Greetings from Fraser, Colorado – the forever home of Byers Peak. We have enjoyed the shortened Fourth of July holiday week at 9,000 feet. The scenes never get old.

This week, after a brief market commentary/ earnings preview, we will chronicle the many telecom/ technology successes from the last recession and describe why we think that troubled times bring out the best in our industry.

The fortnight that was

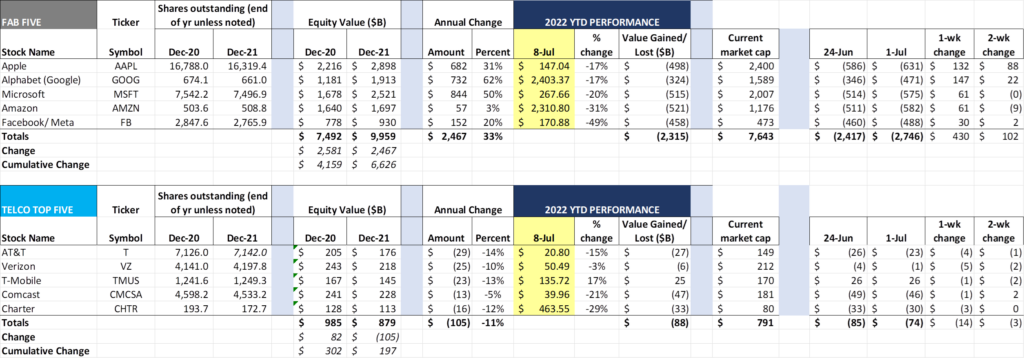

Editor’s note: With the consolidation of the equity market tracking schedules, the 1-week and 2-week changes will now be shown in each Brief.

The third quarter got off to a good start for the Fab Five, with each stock gaining value (group total +$430 billion). Alphabet/ Google led the way (+$147 billion) and Apple was also strong (+$132 billion). With over $2.3 trillion in market cap losses thus far in 2022, an up week was inevitable for the Fab Five. Value sustainability will be better known after earnings outlooks later this month.

The Telco Top Five was a bit weaker, with gains from the end of June given back last week. T-Mobile continues to be strong (+$25 billion YTD), and AT&T (accounting for the WarnerMedia spin) has also returned positive value to shareholders in 2022. It’s possible that after the 2Q earnings results are in, T-Mobile could be the second most valuable of the five stocks in this group as negative sentiment grows over the increasingly competitive home broadband environment.

The earnings parade will commence prior to the next Brief, with AT&T and Verizon setting the stage for growth and profit outlooks in just over a week. Here are the dates announced thus far per each company’s investor relations website:

AT&T: Thursday, July 21

Verizon: Friday, July 22

Meta: Wednesday, July 27

Apple: Thursday, July 28

Comcast: Thursday, July 28

Charter: Friday, July 29

Our view is that the strong dollar will be an important earnings topic for each of the Fab Five, especially with the Euro and dollar at parity (Bloomberg article here). While this is great for travelers, it’s hard to show meaningful earnings growth when currency fluctuations abound (Euro is down 15-20% from last summer).

Other key earnings items to look at will be iPhone sales and service revenue growth (AAPL), advertising outlooks (META, GOOG), a preliminary view of Amazon’s Prime Day (AMZN) and cloud revenue growth and profitability (MSFT, AMZN, and GOOG). The Telco Top Five have more company-specific earnings items, including AT&T’s fiber progress, T-Mobile’s merger synergy outlook, and Verizon’s 5G coverage growth. If there is one theme that is constant across the Telco Top Five, it will be broadband growth (fixed wireless for VZ and TMUS, hybrid fiber/coax growth for CMCSA and CHTR, and fiber for T). We think that cable results will be stronger than most expect, but that this will not quell the naysayers who will predict 2022 2023 doom.

While there were a few newsworthy items over the two weeks, we will keep this week’s commentary brief and close with an interesting European development that caught our eye: The Dutch parliament is establishing home working as a legal right, according to this Wall Street Journal article. Per the article: “Under current Dutch law, employers may reject workers’ requests to work from home without giving a reason. The new legislation forces employers to consider such requests and give a reason if denying them.” While a USA variant of this law would be materially helpful to the Telco Top Five (and American Broadband), we doubt many corporations want to be put on defense.

