More greetings from the 49th state, where Jim and the editor wrapped up their trip last week. Pictured here is the main boat dock in Seward, Alaska (a TelAlaska/ American Broadband exchange). Slightly off camera to the left of this picture is a large cruise ship (2500+ passengers) that connects to a nearly 100 year-old railway. To say the tourism business is booming this post-pandemic summer is an understatement. A terrific trip – let me know if you need some travel tips.

This week, after a full market commentary, we will begin a multi-part exploration of each Fab Five stock’s strategies and their impact to legacy wireless and wireline service providers. First up is Apple, who recently announced a variety of hardware and software changes at their annual Worldwide Developers Conference (WWDC). With $2.3 trillion of market capitalization to build on, they provide terrific insights into the short and long-term future of the industry.

As stated in last week’s shortened Brief, we are resetting the bi-weekly cadence to allow for July Fourth and the Labor Day breaks. Hope that everyone gets a chance to pause and reflect on our freedoms.

The fortnight that was

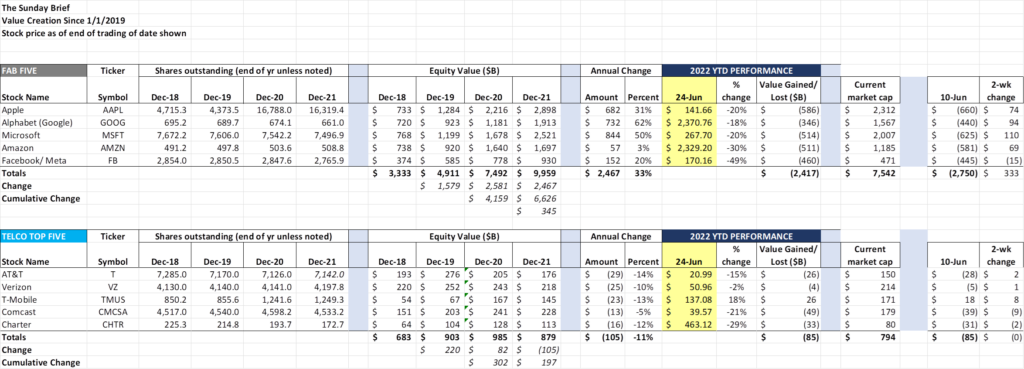

Starting with this Brief, we will use the same “long term” spreadsheet view that we have been using with the interim Briefs. This format is more conducive to discussions on multi-year gains and losses. A full version of this sheet will be attached to the end of the on-line post at www.sundaybrief.com. Also, we will adjust the Amazon share price to reflect the 20:1 share split after the Fab Five announce earnings (should be complete by mid-August).

This was generally a flat fortnight for the Fab Five, with nearly all of the $333 billion gains shown occurring during Friday’s blockbuster session. Four of the Fab Five increased their market capitalizations since June 10. This is largely due to the impression that the “strong get stronger” during economic slowdowns.

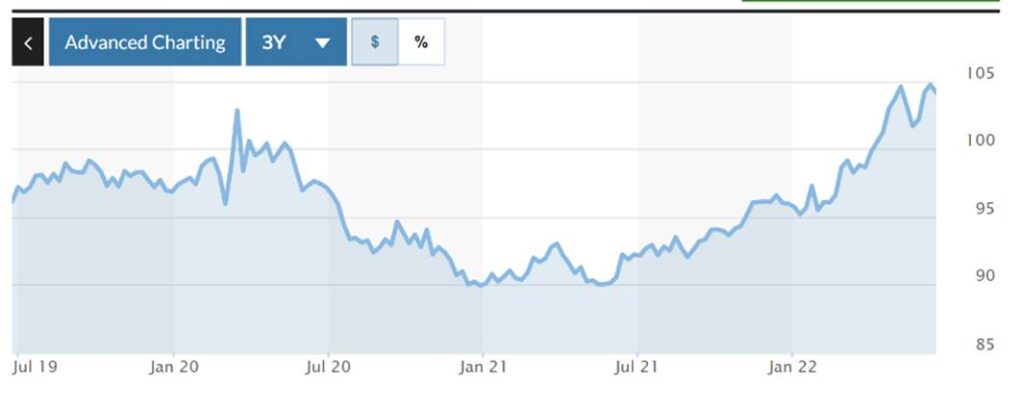

The latest earnings warnings center around the strength of the US dollar (see nearby graph and this link). 13-15% more local currency earnings were needed in 2Q 2022 to simply equal the buying power of 2Q 2021. Expect the words “constant currency” in every Fab Five earnings announcement given the relatively quick change.

