Samsung Networks held its mid-year analyst day last week, giving an update on their progress on the vRAN/Open RAN front, Dish deployment, and the opportunities they see in the Private Networks space. I was among a few key analysts they invited to their offices in Dallas for the meeting. I came out of the meeting well informed about their strategy and future path, which is following the trajectory I discussed in my earlier articles here.

Strong vRAN/Open RAN progress

Since launching its vRAN portfolio, Samsung has steadily expanded its sphere of influence in North America, Europe, and Asia. Although its surprising debut at Verizon was with legacy products, Samsung Network has used its market-leading vRAN/Open RAN portfolio as leverage to expand its reach, including at Verizon’s c-band deployments and at newer customers, regions, and markets. Having both legacy and vRAN support makes them an ideal partner with any operator, be it the ones continuing to use the legacy approach for faster deployment and expansion of 5G or the ones looking to utilize newer architectures for building future-proof networks, or even the ones looking to bridge between the two.

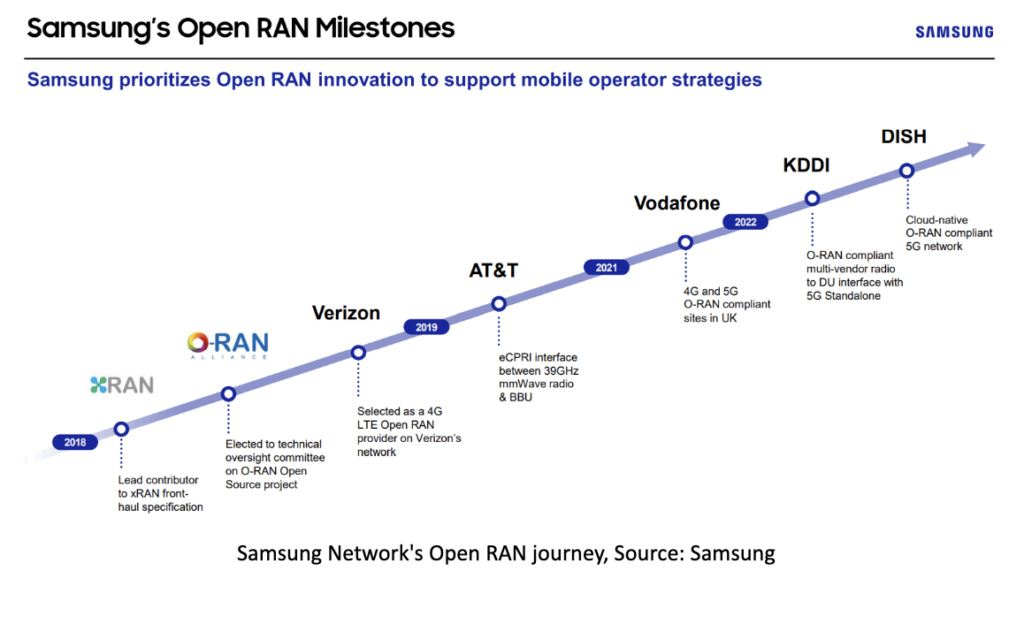

The chart below captures the continuing successes Samsung Networks has witnessed in the last couple of years.

As Verizon’s VP Bill Stone explained to me during a recent interview, a significant portion of their c-band deployment is vRAN. An operator like Verizon, who considers its network a differentiator, putting full faith in Samsung’s vRAN portfolio shows the latter’s product quality and maturity.

Vodafone UK partnered with Samsung Networks to commercialize its first Open RAN site and has plans to expand it to more than 2,500 sites. You can read more about this in my earlier article here.

To clarify, people often confuse between vRAN and Open RAN. vRAN is the virtualization of RAN functions so that you can run them on commercial off-the-shelf (COTS) hardware. In contrast, Open RAN is building a system with hardware and software components with open interfaces from different vendors. vRAN is firmly on its way to becoming mainstream. However, there are still challenges and lingering questions about Open RAN. That’s why the progress of early Open RAN adopters such as Dish, interests everybody in the industry.

