The EU is in grave danger of “throwing out the baby with the bathwater” in its prospective attempts to reform SEP licensing with interventions for the purported benefit of European Small and Medium-Sized Enterprises (SMEs) in IoT.

Europe was once preeminent in cellular communications with 2G GSM—including standard-essential technology innovation, product developments and sales, network deployments, and operator services adoption by consumers. Since its heyday in the in the late 1990s, Europe has declined through a succession of falls from various leading positions in cellular.

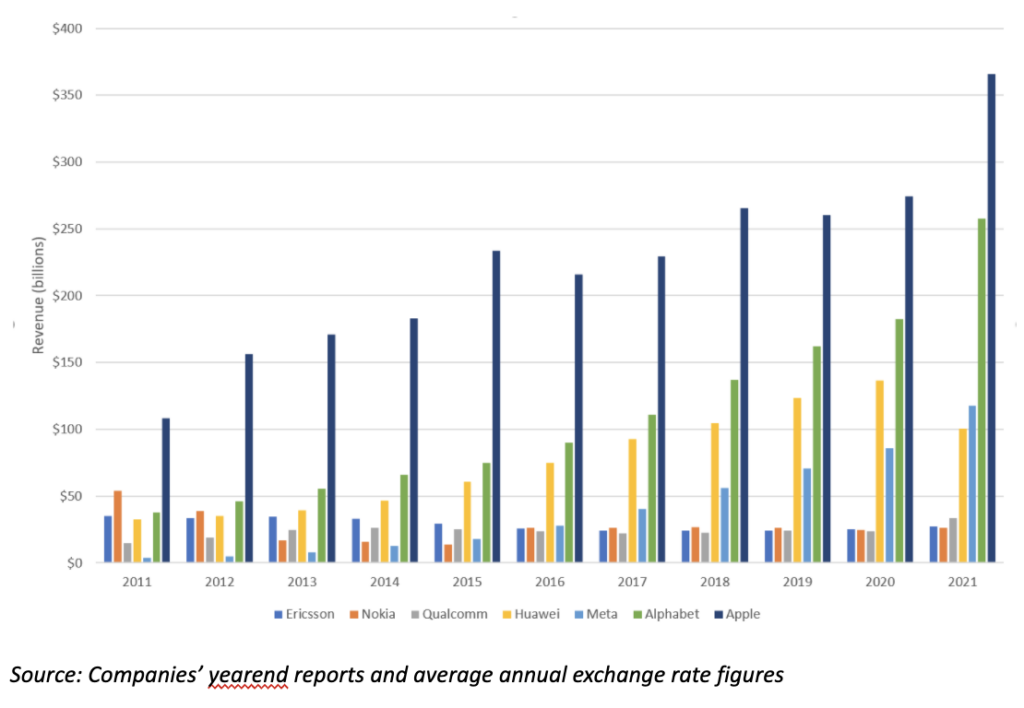

Revenue growth captured in cellular by newcomers from outside Europe

The European Commission’s initiatives to regulate standard essential patents (SEPs)—most significantly in cellular technologies and ostensibly for the benefit of SMEs and other technology implementers—are oblivious to this bigger picture. It is vital for all Europeans that the region’s remaining major players in the cellular ecosystem can flourish profitably and are able to continue investing in R&D for innovation, new products, network deployments and services growth. That means ensuring standard-essential technology developers including the European Union’s Ericsson and Nokia can make fair and adequate returns on their SEP investments. The SEP licensing system needs to be reinforced, not weakened with prospective interventions that are inconsistent, contradictory or that have weak factual justification and would jeopardise Europe’s competitiveness.

Re-establishing European strength in cellular also requires reregulation of operator and other services markets so that European mobile network operators can become profitable leaders in the mobile ecosystem once again. Hopefully the EU’s new Digital Markets Act (DMA) that seeks to reign-in the dominant and abusive behaviour of Big Tech companies such as Apple, Alphabet and Meta will help European mobile operators and others improve their competitive positions and abilities to become leaders rather than remain followers with new technologies and services. Anticipated measures against these Big Tech “gatekeepers” include restrictions on bundling and self-preferencing between complementary services (e.g. search versus shopping), and mandating interoperability among different messaging platforms.

The European Commission, with its call for evidence for an Impact Assessment regarding a new framework for standard-essential patents closing May 9, 2022, follows the US Department of Justice and the UK’s Intellectual Property Office with public consultations on the topic of SEP licensing. These focus on various issues including improved “transparency” with the counting of essentiality-checked patents in setting royalty rates, prospective new collective licensing arrangements and purported problems such as opportunistic behavior by patent owners and implementers.

While the European Commission threatens to meddle with SEP licensing, a paper I have written for 4iP Council considers the broader strategic issues on Europe’s competitiveness in cellular. This longer read shows that virtually all the $14 billion in SEP royalties to Europe’s world-leading innovators Ericsson and Nokia over the last 5 years— that were vital to fund their R&D at a total cost of around $10 billion in 2021—were export revenues generated on smartphone sales by Apple and Asian OEMs. Royalties generated from SEPs in Europe are tiny in comparison: most IoT modules are produced by a top five manufacturers that are Chinese, and there is no requirement for software application developers to take SEP licenses.

Licensing costs pale in comparison to total revenues and profits derived as the cellular ecosystem expands to be worth many trillions of dollars in products, services and applications including IoT.