Here at Dell’Oro Group, we have been asking ourselves why enterprise Wi-Fi 6 has been hit so hard by component shortages — where sequential shipment levels for many manufacturers have declined — when typically new technology shipments rise significantly quarter-to-quarter. We looked deeper into the dynamics of the Enterprise Wireless LAN market and identified three factors that may explain this phenomenon:

- A massive reversal in the permanent trend away from Wi-Fi 5 has disrupted the component planning and manufacturing of Wi-Fi 6.

- Preparing enterprise networks with Wi-Fi 6 for work-from-anywhere usage, particularly in North America, is amplifying demand.

- As wonderful as it is to the entire ecosystem to have governments “raining cash” into the Wireless LAN market, this influx of institutional capital is also amplifying demand.

A trend reversal derails the train

Dell’Oro Group has been tracking the enterprise class Wireless LAN market since 2000, and we have found that transitions to new wireless LAN technologies have followed a somewhat predictable cycle. The transition to Wi-Fi 6, however, has not followed suit. Indeed, in early 2020 — two years into the transition to Wi-Fi 6 —production and supply planning were disrupted to a degree that has made this transition unlike any other.

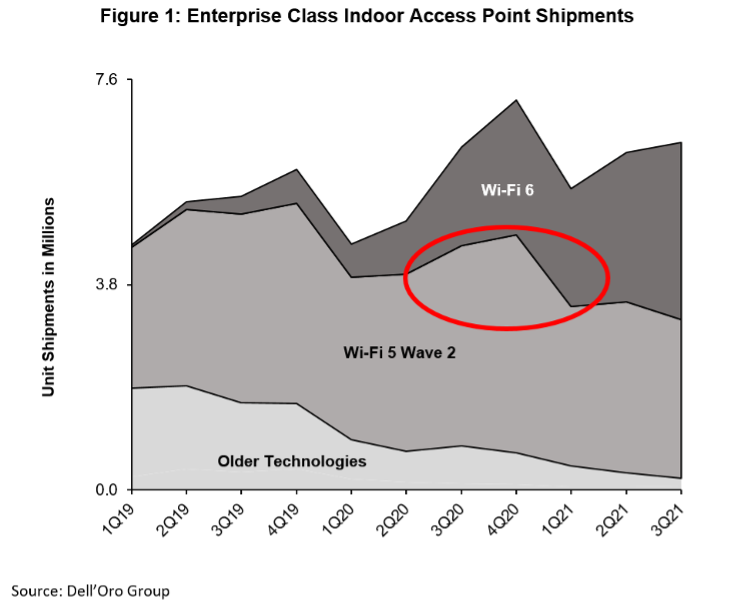

The pandemic caused a surge in entry level Wi-Fi 5 access points, as companies raced to outfit the home offices of remote employees with secure and reliable connectivity (as portrayed by the red circle in Figure 1). This surge disrupted supply and manufacturing plans at many manufacturers.

Had the transition away from Wi-Fi 5 followed the pattern of previous technology transitions, Wi-Fi 5 shipment volumes would have dropped sharply in 2020. Concurrently, component planning and manufacturing would have been focused wholly on Wi-Fi 6, rather than being split between two technologies (which is what happened).

Preparing enterprise networks for work-from-anywhere usage

The efforts to support the remote worker go beyond simply enabling home offices. The infrastructure must be advanced to the point that it can support collaboration among workers regardless of their locations. This involves (1) enabling a veritable tsunami of video content, which drives bandwidth and traffic prioritization support, and (2) providing security that is more dynamic and finer-tuned, such that it can identify the location and identity of a user and apply the appropriate policies and privileges. All of these requirements pile on top of the demands generated by users catching up with delayed projects from 2020.

Adding to Wi-Fi 6 shortages is the recent roaring comeback of sales to the Hospitality, Logistics and Retail verticals. These vertical industries typically make up approximately 20% of overall Wireless LAN market sales, but many businesses in these particular verticals closed or downsized significantly during the pandemic.

As noted at the outset of this paper, supply constraints have severely impacted the Enterprise class Wireless LAN market, with the affects becoming material in 2Q21. The senior executives of three vendors — Cisco, Extreme Networks and HPE Aruba —publicly announced that component supply constraints hindered their ability to fulfill WLAN orders during the quarter. Upon receiving manufacturers’ quarterly shipment data for 2Q21, we analyzed each company’s shipment performance over several years to assess how 2Q21 might have unfolded had there been no supply constraints. We calculated that overall market shipments fell short by approximately 15% of AP units. When taking network management and Artificial Intelligence (AI) applications into consideration, the reduction in potential sales levels was greater, closer to 25%.

In 3Q21, supply chain constraints worsened versus 2Q21 and prevented virtually all western-based manufacturers from fulfilling orders. The effects of this stoppage were exacerbated by the accelerating order rate. We were unable to estimate the 3Q21 shortfall based on public statements; however, it appears to be larger than that of 2Q21. Ultimately, orders that typically ship within two to six weeks are now taking three to six months, if not longer.

Through our recent interviews with distribution channel partners, we learned that supply chain constraints continue to spiral and likely will continue to worsen into 1H22. We also learned that these channel partners — which are closely involved with network architecture and evolution — do not believe that their customers at the very large enterprises are double ordering. Rather, end users are advancing order placements to factor in delivery delays.

Unprecedented government initiatives

Almost weekly, people ask me what is driving the current strong demand for enterprise Wi-Fi. Part of the answer is the extraordinary injection of government funding, which did not unfold after the recessions of 2001 and 2009. In the year or two following both of those down-turns, the unit growth rate of enterprise Wireless LAN access points exploded — phenomenal growth — and rose about 50% year over year.

More and more governments around the world are announcing funding initiatives to advance technology. Are we entering an “Eisenhower Era” of spending? This time on digital infrastructure, rather than on a colossal and decades-long buildout of railroads, super highways, bridges and business buildings. The pandemic has laid bare the importance of connectivity and governments around the world are increasing funding for existing programs and creating new ones.

For example, earlier in 2021, Germany announced a 6.6 B EUR DigitalPakt Schule program. The U.S. passed the $1.9 T American Rescue Plan in March, 2021, and a $1 T infrastructure bill followed in November, along with targeted spending aimed at improving Internet connectivity. The European Union 2021-2027 “NextGenerationEU” stimulus, of which approximately 145 B EUR is earmarked for technology, was also recently announced.

While these programs are not dedicated entirely to connectivity or to Wi-Fi, we believe they will create a pull-through effect that will benefit the enterprise Wireless LAN market for years to come. We see the current supply constraints as a short-term nuisance that is temporarily stalling the development of this technology, and trying the patience of network managers. We also see a remarkable effort on behalf of the manufacturers to help their customers. For example, prioritizing immediate problems with partial shipments and redesigning products to use alternative readily available components. Albeit frustrating, the supply constraints are short-term “speed bumps”, and we are much more excited by what the construction of the world’s new digital highways will bring.