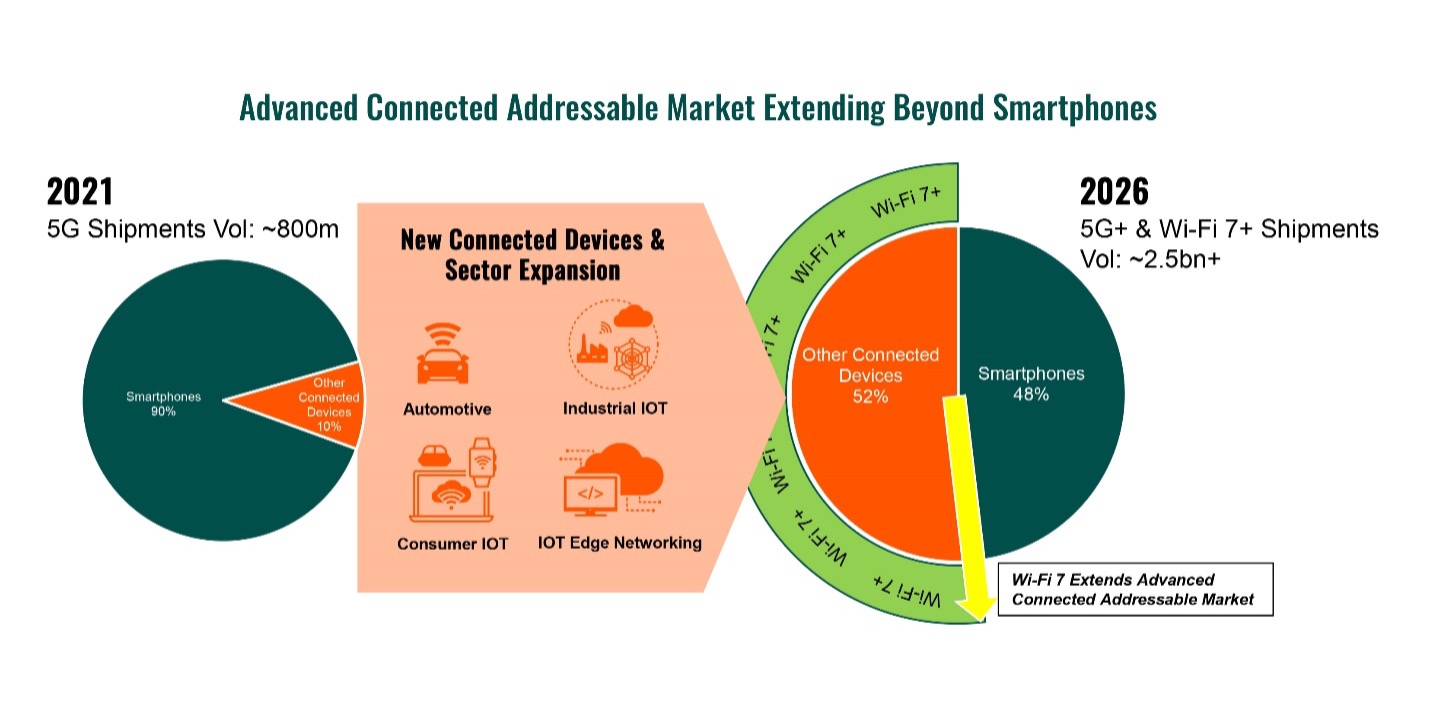

The adoption of 5G continues to thrive in the mobile market, with a raft of device types beyond smartphones set to form part of the wider ecosystem, extending to new industries and a wide array of device categories, including automotive, Extended Reality (XR), Personal Computers (PCs), wearables, mobile broadband and Industrial Internet of Things (IIoT). However, democratization of this extended 5G experience will be constrained, not just by the modem and application processor, but also by the growing complexity of the Radio Frequency Front End (RFFE). In turn, the sheer number of Radio Frequency (RF) components now needed in a 5G device has grown exponentially, while pressure to improve performance and thermal efficiency and condense the overall die size area have become ever more important to help reduce cost and ensure integrity of the signal and communication reliability.

