Greetings from the Midwest. Today’s opening picture shows Paul Stebbins of Wifinity, a small Wireless Internet Service Provider (WISP), presenting to the Vernon County (MO) Commissioners last Wednesday. I chose this picture for several reasons: 1) A reminder that we are meeting in person again; and 2) A reminder that in smaller towns and counties a lot of things still get done in commission proceedings and local hearings. Talking about the unserved needs of residents in Sheldon, Liberal or Bronaugh, Missouri, is one thing, but engineering a scalable and affordable solution is an entirely different matter. A terrific meeting for all stakeholders, and I was grateful to be invited and to represent American Broadband.

This week we will attempt to succinctly summarize the state of telecommunications industry as we enter the second quarter. It’s the culmination of listening to many investor conferences, earnings calls, and analyst/ investor days. Each company in the telecom space is at a different point – no single company is a mirror image of another. But the cumulative result, if each company fulfills its plans, is a solid industry with good fundamentals.

The week that was

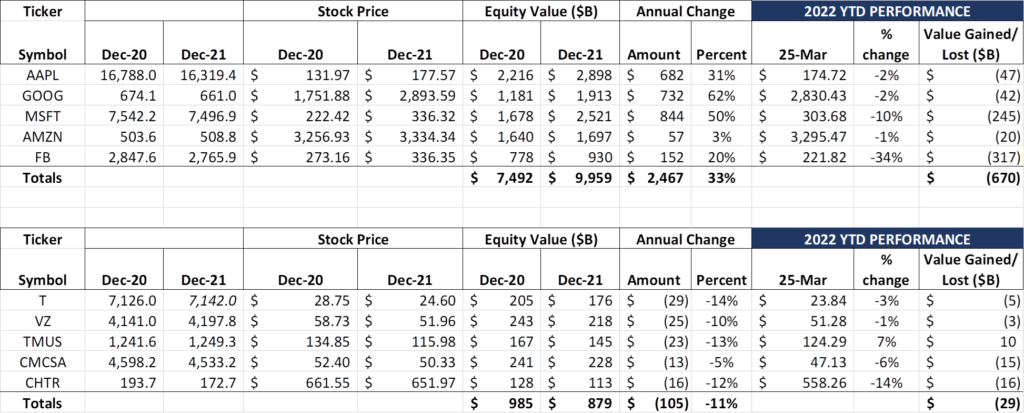

When evaluating the changes in market capitalizations over the last two weeks, we are reminded of a common phrase: “If you don’t like the weather in _____, just wait a day.” Despite the real impact of higher energy prices, higher interest rates (10-yr T-Note at 2.49% as of Friday), and continued supply chain shortages, the Fab Five managed to bounce back by $940 billion over the last two weeks, reducing the 2022 equity losses from $1.61 trillion (through March 11) to $670 billion. This two-week bounce exceeds any change we have seen in any two-week period since we started tracking equity market changes a decade ago (including post-Covid, specifically April 2020 and July 2021).

The Fab Five has now given back 27% of 2021’s gains in 2022. For three of the five, those losses are negligible: Apple is down a mere $47 billion (7% of 2021’s gain), Google/ Alphabet down $42 billion (6%) and Amazon down $20 billion (35%). For Apple and Google, it’s the equivalent of removing December 2021’s Santa Claus rally gains. Preserving current value while other companies (e.g., Facebook/ Meta) are plummeting improves relative market standing. Absent Facebook, Fab Five values are stabilizing – that’s a really good thing.

The case with the Telco Top Five is different. Their overall value improved $6 billion over the fortnight (good), but the fact that only one (T-Mobile) is positive for the year is concerning, especially given 2021’s dismal performance. Comcast continues to recover (+$10 billion loss improvement over the last two weeks), and investors are getting more comfortable with the prospects for Discovery/ WarnerMedia (+$5 billion), but there’s no conviction for the segment overall, which is particularly amazing given its critical role in creating tomorrow’s economy.

