Greetings from Kansas City, Nebraska and Louisiana. Pictured is one of the stops on Jim’s broadband tour of the Cornhusker state, Buck’s Bar and Grill in Venice, Nebraska. Terrific food and amazing service (and, while not personally witnessed, the live music also has a pretty darn good reputation). While underserved from a broadband perspective, Venice is well-served at Buck’s.

This week, after a brief market commentary, we will dissect AT&T’s virtual investor day presentation. Originally, we had planned on a side-by-side comparison of Verizon’s and AT&T’s respective presentations, but AT&T’s is so rich we will need to punt the comparison to a future Brief (note: we were very impressed with many things about Verizon’s Investor Day presentation and product/ platform announcements).

The week that was

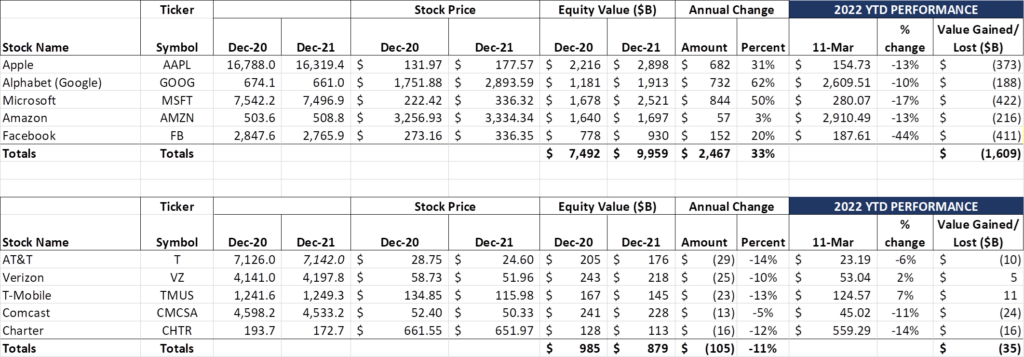

The last two weeks have not been kind to the Fab Five (down $495 billion over that period). After an upbeat and invigorating announcement (more on that below), Apple’s equity value continued their downward trend (-$165 billion over the last two weeks). Microsoft’s $129 billion loss over the fortnight was second; their year-to-date 2022 loss now exceeds $420 billion (exactly half of their 2021 gains have been clawed back this year). Facebook has lost $411 billion thus far in 2022, which encompasses all of 2021, 2020, and part of 2019’s gains. It’s been an unkind year for the Fab Five, and we still have more than eight months to go.

The Telco Top Five (TTF) stock values are not as volatile as their Fab Five brethren, with a mere $35 billion in 2022 capitalization losses. Two of the TTF have actually increased their capitalizations this year: Verizon (+$5 billion) and T-Mobile (+$11 billion). As we discuss below, there’s a movement away from cable stocks given uncertain value creation prospects; we believe that this thesis assumes that cable has no counterpunch to fiber, and, as a result, is incorrect. Cable has many options as the market share leader in broadband – we think this is lost on much of the analyst community.

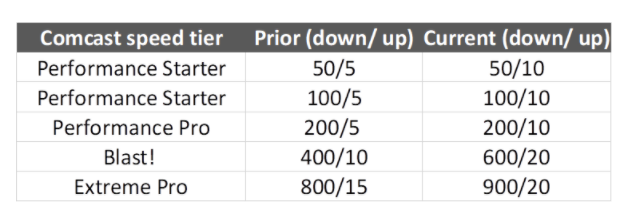

Exhibit 1 for cable: Comcast and Spectrum both announced and implemented speed increases to many of their basic plans to improve their product competitiveness. In the Northeast, Comcast announced moderate speed changes to their lower tiers, but more substantive changes to their middle tiers (see nearby table). We still think that there will be pressure to increase upstream speeds as devices begin to enable higher-capacity front facing cameras, but the download experience will be immediately upgraded for many customers with this change. Streaming quality will improve, and the migration from traditional linear cable to IP-based streaming will increase (no surprises). It’s a low cost, high impact move.

Spectrum announced last week that they have nearly completed their base speed upgrade from 100 to 200 Mbps – over 95% of their footprint now starts with the new speed. We believe that this redesign is in part due to entry-level packages from fiber providers of 100 Mbps symmetric service. As management has indicated on previous earnings calls, a substantial majority of Spectrum customers elect to use the baseline service. While the upload speeds do not improve, the headline speed doubled, and that keeps Spectrum in the game as wireless and fiber alternatives begin to emerge.