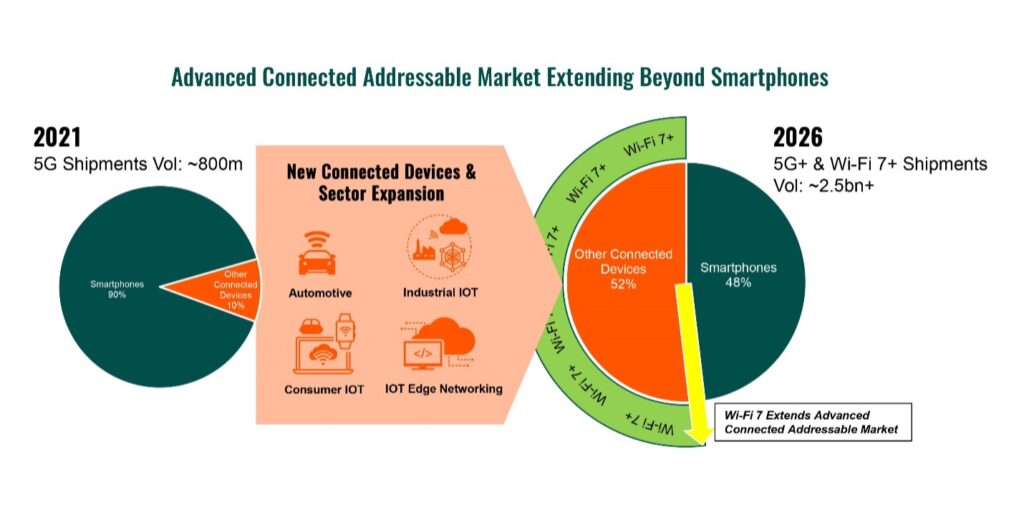

While the burden of 5G on the RFFE is starting to be resolved by the industry, this complexity is set to increase again if high bandwidths available in 5G are to be unlocked, coupled with co-existence with next-generation Wi-Fi, which also operates at high frequencies. Having the ability to provide greater integration between 5G and Wi-Fi connectivity, under this advanced connected market environment, will make the task easier for Original Equipment Manufacturers (OEMs) to develop devices more quickly and effectively, while addressing both added costs and scalability.

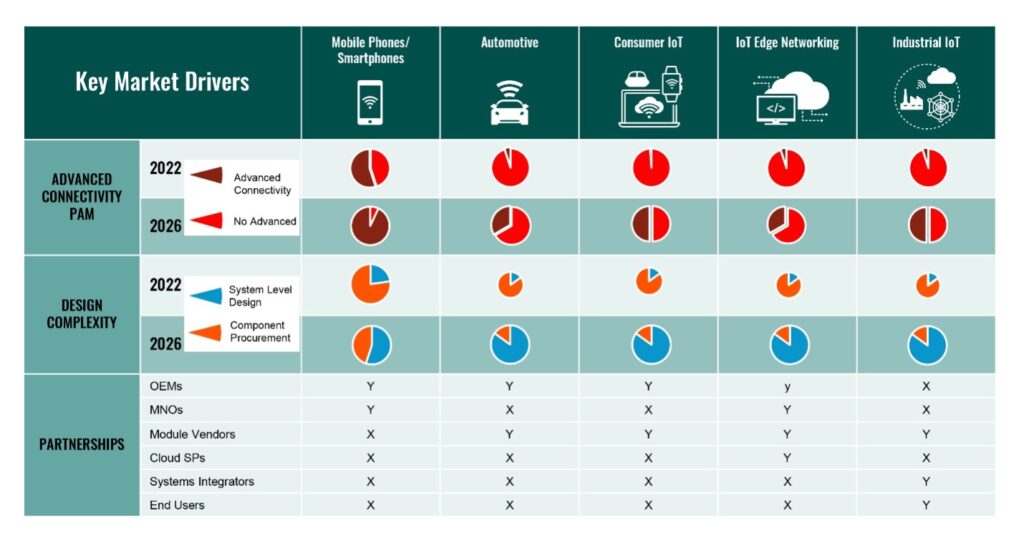

Figure 1: Advanced Connected Market Moving Rapidly beyond Smartphones, Creating Opportunities for RFFE in New Sectors

