June greetings from the 49th state, home to some pretty noisy glaciers (Aialik Glacier pictured). We have had a terrific ten days touring many of the TelAlaska properties and learning more about broadband deployment challenges. TelAlaska has an amazing team working every day to improve the lives of Alaskans.

This week’s Brief will be abbreviated due to travel schedules (and summer solstice celebrations), but we will begin an in-depth look next week at how Apple’s developments could impact the telecom industry. This will also get regular Brief publication on a non-Holiday weekend schedule.

The fortnight that was

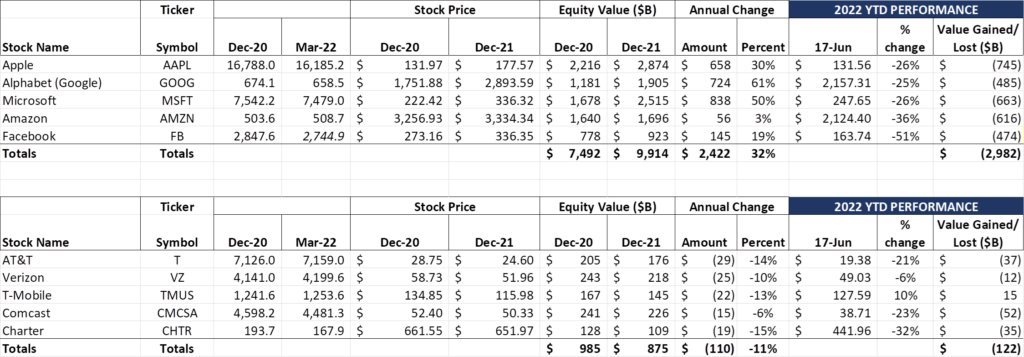

The Fab Five had a miserable two weeks, losing $718 billion (or the value of the Telco Top Five minus T-Mobile) over the period. Each stock lost value (AAPL leading the loss, down $224 billion), and Amazon and Facebook/ Meta now have materially lower market capitalizations than their end of 2020 levels.

Relatively speaking, the Telco Top Five had a better week than most of the other market sectors, with Charter and Verizon losing the least. As we have stated previously, the cable stocks (CMCSA and CHTR in the Telco Top Five) are really taking a hit in 2022. While we think that the long-term prospects for cable are very good, we anticipate that an anxious sentiment will increase for the cable industry after second quarter earnings.

There was a lot of talk this week about inflationary and recessionary pressures, with AT&T’s CFO, Pascal Desroches, making the following statements at the Credit Suisse Communications Conference (transcript here):

“We’ve built in a fairly healthy level of inflationary expectations into our budget. With that said, it’s running harder than we thought. And you saw one of the things that we did recently was to raise prices in response to that as we — and it’s something we’re going to continue to keep an eye on. And we’re seeing it. We’re seeing inflation in labor, supplies, energy, transport. So we’re keeping an eye on it. And if it continues, which candidly, as I sit here today, I expect it to continue for the foreseeable future, we’re going to have to look at pricing again as a potential leverage to help offset that… inflation is probably the area that I worry the most about.”

“As I look at the inflationary expectations over the next several quarters, it’s hard for me to envision that’s not going to impact the consumers negatively, and that we and others will see some pressure.”

Raising price is hard to do in the telecommunications industry, especially with the competitive threat posed by Verizon-backed cable MVNOs. Prior to additional “headline” or “advertised monthly” price hikes, we think that AT&T will continue to go down the path of decreasing their content bundle offerings (the HBO Max inclusion with higher-end AT&T plans already ended this month) and also increasing selected fees (reduced discount for autopay/ paperless billing, resumption of installation charges for fiber customers, modem fees for premium Wi-Fi, even an increase in their 1 Gbps fiber base rate). The cable industry appears to be headed down a path where they face lower levels of competition, and AT&T might join them.

The alternative that we don’t think AT&T will pursue (although we would not be surprised to see it occur) is a slight (1-2 quarter) slowdown in deployments. Desroches did not mention this as an option (in fact the company appears to be accelerating their efforts), but it’s entirely possible that lever might be pulled. If a recession is just around the corner, extending some schedules might make sense (even with some accelerated depreciation benefits ending).

Finally, while we will go into greater depth in next week’s issue, we can’t help mentioning the latest iMessage feature: editing (including unsending) messages to other in-app users. What’s interesting is that there does not appear to be an ability for the message recipient to reject the edited message or even to show the previous and current iteration of the message (in legal parlance, the “redline”). I can only imagine what effect this will have on relationships, court cases, etc. More details from The Verge on this feature are here.

That’s it for this abbreviated version. We have a fairly lengthy Google I/O + Apple WWDC impact Brief coming next Sunday. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a great June and go Royals and Sporting KC!

(And yes, we will greatly miss the 33 years of coaching excellence exhibited by Davidson Men’s Basketball Coach Bob McKillop. Full story here).