Two weeks ago, we covered the Samsung Galaxy announcements and highlighted the availability of higher powered cameras on the Samsung Galaxy S22 Ultra and Galaxy Tab S8 Ultra. Last week, Apple announced their newest tablet, the iPad Air, which now sports the iPad Pro 12 MP Ultra Wide front camera (tech specs here). Both front and rear cameras are now 12 MP with rear-camera capability to record at 4K at 60 frames per second. All new iPad Air models now feature Apple’s proprietary Center Stage software which automatically adjusts the viewing to include all participants in the video conference (see nearby picture).

12 MP has become the new front-facing camera standard. Right now, it’s engineered to handle HD 1080p pictures, but we think 2023 will enter with newer and bolder tablet front-facing cameras capable of 4K (which we believe would consume 20-25 Mbps upstream bandwidth). Adoption will follow as Apple and Samsung (and Zoom, Cisco and others) quickly incorporate Apple’s hardware changes into their videoconferencing applications. At this point (we think it’s late 2023 when adoption begins to hit “mainstream” status), the upstream capacities will become constrained absent DOCSIS hi-split augmentations. It’ll be a heavy lift for the entire industry (note that Spectrum’s bandwidth upgrades described earlier have taken 15 months to reach the 95% level), but front-facing camera demand is the greatest threat to sustained cable broadband leadership.

Separately, Apple announced the iPhone SE to meet the budget-minded segment (at $499 for the basic model, or ~$21/ mo. for 24 months). We have always favored the SE over the Mini and fail to understand the demand for the latter so long as the SE continues their biennial upgrades. For a comparison of the differences (mainly camera and $270 price) between the iPhone Mini and the iPhone SE, check out AT&T’s website here. It would not be surprising to see the Mini sold in an online-only format and the iPhone SE take its place in stores.

The New (Yet Old) AT&T

Since our last Brief, Verizon and AT&T have held their respective analyst days (Verizon materials here and AT&T here). Our focus today is on AT&T’s March 11 presentation. As mentioned above, this is not to slight Verizon, as we thought they had a lot of interesting product announcements (particularly the +play content discovery platform), but AT&T’s transformation trumps Verizon’s evolution.

AT&T sought to do two things in Friday’s presentation: 1) Describe and detail the financial attractiveness and industry competitiveness of the connectivity company that remains after WarnerMedia is carved off; and 2) Paint the current strategy in the context of a greater vision for the future of telecommunications. We think that they succeeded with the first objective, but missed the mark on the second.

John Stankey laid out two “acts” in his opening remarks. The first is the realignment of the company to focus on connectivity (and not entertainment). The second is to develop software that enhances the value of AT&T’s network (a radical shifting of AT&T’s core competency). Here’s AT&T’s CEO on the transition (emphasis added):

“When our first act is done, we’ll be a more focused, agile and capable domestic network leader. We’ll be a company with a smaller product portfolio built on the back of fiber in the core metropolitan and suburban areas, combined with a highly capable nationwide wireless network able to extend even greater capabilities in utility than ever before, beyond our core. Our legacy cost will be permanently altered and we’ll be positioned for our next generation of growth. We’re mindful that we operate in ever-changing and dynamic markets.

While we like the durability of our asset-intensive products, we desire a better balance of revenues and profits that are generated from more flexible and asset-light approaches that software brings. After retrenching from entertainment, we have more work to do to differentiate our connectivity.

We’re not talking about transformative M&A here. Instead, we’re focused on developing software and capabilities that lay on top of our network and optimize our connectivity value proposition. I’ll acknowledge, we’re hard at work on that front, but we’re not ready to share any conclusions or projections with you today.

It’s vitally important we get act one right. Without successful execution on this act, our management team knows the second act doesn’t really matter. As we establish your confidence in what we outlined today, I do expect we’ll be back with more. There are just too many exciting opportunities in unmet customer desires to be satisfied with one-act play.”