Since our last Brief, Amazon closed their $6.5 billion acquisition of MGM (WSJ article here – note the fragile nature of the approval described in the article). James Bond now has a home in Seattle, where he will join Al Michaels and Kirk Herbstreit, the new hosts of Thursday Night Football on Amazon’s Prime Video. (Note: the link in the previous sentence outlines several changes in the sports broadcasting arena – it’s a good time to call games!). What these changes presage for the future of the NFL Sunday Ticket remains to be seen, but it’s clear that Amazon wants a seat at the table and we would not be surprised to see Apple, Google, or Amazon emerge as the new provider.

In another interesting development, Google Fiber has new union members, according to this cnbc.com report. BDS Connected Solutions, a small Kansas City-based contractor to Google, voted to unionize under the Alphabet Workers Union. The employees mentioned in the article work in the Google Fiber retail store. While this is a very small development, it could blossom into something larger and we are keeping a careful watch — because it’s our hometown and it’s Google.

Finally, it’s worth noting that the Samsung Galaxy S22 Ultra (a.k.a., the new Note) has really gotten off to a good start at the carriers and on Samsung.com. Depending on the size and color, delivery dates are now extended into mid-May. These delays are likely caused by a combination of stellar reviews (see ZDNet’s take here and CNET’s here) and aggressive trade-in promotions from Samsung. We will be putting the Galaxy S22 Ultra to the test starting in mid-April.

The state of telecom —Q1 2022 (Part 1)

After dozens of hours of conference calls, three analyst days (Verizon, AT&T, and Cable One) and many articles and email exchanges, we think we have enough to develop a state of telecom. While there are many ways to define the environment, we have decided to focus on three specific developments: a) Whether fixed wireless captures a meaningful share of the home broadband market; b) Whether cable MVNOs increase their share of gross adds in the wireless market, and c) How companies react to increased economic uncertainty and increased wage pressures.

What if fixed wireless is really successful?

In our April 2021 Brief called “Is T-Mobile a Credible Home Internet Provider?” we asked the following question: “If T-Mobile intended Home Internet to be a user of excess capacity and demand is far greater than expected, will they ration or limit the number of customers the service is available to after they have hit their fill rate?”

Since we wrote that nearly a year ago, we have listened with great care to T-Mobile’s response to that question. T-Mobile’s CFO, Peter Osvaldik, described their philosophy at last week’s Deutsche Bank conference (link here – comment is in the 37th minute):

“… when you see peak capacity for mobile phone traffic and when you see peak capacity traditionally from high-speed Internet or fixed wireless home broadband, those two times are a little bit different but we engineered a peak capacity. And every time we know there’s going to be peak capacity excess delta, that’s where we go sell. And as that rollout continues this year, the amount of homes where we’re going to be able to do that is only going to expand. So it’s absolutely within the capacity of this network being sold and controlled very smartly. We’re not going to degrade mobile phone user experiences. That’s our number one priority, but there is just so much excess capacity to build.”

Peter’s response implies one of two things: 1) C-Band deployments will lead to significantly increased mobile phone traffic demand, and 2) This 5G upgrade-driven demand will increase the pro forma gap between peak daytime use and likely home Internet usage. It only makes sense, then, to increase the availability of excess capacity (deprioritized to 5G mobile traffic) for residential broadband.

Said another way:

- In underserved broadband markets, DSL speeds languish (we have spent a lot of time describing AT&T’s and Lumen’s Internet deserts). T-Mobile Home Internet is a welcome solution

- Many of these new home Internet customers will become T-Mobile 5G mobile customers

- New customers increase peak traffic demands

- New peak traffic demands drive additional opportunity for utilization of excess nighttime capacity

Because T-Mobile’s addressable market segment is predominately rural (about half of T-Mobile’s targeted 7-8 million households could come from rural markets, with the vast majority of the remainder coming from poorly covered suburban locations), the logic discussed above makes a lot of sense. T-Mobile is likely to install a minimum network configuration in those markets which should carry excess capacity. The key for T-Mobile is exercising discipline around the customer experience and not oversubscribing customers on a fixed amount of backhaul.