In comparison to the rollout of 5G, great leaps in Wi-Fi performance have been enabled by the rapid expansion of available unlicensed spectrum in recent years, delivering enhanced throughput and latency speeds. However, this development has also heralded significant RF challenges in Wi-Fi that had not been previously experienced. Indeed, the expansion of Wi-Fi into the 6 Gigahertz (GHz) band and the emergence of the new Wi-Fi 7 standard are causing unprecedented technology complexity and challenges in the way that the radio is designed and implemented. This complexity has also been exacerbated by increasing regional variations in Wi-Fi spectrum accessibility and power level regulations, as well as new technical features of Wi-Fi 7, notably Multi-Link Operation (MLO) as one of the headline features. The drive to Wi-Fi 7, accelerating new experiences and use cases, brings with it other key advantages over Wi-Fi 6, such as increased throughput and capacity using an advanced modulation scheme (4K QAM), wider bandwidth, lower latency and more stable connections in congested environments. For the purposes of this article, the integration of Wi-Fi 7 (and beyond) with or without cellular 5G+ will be referred to colloquially as having “advanced connectivity.”

Figure 2: Increasing 5G and Wi-Fi 7 Complexity Expanding Numbers of New Components

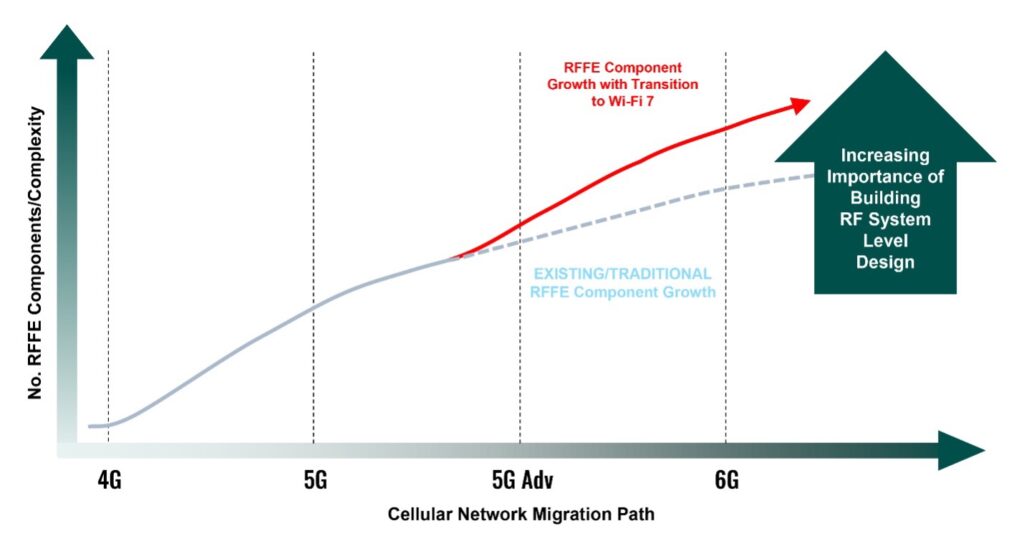

The challenges brought about as the market transitions to Wi-Fi 7 are very similar in nature to those encountered by the cellular industry when migrating to LTE Advanced Pro and 5G. In this instance, many smartphone OEMs were pushed to delegate their RF system design, which was mainly to Qualcomm. In a similar fashion, building high-performance Wi-Fi modems will no longer be the only key differentiator in the Wi-Fi 7 market landscape if it is not aligned with solid RF designs using cutting-edge components.

As witnessed in the 5G space, new RF designs and a greater number of filter derivatives are helping to address upcoming Wi-Fi challenges, such as higher bandwidths, multiple channels, adjacencies to 5G New Radio (NR) frequencies, etc., but further advancements are required in order to harness the full power of the newly available unlicensed spectrum in all markets and the promised technical improvements offered by Wi-Fi 7. Thus, RF design becomes essential in ensuring that next-generation Wi-Fi-enabled equipment can effectively deliver on its promises, despite these new features putting tremendous constraints on the RFFE and filter designs, in particular.

