Holiday greetings from Colorado, Kansas (via I-70), and Missouri where we celebrated a white Christmas on the slopes (pictured) and also blazed a few new trails on my in-law’s Missouri farm (picture at the end of the Brief). Lots of windshield and outdoor time for us – hope your 2022 is healthy and happy.

This week, after the normal market commentary and what will likely be the last of the Apple iPhone 13 backlog assessments, we are going to discuss the future of the home television. There are lots of themes for CES (we will cover a few at the beginning of that section), but the most important in our opinion is the merging of different activities from separate (e.g., smartphone, laptop, desktop, tablet) screens on to a larger home TV format. We will start with a brief history, but then explore the delicate dance between network capacity, content resolution, and distribution.

The week that was

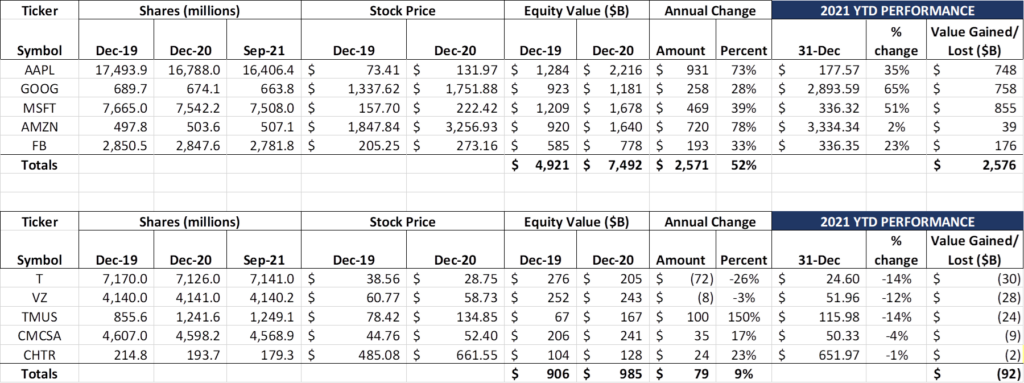

After a fairly volatile Thanksgiving to Christmas period, things quieted down in the last two weeks of the year. There was a small Santa Claus rally that propelled the Fab Five total equity market gains to 2020 levels, something we thought was impossible (and we continue to think is unsustainable). Big winners over the last two weeks were Apple (+$87 billion) and Microsoft (+$86 billion), offset by losses in Amazon (-$22 billion) and Google ($-62 billion).

For the year, Microsoft gained $855 billion in market capitalization, and is in line with Apple to eclipse the $3 trillion market capitalization level. To put that into perspective, the net sum of the Telco Top Five is slightly less than $900 billion. Incorporating the values of the non Telco Top Five companies (including everyone’s favorite, Dish), it’s safe to say that Microsoft alone is worth ~3x more than the US telecommunications/ cable industry. Software ate the world, and it’s now head and shoulders taller than their partners/ competitors.

The Fab Five now has a market capitalization (~$10.1 trillion by our count) that is 10-11x larger than the Telco Top Five (~$893 billion). The Telco Top Ten shrank this year: every one of the five companies we cover lost value, including T-Mobile (by our count, it’s only the second time in the last ten years that the company shrank on a yr/ yr basis). AT&T has lost more than $100 billion in value over the last two years (thanks to outgoing CEO Randall Stephenson’s “we can do it all” strategy). Verizon is treading water on value creation and took on more debt as a result of the C-Band spectrum auctions that concluded in 2021 (see last week’s Brief here for more analysis of this Top Five event).

Cable, which has enjoyed a strong run over the last decade (and especially Charter over the last five years) is facing new fears of a broadband slowdown as AT&T and other fiber-based telco companies wake up to the opportunity to equip homes with Gigabit speeds. We think that cable’s growth will slow, but new home growth (where cable is strong and can compete “glass v. glass”) continues to more than offset suburban and metro losses. We also believe that newly deployed fiber can compete effectively against wireless home internet solutions, with 100 Mbps symmetric (up/ down) speeds for $50 (or less) with no term commit becoming the entry point. There’s still plenty of opportunity in rural America for fixed wireless solutions, but towns and suburbs will have a fiber bias that will limit market share gains at the current (T-Mobile) $50/ month price point (note – Verizon offers their LTE home Internet product with slower advertised speeds than T-Mobile for $40/ mo. for existing Verizon customers who spend more than $30/ mo. We like this option for many rural/ remote areas and are perplexed as to why Verizon undermarketed this option in 2021).

Bottom line: The Great Value Divergence continues. Continued Fab Five gains will have to come from new market expansion. This includes content (see our discussion below – YouTube is already there) and cloud/edge/ enterprise. Who wins depends on how you answer two questions: 1) Is content bundling (e.g., Verizon/Disney+ or T-Mobile/ Netflix) more lucrative than content production (Apple TV+, YouTube Originals, Amazon’s NFL ambitions), and 2) Will Chief Information (Security) Officers increasingly trust AT&T and Verizon more than Microsoft, AWS, and Google for their future needs? Some thoughts to consider as we start 2022.

