Last year Qualcomm rolled out its vision of leveraging a unified technology roadmap to grow its end market well beyond smartphones and grow addressable market 7-fold over the next decade to $700 billion. Now the company is rapidly executing on that plan with across the board growth beyond handsets in industrial and consumer IoT, RF front-end, automotive, and other areas.

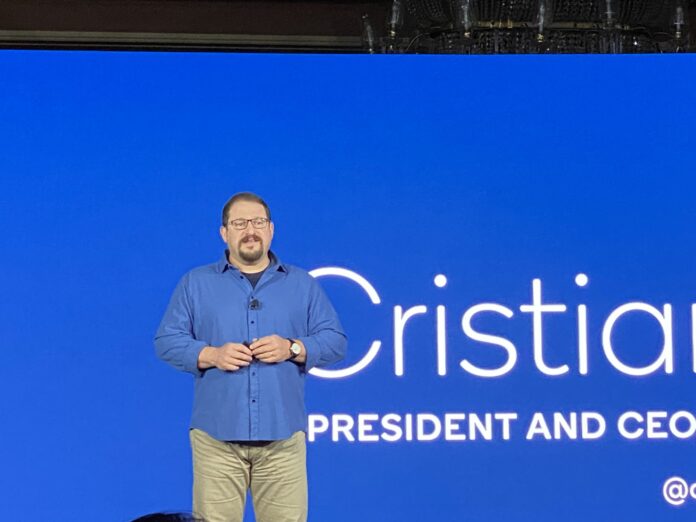

Speaking this week at the Morgan Stanley Technology, Media and Telecom Conference, Qualcomm CEO Cristiano Amon provided a look at how the firm thinks about innovation in a particular area then develops a platform- rather than a product catalog-type play.

He gave the example of the broad IoT market. “You have a lot of development of a portfolio of products, almost like a catalog-type business that you develop a bunch of different products for those categories. The Qualcomm approach is very different.”

Amon continued: “We took individual technologies, whether it’s connectivity–it doesn’t matter if it’s cellular, Wi-Fi, Bluetooth–we look [at] CPUs, GPUs, NPUs or artificial intelligence, image signal processor, our digital signal processor or video engines. And we develop a roadmap based on not what a particular segment needs but what is the best thing we can do from a technology standpoint on that particular vector of innovation. Can we fundamentally change camera? Can we fundamentally change each one of the modem technologies?”

This approach has resulted in a machine that can build SoCs at scale using core IP which can then be repurposed for compute, IoT or automotive, for example. On the automotive front, Qualcomm announced this week a partnership with BMW Group and Arriver Software; Qualcomm’s Snapdragon Ride Vision SoC, compute SoCs and car-to-cloud services platform will be used to further development of automated driving solutions. In the automotive segment, Qualcomm has seen a ramp in revenues and has a multi-billion dollar pipeline.

This also shows, Amon said, “that our R&D engine scales. That’s why every single one of the new growth businesses we have for Qualcomm has been accretive to margins because it just provides additional scale to this, into our R&D engine. And I think that’s…one of the key pillars of the strategy.”