As a first step toward untangling the complexity of adding the advanced connectivity of both 5G and Wi-Fi to devices, Qualcomm has announced the addition of new Front-End Modules (FEMs) to its portfolio, which are designed for Wi-Fi 6E and the new Wi-Fi 7 standard. Notably, these new FEMs are aimed at extending the use of Qualcomm’s RFFE beyond smartphones to reach out to new industries and a wide array of device categories. However, this strategic direction is not just for the preserve of Qualcomm because the market is moving swiftly to the use of system-level design, not just in smartphones, but more broadly in other advanced connectivity device sectors.

Figure 3: Growth in Penetration of System-Level Design versus Component Procurement

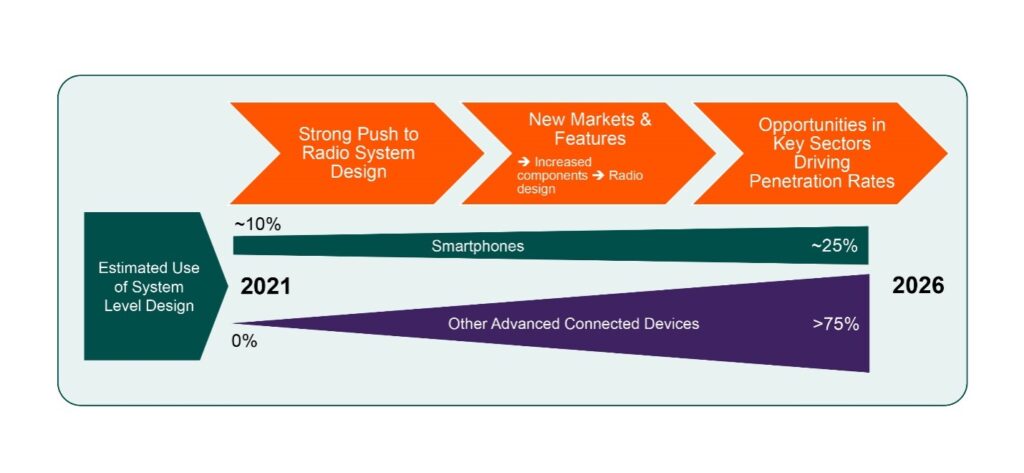

Qualcomm’s latest offerings are brought into stark relief as the company can build on its unique expertise and know-how developed in cellular through offering end-to-end connectivity solutions from the antenna to the modem. With these new Wi-Fi FEMs, Qualcomm has put itself in prime position to leverage this expertise in the increasingly complex Wi-Fi technology landscape to address new market opportunities and support both Wi-Fi and cellular connectivity across multiple markets. Moreover, not only will the new FEM solutions enable Qualcomm to raise competitive barriers to its rivals in the Wi-Fi 7 market, but the company could also generate scale for these solutions, offering them at competitive price points in both the cellular and Wi-Fi markets.

At first glance, Qualcomm’s new products could be viewed as stealing an advantage over its competitors and enhancing its competitive threat to other RF vendors. While Qualcomm’s latest RF modules can be used with third-party Wi-Fi and Bluetooth modem chipsets, there is industry conflict between those companies that provide RFFE components in close collaboration with others to offer total systems, such as Murata and Qorvo, and those that have end-to-end designs, notably Broadcom. It will be up to device OEMs to assess whether modular or end-to-end RFFE components are best suited to their needs.

Figure 4: Market Growth in Advanced Connectivity Needs Requisite System-Level Design

The step taken by Qualcomm, though, is an important move to help push the industry toward grasping the fundamentals for resolving the snowballing complexity of integrating advanced connectivities, while learning lessons in cellular radio design. The RF companies that win out and gain industry support will need to demonstrate that their solution — in whatever form that takes — is able to improve performance, reduce time to market, lower overall costs and allow flexibility and customization. Such metrics will become imperative for end-device differentiation, notably as the RF battleground extends into new sectors and markets beyond smartphones.