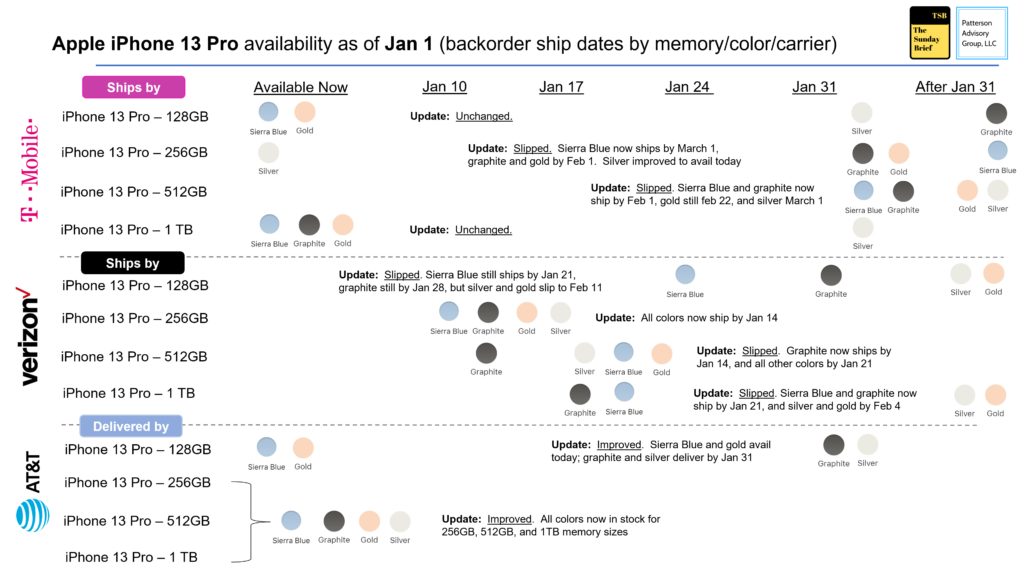

Apple iPhone 13 availability as of January 1, 2022

It’s strange for us to be writing about iPhone shortfalls a full 14 weeks after the launch of the iPhone 13. But here we are, for what will hopefully be the last update on backlogs. The good news is that nearly all iPhone 13 availability issues have been put to bed, and the iPhone 13 Pro Max appears to be headed that way (except for some backlog at T-Mobile and Verizon). The iPhone 13 Pro which is still the heavily advertised lead offer at T-Mobile, is still backlogged, however:

This chart leaves a lot of questions:

- Did AT&T forecast demand based on iPhone 12 volumes (which benefitted from 5G radios and the extension of promotions to the current customer base), or are Verizon and T-Mobile taking Apple share?

- Is the Verizon backlog (which is largely in week-for-week slip on most colors) driven by embedded base upgrades or by new trade-in promotions?

- Can T-Mobile keep customer attention with “ships by” dates extending into March?

Our sense from tracking iPhone backlogs for several years is that Verizon’s backlog is heavily driven by embedded base migrations and the trade-in promotion. We also think that T-Mobile’s aggressive marketing (including to their Sprint base) is driving the backlog. This bodes well for Verizon churn, T-Mobile (Sprint legacy base) churn, and T-Mobile gross additions. It’s important not to over extrapolate T-Mobile’s gains here: we would be more surprised if T-Mobile had the iPhone 13 Pro in stock, even at week 14, with their blanketed advertising.

As mentioned earlier, this is the last iPhone backlog chart discussion we will have in the Brief, although it’s probable that we will publish the iPhone 13 Pro availability on the website on January 9. Apple should post better iPhone sales results simply because they deployed all models on September 24 (versus the staggered pandemic-related launch in 2020), and they could have done even better with stronger production of the iPhone 13 Pro.

CES preview 2022 – TV’s future

On Wednesday, CES 2022 commences for an Omicron-shortened show. While many companies have pulled out of the event, it’s still estimated that more than 100,000 attendees (including Jim) will show up to hear star-studded keynotes and see the latest developments.

Because of the breadth of the show, everyone seems to be coming for a different reason: autonomous automobiles, mini-LED TV technology, interoperability of AR/VR software with new hardware, smart home integration, and the latest in smartphones, headphones and earbuds. Each of these themes could be a trade show in their own right – when they all come together under one roof, it’s downright special.

Our focus for the rest of this Brief is on one of the top topics at the show: The merging of multiple content sources into the connected TV. Our thesis is simple: YouTube set the stage over the past sixteen years for user-generated on-demand content, yet the developments to come will dwarf the value generated by its pioneer.