How a recession brings out the best in telecom and tech

If some TV financial pundits (and the Atlanta Fed) are to be believed, America is already in a recession. 2023 planning estimates now reflect shifting consumer consumption as higher food and energy prices take hold. Businesses are being pressured to raise employee wages to cover costs (although Friday’s report shows that annual wage gains of 5.1% continue to lag annual inflation of 8-9%). Everyone desires a speedy resolution to this pandemic-led pandemonium yet only the most politically motivated, word-salad spewing talking heads are predicting the wage-price spiral to slow.

Let’s assume inflation continues in the 7-9% range through the end of 2022, and the Fed raises rates by an additional 200 basis points to slow the economy. Costs of capital rise, late-stage VC funding for many companies that appeared poised for an IPO dries up (see article here – it’s already happening), and everyone begins to pull back. Hiring slows (see last week’s Meta headline), and some of the more marginal players in the crypto world go bankrupt (more here). The 10-yr bond stays relatively low (4.0-4.5%) because of the dollar’s strength, but 30-year mortgage rates stay in the 5.5-6.5% range (still seems a bargain to those of us who purchased a first home in the 1990s, but double the rates of 2020-2021 – see nearby chart from the St Louis Federal Reserve).

Against this backdrop, it would be logical to conclude that America will enter a sustained period of stunted innovation, start-up capital will be scarce, and Silicon Valley will be seeing the 1980s all over again (a very bleak time). Before we fall victim to the ill-informed apocalyptic forecasts, we thought that it might be good to look at the last recession as a reminder of what happens when “the tough get going.”

Beginning in late 2007 and extending through 2009 the world experienced “The Great Recession.” Most readers remember this time as one marked by severe financial system stress, followed by a collapse of the real estate market. Interest rates and inflation dropped, and those who lost their jobs or otherwise migrated started businesses (e.g., Mobile Symmetry). The Federal Reserve began a process of quantitative easing and clamped down on bank lending practices. Despite a lot of real gloom and doom, three tailwinds emerged: 1) the disruptive impact of the smartphone (which we have documented in no less than a dozen Briefs); 2) the rise of cloud computing (particularly Amazon’s AWS service), and 3) the rise of faster networks (at that time 4G LTE, and now 5G).

In preparation for this Brief, I asked the following question to the LinkedIn universe: Can you name companies/ apps that started up during The Great Recession (we categorized 2007-2011 as the time period to reflect the financing lag that typically occurs for early stage funding)? We received thousands of views (just below 3,000 at current count) and several dozen responses. Here are ten companies that pulled through that knothole and thrived through adversity:

- Siri was released as an iOS app in February 2010 (WIRED article here). Amazon’s Alexa and Microsoft’s Cortana products would not be introduced until 2014. It was so popular that Apple acquired the company two months later (New York Times article here) and quickly incorporated that technology in the iPhone 4S release in October 2011 (Apple announcement here). As most of you are aware, voice recognition is the more difficult part of these apps (the other part being returning the most relevant search string result), and early versions of Siri were the subject of many late-night comedian jokes (here). But Siri took advantage of all three tailwinds described above and proved to be an early Apple app winner.

- Twitch went live in June 2011 and by February 2014 was widely credited as one of the top drivers of peak Internet traffic. They were an AWS customer who caught the attention of Amazon. The Seattle Fab Five member purchased the company in 2014 for $970 million and immediately integrated the service into their Prime services. Like YouTube’s business model, Twitch depended on individuals to be excellent “hosts” – this proved to be financially profitable for many in the community. For gaming teenagers during that time (now twentysomethings), this was their escape, playground, and nightly party all wrapped into one.

- Airbnb started in 2008, received their first seed monies that year (Y Combinator and a late-year seed round led by Sequoia), and is now a member of the Nasdaq 100. Even with 2022’s significant stock price correction, they can boast a $70 billion market capitalization. Like Siri, it was highly dependent on the app economy, cloud computing, and faster mobile networks. Like Twitch, it also enabled others to make money as Super Hosts.