We will spend a lot of time talking about AT&T’s progress in the coming months as they rollout new wireless spectrum (part of Act 1), but it’s important to think about what AT&T’s CEO is contemplating in Act 2. He was asked about this in the Q&A (question from Phil Cusick, roughly at hour two in the video) and here’s his response:

“On your second question about what I refer to as Act 2, we are doing a lot of work today that is enabling us to open up aspects of the network for others to come in and start offering value-added services associated with it. In addition, there are things that we can do with our customer base is to start giving them control.

I think Jeff [McElfresh] alluded in his remarks about how much we’re seeing if we go into our large enterprise customers and a CIO talks to us about, “I need the ability to manage the network from my employee who’s working from home just like I did when they were sitting at their desk on the corporate LAN.” And some of the work that we’re doing right now is on how do we begin instantiating software that can add these features back into the network that allow us to put value add on top of it and sell those managed services or capabilities back into the core connectivity that we put in place. That would be an example of that.

We’re doing a lot of work. I think as you heard [Rasesh] talk about in the customer segment, on enabling software capabilities to the network and the hyperscaler cloud so that those capabilities can be attached to certain applications and services that people choose to use. We believe those features and capabilities over time add core value into the connectivity and can prefer other aspects of our connectivity.

So I’m not talking about moving up the stack to try to attack a sales force were to try to replace somebody who’s in the application space. We’re talking about moving up the stack to do things with our network that allows us to prefer our connectivity because it will work better with people who are running more sophisticated software on top of that stack, which allows us to stay at a premium position in the market and differentiate in ways that others cannot.”

Said another way, even though Meta and Verizon announced a strategic partnership the week prior, AT&T will be the better partner because the metaverse will work better over AT&T’s regional fiber network than Verizon’s national network. Companies will flock to integrate into large fiber networks (including Fios, Lumen and AT&T) and develop network API relationships because a) integration is a snap; and b) customer experience is improved.

If the last paragraph appears to be confusing, it should. Applications have long been built assuming a variety of physical layers: Copper, Hybrid Fiber Coax, Fiber, and Wireless. Like it or not, a “lowest common denominator” is used. That’s one reason why YouTube defaults all downloads to 480p speeds. It’s why iOS is a critical part of Apple’s value proposition. And it also a reason why a company like Masergy, one of the leaders in implementing Fortinet’s Work from Home solutions, was attractive to Comcast.

We are not saying that AT&T will not be effective in convincing some companies (specifically Microsoft and Oracle). But telecommunications history has proven that extensive national or global coverage is critical to sustain any fusion of the OSI stack.

How big will AT&T’s fiber footprint be? Jeff McElfresh provided the best color (emphasis added):

“To put it simply, today, 20% of our wireline footprint is served with fiber. By 2025, our goal is to improve this to more than 75% served by fiber and 5G, which represents the majority of our network surface area. That’s a platform to fuel growth, and we won’t stop there. We will continue to push our capable 5G network further to support the remaining wireline footprint.”

Jeff later discussed the process of removing copper from smaller towns but substituting the bandwidth requirement with fixed wireless “in limited circumstances.” The company went on to emphasize that this was not a widespread endorsement of broad fixed wireless coverage (in fact, they went to great lengths to discuss why fixed wireless was not a good idea for locations with tonnage of 800 GB/ month or more), but rather for “lite” uses.

This slide, and some additional commentary from McElfresh (see slide 24 here), provide some additional context:

“We have many square miles outside of our fiber footprint, that we have very little to no demand that’s existing in this part of our footprint, and we’ve made the necessary filings and the cooperation work with the local authorities and the FCC to begin to unwind and remove that copper infrastructure out of that footprint. And in those parts of the market, we’re going in with [catch] products, transitioning customers that are in that part of the footprint, to a better product served by wireless in many instances.”

Bottom line: AT&T has its hands full with Act 1. It will take at least an additional 3-4 years to implement. At the end of the day, AT&T’s competitive footprint will be ~30 million locations, with another 15 million or so with limited 5G fixed wireless. All of this assumes AT&T gains no significant government grants, but even with 4-5 million of additional coverage, will it be enough to create competitive differentiation versus cable and Verizon? We are skeptical.

That’s it for this week’s Brief. In two weeks, we will wrap up with additional insights from Verizon’s Investor Day and some additional commentary on other fiber providers. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Thanks again for the referrals, and go A-10 regular season winning Davidson Wildcats!