Greetings from Missouri, Nebraska, and the Dominican Republic, where the staff enjoyed a corporate retreat over the Easter holiday. There’s a lot to cover this week, so we will be very brief in the market analysis commentary. AT&T and Verizon kicked off earnings on Thursday and Friday, and the economic tension was present in each of their presentations. Their differing responses led to differing results on Friday.

The week that was

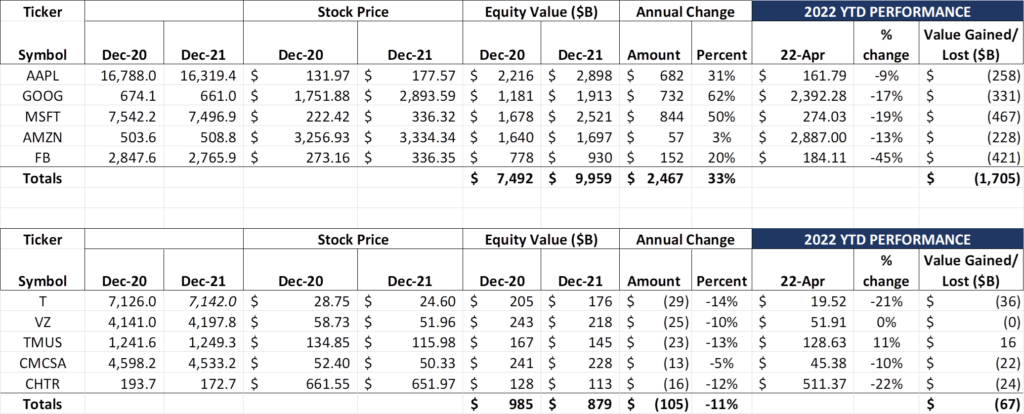

It’s been a remarkable two weeks for the markets. The Fab Five declined an additional $1.25 trillion dollars over this period, a fortnight level not seen since March 2020. And the Fab Five have now given up 69% of 2021’s gains. As we discussed in last week’s web-only post and in previous Briefs, losses are disproportional: Meta/ Facebook represented 9.3% of the total market capitalization at the beginning of 2022 but makes up 24.7% of the total YTD loss (and now only represents 6.1% of the Fab Five market cap). For the long-term investor, this “price pruning” is natural yet never without pain and angst. Perhaps some of these losses will reverse when each of the Fab Five release Q1 earnings results next week.

The situation with the telco Top Five is quite different. While they suffered a 6% equity value loss over the last two weeks (for reasons described below), Verizon has been one of the few Dow components with a plus sign next to their stock price throughout 2022 (currently, they are ranked 13th in performance – right in the middle). T-Mobile is up double digits and, using the April 11th WarnerMedia-Discovery closing price ($42 billion of equity value spun off to shareholders), AT&T “Remain Co” is actually up a few billion dollars on the year. This is nothing to crow about given years of mediocre performance from both AT&T and Verizon, but the wireless part of the communications sector is holding up pretty well amidst the current turmoil.

Charter and Comcast are a different story. Both companies release earnings next week (Comcast on Thursday, Charter on Friday, both prior to market open). We think the cable story is still very bright, and that their wireless MVNO growth will be very strong. More on fiber and cable’s strategy below in the context of AT&T and Verizon’s earnings announcements, but the bottom line is that there are many chapters left in the broadband story, market share transitions take time, and incumbents have the upper hand in nearly all scenarios.

