Greetings from the Midwest and Southeast (at left, toting the week’s produce from Kansas City’s open-air City Market). The freshly-picked watermelon we purchased there was far sweeter than the Chiefs performance in their first preseason game (and narrowly beating the Commanders did not assuage the Arrowhead faithful). 2022 has not been a good sports year for the City of Fountains, and many of us long-time fans of the Royals, Sporting KC and Chiefs are getting anxious.

On a brighter note, August has been a surprisingly active month for the telecommunications and technology industries; there is plenty of news to talk about. We will also spend some of this week’s Brief discussing T-Mobile’s prospects for the business market and the overall M&A environment given increasingly active federal and state regulators.

One last note – American Broadband, Cameron Communications, and TelAlaska have rebranded as Fastwyre (video here). We also market launched Westlake, Louisiana with Fiber to the Home for 99%+ of the residents where we will be competing against AT&T and Vyve Broadband. More on that competitive environment in a future Brief.

The fortnight that was

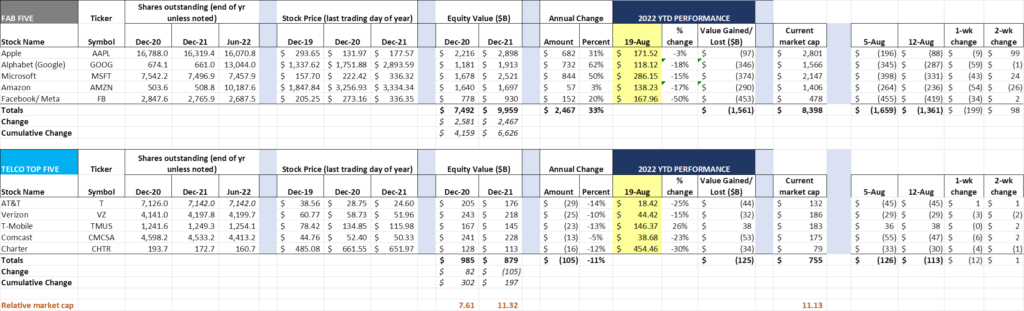

One of the great things about a bi-weekly market commentary is the “leveling effect.” A great week (Aug 8-12) can be partially offset by a subpar week (this past week) and, at the end of the day, the Telco Top Five is back to levels on August 5th and the Fab Five +$98 billion (which represents a 1.2% gain in their total market value).

Apple (+$99 billion, or $20 billion more than Charter’s total equity value) and Microsoft (+$24 billion) gained the most over the last two weeks. Part of Microsoft’s gain came on the heels of Zoom Video’s weak Outlook – apparently Teams is making more inroads into many of Zoom’s markets. As of Friday, Zoom was down 45% in 2022 and more than 70% over the last 12 months; Microsoft is down 14% YTD and 4% over the last 12 months. While we love the Zoom product and believe it’s materially better than Teams, the last time we felt this level of impending doom was with a company called Palm after the Pre was launched.

For those of you who missed it, Apple announced that they are going to be making some announcements on September 7th. According to this Bloomberg story, there’s a wide expectation that the iPhone 14 will launch on September 16 which is slightly earlier than previous years (cf: in the last Brief here, we talked about the selling season starting earlier in 2022 than in previous years). The Bloomberg article has a terrific summary of what features and products will likely be announced (RIP, iPhone Mini).

The other really big news over the last fortnight was Disney’s earnings announcement and subsequent price hike (full details here from The Verge). ESPN+ has already been raised to $9.99/ mo. (still the cheapest way to watch A-10 basketball if you live in the Midwest), but ad-free Disney+ is going to $10.99/ mo. and an ad-supported version is going to be introduced at $7.99/ mo. Disney is smart to introduce product bundling, but the myriad of ad-supported and ad-free bundles is going to be hard for many to keep straight. It will be interesting to see which versions are included in Verizon’s 5G Play More and Get More plans (details here). If they stick with ad-free for the Holiday season, Big Red could have an advantage against AT&T (who is dealing with HBO Max removing titles this week, outraging “Sesame Street” fans nationwide – more in this Washington Post article).

