There is a long journey ahead for 5G monetization but CSPs can start by tuning up their networks to deliver the best experience possible

5G is setting the stage for a boom in cellular use cases that extend beyond those in the consumer segment, creating what Stéphane Téral, chief analyst at LightCounting, called “a long tail of services,” all of which come with their own potential for monetization.

5G’s promise of lower latency and higher throughput, for instance, is being used to address enterprise, Industry 4.0 and autonomous vehicle needs, opening up new monetization opportunities for communications services providers (CSPs), as long as they carefully pair technology investments to desired business outcomes.

That’s not to say that new revenue opportunities are not waiting to be unlocked in the consumer segment. Particularly in the U.S., operators are standing up fixed wireless access home internet service and going head-to-head with cable companies. There are also emerging device types, cellular-connected PCs and AR/VR products, that could push ratepayers into new plans with more lines. Gaming is also a nascent area for operators with the logic being that mobile gaming is a growing space, and it could certainly benefit from 5G, so there might be an opportunity for a premium-priced gaming tier.

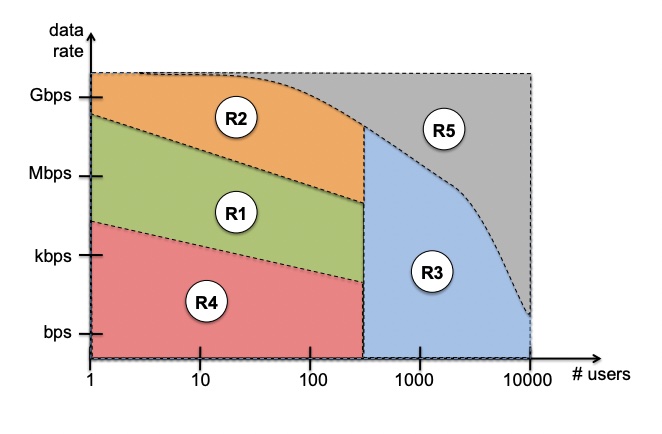

To better explain these two paths to 5G monetization and how they relate, Téral tapped into the Region (R) concept. First published in a 2013 Bell Labs’ research paper, the concept is an attempt to map the possibilities of the next generation of cellular technologies by determining the boundaries of possible data rates as network users increase. Ultimately, Téral concluded, two forms of 5G monetization are established: direct and indirect.

Region 1: the low-hanging 5G monetization fruit

According to Téral, the industry is currently in Region 1 (R1), and while Region 2 (R2) requires ongoing research to improve spectral efficiencies (will it be 6G?), he believes there already exists significant potential for Region 3 (R3) and Region 4 (R4). Considered to be direct monetization, R1 involves enhanced mobile broadband (eMBB).

“[In Region 1], you have the service providers collecting 5G revenues if they do a good job of selling the network and coming up with packages that people are willing to pay for,” said Téral, providing specific lifestyle needs such as video streaming, cloud gaming and immersive sports and music events with AR/VR services as examples of such premium-tier consumer services.

“And then, gradually, you go after the rest of your subscriber base,” he continued. “That is the process we are observing. Region 1 is clear cut.” And by that, he means it’s simple and reflects monetization models of the past.

LightCounting estimates that global 5G revenues were between $15 and $20 billion in 2021, with 86% coming from R1 services, driven by strong 5G subscriber uptake in China and Korea, both of which implemented “winning” 5G consumer strategies, according to Téral.

Using supporting materials from Ericsson, Téral laid out these strategies: “Number one, build a network [that] is cost-efficient and scalable. Then you have to look at how to deliver the best smartphone experience. Eventually you expand the 5G [wireless] coverage. Then […] you go after fixed wireless, as well. Then, beef up the pricing strategy [and finally] you lead with innovative and immersive services.”

In South Korea, almost 30% of mobile subscribers — equal to 20.9 million — are on 5G as of the fourth quarter of 2021. That number is even greater in China, reaching 730 million subscribers as of the end of 2021. In the U.S., however, 4G remains the dominant consumer revenue engine because 5G operations in low-band spectrum are not yet producing speeds faster than 4G.

“The U.S. [started] 5G on the opposite side of the rest of the world,” explained Téral. “They didn’t have mid-band. T-Mobile [did] after acquiring Sprint [and that] put T-Mobile in a sweet spot. In fact, it is now the poster child of real 5G, if you wish, in the U.S.”

While AT&T does not publish their average revenue per account (ARPA) data, both T-Mobile US and Verizon’s ARPA figures are increasing, so Téral expressed confidence that “things are looking up in the U.S.,” adding that the deployment of C-band will provide additional revenue opportunities for U.S. operators.

Region 3 and Region 4: 5G as the complex enabler

Region 3, which involves mMTC (Massive Machine-Type Communications), and Region 4, which involves uRRLC (ultra-reliable low-latency communications), are examples of indirect 5G monetization, and LightCounting estimates that these two regions raked in a combined 5G revenue of between $2 and $2.8 billion as of 2021, based on GSA, Ericsson and Nokia data points.

From Téral’s perspective, R3 and R4 both represent a “more complex environment characterized by the need for tight cooperation and partnership between various players to solve a specific issue.”

In other words, these regions require knowledge of enterprise, industrial and government needs so that an ecosystem of partners can be developed specifically to address those needs.

“In Region 3 and 4, 5G is the enabler,” said Téral. “This means it’s not necessarily the service provider that is going to collect money for a particular use case; it can be a partnership between a service provider, a systems integrator and a vendor. 5G is being used […] to solve a problem and […] this is not a direct 5G monetization item.”

In this case, he continued, 5G is simply helping a customer achieve a desired business outcome, such as providing further efficiencies within a factory, and in doing so, the customer deploying 5G is also collecting on the extra revenue. All of this, he said, makes it challenging to parse out who can truly claim additional revenue from 5G services.

The bottom line, Téral concluded, is that there is a long journey ahead for the monetization of 5G, but CSPs can start by tuning up their 5G network to deliver the best experience possible and offering tailored packages to those consumers willing to pay a premium. The next step, R3 and R4 will take more time to establish, particularly because Wi-Fi and LTE are good enough for most current IoT application, and when it comes industrial 4.0, 5G will have to compete with other technology offerings like non-cellular Bluetooth Low Energy (BLE) indoor tracking systems, LPWAN, NB-IoT, LTE-M and non-cellular LoRaWAN.

“We are on a long journey; it has started. That’s the good news,” he said, adding that by following in the steps of those leading the industry, like South Korea and China, and heeding the roadmap laid out by Ericsson, the industry will “get there” in terms of monetizing 5G across R1, as well as the more complex and elusive R3 and R4.