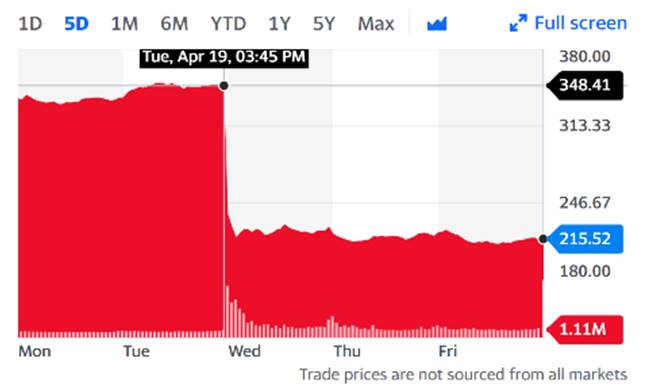

Lastly, one of the stocks others have in their Fab Five (Netflix vs. our inclusion of Microsoft) had a very bad week, tumbling 38% (~$36 billion) in three trading days (see 5-day chart nearby courtesy of Yahoo! Finance). This downdraft was driven by poor results (200,000 subscriber loss) and a bleak second quarter outlook (2,000,000 subscriber loss). The reasons are myriad, but, as we have discussed in many Briefs, it’s a “buyer’s market” for content right now and the cost of producing good content is rising. As we document below, HBO Max, DirecTV’s streaming platform, and Peacock are being heavily marketed, and, with shows like “The Office” leaving Netflix in 2021, the only surprise is why it took this long for the market to adjust.

AT&T and Verizon earnings—under pressure

In the midst of the market downdraft last week, AT&T and Verizon announced earnings. Neither excited the markets as their results were generally in line with estimates. While each company has different growth strategies, both are executing against economic headwinds. AT&T ended the week up slightly (0.4%), while Verizon managed to erase all of the gains posted earlier in the week on Friday and closed down 2.8% for the week.

AT&T’s report (full materials here) can be summarized in two words: on track. Whether investors agree with their “Everyday Low Price” fiber pricing or “new and existing customers are treated the same” wireless strategy, there’s no doubt that Ma Bell is transforming. Whether it’s $40 billion in debt reduction or 17 million fiber homes passed (+800K vs 4Q 2021) or flat postpaid monthly phone churn (0.79%), they are on track to grow share.

However, share growth has come at a hefty cost, as we will detail below. AT&T’s CEO, John Stankey, signaled that profitability was just around the corner in his opening statement:

“Our focus on driving efficiencies continues to show tangible results from our network build-out to customer experience. As we told you, we’re initially reinvesting these savings to fuel growth in our core connectivity businesses. However, as we move to the back half of this year, we expect these savings to start to fall to the bottom line.”

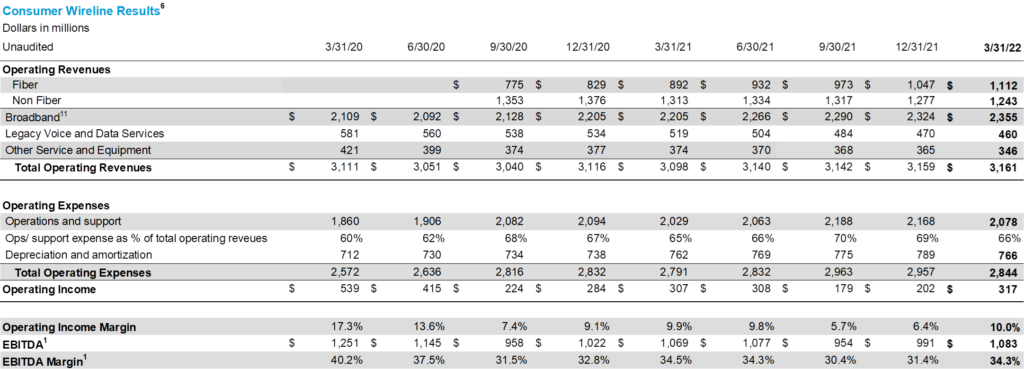

How bad is it? Let’s look at the consumer wireline unit profitability (nine quarter trends):

We modified AT&T’s reported statements by moving up the broadband revenue components (fiber vs. non-fiber) and also calculating the operations/ support expense as a percentage of total operating revenues. There are many things to note here, but our focus in this Brief is on two items:

- Operations and support costs are already falling as a percentage of total consumer revenues. It looks like they peaked in 3Q/4Q 2021 and are in the process of falling. This is a function of several factors, the most important being the reduction of operating expenses in the non-fiber markets. As we documented after AT&T’s 4Q earnings (Brief here) and Investor Day (Brief here), they have very different plans for less densely populated areas than metros. As AT&T expands their metro presence (including suburbs in Dallas, Austin, Houston, Atlanta, and Chicago), there is less copper to maintain. Offsetting that is the cost of operating two networks (although the incremental cost of operating a fiber network is less than DSL).