Should T-Mobile follow Verizon’s lead and introduce it as a discounted bundled product (e.g., to all Magenta family plans), we would start to worry. Hopefully if that path is taken, they have either invested in local transport infrastructure (something they have repeatedly stated they are not interested in pursuing) or have raised rates on the Home Internet product to cover capacity-related costs. We still believe that they will likely underachieve their objectives as more rural communities are presented with Fiber to the Home (FTTH) products.

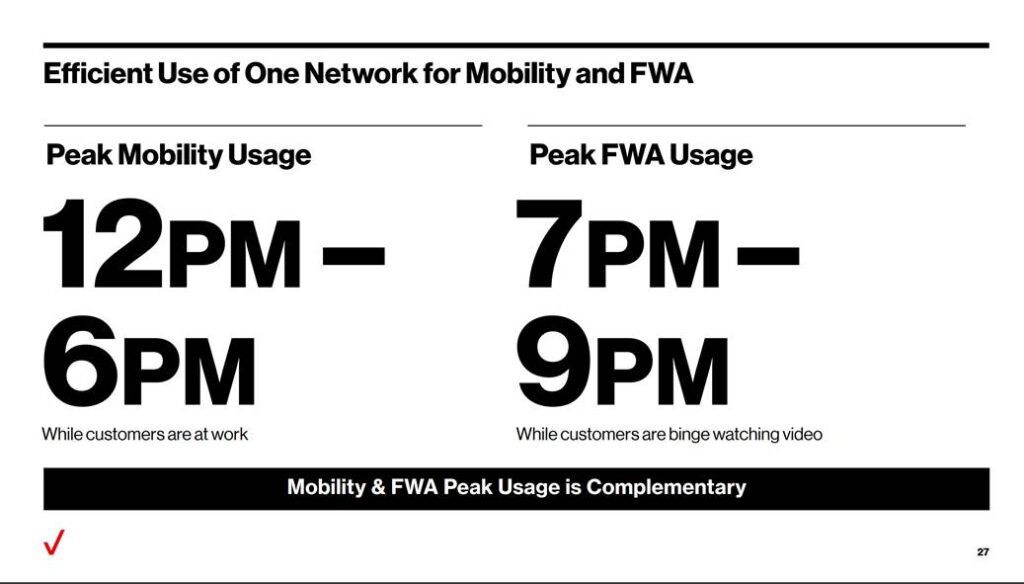

Verizon faces a completely different market and is targeting customers in a much different manner. Here’s the network capacity slide presented by Verizon’s EVP and President of Global Network and Technology, Kyle Malady, in their recent Analyst Day:

Verizon’s argument is the same as T-Mobile’s, but it’s coupled with an additional cost advantage: 50% of Verizon’s cell sites will be directly connected to dark fiber either leased or owned by the company by the end of the year. With a terrific Tier 1 IP backbone and those economics, the only material step functions are the radios.

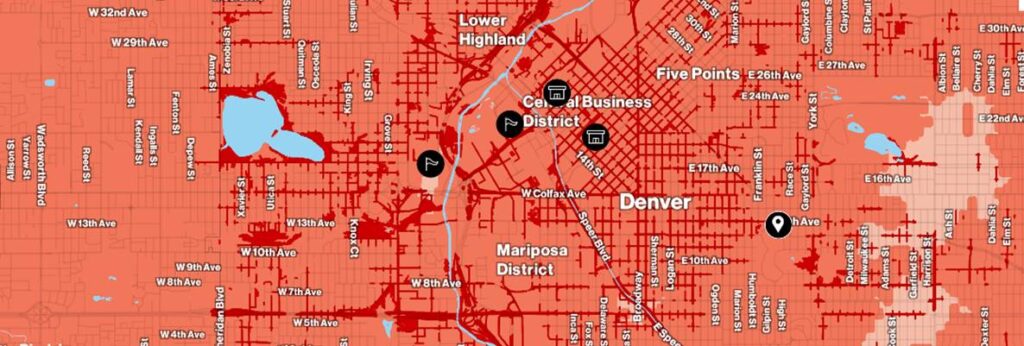

Let’s look at a few out of region (meaning non-Fios) locations where Verizon has already deployed fiber. First up is downtown Denver, a CenturyLink territory (picture nearby).

