Service providers, including CSPs, accounted for 55.3% of total compute and storage infrastructure spending for the quarter, said IDC, with inflation and better inventory driving future spending.

International Data Corp. (IDC) reports that spending on compute and storage infrastructure products for cloud deployments, including dedicated and shared environments, increased 17.2% year over year in the first quarter of 2022. IDC predicts spending on shared cloud infrastructure to surpass non-cloud infrastructure for the first time this year, rising 24.3% to $26.3 billion for the full year.

By the numbers: IDC says that shared cloud infrastructure spending grew 15.7 year-over-year (YoY) for the quarter, reaching $12.5 billion. Spending on dedicated cloud infrastructure rose to $5.9 billion, a 20.5% YoY rise. Investments in non-cloud infrastructure increased to $14.8 billion, up 9.8% YoY, showing an unbroken growth streak for the past 5 quarters, according to the report.

IDC predicts $90.2 billion in annual cloud infrastructure spending for the full year 2002, growing 22% YoY. The research firm attributes this rise partly to inflationary pressure, as well as long-awaited easing of supply chain issues, which IDC sees winnowing in the second half of the year.

Service providers – including Communication Service Providers (CSPs), cloud service providers and managed service providers – spent $18.3 billion on compute and storage infrastructure cumulatively for the quarter, up 14.5% from the first quarter of 2021.

“This spending accounted for 55.3% of total compute and storage infrastructure spending. Spending by non-service providers increased 12.9% year over year, the highest growth in fourteen quarters. IDC expects compute and storage spending by service providers to reach $89.1 billion in 2022, growing 18.7% year over year,” said the report.

Looking at compute and storage infrastructure spending from a global perspective, the region with the strongest growth was Asia/Pacific (excluding Japan and China) at 50.1%. The United States, China, Japan, Africa, and the Middle East all saw double-digit growth. Europe is where things get more complicated.

“Western Europe grew 6.4% and growth in Canada slowed to 1.2%. Central & Eastern Europe, affected by the war between Russia and Ukraine, declined 10.3%,” said IDC. The report also notes that compute and storage infrastructure spending declined 11.3% in Latin America. The spending prognosis for Eastern Europe is predictably grim.

“For 2022, cloud infrastructure spending for most regions is expected to grow, with four regions, APeJC, China, the U.S., and Western Europe, expecting to post annual growth in the 20-25% range. Impact of the war will continue to hurt spending in Central and Eastern Europe, which is now expected to decline 54.6% in 2022,” said IDC.

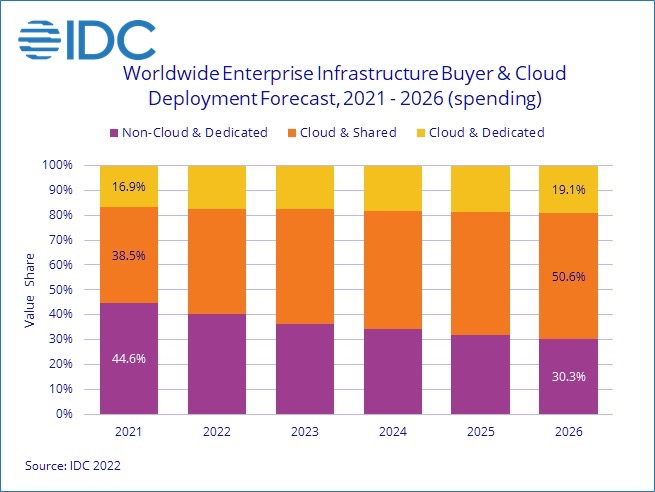

Only 47.8% of the dedicated cloud infrastructure tracked by IDC was deployed on customer premises. IDC predicts a 14.5% compound annual growth rate (CAGR) for compute and storage cloud infrastructure through 2026, reaching $145.2 billion by then.

“Shared cloud infrastructure will account for 72.6% of the total cloud amount, growing at a 15.4% CAGR,” said IDC. Dedicated cloud infrastructure is anticipated to grow at a 12.1% CAGR, with spending on non-cloud infrastructure predicted to grow at 1.2% CAGR to $63.1 billion by 2026.

“Spending by service providers on compute and storage infrastructure is expected to grow at a 13.4% CAGR, reaching $140.8 billion in 2026,” said IDC.

Long term, IDC expects spending on compute and storage cloud infrastructure to have a compound annual growth rate (CAGR) of 14.5% over the 2021-2026 forecast period, reaching $145.2 billion in 2026 and accounting for 69.7% of total compute and storage infrastructure spend. Shared cloud infrastructure will account for 72.6% of the total cloud amount, growing at a 15.4% CAGR. Spending on dedicated cloud infrastructure will grow at a CAGR of 12.1%, said IDC.

“Spending on non-cloud infrastructure will grow at 1.2% CAGR, reaching $63.1 billion in 2026. Spending by service providers on compute and storage infrastructure is expected to grow at a 13.4% CAGR, reaching $140.8 billion in 2026,” said IDC.