- Depreciation costs are dropping as a percentage of the total consumer revenues (24.2% in Q1 2022 vs 25.0% in Q4 2021 and 24.6% in Q1 2021). With billions of fresh capital being poured into their consumer network, one might expect much higher depreciation. Fiber has a longer life, however, and this lowers depreciation expense (both AT&T CFO Pascal Desroches and John Stankey emphasized the long-lived nature of the asset on the call).

AT&T might get some savings from a reorganization (see this from Reuters on some of the changes announced last week), but the real savings comes from a “cap and grow” policy on copper/ DSL that was started immediately after Stankey took the helm (USA Today article here). Because they have fewer copper customers to convert (a short-term loss), the transition from copper to fiber can occur more quickly. Lower operating costs and quicker copper retirements make the post-fiber profitability picture brighter for AT&T.

As the table above shows, broadband’s strongest months tend to be late Q2 through early Q4 (“Move season”). That’s when we will see whether AT&T’s pricing strategy is effective. Assuming they are only building fiber to new developments (highly likely with most metro areas), that sets up a fiber vs. DOCSIS showdown. We think that they will likely split those greenfield additions with cable and not take disproportional share (and we aren’t entirely sure that if AT&T’s pricing were $10 lower, or if they ran a “X months 50% off” promotion, that they would see a material gain). But by the end of July, we should know whether the changes they implemented earlier this year are delivering growth.

While there are many other items to discuss with AT&T’s earnings, John Stankey’s comments on inflation, both prior to and during the earnings call are worth mentioning. Stankey made several comments to The Wall Street Journal on April 9 (article here) indicating that AT&T may have the opportunity to raise prices in line with increases in labor costs. “You’ll probably start to see it over the next several quarters, not just telecom—more broadly in the economy because of the patterns that we’re seeing” was the quote in WSJ. This drew a lot of raised eyebrows from industry analysts and competitors alike as MVNO agreements tend to have no escalators – any price increase would be likely to result in higher monthly churn (or lower share of gross additions).

Stankey clarified his comments on the call, saying:

… I’ll go back to the comments I made a couple of weeks ago, which is broadly across the board in the economy right now, we are seeing inflationary pressures and the consumer is seeing that every place they go. It’s my belief, if we do not see some moderation in this fairly quickly that I think every business in the United States is going to be dealing with the cost of inputs. And I don’t see the wireless industry being immune from that nor any other industry being immune from that.

And as I shared earlier, there’s a lot of different ways you can deal with price adjustments. There’s a lot of different tactics and approaches you can use. But when we’re looking at the customer base as satisfied as we are, when we look at a customer base with some of the value we’ve been putting back into the product and service over time, when we look at our current churn levels do we believe we’re in a position if we’re forced into a situation where we have to start maybe taking some price that we can do that and move it through? Our history would suggest that we know how to do that, and we can do that. And we’ll be very smart and judicious as we have to apply it. But running this business and not sitting here and evaluating where we have options to move on pricing and be successful, I wouldn’t be doing my job properly.”

If history is any guide, the way AT&T and other telecommunication companies might apply it is through a “bottom of the bill” surcharge increase. This would allow them to have comparable advertised prices, excluding taxes and fees. Two different economic scenarios play out in an inflationary environment:

- Scenario #1: Customers who are not on fixed incomes earn more, and therefore are willing to pay more for wireless services (or upgrade their plans). AT&T addresses the fixed income segment through 55+ plans.

- Scenario #2: A recession hits, and unemployment grows (the latter unlikely to last more than a few quarters due to more employment opportunities). This may result in some “shopping around” for broadband services, especially “deals”, and perhaps some downgrading from postpaid to MVNO/ prepaid services. For the AT&T base, however, the impact would be a “stay in place” mentality with fewer fiber and wireless upgrades, and likely increased retention of smartphones.

