Fixed Wireless Access (FWA) is a method of providing last-mile wireless connectivity to campuses, industrial facilities, Small Office/Home Office (SOHO), residential estates, etc., and has been growing in popularity since the introduction of 5G, which was commercially launched in 2H 2019. According to the latest Global mobile Suppliers Association (GSA) FWA Forum, there has been a 10% growth in global FWA services launched between 2020 and 2021, with more than 39% of mobile operators that have launched 5G services also launching 5G FWA services as of April 2022, signaling robust FWA growth driven by 5G.

5G augments FWA

With 5G’s gigabit capabilities and “fiber-like” data rates, FWA could now be well suited as an alternative to wired broadband solutions and generate new business solutions and value for mobile operators to improve their Average Revenue Per User (ARPU). With Massive Multiple Input, Multiple Output (mMIMO) in the 64T64R configuration, Verizon could reach theoretical speeds of up to 1 Gigabit per Second (Gbps) for 5G in the C-band, making 5G FWA a viable competitor to cable and Asymmetric Digital Subscriber Line (ADSL).

FWA gains global momentum

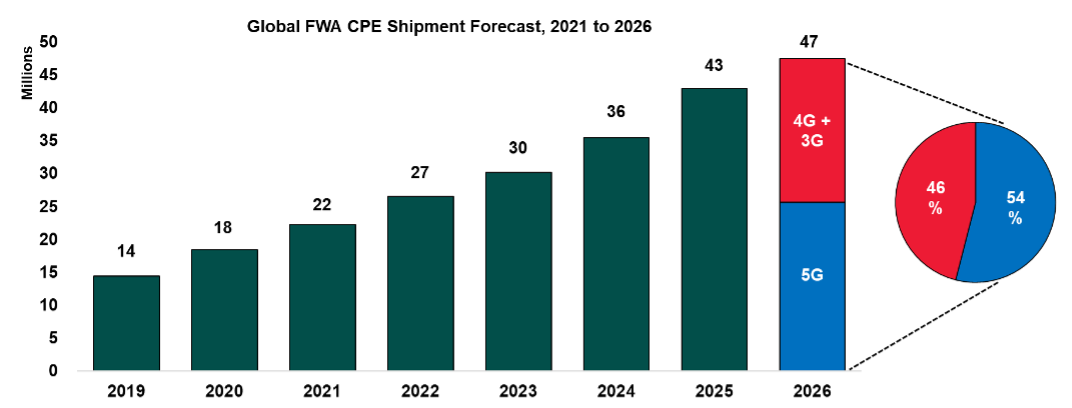

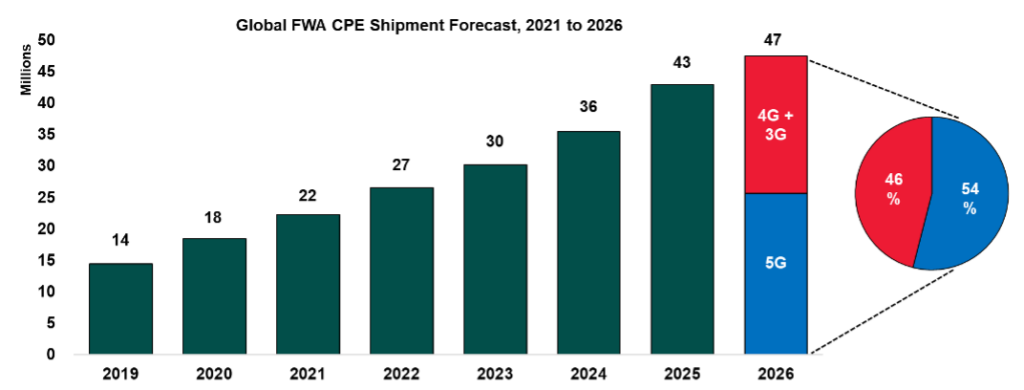

ABI Research forecasts that the total number of FWA subscriptions will grow from 81 million globally in 2021 to slightly over 180 million in 2026, representing a Compound Annual Growth Rate (CAGR) of 17%. Consequently, ABI Research believes that global FWA Customer Premises Equipment (CPE) shipments will reach 47 million annually by 2026, with 5G FWA CPE making up the majority of shipments by 2026 as depicted in Chart 1.

Chart 1. FWA CPE shipments, world markets: 2019 to 2026

ABI Research has already begun seeing momentum for FWA gathering globally. Mobile operators see FWA as a growth opportunity that can use excess network capacity, especially as more spectrum bands like Millimeter Wave (mmWave) (26/28 GHz) and C-band (~3.5 GHz) come into play. It is also prudent to note that 5G capacities would be able to meet the gigabit average data traffic per user per month Download or Upload (DOU) requirements of home broadband users, especially during the hours after 6 p.m. when mobile data traffic is lower and fixed broadband traffic is higher.

The 5G FWA value proposition for mobile operators is good news for their business. Mobile operators can stand to create new pricing packages based on different factors, such as data rates and data volumes, for different use cases, such as cloud gaming and Augmented Reality (AR) or Virtual Reality (VR), and offer new services, such as a 5G FWA private line that competes with fixed broadband. In fact, Rain and Huawei have begun successfully deploying 5G FWA solutions in South Africa to compete with the fiber market in dense urbanized areas, and have demonstrated that the average throughput for these areas using 5G FWA was almost twice that of using fiber, proving how 5G FWA is technologically- and business-ready to compete against fiber.

Benefits of FWA

Including FWA in a mobile operator’s 5G strategy has many benefits. First, on the networks side, FWA, when compared to Fiber-to-the-Premises (FTTP), is much less capital intensive to roll out. This is due to FWA being able to use existing network site infrastructure to transmit Radio Frequencies (RFs) directly to CPE installed indoors or outdoors. Furthermore, FWA CPE can be much cheaper to install and maintain, as the Operating Expenditure (OPEX) of maintaining CPE is less than that for wired landlines, which can span many miles across geographically challenging terrain, such as valleys, water bodies, etc.

