Many industry experts consider global SA progress to be surprisingly slow

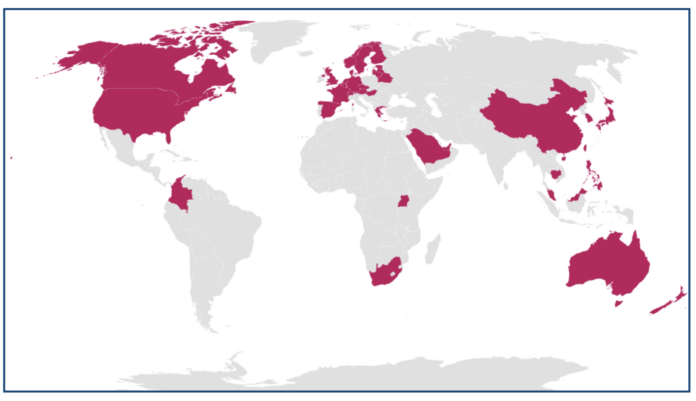

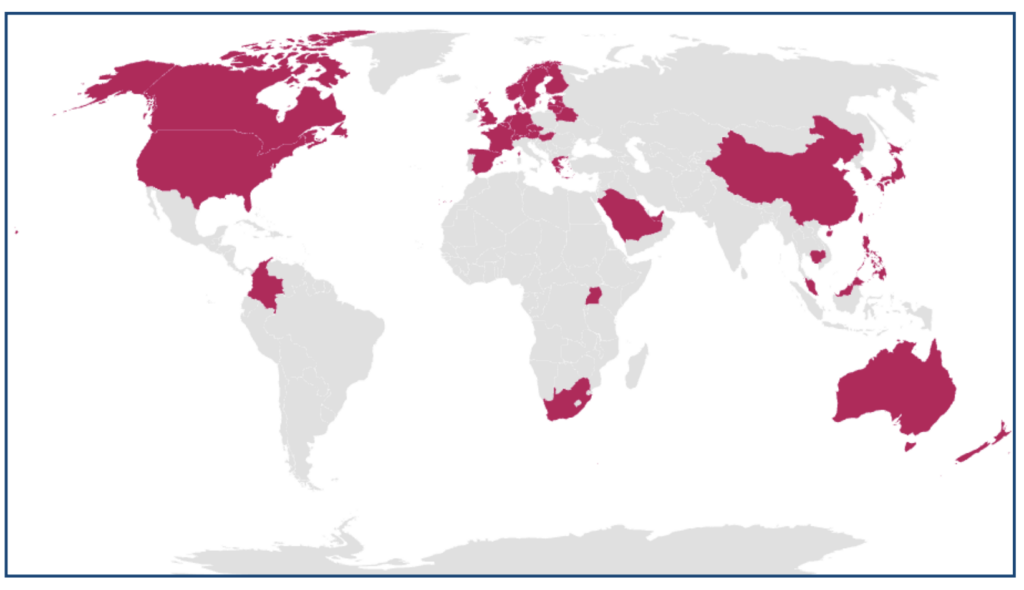

As of January 2022, GSA reported that 99 operators in 50 countries worldwide are investing in public 5G Standalone (SA) networks in the form of trials, planned or actual deployments and that 20 operators in 16 countries/ territories had launched public 5G SA networks, including China Mobile, Vodafone UK and Germany, SoftBank, T-Mobile US, SingTel, STC, Rogers, RAIN and DIRECTV.

Countries/territories with operators identified as investing in public 5G SA networks

An additional five operators have deployed 5G SA technology but not yet launched services or have only soft-launched them, another 25 or so have announced 5G SA pilots for public networks and 22 more are reportedly involved in evaluations/tests/trials.