- Uber started in 2009, and, like Airbnb, was heavily dependent on the app economy for its success. Like Airbnb and Twitch, it’s business model enabled individuals to earn income. Rather than rehash a series of articles, here’s a good summary of their early days from Investopedia. Besides their app dependency, Uber was one of the first iTunes App Store successes to use GPS. While commonplace today, the near-real time movement of vehicles in the app was groundbreaking. The company went public in 2019 and was not immune from the price downdraft of 2022 (they are worth half of their value after their first day of trading).

- GroupMe was conceived at TechCrunch Disrupt 2010 (May). By August 2011, it was delivering 100 million messages per month – by June 2012 that number had grown 5x. Skype acquired the company in 2012 for what is believed to be ~$80 million (Skype was in the process of being acquired by Microsoft in 2012). Not a bad return for slightly more than two years of work. As of the end of 2021, GroupMe has approximately 1.3 billion active users.

- WhatsApp originally started as an Apple iOS app focused on the smartphone user’s state (on the phone, in a meeting, do not disturb, etc.). The original app was introduced in early 2009 and was not the immediate hit we saw with others in this list. When Apple introduced push notifications into their June 2009 iOS release, however, the app flourished. The former Yahoo! employees were now founders of the fastest growing messaging company in history. By February 2013, they had 200 million active users; this doubled to 400 million by December 2013 (Sequoia led their early funding rounds). In February 2014, they were purchased by Facebook for an eye-popping $16 billion (most of it was in Facebook stock, which has appreciated significantly since 2012 – New York Times article here). While WhatsApp more heavily depended on the rise of smartphones and cloud computing, the speed of one’s status change was particularly important.

- Cloudflare started in 2010 and went public in 2019 (current market capitalization of ~$16 billion). The maker of security and networking software is best known for thwarting distributed Denial of Service (DDoS) attacks. While they have a lot of critics because of some of their customer base (see Cloudflare’s 8chan termination blog post here), their product is generally regarded as top-tier.

- Viber was started in Israel in 2010 as an app devoted to reducing the cost of long-distance relationships. For three years, app users were not charged for any voice calls. Along with WhatsApp and Apple’s homegrown Face Time application, Viber significantly impacted international voice revenues for wireless and wireline telecommunications carriers. They were purchased by another disrupter, Rakuten, in 2014 for $900 million (New York Times article here).

- Dropbox was technically started a few months prior to The Great Recession (February 2007) as Evenflow by MIT student Drew Houston. While not dependent on the app economy, cloud computing (and storage) as well as low latency and fast networks are very important contributors to their success. They hit the 1 million user mark in April 2009, the 50 million mark in October 2011, and the 100 million mark in November 2012. Like Uber, they currently trade below their IPO price but are valued at $8.5 billion as of Friday’s close. For a good read on their early days, here’s a terrific 2018 article from TechCrunch.

- Clover was incorporated in October 2010 and raised its first round ($5.5 million) a month later. It was one of the few hardware companies to be funded by Silicon Valley VCs during The Great Recession (Sutter Hill Ventures and Andreessen Horowitz). Their first point of sale product did not ship for over three years after initial funding (but those were some fun meetings). During the waiting period, they were purchased by First Data Corporation, who was later purchased by Fiserv. Their collaboration with Apple Pay (announced in 2014) was one of many factors that launched them into point of sale (POS) leadership. They are now the largest U.S.-based POS firm.

There are dozens more to add to this list. The important point, however, is that each of the companies lived through what many of us would consider to be the “worst of times.” They addressed real needs, pushed the needle of innovation, and learned to market to customers who were reticent to spend what little discretionary income they had.

This time is different. Not only do we have continued improvements in iOS and Android (and machine learning and artificial intelligence), but fiber is connecting more homes and small businesses than ever. Faster wireless networks are proliferating (both Wi-Fi and 5G), and higher energy costs are driving smarter homes. Our population is aging, and maintaining a healthy population is critical to broad-based care. With more problems to solve, and a more consistently connected population, what will the next recession produce?

In two weeks, we will parse AT&T’s and Verizon’s earnings. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy July (wherever that takes you), and go Royals and Sporting KC!