The Telco Top Five in total stayed flat for the week, with shifts moving from cable (CMCSA, CHTR) to telco (particularly TMUS). T-Mobile continues to move up the value table, with a mere $6 billion separating them from Comcast. From comments made at analyst conferences over the past two weeks, it does not appear that T-Mobile is losing much if any market share to the cable MVNOs, and, in fact, is gaining more fixed wireless broadband market share in nearly every market.

While we will not go into detail on the latest batch of RootMetrics RootScore reports (will save that for the next Brief when all 125 metros should have posted results), we will note that there has not been any material movement towards T-Mobile’s overall network performance (4G and 5G combined). Verizon appears well positioned to be the winner in a majority of the metropolitan areas. RootMetrics is one of several third-party network performance companies, and their testing methodology is different from companies like Open Signal and umlaut. As is the case with each report, trends matter as much as the results.

Here are the markets where Verizon has been the outright winner for each of the last four RootMetrics Root Score Reports (note: this list will increase after the full results have been posted):

Large Metros: New York City/ TriState area, Chicago, Los Angeles, Atlanta, Phoenix, Tampa, Riverside (CA)

Other Metro Areas: Chattanooga, Cincinnati, Colorado Springs, Dayton, Flint (MI), Ft Wayne, Honolulu, Indio (CA). Palm Bay (FL), Reno

With four consecutive wins in the last two years in half of the top 10 metros, (and 7 of the top 20 – so far), Verizon is still the top carrier. AT&T’s outright wins have fallen from 15 in the first half of 2021 (when the full effect of FirstNet deployments would be most apparent) to 2 thus far in 2022. Based on our tracking, it does not appear likely that this figure will grow beyond 3 or 4 after all of the results are in. One would have to believe that this should help Verizon compete for incremental corporate account business.

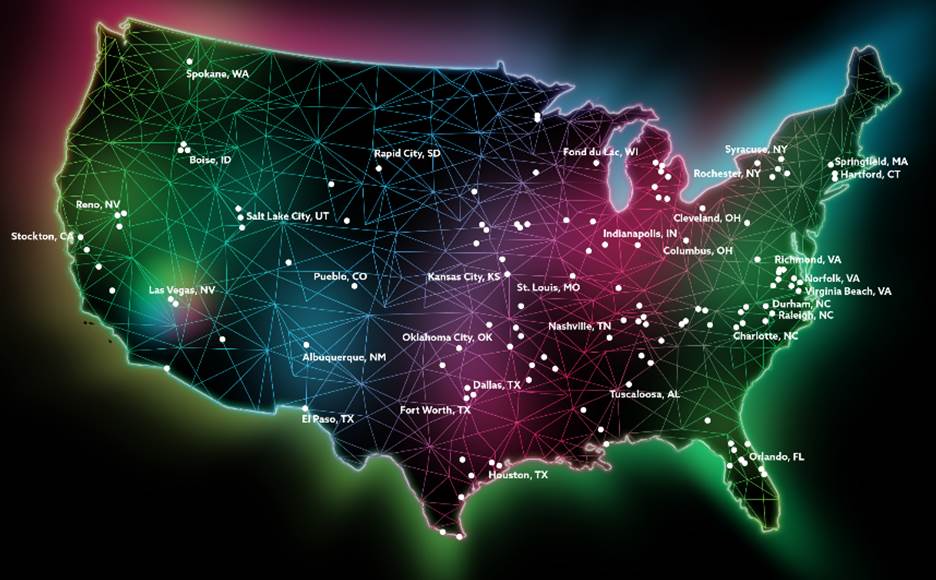

Since our last full Brief, Dish announced that they had deployed their new network (branded as Genesis) in 20% of the country. Nearby is a map of their current service areas. Like our good friend Roger Entner (listen to his podcast summary here), we think that this milestone deserves a special mention simply because of the many “firsts” that the Dish team accomplished with this deployment. We also agree that there are many “hard parts” remaining.

After the milestone announcement, Dish also disclosed that they were making up with T-Mobile (subject to Department of Justice mid-August approval). Their wholesale expansion announcement (here), which includes a “multi-billion revenue commitment” surprised many industry insiders given the back and forth sniping a year earlier (which surrounded the Boost customer impact of the CDMA network shutdown). Perhaps most interesting is that T-Mobile Chief Marketing Officer is quoted in the Dish news release. To have branding executives quoted on a multi-billion wholesale deal seems very strange – we assume this reflects Mike’s efforts in his previous role (President of T-Mobile for Business) and not his current one.

