Bouygues Telecom has announced it will shut down its LoRaWAN network in France from 2024, and start to sell new IoT business and migrate existing IoT accounts to its cellular-based NB-IoT and LTE-M networks. Following the bankruptcy last month of rival IoT firm Sigfox, the other French-born heavyweight in the unlicensed IoT domain, the decision by Bouygues to can LoRaWAN raises questions about the viability of publicly available non-cellular IoT altogether.

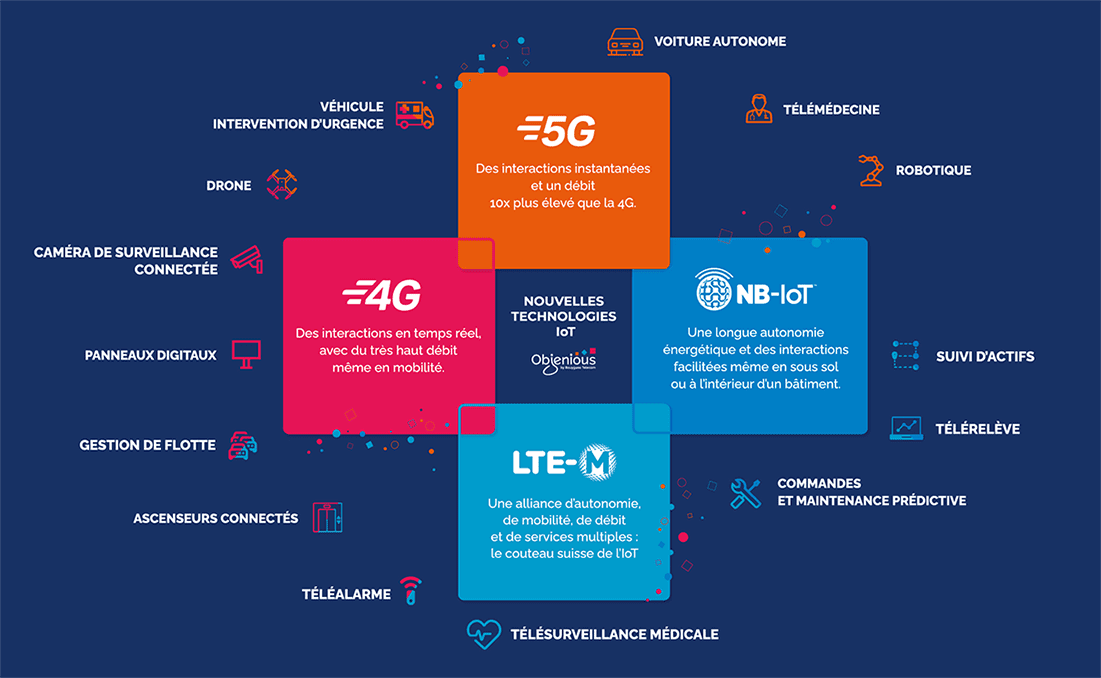

Bouygues Telecom made clear the late rise of cellular IoT – with mobile operators finally getting to grips with pricing and roaming, and rolling out NB-IoT and LTE-M in earnest – informed its decision to step away from non-cellular LoRaWAN. The firm’s IoT subsidiary Objenious, a long-time member of the LoRa Alliance, expects to have more than half of its connections on NB-IoT and LTE-M by the end of 2022 (“by 2023”), and will switch off its LoRaWAN network completely by the end of 2024, it said.

A statement said: “Faced with the very rapid development of these technologies, Objenious has chosen to accelerate their deployment and position itself on a complete cellular IoT technology panel, thus becoming the first IoT player in France to offer both NB-IoT technologies and LTE-M. By 2023, these new cellular technologies should become the majority of our customers’ choices with more than half of LPWA connections.”

The parallel Sigfox story, intensely troubled in recent times, has been temporarily halted at least, with court appointed administrators in Toulouse currently in the process of picking through fire-sale offers for the company’s core technology business and French network operator. Offers have been received from a number of Sigfox operators, including Singapore-based UnaBiz, Switzerland-based Heliot Europe, and UAE-based iWire group.

French vendor Actility, in the LoRaWAN camp, is also among the bidders, and shares an investor, in the form of French national investment bank BPI France, with Sigfox. But the news from Bouygues Telecom, one of two (with Orange) cellular operators selling non-cellular LoRaWAN in France, will be felt by the whole IoT market – and embraced by the old cellular crowd, whose slowness with NB-IoT and LTE-M allowed Sigfox and LoRa/LoRaWAN (sold to US-based Semtech in 2012), a foothold in the IoT market in the first place.

More than a foothold, these twin non-cellular technologies effectively created the LPWA-end of the IoT market, and have stood-up the excitable idea of massive-scale low-power IoT sensing until now. At the same time, the LoRa/LoRaWAN market will not be so easily toppled. It has a number of major backers, notably Amazon (and AWS), and is showing the way with new models for public infrastructure-building, notably with the well-hyped rise of crowd-sourced blockchain outfit Helium, but also as (a LoRa-only) part of Amazon’s Sidewalk initiative.

Even so, the message from Bouygues Telecom shows the traditional cellular community may be done with non-cellular IoT, and suggests it thinks cellular IoT is finally ready-to-scale, and make good on the yawn-making promise of ‘massive IoT’. The firm has said its key Objenious Starter offer – providing access to its LoRaWAN network, roaming deals, management platform, and various analytics tools (for €20) – is dead, from September, meaning no new sales after the date.

It said: “The LoRaWAN network marketed by Objenious and the associated services will no longer be accessible beyond December 2024. We will offer our customers migration possibilities to support them towards alternative cellular IoT solutions. The Objenious Starter offer will no longer be available from September 1, 2022.”