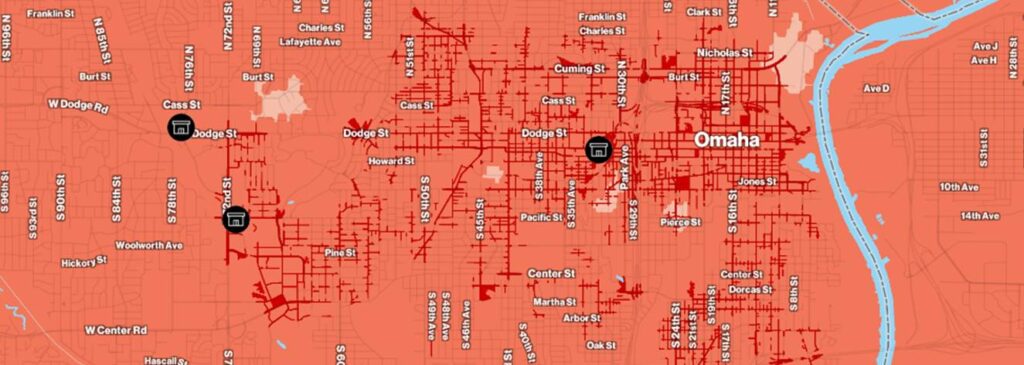

Google also made some telecom news over the last couple of weeks as they announced that Google Fiber was talking to leaders in five states – Arizona, Colorado, Nebraska, Nevada and Idaho – about expanding their presence. Having had a year or so to get to know the competitive environment in Central and Eastern Nebraska, where Allo, Verizon (see Omaha 5G Ultra Wideband market map nearby – the lines represent fiber/ millimeter wave coverage), Great Plains and the ever-scrappy Stealth Broadband are making significant inroads into Lumen, Spectrum, and Cox markets, we scratch our heads with respect to yet another Nebraska fiber solution. Outside of a few legacy Windstream/ Lincoln Telephone markets, we would classify Nebraska as “crowded.” Even Blair (population 7,800) has two FTTH providers (Fastwyre being one of them) and three fiber providers for businesses (Cox Business has a meaningful presence there). With Omaha, Lincoln, and Fremont all seeing three Gbps-capable solutions today, we can only wonder how broad Google’s business case will be.

On the regulatory front, the FCC released their latest thinking on the future of the Universal Service Fund (USF). Fierce Telecom has a terrific summary of the document. An entire Brief should (and likely will) be devoted to this topic to do it justice, but the myriad of triggering articles indicating that Big Tech is probably going to fund the USF are inaccurate and misleading. We expect the FCC to deliberate for some time the implications of the recently passed infrastructure bill (a.k.a., IIJA and specifically the BEAD funding) on the competitive landscape. While a fully-fibered network has lower costs and fewer trouble tickets than copper, the conversion process can take years to complete. Every partially converted network still has copper to operate and maintain.

In the USF document linked above, the FCC makes the following statement concerning an RDOF II auction (pp. 28,29):

“The Commission should consider how and/or whether future planned processes, such as RDOF Phase II, remain necessary after the Commission’s creation of the Fabric and deployment commitments under BEAD and/or other Infrastructure Act programs are made. If at this time there are still areas lacking broadband service meeting the speed and latency standards required by Congress in the Infrastructure Act, the Commission should initiate a rulemaking to determine how to most efficiently bring broadband service to those areas and reevaluate whether additional support processes are needed.”

While this document is not a final ruling, it’s interesting to note that RDOF II (which would have represented over $12 billion in funding) has been effectively pushed to the back of the funding line, especially given the widely expected rejection of the LTD Broadband and SpaceX applications in early August (which effectively negated 20+% of the winning bids). As Fierce Telecom’s Diana Goovaerts also noted in a follow-up article, there are three additional large RDOF I applicants (Nextlink, Astound, and Starry) awaiting long-form funding approval.

While these regulatory actions are mind-numbing to some, they form the basis of network cost positions for suburban and rural locales, impact wireless technology development, and potentially cement incumbency for years to come. We urge the Commission to carefully consider renewed excitement from the largest legacy carriers who have suddenly rediscovered their love of fiber networks after years of local market abandonment and neglect. Experienced local management and accountability delivers the highest probability of achieving universal service objectives.