Bottom line: AT&T is on track. Fewer economic pressures would be better for their outlook, but AT&T’s biggest risk is not the economy. Execution against large cable companies who are trying to attract Ma Bell’s postpaid wireless base is a greater challenge. We will see with next week’s results how successful they have been (we sense an upside surprise).

Verizon announced earnings on Friday (full package here), and their outlook and messaging were also “on track,” except for two statements. The first was in Verizon CFO Matt Ellis’ opening comments:

“On the Consumer side, phone net losses were 292,000 in the quarter. While churn was steady, we saw a decline in phone gross adds of 2% from the prior year. This gross add trend was more pronounced in March and is continuing into April. We will continue to take appropriate measures to be competitive in the market. We are pleased with the quality of the business that we are writing and are confident in the value of the postpaid phone gross adds we are attracting.”

“Phone gross add weakness”: Four words no wireless analyst wants to hear. And, other than some platitudes about management’s comfort with their plan to address this weakness, there wasn’t a good root cause explanation. Was it due to the fact that there were fewer iPhone gross add carryovers than we saw in 2021 (this is a likely cause given our tracking of iPhone 12 vs. 13 shortages – recall our December 26 Brief on that here)? Was it due to cable’s inroads and the not-so-secret news that the cable networks use Verizon as their underlying network carrier? Given the inclusion of this statement in opening remarks, we are very surprised at the lack of a detailed response. Frankly, it created an unnecessary cloud over extremely strong fixed wireless and Fios net add performance.

Secondly, there were Matt Ellis’ comments concerning inflation:

We saw inflationary pressures building towards the end of the first quarter and expect those to continue given the current environment. The major areas of exposure for us are energy-related costs for our network operations and transportation as well as labor-related costs, including both our direct workforce and third parties. While these items have not had a significant impact on our overall results to date, they represent a meaningful portion of our direct cost structure and have the potential to drive additional expense pressures throughout the rest of the year.

We also believe that the inflation we have seen throughout the economy may alter both the consumer and business landscape in which we compete. It is too early to predict how this changed landscape may impact our near-term results or how long it will last, but we are confident that the strategy we have put in place will allow us to achieve our long-term growth plans.

We find the transportation comments particularly interesting given the density of the metropolitan areas in which Verizon operates. If Verizon had operating regions in Nebraska or Louisiana (or even Alaska), one could see the impact of $1-1.50/ gallon gas price increases. But Verizon is in Baltimore, Washington D.C., New York City and Boston. If truck technicians are logging more than 120 miles per day on average we would be extremely surprised. Does $6-9/ day more in fuel expenses per truck move the needle on Verizon’s total costs of revenue (re: Verizon had $27 billion in Q1 service revenues)?

Maybe this relates to central office costs. But, with Fios nearly deployed (unlike AT&T), the central offices have been realigned to reflect fiber equipment energy usage (which is a fraction of DSL/ copper). This also doesn’t make sense. Perhaps it’s power-related costs at the cell tower that increase because of additional C-Band and LTE networks. But again, the measurement would be in incremental cost increases, not the “two networks vs. one” step function that would have been budgeted.

Perhaps this relates to anticipated cost increases for both labor and operations. This makes sense, but Verizon is (as they stated on the call) one of the best supply chain management companies in America today. Have they thrown in the towel on inflation?

There’s more to discuss with Big Red as they had a really strong quarter. All of their issues were readily explainable (even Tracfone, which, in our view, represents a vector that could compete with fixed wireless for revenue growth leadership).

Bottom line: Verizon failed to manage their quarterly earnings message. They still have a terrific network (see the latest RootMetrics RootScore Metro reports here – note that AT&T has no individual company wins to date in 1H 2022). They have an accelerated C-Band deployment schedule. ARPA and account growth continues. Yet their response to one very explainable issue (gross add weakness) and FUD (Fear, Uncertainty and Doubt) around their inflation message left investors perplexed. The only surprising fact was that their stock was not down more than 6% on Friday.

That’s it for this week’s Brief. In two weeks, we will attempt to discuss eight earnings releases and find some common threads as we navigate through the remainder of 2022. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Until then, go Royals, Sporting KC, and Davidson College Baseball!