Also, FWA CPE vendors are constantly improving their product lines and innovating new features with regard to self-installation, which can negate the need for an on-site technician to do the initial deployment.

Second, FWA can provide exceptional Quality of Service (QoS) with zero impact on existing 5G Enhanced Mobile Broadband (eMBB) customers. Through proper network planning using technology like Artificial Intelligence (AI) to predict data traffic based on geolocation and provisioning of network resources like Physical Resource Blocks (PRBs), mobile operators can ensure that resources are scheduled in a way that meets the data requirements of both FWA and eMBB customers with no compromise. Huawei, which is deploying 5G FWA solutions through its networks, has found that byusing QoS Class Identifier (QCI)-based CPE prioritization to schedule resources, its WTTx Suite designed for FWA can ensure that there will be no impact on a mobile operator’s existing eMBB offerings.

Third, FWA can provide a faster Return of Investment (ROI) with differentiated services, which have been observed to help improve a mobile operator’s Average Revenue per User (ARPU). FWA can be deployed faster than FTTP due to the simple deployment of CPE, which can be optimized and validated with a vendor’s networks through partnership programs and certifications. Due to the benefits of FWA in being able to support downloads in the gigabit capacities, mobile operators can offer differentiated pricing packages to customers based on data rate and DOU requirements. For example, mobile operator Zain Kuwait has seen a rapid adoption of FWA users in the past 2 years and has reportedly generated an increase in 20% of ARPU between 2020 and 2021. This translates to an increasing profit growth rate from -22% in 4Q 2019 to 13% in 2Q 2021, as reported by Zain Kuwait. Due to the quicker Time-To-Market (TTM) for deploying FWA and the revenue opportunities it brings, FWA can potentially help mobile operators achieve a faster ROI compared to deploying 5G networks offering only eMBB solutions.

New business opportunities for value creation

FWA can serve multiple scenarios and use cases due to its ease of deployment and flexibility. FWA can also serve a wide variety of scenarios, such as rural regions, geographically challenging locations (e.g., islands and beaches), urban and sub-urban locations, enterprises and SOHO.

Mobile operators will have to be aware of the use cases that FWA can provide for customers and look toward incorporating some of these into their long-term FWA strategy. Currently, DOU and data rate needs for FWA are growing faster than mobile cellular. For example, T-Mobile reports that its average FWA user has a DOU of between 300 GB and 400 GB, with 10% of its FWA users consuming 1 Terabyte (TB) of data per month. As 5G FWA can provide gigabit bandwidths, many new use cases can be offered to customers. This includes 4K solutions, such as 4K high-definition video services, live-streaming sporting events, cloud gaming solutions and advanced AR and VR services.

Based on Huawei’s current FWA deployments with mobile operators like Zain Kuwait and STC, ABI Research found that the impact on services is nil. Cell load impact was found to not exceed 50% for the majority (> 90%) of all Huawei’s cell sites running both FWA and eMBB. Furthermore, with mMIMO 64T64R antennas and FWA-optimized CPE, cell capacity can be improved by more than 10X, which will be sufficient to service these data-hungry use cases.

Mobile operators can also look to FWA as a competitive alternative to FTTP solutions with 5G capabilities. In fact, with 5G, FWA is no longer a business proposition limited to countries with low FTTP penetration and is a good solution to deploy quickly for new markets due to its faster TTM and relative lower cost than fixed line. Even markets like China and Japan, which have strong FTTP penetration, are seeing the adoption of FWA due to multiple factors, such as a more mobile and younger demographic and having underserved regions near the sea or on fishing boats that fixed line cannot reach.

Deployment recommendations

To maintain the customer experience and enable faster TTM, mobile operators should look toward methods to enable faster deployments without compromising quality and proper network provisioning to enable the required Service-Level Agreements (SLAs) for differentiated FWA services. For deployments, mobile operators should select FWA CPE that is validated with the 5G networks they are using. These validation tests would allow CPE to meet certain standards, including QoS provided, Operating Support System (OSS) compatibility, etc., and therefore, enable faster TTM.

Network provisioning should take the form of pre-deployment planning and post-deployment maintenance. In pre-deployment, it is important to understand the current network coverage available and whether the necessary resources can be provisioned for FWA without affecting eMBB performance. One such solution is Huawei’s WTTx Suite, which helps mobile operators’ provision FWA deployments. One such feature of the solution is that it uses AI to predict the network resources needed to provision a selected location and selects the optimal FWA CPE for the customer. For post-deployment, it is important that automated network scheduling solutions are in place to ensure that the required data rates and bandwidths can dynamically be shifted based on factors like traffic behavior, time of day, etc.

Conclusions

FWA is a significant opportunity with 5G. Mobile operators need to understand the value that FWA can bring and how to leverage 5G to enable new use cases, including video streaming, cloud gaming and advanced technologies like AR and VR. Currently, technological standards offered by mMIMO 64T64R antennas, FWA CPE developments and optimizations and growing spectral and network capacities will allow FWA to provide exceptional experiences without encroaching on the quality of existing eMBB services.

Through this, mobile operators can unlock the value of many new use cases and improve the financial bottom line with new pricing packages, differentiated services based on data rates, bandwidths, etc. However, mobile operators will also need to ensure that they have a strong deployment strategy to leverage the native advantages of FWA, which is its speed of deployment across multiple scenarios, allowing it to be rapidly deployed in new markets. This will include the use of proper network provisioning tools using AI and smart resource scheduling to guarantee QoS.