Multi-cloud strategies still more theory than practice

As global digitization efforts continue, enterprise IT is increasingly tasked with enabling cloud-based digital transformation at every level of business. Hyperscalers have been fast to respond with an increasingly rich array of enterprise solutions aimed at capturing that market and creating disruption points to tilt the market in their favor. But there still isn’t a clear winner among the dominant hyperscalers vying for their business. Next Pathway outlined some of these trends in its new State of Enterprise Cloud Migrations report.

“This is the third survey we’ve done,” Chetan Mathur, Next Pathway CEO, told RCR Wireless News. Next Pathway automates corporate data migration to the cloud. Mathur said they collected data for the survey in February 2022, polling more than 1,000 IT professionals and decision makers. Mathur said Next Pathway’s customers run the gamut, though many of their clients are in finance, telecom, and retail sectors.

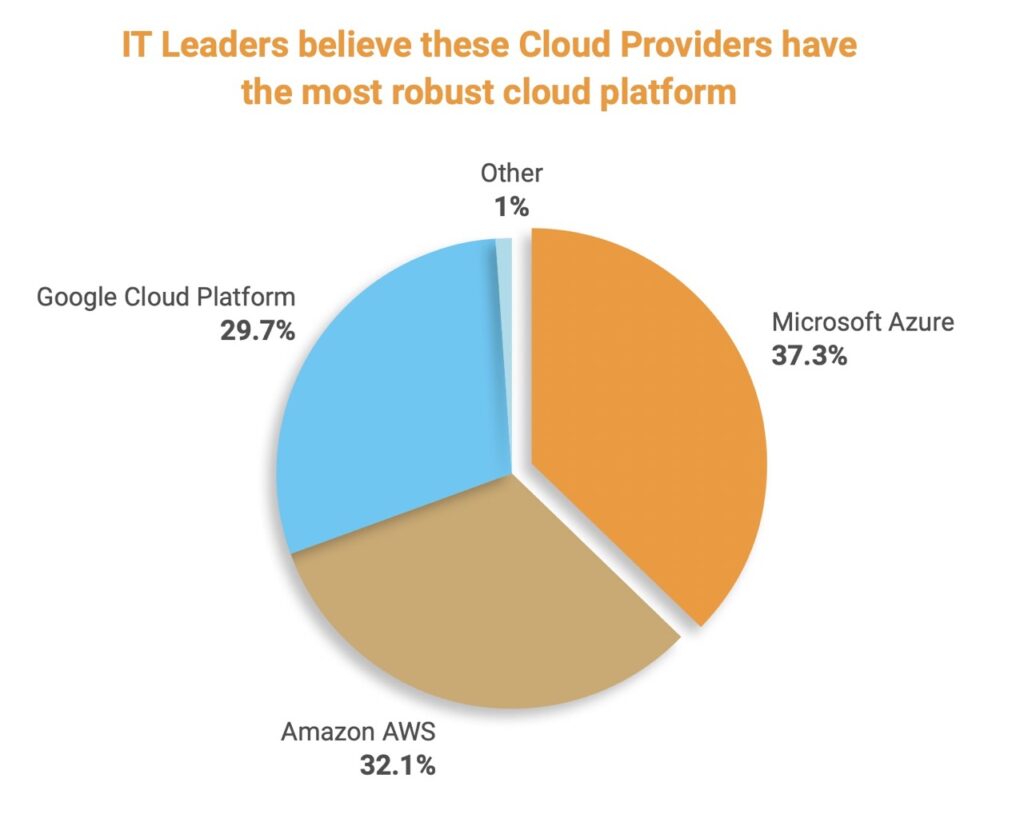

There’s no clear winner among the “big three” hyperscalers when it comes to corporate IT marketshare, said Mathur. Although Microsoft does have a slight edge with Azure – at 37.3 percent – which Mathur attributes to the company’s institutional dominance in enterprise IT. Amazon Web Services (AWS) had 32.1 percent and Google Cloud Platform had 29.7 percent, respectively. Each of the platforms sports differentiation that’s important to different aspects of enterprise IT, he said.

“With Microsoft growing up in the enterprise for the last 30 years or so, they seem to have the confidence of enterprise CIOs,” he said. “Security, familiarity, those sorts of things.”

AWS has the edge with developers, who appreciate the company’s rich set of platforms and services and its broadly accessible tools. “They’ve taken the strategy of open sourcing whatever they can,” he said.

Google’s powerful data analytics tools, driven by Artificial Intelligence (AI) and Machine Learning (ML) are favored by Next Pathway’s telecom and big data clients, Mathur said. “I find that a lot of data scientists like Google,” he said.

Mathur said that enterprise IT decision-makers are under pressure to move workloads to the cloud – 78.3% of those polled see demand for it – only about one-third, or 33.6%, have actually completed a workload migration to the cloud.

“We’re still in early days,” said Mathur. Enterprise IT needs help, in the form of more services from hyperscalers and more industry-specific options for various vertical markets.

While deployment strategies across multiple cloud service providers may promise advantages like redundancy and fault-tolerance, most IT decision makers working on data migration efforts surveyed for the report are sticking to a single public cloud provider for now.

Interest in hybrid cloud but little movement

Hybrid cloud deployment – some combination of public cloud and private cloud storage – has top mindshare among IT decision makers. Most – 97% – acknowledge there are benefits to a hybrid cloud strategy. But only 30% have a hybrid cloud in production today.

Part of the problem, asserts Mathur, is a general lack of institutional knowledge. About a third, or 32.5% of those polled, complained about the absence of skill within their existing personnel to manage multiple cloud deployments. The fear of spiraling operational costs and concerns over an even more challenging security environment also top decision-makers’ lists.

Mathur cautions his clients to plan their cloud migration efforts carefully. “Take your time, plan it out. Don’t be panicked that you’re not moving everything to the cloud, day one.”

Without fully factoring in all the issues involved in legacy workflows and systems, he said, enterprises will sometimes find themselves in the worst of both worlds. He pointed to an example with an unidentified client who rushed to migrate to the cloud, only to discover after the fact lingering dependencies that kept them reliant on their existing data center installation, which they originally planned to wind down.

“Not only did they migrate to the cloud and incur the cloud costs, but they couldn’t actually cut the cord [from the data center], so they got hit double on the cost,” he said. “The true cutting of the cord is when you realize those savings.”