Open RAN investment grows from less than 1 percent of total RAN spend in 2019 to 3-5 percent in 2022

While there are distinctions between Open RAN, open virtualized RAN, cloud RAN and further sub-combinations of those architectures, these new approaches to building the radio access network are making inroads in the real world, according to Stefan Pongratz, vice president of research firm Dell’Oro Group. At the moment operators in the Asia Pacific and North American regions—think Rakuten Mobile and Dish which are building greenfield networks using this approach—are leading investments, but that will likely change as we approach 2030 given the massive commitments from multinational European telcos.

“When it comes to the type of Open RAN,” Pongratz said, “I think it’s important to acknowledge that Open RAN isn’t just one technology or architecture. We think of it as a movement encompassing multiple architectures and technologies. Everyone is going to take a different approach here. We see a wide disparity right now in terms of the operators’ engagement…especially the European operators. They want to take a more holistic approach and not a tiny sliver of Open RAN. It’s taking a little bit of a longer time. European operators are lagging a bit when it comes to commercializing.”

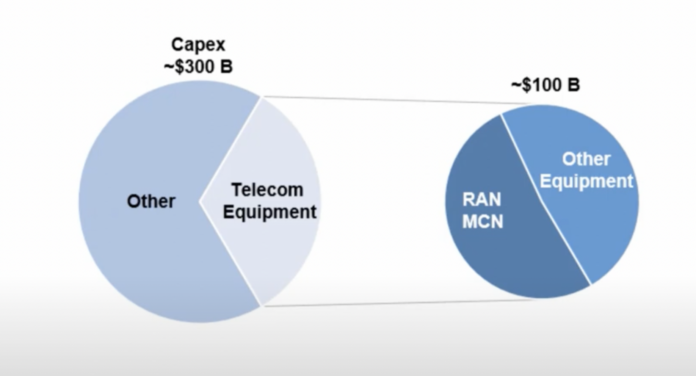

By the numbers, Pongratz posited that operators globally spend around $300 billion annually in capital outlay, a third of which goes toward network equipment. If you take out that $100 billion, there’s approximately an even split between RAN and mobile core network spend and then all other equipment. Of the RAN investment, his research suggests that Open RAN spend was less than 1 percent of the total in 2019 and has grown to between 3 percent and 5 percent this year.

Pongratz pointed out that while Open RAN investment will obviously include radio equipment, he pointed to Telecom Infra Project work that looks into open fronthaul gateways, transport network elements, and even Wi-Fi. The market, he said, is “going to expand in terms of the scope from an equipment perspective and probably, more importantly, the services.” The Open RAN vision is “also going to modularize more so the services aspect and change the business model there…The overall market opportunity is fairly significant.”

Open RAN in Europe is lagging but likely not for long

The biggest Open RAN deployments are regionally concentrated with notable investment from Rakuten Mobile in Japan and Dish in the U.S. which are both building greenfield networks. But over the next decade, expect significant momentum in Europe given long-term commitments from operators, including Deutsche Telekom, Orange, Telefonica and Vodafone.

As Pongratz said, “Europe is still a little bit of a small sliver of the total market right now. Asia Pacific, North America [are] probably the lion’s share. The European operators are definitely ahead when it comes to committing and announcing targets…They have outlined clear targets in terms of 2025 and 2030…In Europe I think they’re taking a little bit more time partly because they’re looking at a more holistic Open RAN and not just a small portion of Open RAN.”

All that said, the path forward isn’t without some risks. “I would just say it’s still early when it comes to understanding a lot about the value and the total cost of ownership,” Pongratz said. The TCO question mark relates to the newness of Open RAN—it’s impossible to gauge product lifecycle TCO without any proof points as to TCO over the lifecycle of Open RAN. “Operators and enterprises are going to have to work with the solution that is most flexible and gives them the best TCO regardless of what that is. Let the markets decide that.”