There’s excellent deployment across the Central Business District, Lower Highland, Five Points and Mariposa areas, but minimal overage in Aurora, Centennial, Golden, Bloomfield, and other parts of suburban Denver. In fact, the Mile High City is currently a mishmash of LTE (lighter color near Aurora), 5G Nationwide and Ultra Wideband. This will lead to an array of residential Internet experiences, at least in the short term. Given Lumen’s history of underinvesting in areas like Aurora (see our Brief on it here), maybe Verizon will provide a “better than” experience for customers looking to move away from Comcast, but it’s hardly the product that they tout in their advertising. This is why we aren’t worried about Comcast’s market share gains in cities like Denver (and why we think that Lumen is the greater threat to take 10-15% share in the short term if they get their deployment act together).

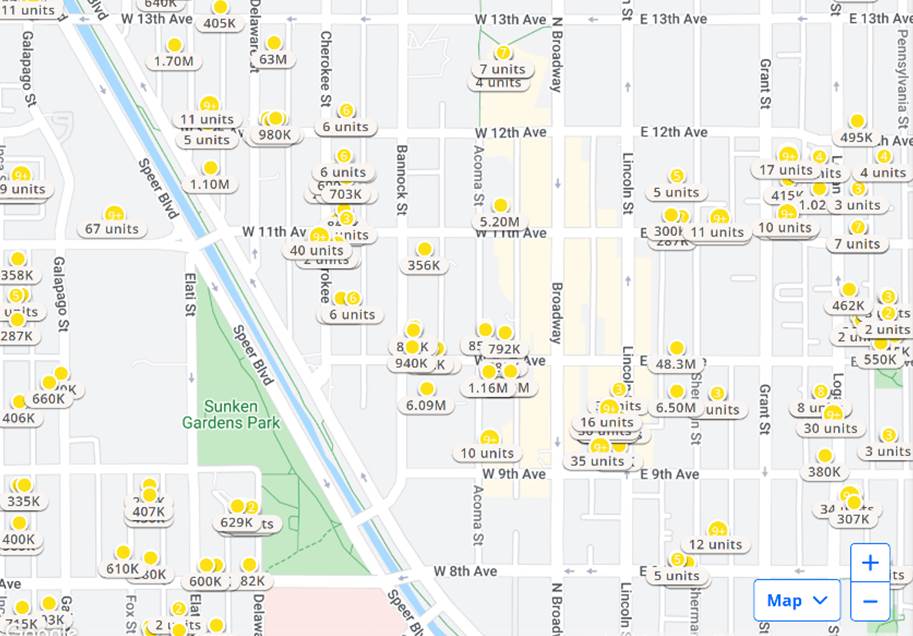

The other reason is shown most clearly in the nearby Zillow map showing units that have sold in the last couple of years south of the Mariposa District north of Cherry Creek – note the word unit. These are not suburban single-family homes, but small complexes of 10-90 apartment units. Verizon’s Internet product will certainly work in a standalone manner in most apartment units, but should their marketing be targeted to the owners/ managers of the units? Which is more valuable, the fiber powering the millimeter wave radios on Broadway, or the radio capacity itself? Fortunately, Verizon has excess supply of both, but only seems to be promoting one use – individual Internet access.

We found it interesting that no mention was made of a Multi-Dwelling Unit (MDU) strategy in their 2022 Investor Day (which was full of new products and investment announcements). If they wish to increase their market share in “chunks” it’s going to be critical that MDU owners and operators are included.