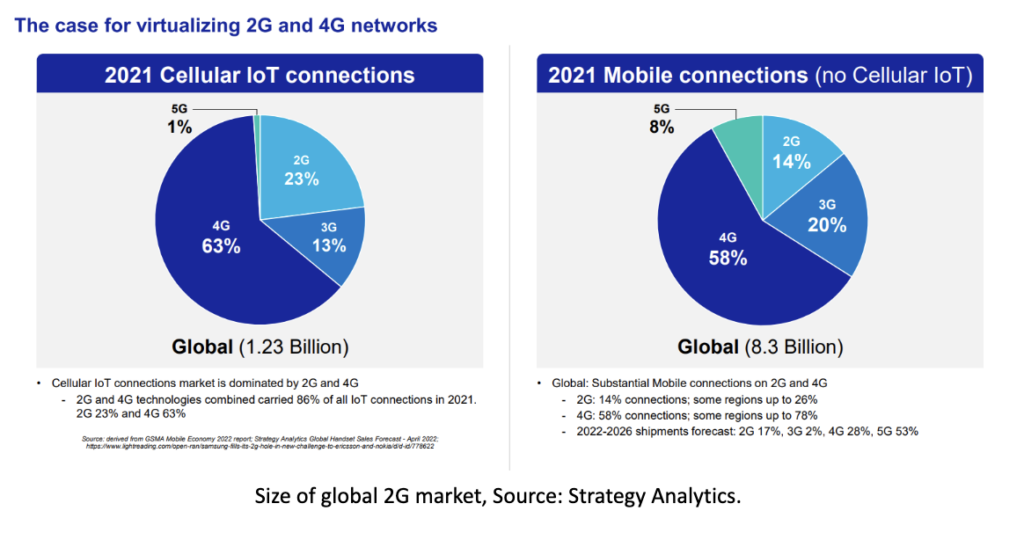

Samsung’s recent announcement regarding 2G support for vRAN was interesting. I knew that there are some 2G markets out there. But was surprised to see the size of this market, as illustrated in the chart below:

This option of supporting 2G on the same Open RAN platform will help operators efficiently support the remaining customers and eventually transition them to 4G/5G while using the same underlying hardware. From the business side, this option will help Samsung Networks break into new customers, especially in Europe.

Powering America’s first-ever Open RAN network with Dish

Nothing illustrates more than one of the world’s most watched new 5G operators fully committed to Open RAN launches its network with you as the primary infra vendor. Dish has a long list of firsts: the first fully cloud-native vRAN and Open RAN network in the US; the first multi-vendor Open RAN network in the US; the First to use public cloud for its deployment, and more.

As evident from many auctions, public disclosures, and this study by Allnet Insights & Analytics, Dish has a mix of many different spectrum bands with highly variable characteristics. They include bands from 600 MHz to 28 GHz, bandwidths ranging from 5 MHz to 20 MHz, paired (FDD), unpaired (TDD and supplemental downlink), licenses in crosshairs with satellite broadband operators, and so on. Dish has embarked on a unique journey of being a major greenfield countrywide cellular provider in the US in a few decades while adopting a brand-new architecture such as Open RAN. Additionally, it also has tight regulatory timelines to meet. In such a scenario, it needs a reliable, versatile, financially strong infra partner with a solid product portfolio. Above all, it needs a vendor fully committed to Open RAN. Dish seems to have found such a partner in Samsung Networks.

To be clear, it is still very early days for Dish and Open RAN. The whole industry is watching their progress with open and watchful eyes.

Finding a foothold in the private networks market

Private Networks is one of the most hyped concepts in the cellular industry today. Indeed, 5G Private Networks have a great prospect with Industry 4.0 and other futuristic trends. But based on my interactions with many players in the space, customers’ real needs seem to be plain-vanilla mobile broadband connectivity. In many cases, be it large warehouses, educational institutions, or enterprises with sprawling campuses, cellular Private Networks will be needed for use cases requiring seamless mobility, expanded coverage (indoor and outdoor), increased capacity, and in some cases, higher security. And these will complement Wi-Fi networks.

During the event, Samsung Networks explained how they are addressing these immediate and prospective long-term needs of the market, with examples of early successes. These include deployments at Howard University in the USA, a relationship with NTT East in Japan, and the latest collaboration with Naver Cloud in South Korea.

Naver also has deployed an indoor commercial 5G Private Network in its office. The network, covering a sizeable multi-story building, serves a bunch of autonomous robots. These robots work as office assistants, providing convenience services, such as delivering packages, coffee, and lunch boxes to Naver employees throughout the building. All the robots are controlled by Naver’s cloud-based AI. The need for 5G instead of Wi-Fi stems from mobility, low latency, coverage, and capacity requirements.

Mobility is needed for reliable connectivity with hand-offs when robots are moving around. Low latency is required to connect robots to cloud AI for seamless operations. Extended coverage and capacity are needed to ensure the connectivity of robots is not degraded by the traffic from all the other office machines, including computers, printers, network drives, and others.

Naver and Samsung are planning to market such concept and services to other customers.

In closing

The analyst meeting provided other analysts and me with a good understanding of Samsung Networks’ current traction in vRAN/Open RAN and an overview of their strategy for the future.

It seems Samsung Network is well poised to expand its market with its vRAN/Open RAN portfolio, along with support for legacy architecture. Dish being a bellwether for Open RAN, the industry is very closely watching its success and its collaboration with Samsung Networks.

Private Networks is an emerging concept for 5G with great potential. Samsung Networks seems to have scored some early partners and deployment wins.

The 5G infrastructure market expansion is exciting, and Samsung seems to have gotten a good head start. It will be interesting to see how it evolves, especially with the fears of global recession looming.

Meanwhile, to read articles like this and get an up-to-date analysis of the latest mobile and tech industry news, sign-up for our monthly newsletter at TantraAnalyst.com/Newsletter, or listen to our Tantra’s Mantra podcast.