Lastly, we would be remiss if we did not pause to mark the 20th anniversary of “the beginning of the end.” Two decades ago, months of tremors culminated in the announcement of the largest fraud in American business history — WorldCom admitted that they had been overstating their EBITDA for the last two years (which was later adjusted to be a multi-year admission totaling more than $11 billion). CFO John Sullivan was fired (former CEO Bernie Ebbers had resigned ~10 weeks earlier), and John Sidgmore attempted to guide MCI WorldCom through an enormous black eye until his untimely death in 2003. A full chronology of the events surrounding WorldCom from The New York Times is here, and our Sunday Brief from July 2012 (titled “WorldCom’s Unanswered Questions”) is here.

The actions of a few changed the future of the telecommunications industry forever. MCI WorldCom’s demise remains, outside of AT&T’s divestiture and perhaps the enactment of the 1996 Telecom Act, the most influential event in the history of telecommunications.

How will Apple grow?

On a brighter note, Apple held their Worldwide Developer Conference earlier this month. The range of announcements reflects the $2.3 trillion value of the company: everything from chipset development through medicine management, auto dashboard management, and installment payment management. A few hours of announcements has the real potential to change how we work and live over the next few months and years.

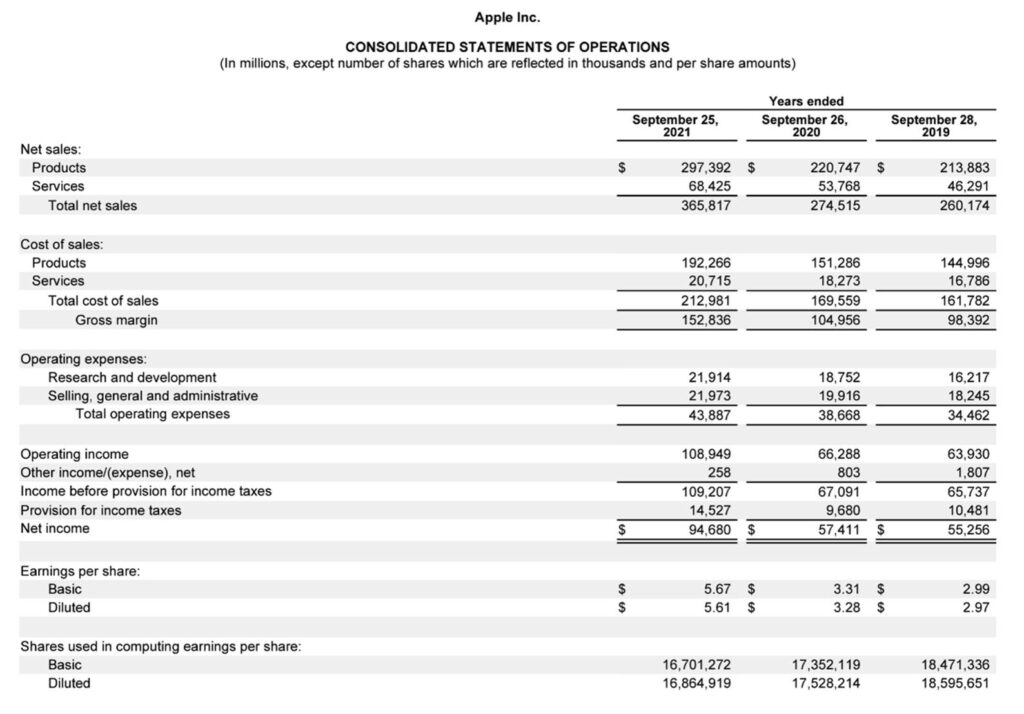

Before digging into the communications aspects of the conference, let’s take a quick look at Apple’s performance over the last three years (from their 10-K for the period ending September 30, 2021).

Services revenues are up 48% over the three-year period (gross profits grew 55% over the same period). Gross margin % is up from 37.8% to 41.8%, reflecting increased hardware margins as well as better mix of higher margin services revenue (2021 services gross margin of 70% on $68 billion in annualized revenue – very nice indeed). Fueling the fire of politicians who routinely bash “Big Tech,” Apple pays less than 4% of its revenues in taxes (regardless of locale). And, despite spending more than $21 billion in 2021 in R&D (and more than $56 billion over the last three years), they have been using excess cash to buy back shares (1.73 billion over the last two years, reducing shares outstanding by 9.3%).

All this, and the company still has negative net debt ($71.7 billion more cash and short/long-term marketable securities than term debt). Is it any wonder that, with these growth rates, the company has added more than $1.58 trillion in market capitalization since 1/1/2019 (more than 1.9x the valuation of the Telco Top Five), even with the current 2022 pullback?

