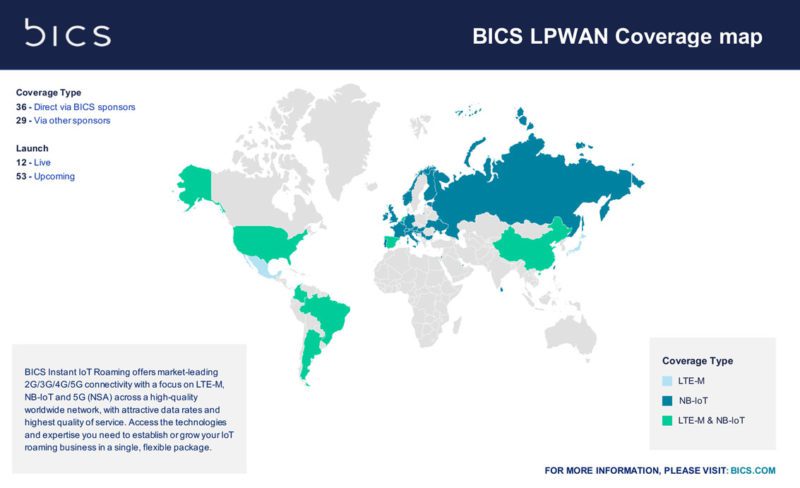

International cellular provider BICS has promised to offer the largest NB-IoT footprint in the world, to match its existing roaming coverage on 2G, 3G, and 4G in 700 networks and 200 countries, as NB-IoT networks are rolled out internationally by operators and international roaming arrangements are struck by BICS.

The Belgium-based firm has been busy through 2021 to ramp-up its cellular IoT roaming footprint, covering the twin LTE-based cellular IoT standards for low-power wide-area networking (LPWAN), in the form extremely low-power (narrowband) NB-IoT, geared for static fit-and-forget IoT monitors and intermittent tracking solutions, and more wider-band low-power LTE-M, better suited for always-on mobility solutions.

But after early progress from the cellular operators with LTE-M, and a flurry of LTE-M roaming agreements by BICS, the NB-IoT market has started to pick up. In general, the market views higher-powered LTE-M as a replacement technology for 2G, whereas lower-powered NB-IoT is pegged to kickstart the ‘massive IoT’ revolution, and reveal new IoT use cases to drive a broad-brushed ‘digital transformation’ in society. So the promise goes.

At last count, BICS claimed NB-IoT roaming deals in a dozen countries, with new contracts being signed at a faster rate than on LTE-M. It has smashed a loose target of “more than 20” NB-IoT roaming contracts by the year-end, and currently boasts 45 new NB-IoT and LTE-M destinations at the end of 2021. Electronics distributor Avnet, with which BICS has a go-to-market deal, says two thirds of “cellular requests” from IoT vendors are now for NB-IoT coverage.

Issues with network interoperability and airtime billing, as well as with roaming, have been largely dealt with, it reckons, in no small part thanks to the work of IoT-style MVNOs like BICS. Speaking with Enterprise IoT Insights (see video interview below), Mikaël Schachne, vice president of telco market at BICS, reflects: “We are doing the technical work and signing the agreements… [to have] the widest international coverage.”

He continues: “It’s a lot of effort. But we have done the same already, a long time ago, with 2G, 3G, and 4G – so you can enjoy cellular anywhere in the world. And we are going down the same road with NB-IoT to provide connectivity in more than 700 networks and 200 countries, at some point of time. BICS is aiming to provide the largest NB-IoT footprint in the world, and we are making progress every day with that.”

The excitement around NB-IoT is tangible, suddenly – among network operators, hardware makers, and solution providers. To labour a metaphor, it is almost like the ‘chosen one’ in the big IoT sphere; the technology that will finally drive the kind of ‘massive’ scale the IoT market has promised for years. Schachne explains: “[It brings] great benefits – like less power and smaller battery-size, which open the door to a brand new range of connected IoT devices.”

It means the IoT market can go in new ways, to develop new IoT devices for new IoT use cases – so the connection numbers spiral upwards, and digital-change extends outwards. Schachne (see video interview below) suggests there are three billion M2M or IoT devices kicking around, as it stands, and only 10 percent based on LPWAN technologies. “With NB-IoT… it could double to six billion devices five years from now [with] a quarter [connected] to NB-IoT or LTE-M.”

But why the hold-up, until now? What has taken massive IoT so long? “It’s a brand new technology,” responds Schachne, drawing a distinction between a novel LTE technology in a slide deck, or a 3GPP working group, and a technology in a national LTE network. “To really make use of it, you need to have coverage everywhere in the world. And for that, operators need to upgrade the network environment [and] sign new interconnect agreements.”

But why the hold-up, until now? What has taken massive IoT so long? “It’s a brand new technology,” responds Schachne, drawing a distinction between a novel LTE technology in a slide deck, or a 3GPP working group, and a technology in a national LTE network. “To really make use of it, you need to have coverage everywhere in the world. And for that, operators need to upgrade the network environment [and] sign new interconnect agreements.”

He adds: “We’ve seen a lot of great advances, especially, in regions like Europe, Asia, and the Americas. But there is still a lot to make sure that NB-IoT is available everywhere in the world, where NB-IoT devices are connecting. And this is where BICS is playing a big role. We are discussing with every mobile operator about opening up network access to make sure OEMs can benefit from it when sending their devices to those places in the world.”

As well as roaming deals with operators, and technical work with manufacturers, BICS has also helped to simplify the commercial model around inter-market NB-IoT airtime billing. The firm’s SIM for Things product sets a flat fee, on a monthly or annual deal; it does away with crazy per-MB charges, and provisional two-way settlement deals, and makes the IoT story easy for device makers, solution providers, and enterprise users to digest.

Schachne comments: “BICS is aiming to provide a simple value proposition to the hardware manufacturer, where they can have one price for their devices everywhere in the world. This is really the role we are playing to adapt the different commercial models of each individual mobile network to the needs of the OEM. [We are] acting as a facilitator and, somehow, simplifying the whole commercial environment, which can become extremely complex.”