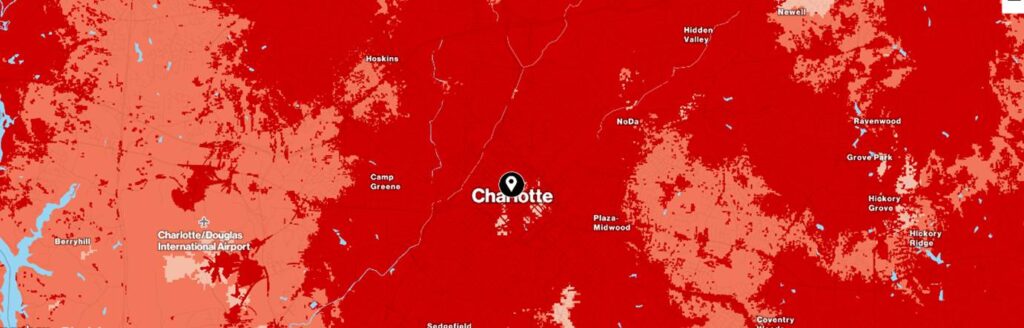

Let’s see how Verizon is doing in a faster growing market like Charlotte (see nearby map). The Queen City is predominately AT&T (although some Windstream to the North and East), and Spectrum (legacy Time Warner Cable). As the maps show, there’s more Ultra Wideband coverage here than in Denver. Verizon also enjoys meaningful market share throughout the Charlotte area (more than AT&T and T-Mobile combined according to our sources). With the exception of the airport (at least for a few years), the ability to take Charlotte “all deep red” is high. Verizon also has developed good fiber relations in Charlotte (despite their previous reliance on Spectrum for wholesale capacity).

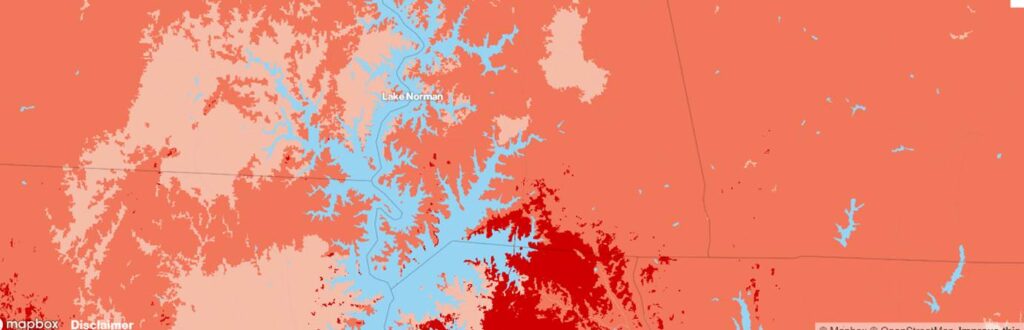

Charlotte is expanding rapidly, however, in all directions, but particularly to the north. Here is the Verizon coverage map north of Davidson (commonly known as the Lake Norman area). More investment needed here, just as AT&T and Spectrum are beginning fiber builds in the area. Verizon’s challenge out of their current FiOS region will be managing network patches. This is likely a 3-4 year phenomenon until 5G Ultra Wideband is available more broadly, but explains a lot of their conservative views. The question becomes “Will FTTH efforts funded by the latest infrastructure bill diminish the attractiveness of Verizon’s offer?”

We think that a $25/ mo. product (Verizon provides a 50% discount for Home Internet on all but their basic tiers today – see here) will be very attractive to many households looking for more value out of their broadband service. Bottom line: Because Verizon has content integration with Disney, Apple, and soon Netflix (see +play platform announcement here), and has fully bundled premium wireless plans with content, we think 5G Ultra Wideband (or Fios in territory) represents the greatest threat to cable DOCSIS for current homes. We do not think that Verizon has the expansion muscle to compete for new builds versus cable for the next several years, and, for this reason, will only take “teens” market share through 2025.

Verizon and T-Mobile have very ambitious expectations for their fixed wireless products. Their pricing models are based on busy hour assumptions that have limits (Verizon less so than T-Mobile given their extensive end-to-end ownership of transport assets in metro areas). But wireless has extensive experience with product and content bundling. Our bet is that FTTH expands more quickly than most expect and that it provides the greater challenge to cable than wireless. In fact, fiber + wireless might be a stronger bundle (even from two separate but strategically aligned carriers) than an all wireless bundle.

That’s it for this week’s Brief. In two weeks, we will look at the flip side of fixed wireless and ask the question “What if cable more aggressively markets their wireless bundle to their customer base?” Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the new website). Until then, go Royals, Sporting KC, and Davidson College Baseball!