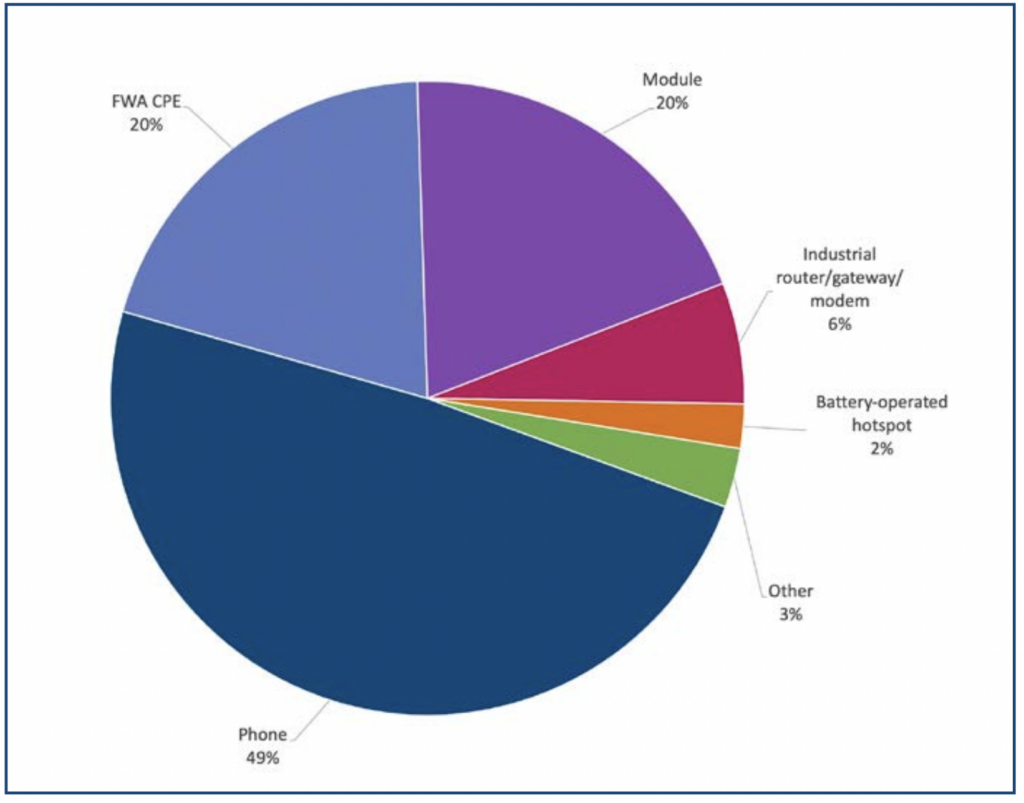

Another way to track progress is to look at the device ecosystem. GSA reported 663 announced devices with claimed support for 5G SA, up 138% from 278 at the end 2020. Of these devices, 461 are commercially available. 5G SA devices accounted for 35.6% of 5G devices in Dec 2019, 49.7% in Dec 2020 and 54.6% in Dec 2021.

When broken down by form factor, phones accounted for just over half (50.3%) of announced 5G devices with standalone support, with fixed wireless access consumer premises equipment (FWA CPE) and modules tying for second place, each accounting for 20% of devices.

Announced 5G devices with stated 5G SA support, by form factor

Despite T-Mobile US actually being the first carrier in the world to activate an SA network in August 2020, Chinese telcos have been the biggest champions of this brand of 5G, and according to LitePoint’s Director of Business Development Rex Chen, it’s a strategy somewhat unique to the country.

“China is pretty gung-ho about Standalone, not so much in North America,” he explained. “In the U.S., you have 300 million plus people, and other than a few big cities, we all live kind of far from one another. In China, you have more population and a really high density of people and if you’re covering those big cities, you’re covering not just a massive part of the population, but also those who can afford 5G smartphones, so if you’re China Mobile or China Unicom, if you deploy 5G cellular in Beijing, you can easily get to 10, 20, 30 million people.”

In the U.S., by contrast, there aren’t as many locations — other than maybe New York City and Los Angeles — where there is such a high population density. In this way, the ROI might be a bit fuzzier in the U.S. than in China. “And let’s be honest,” Chen continued. “China has more FR1 spectrum deployments than the U.S., so that will make 5G SA more attractive.”

No matter how you look at it, many consider global SA progress to be surprisingly slow. “I thought that by now, SA would be more widely adopted,” said EXFO’s Group Manager of 5G Transport and RF Sebastien Prieur. “We are barely starting to see it in terms of operators turning it on. Verizon and AT&T are focusing much more on building out the edge.”

He added that other priorities like densifying the network and turning up C-Band spectrum are taking up a lot of operator energy and resources.

“This will be true for the next few months,” Prieur said. But he assured that SA is coming and that once adequate 5G coverage is achieved in the U.S., with the help of C-Band, operators can move onto the next phase, which he is sure will be transitioning to SA.

According to Jack Fritz, principal at Deloitte Consulting LLP’s Technology, Media, and Telecommunications, getting to SA is certainly a priority for operators, but “there’s a lot of priorities” that are “all competing for attention.”

Beyond the fight for attention, 5G Standalone may not have clear or direct enough monetization opportunities just yet and Fritz thinks this, combined with the potential risks — perceived or otherwise — related to switching how a network is routed and traffic is managed has created some operator hesitancy from both from a performance and cost standpoint.