Bigger questions after second quarter earnings (Part 2)

In the last Brief, we tackled two questions we think remain after second quarter earnings:

- How can cable mobile/ broadband bundling succeed?

- How aggressive will (holiday) promotions be for the rest of 2022?

Specifically, we noted that the largest cable providers have managed to achieve relatively small market shares over the last four (or five) years, but think that this holiday selling season will deliver more aggressive offerings. Cable is losing control of their stately march to wireless market share dominance thanks to Verizon’s and T-Mobile’s aggressive fixed wireless gains.

This week, we will cover two additional questions we think remain unanswered:

- Is T-Mobile a meaningful business player beyond small business (50+ employees) in the next five years?

- Can any meaningful acquisition activity receive approval? Are there alternative structures that can address strategic gaps?

Question #3: T-Mobile for all businesses?

Those of you who have followed the Brief over the last decade know that we are big fans of T-Mobile. From our “Dear John” letter in 2012 to the full chronicle of the T-Mobile/ Sprint merger throughout 2019 and 2020, we have analyzed every Uncarrier move and have been quick to point out Magenta’s strengths. The result has been a dramatic narrowing of market capitalization over the last decade (from ~$200 billion gap between T-Mobile and Verizon in 2012 to less than $3 billion at various points this past week – see nearby five year chart).

The prospects for growth at T-Mobile are bolstered by their understanding of the consumer market and their ability to quickly mine synergies from the Sprint acquisition. T-Mobile is in a singular market position with their wholesale (through Mint Mobile and others), branded prepaid (Metro) and postpaid businesses. They understand how to invest in retail distribution, customer service, and marketing to grow market share better than their larger peers. And, thanks to their network “layer cake” (which now includes more 600 MHz spectrum thanks to a $3.5 billion purchase from Columbia Capital), they have a sustainable foundation to remain competitive.

As shown on the most recent earnings conference call, however, T-Mobile has a much different position in business than consumer. Here’s our paraphrased summary of questions asked by the analyst community a few weeks ago:

- David Barden (Bank of America) – Question about stock buybacks and increased EBITDA guidance.

- Simon Flannery (Morgan Stanley) – Questions about fixed wireless pull-through value and network capacity impacts. Mike Sievert, at the end of a lengthy response, cited the “exciting opportunities” that exist in the business space for fixed wireless.

- John Hodulik (UBS) – Questions about state of the consumer and details about the source of postpaid phone churn (Sprint versus Magenta).

- Craig Moffett (MoffettNathanson) – Questions about edge computing, 5G, and T-Mobile’s overall competitiveness in this space. Callie Field, the new head of T-Mobile for Business, cited their “exciting” work with customers on wireless last mile access and discussed their placement of 6,400 sensors that helped better inform fans of progress in the Sail Grand Prix (for which T-Mobile is the title sponsor – see announcement here). “We are very interested in where we are headed with these advanced network solutions.” Mike Sievert added some comments about the benefits of including global roaming in new business plans, and Neville Ray, T-Mobile’s President of Technology, discussed the value of a 5G network core.

- Bill Ho (556 Ventures) – Question about notable enterprise wins from T-Mobile for Business. Callie Field responded with a discussion of recent work with General Mills and AutoZone on smart warehousing and referenced discussions with global automakers on vehicle-to-vehicle networking. Callie also referenced the introduction of bundling Apple Business Essentials with their business plans, a key feature for small and medium businesses. Mike Sievert then referenced that T-Mobile is deepening their relationship with existing business customers in addition to bringing in new logos (they are no longer a stalking horse for supply chain directors simply to reduce AT&T pricing).

- Jonathan Chaplain (New Street) – Question about fixed wireless capacity vs total addressable market, and question on T-Mobile’s progress to achieving a 20% market share in enterprise. Peter Osvaldik, T-Mobile’s CFO, reiterated the fact that T-Mobile is seeing gains in every market segment and that fixed wireless access was not contemplated in the 20% share target.

- Roger Entner (Recon Analytics) – Question concerning the impact of free devices and churn.

- Phil Cusick (J.P. Morgan) – Question concerning Days Sales Outstanding (DSO) and prime customer mix (health of the consumer).

