Microsoft, Amazon, Salesforce and Google come out on top

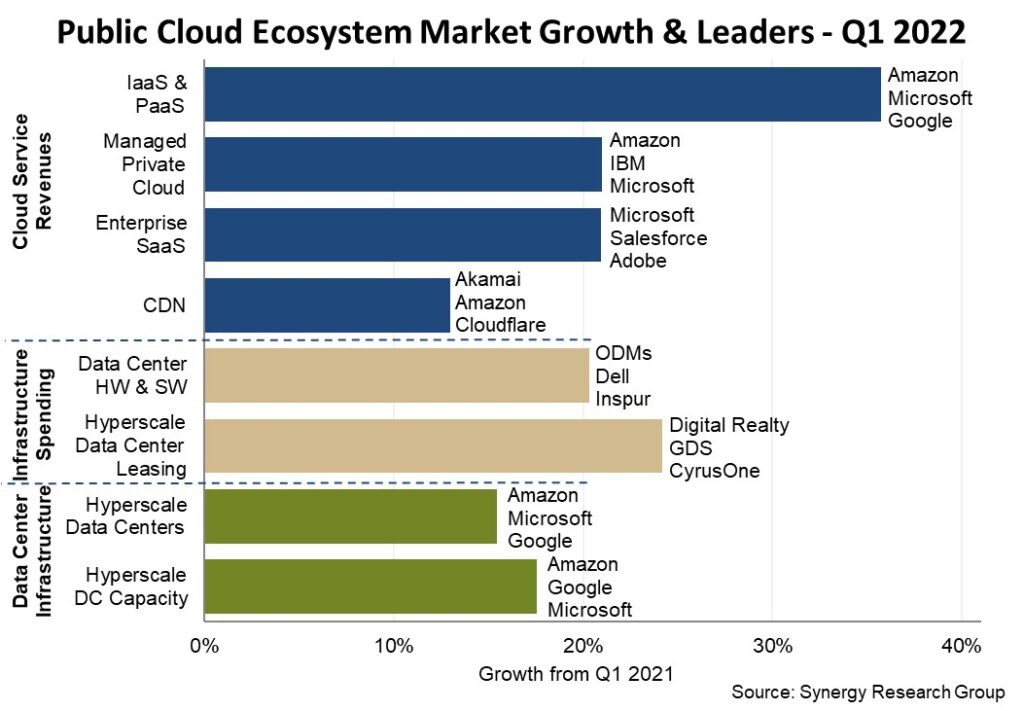

Public cloud service and infrastructure markets hit $126 billion for the first quarter of 2022, growing 26% year over year. Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) spending saw the biggest growth, reaching 36% for the first quarter, or more than $44 billion. Those are some of the takeaways from Synergy Research Group’s (SRG) latest report.

“Across the whole public cloud ecosystem, companies that featured the most prominently were Microsoft, Amazon, Salesforce and Google. Other major players included Adobe, Alibaba, Cisco, Dell, Digital Realty, IBM, Inspur, Oracle, SAP and VMware,” said SRG.

Combined, these businesses accounted for 60% of all public cloud-related revenues, according to the report. SRG found that managed private cloud services, enterprise Software as a Service (SaaS) and Content Delivery Networks (CDN) comprise a total of $54 billion in service revenues, showing 21% year-over-year growth. Amazon, IBM and Microsoft led the charge in managed private services, while Microsoft, Salesforce and Adobe were standouts in the SaaS segment. Akamai, Amazon and Cloudflare ate up the lion’s share of quarterly CDN revenue.

Another $28 billion was spent on public cloud infrastructure, including building, leasing, and equipping data centers, up 20% year-over-year. And while cloud spending is rising globally, nowhere is it growing faster than in the United States, said SRG. 51% of all hyperscale data center capacity is in the U.S., which also retains 44% of all public cloud services revenue.

“Across all service and infrastructure markets, the vast majority of leading players are US companies, with most of the rest being Chinese,” said SRG. The rest, in this case, represents about 8% of total Q1 cloud services revenue, and about 15% of global hyperscale data center capacity.

Diving into IaaS and PaaS

John Dinsdale, a Chief Analyst at Synergy Research Group, predicts 15-40% market growth per year, and says that PaaS and IaaS are leading the cloud service market.

“Looking out over the next five years the growth rates will inevitably tail off as these markets become ever-more massive, but we are still forecasting annual growth rates that are generally in the 10% to 30% range,” said Dinsdale. Dinsdale said he anticipates that major cloud service providers must double in size within the next three to four years to continue to scale worldwide demand.

IaaS enables enterprise IT to outsource cloud computing network infrastructure like physical computing resources, scaling, and security. Examples of IaaS include Amazon EC2, Microsoft Azure Virtual Machines and Google Compute Engine. IaaS spending has increased dramatically year-over-year, driven by new trends in hybrid cloud and hybrid workforce solutions. As enterprises digitalize their operations into the cloud, IaaS sales are expected to increase.

PaaS delivers a framework for developers to create customized applications and middleware. Providers of PaaS offer host environments that deliver the app to users over the web. PaaS is a popular option for small to medium-sized businesses and bootstrap startup operations. They find it appealing as a cost-effective way to manage development resources. There is no lingering hardware to pay for. The core development stack is managed, and app time to market is rapid.

SRG’s prediction of strong IaaS segment growth was also reflected in Gartner’s latest poll of public cloud IaaS spending. It showed the segment growing 41.4% in 2021, totaling $90.9 billion, up from $64.3 billion year-over-year. Amazon is still the premiere IaaS provider in the survey, followed by Microsoft and Alibaba. Google and Huawei are fourth and fifth, respectively. Together, the top five IaaS providers account for more than 80% of the entire market, Gartner reports.

Worldwide end-user spending on public cloud services will grow 20.4% to $494.7 billion, up from $410.9 billion in 2021, according to Gartner. Gartner expects end-user spending to approach $600 billion in 2023. The report highlighted the growth of IaaS market and identified hyperscale edge computing and Secure Access Service Edge (SASE) as disruptive market factors.