The problem of Apple’s recent success is that it breeds higher expectations. As of Friday’s (June 24) close, Apple still sells at a 23.08 Price/ Earnings multiple, implying an earnings growth rate of ~20-25% annually forever. Apple’s long-term earnings growth rate (since the launch of the iPhone or 14 years) is about 33%, with most of that driven by their performance in the 12 months ending September 30, 2021 (an extraordinary earnings growth year for the company).

For Apple to keep their P/E multiple in the 20s (assuming no incremental share buybacks), they will need to increase their pre-tax profits by about $60-70 billion for the 24-months ending September 30, 2023. Splitting that evenly over both years (total targeted operating 2022 profit of $145 billion; $180 billion in 2023) that would imply revenue growth (using the current product/ service mix) of about $235 billion over the two years ($600 billion in revenue * 30% operating margin = $180 billion in FY 2023 operating margin). Halfway through their latest fiscal year (which includes the latest iPhone sales cycle), they have grown operating income by about $10 billion and appear on a trajectory of $40-50 billion growth by the end of their 2023 fiscal year.

The analysis above highlights the struggle Apple faces – more markets are required to be conquered. Growing $110-120 billion in revenues every year is equivalent to two Verizon Consumer Group service revenues growth, every year, for the next two years.

One way to increase revenue growth is to accelerate iPhone (and other Apple product) sales. The longer consumers hold on to devices, the harder it is to grow revenues. Hence Apple’s foray into Apple Pay Later, a Buy Now/ Pay Later (or BNPL) service where any online or in-app purchase on the Apple Card can be extended over six weeks with no interest. For stretched consumers (perhaps during/ over a Holiday period), Apple makes it easier to make larger purchases.

Apple is using their developed credit scoring/ checks and balance sheet to finance the initiative (see CNBC report here). They are becoming more of a bank, building on nearly two years of Apple Card experience (built in partnership with Goldman Sachs – more on that from this August 2019 Brief). That’s why the concept of a monthly fee for hardware and support for your entire home is not as far-fetched as it was when it was first reported by Bloomberg earlier this year (article here).

The implications to the wireless industry could not be clearer: How many iPhone upgrades are required before customers go to Apple directly for iPhones rather than Verizon, AT&T, and T-Mobile? And, with no 24/30/36-month payment commitment to the carriers, why won’t switching/ churn increase? And, if phone and other equipment purchases become part of a larger program, won’t the momentum change to buying from Apple directly?

In addition to Apple Pay Later, Apple also introduced a new chipset, the M2. While these will initially go into the MacBook Air and the MacBook Pro, eventually they are going to make it into the iPad Pro models. The M2’s media engine supports H.264 and HVEC protocols (8K resolutions), yet, despite the camera upgrade with the latest Apple laptops and tablets, it still only supports 1080p camera resolutions. We are less than 24-months away from widespread deployment of 10-15Mbps upstream requirements, and many legacy DOCSIS 3.1 systems are not ready. It’s clear from the M2 chipset specifications that Apple’s laptops and tablets will soon have capabilities that exceed HD quality. Upstream cable systems will struggle, at least until hi-split architecture changes are completed in 2022 and 2023. For Apple to meet its unit growth targets, it’ll need to accelerate tablet and laptop sales. This places more pressure on the bandwidth demands of networks that connect to these powerful devices (in a future Brief, we will describe the kluge Apple announced at WWDC, an accessory developed with Belkin that allows MacBook and iPad users to use their higher-powered iPhones in place of the laptop camera. This appears to be a last-minute add and a missed product line opportunity).

Finally, the item we mentioned in last week’s Brief – living, breathing Messages. As Apple stated here (footnote 2): “Users can edit or recall a message for up to 15 minutes after sending it, or recover recently deleted messages for up to 30 days after deletion.” Our understanding is that this applies to messages sent though the Messages app (Apple user to Apple user), but are we headed to SMS messages as well? And, as we mentioned last week, can the recalled message be refused? Is there a redline? What if the message is shared across a group and some refuse the recall and others don’t?

You can see where this is headed – message caching apps are about to proliferate – ones that store original versions of edited messages (kind of a modified Twitter approach?) as well as ones that automatically reject any requests to edit or recall a message. And, if the industry goes down this route through IMS, we are in for a real treat.

So much more to cover (we did not even touch on Apple’s foray into monitoring your medicine intake), but that’s it for this week’s Brief. The next Brief will be a combination of 2Q earnings preview and a continuation of our regulatory broadband update (thanks for the comments on the first installment). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a safe Fourth and go Royals and Sporting KC!