- Brett Feldman (Goldman Sachs) – Questions concerning Sprint customer migration as well as fixed wireless distribution and marketing. Mike Sievert referenced that T-Mobile for Business connections are still a minority of total fixes wireless connections, and that the sales cycles are longer.

- Michael Rollins (Citi) – Question on postpaid net additions as well as update on Sprint wireline network monetization. Mike Sievert addressed the Sprint wireline network question, saying “We are obviously conducting a review as to the best way to manage that asset. It’s a terrific product with a deep, deep legacy in our company and it’s important that we make the right decisions there for the long haul taking into account how the market has changed over time.”

While we did not measure the precise Q&A time that was devoted to T-Mobile For Business, it’s either the subject of or referenced in about half of the session. This is both a testimony to T-Mobile’s traditional consumer strength as well as a strong indicator concerning what should be the next market share focus.

We are not shy about providing advice (we published many “Dear _____” letters over the Brief’s history – Marcelo Claure letter from 2014 here) and would strongly suggest that T-Mobile assess the global nature of enterprise needs. Simply put, this is a problem not solved solely by T-Mobile USA – their parent, Deutsche Telekom (who will soon be the majority shareholder in TMUS), must take the lead and forge a globally competitive solution that allows T-Mobile USA to win 33% of all new enterprise bids by 2025.

We would suggest that any strategy solve for at least three needs:

- Access (from the conference call, it sounds like T-Mobile USA is on a path to share leadership here)

- Analysis (defined as quickly and accurately pairing network and application information)

- (Automated) Action (using b and clearly defined rules, enable decision-making that improves business performance)

This discussion leads us to the last question –

Question #4: How to thread the acquisition needle

Those of us who have been around the telecom industry know that there are seasons where acquisitions are easier than others (David Cohen of Comcast pitching Comcast + Time Warner Cable comes to mind). With Lina Khan as head of the FTC and Jessica Rosenworcel as head of the FCC, most scale-producing mergers are likely off the table (when we think large, we are talking about Cox + another cable company, or even Lumen/ Level3 + T-Mobile) without significant concessions.

If clearing federal hurdles were not enough, the states of New York, Illinois and California will gladly step in and extract additional concessions to improve union job prospects in their states. And the thought of one of the Fab Five buying their way into network access would likely send both federal and state government authorities into orbit. How should companies that have excess cash execute an M&A strategy?

A couple of thoughts here:

- Stakes are easier to justify to the feds and the states than outright control. Taking a 40% ownership stake in Level3 (Lumen’s International and Global Accounts or IGAM division) might help T-Mobile and even Deutsche Telekom solve some problems. Lumen’s costs for fiber deployment are going up, and their timelines aren’t improving – additional funding would be welcome. That might provide a path to ownership when the regulatory environment is more conducive to large transactions

- Solving the problem with interested but non-traditional telecom players through a joint venture also is easier to clear regulatory hurdles. JVs are out of vogue – “too hard, too complex, most don’t work” is enough to chase away most Corporate Development executives (and investment bankers love to use that line a lot). But what if T-Mobile or AT&T were to strike a broad agreement with Brookfield Asset Management or CBRE or both to bring fiber to each of their buildings (globally) and enable best in class wireless solutions? In a world where 2-5-8-10 Gbps speeds are being delivered for work from home solutions, where does that leave commercial real estate and the “return to work” mantra?

AT&T needs an out of region fiber partnership. T-Mobile needs a complete and comprehensive story for enterprise customers who want to go beyond fixed wireless and sensor-based solutions. Verizon has significant underutilized assets in their 5G Ultra Wideband markets and will likely lose their “most valuable US telecom company” status to T-Mobile very soon. The cable companies are increasingly focusing on defending their DOCSIS turf while perfecting a nationwide story through Comcast’s Masergy division. Who will make the first move that adds value even in the face of complexity?

Fortunately, increasing telecom cash flows should precede any final solution. We will have plenty of clean-up items to discuss in the next Brief (which we will likely publish on Saturday of Labor Day weekend as opposed to Sunday). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy the rest of August and go Royals, Chiefs, and Sporting KC!