Over the next decade, the rise of multi-hundred megabit per second (or gigabit per second) households will increase exponentially. This will come not only through infrastructure-supported fiber deployments, but also through wireless last mile providers. The implications to our society will be as great as the rise of electricity and running water during the previous century.

While smartphones marginally continue to improve their screen quality (the highest resolution device sold by the Big Three U.S. carriers, the OnePlus 9 Pro 5G (pictured nearby), boasts 551 pixels per inch, with an overall resolution of 3216 x 1440 pixels), there’s only so much wireless providers can do even with this device to prove the value of 5G upgrades. Since most smartphones access in-home Wi-Fi (especially over DOCSIS and Fiber), the value and clarity of premium smartphones can already be seen.

However, there’s another in-home device that has just begun to connect to a multi-hundred megabit per second world – the television. HD technology (~8 Mbps bandwidth required per device) is yesterday’s news and is consistently priced below $500 at Walmart.com, 4K (~25 Mbps per device) is now officially mainstream (see our coverage of the Amazon TV announcement in this Brief), and 8K (~100 Mbps per device) now breaking the $2,000 barrier (65” TCL here on Amazon). There is no question that technology adoption will drive bandwidth away from traditional cable and satellite set-top boxes over time, but one question does remain: What will we watch (or do) with these new devices?

To find a possible answer to this question, we need to go back to Valentine’s Day 2005, when YouTube was born (more on their history in this Wikipedia post). From YouTube, we got used to searching for content (just like web searches on Google), watching an occasional advertisement (which led to the rise of ad-free YouTube premium), and accepting Google’s “because you watched this” recommendation engine. Posting quality videos became more than a marketing exercise: it also became an opportunity to make money from user-generated content. Hopes of “going viral” became more than a dream for many – queue Motimaru cat videos (see nearby picture – nearly 620 million total views).

Without a doubt, we will watch more user-generated content (produced in 4K, 8K, or whatever K Google will allow with their upload policies). There’s a cycle here that grows global content adoption:

- In-home bandwidth options continue to proliferate (more multi-hundred Mbps homes)

- Smartphones (with 4K recording capabilities – more common now) upload mode video

- Google changes their upload limit for verified accounts (currently at 256GB – more here)

- Google’s recommendation engine gets more sophisticated

- Videos are presented and broadcast in 4K to more homes

- More advertisements are shown (also in 4K)

- More income is generated for YouTubers with large amounts of subscribers

Is there a point when professionally produced content (e.g., Game of Thrones) launches first on YouTube? Probably not anytime soon, unless YouTube Originals grow exponentially in popularity. But YouTube’s base (2 billion + users, 30 million daily active users) and time spent on site (40 min/ day) could attract additional content that is very close to that shown on YouTube TV. YouTube has already successfully merged streaming audio (those of us who subscribe to YouTube Music know it all too well) – merging broadcast with high-quality user-generated content is not far behind. More multi-hundred Mbps households will accelerate that trend.

A second answer to “What will we do with these new, powerful displays?” can be found with the website Twitch, and, to a greater extent, Microsoft Xbox Live. The former has 140 million users (as of December, most of whom pay between $2-10/ mo. to learn how to play video games and hang out with Twitch stars) while the latter has a mere 100 million (many of whom pay $40 every six months to join an elite Gold club). With more bandwidth, viewers of a particular Twitch channel could try out new hacks live. This feature will drive more time on the Twitch site and increase overall revenues.

The last solution we will discuss in this Brief is communications. We have talked a couple of times about what Meta/ Facebook is attempting to do with the Portal+ product (newest version here). We think the product capabilities encompassed in the Portal+ are significant: Smart Sound, Smart Camera, and the use of Augmented Reality effects and filters are just a few of the features offered. But one can see how a smarter version of their sister product, the Portal TV, can change how we use big screens to communicate with family and friends. Add in an Apple Facetime smart TV app (and a camera to new Apple TV hardware) and aggregate upstream bandwidth needs will go through another step function increase. It’s not imminent, but one would think that Apple’s closest shot to controlling the home begins with a TV app that increases the value of FaceTime.

There’s a lot more we could discuss: How Skype and Microsoft challenge Apple and Facebook with their own in-home communications product, the use of console storage (e.g., unused capacity in a Sony PlayStation) to cache recorded or likely content requests (reducing network needs and improving overall service), and the impact of advertising on any or all of these trends. These will need to wait for future Briefs.

What is certain is that the Electronic Programming Guide format is going to fade away, and, as we have discussed in a previous brief here, the “gigantic bundle” will wane in importance (driven by Google and Amazon, both of whom have the platforms to support micro-purchases). Neither of this is good for linear video providers and traditionally-produced content that is dependent on a linear model. More to come on this and other topics after CES 2022.

That’s it for this week’s Brief. In two weeks, we will discuss what we learned from Vegas as well as begin to look at Q4 developments for the wireless service providers. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals, and Go Davidson Wildcats and Go Chiefs!