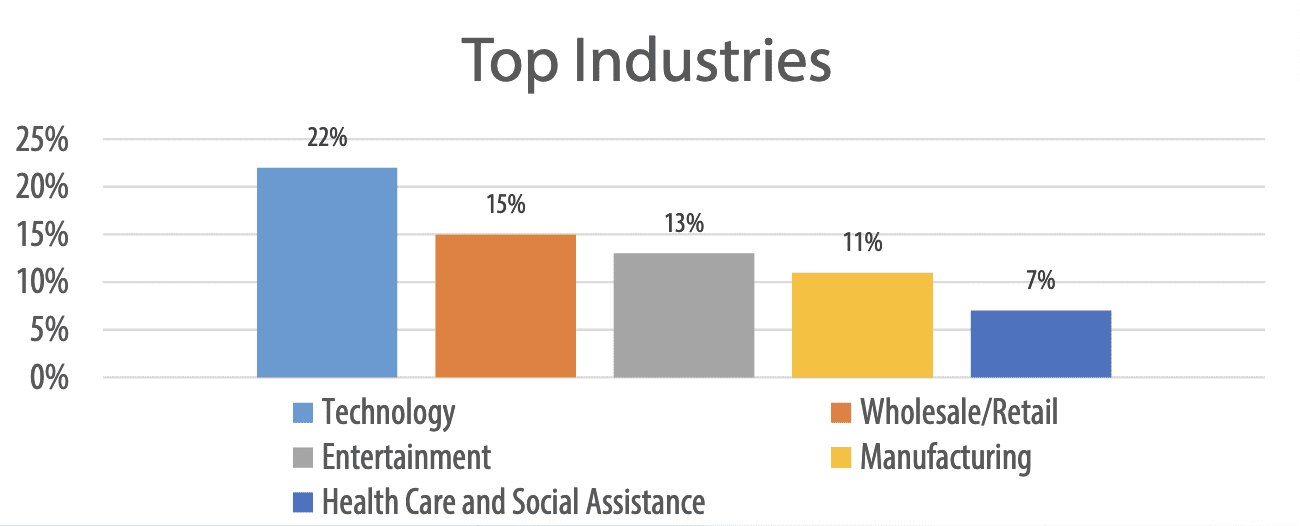

A California-based research firm, called TECHnalysis Research, has polled 400 US-based organisations either using or interested in using private cellular networks, and come up with a handy (regional-anecdotal) snapshot of the state of the market, with some decent figures to consider. Among them, it lists the top industrial sectors (‘verticals’) for private 5G; these are ‘technology’, retail/wholesale, entertainment, manufacturing, and health/social care.

As such, the logical conclusion is that, as suspected, the shared US 3.55-3.7 GHz CBRS band, where all the US action on private networks is taking place, is not only/majorly an Industry 4.0 market, as yet. Of the respondents (all polled by telephone) that already have a shiny new (LTE-based) private cellular network, more than one in five (22 percent) are in the ‘technology’ sector, whatever that is. Tech services? Tech manufacturing? It is not specified.

Another 15 percent are in the wholesale/retail sector, and 13 percent are in the entertainment game. Again, more granular definitions – definitions of any kind, actually – would be helpful. Does wholesale/retail include warehousing and logistics? Does entertainment cover stadiums? Presumably it does. Manufacturing, the classic venue for private LTE/5G, is the destination for 11 percent of LTE installs. Health/social care is a rung below, at seven percent.

Another 15 percent are in the wholesale/retail sector, and 13 percent are in the entertainment game. Again, more granular definitions – definitions of any kind, actually – would be helpful. Does wholesale/retail include warehousing and logistics? Does entertainment cover stadiums? Presumably it does. Manufacturing, the classic venue for private LTE/5G, is the destination for 11 percent of LTE installs. Health/social care is a rung below, at seven percent.

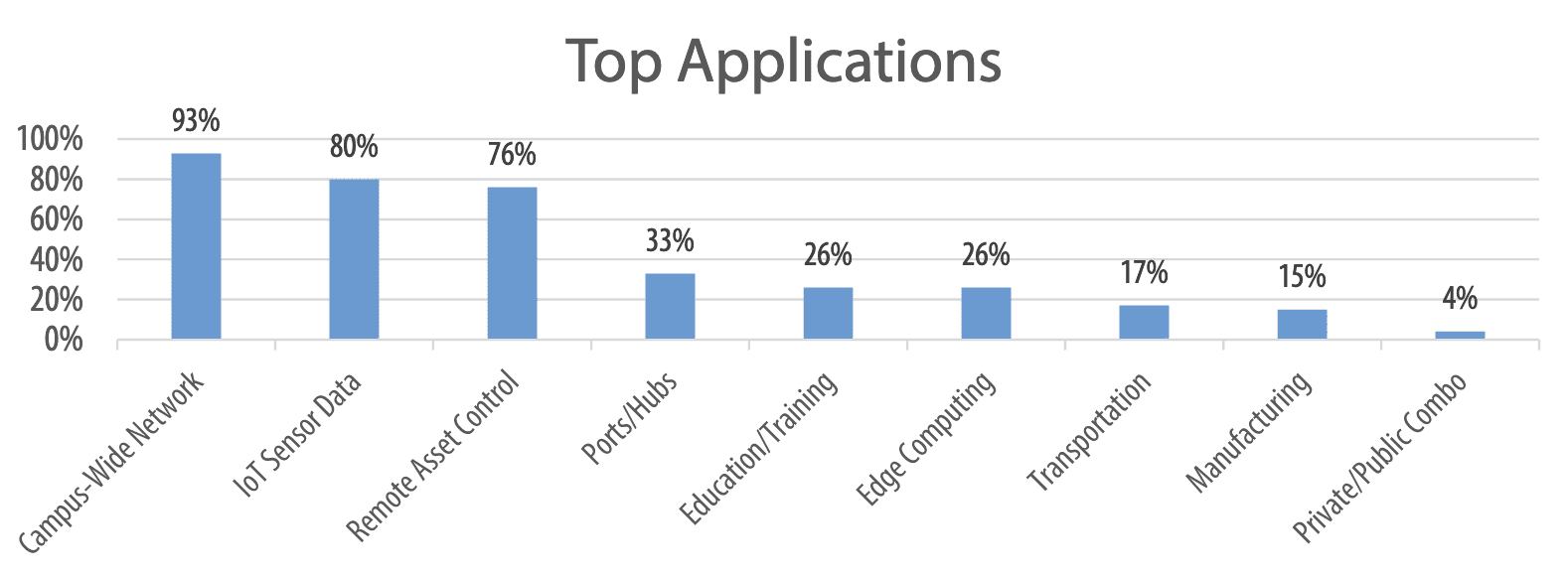

It is not clear how many of the 400 respondents polled (by telephone, if it’s important) in the survey are actually sitting on new radio gear. But the majority of them are using their LTE gear for wide-area connectivity (93 percent), IoT sensor data (80 percent), and/or remote asset control (76 percent). At the same time, one in three are using LTE for ‘ports/hubs’, as a stated application; it is unclear which vertical this slots into. Manufacturing?

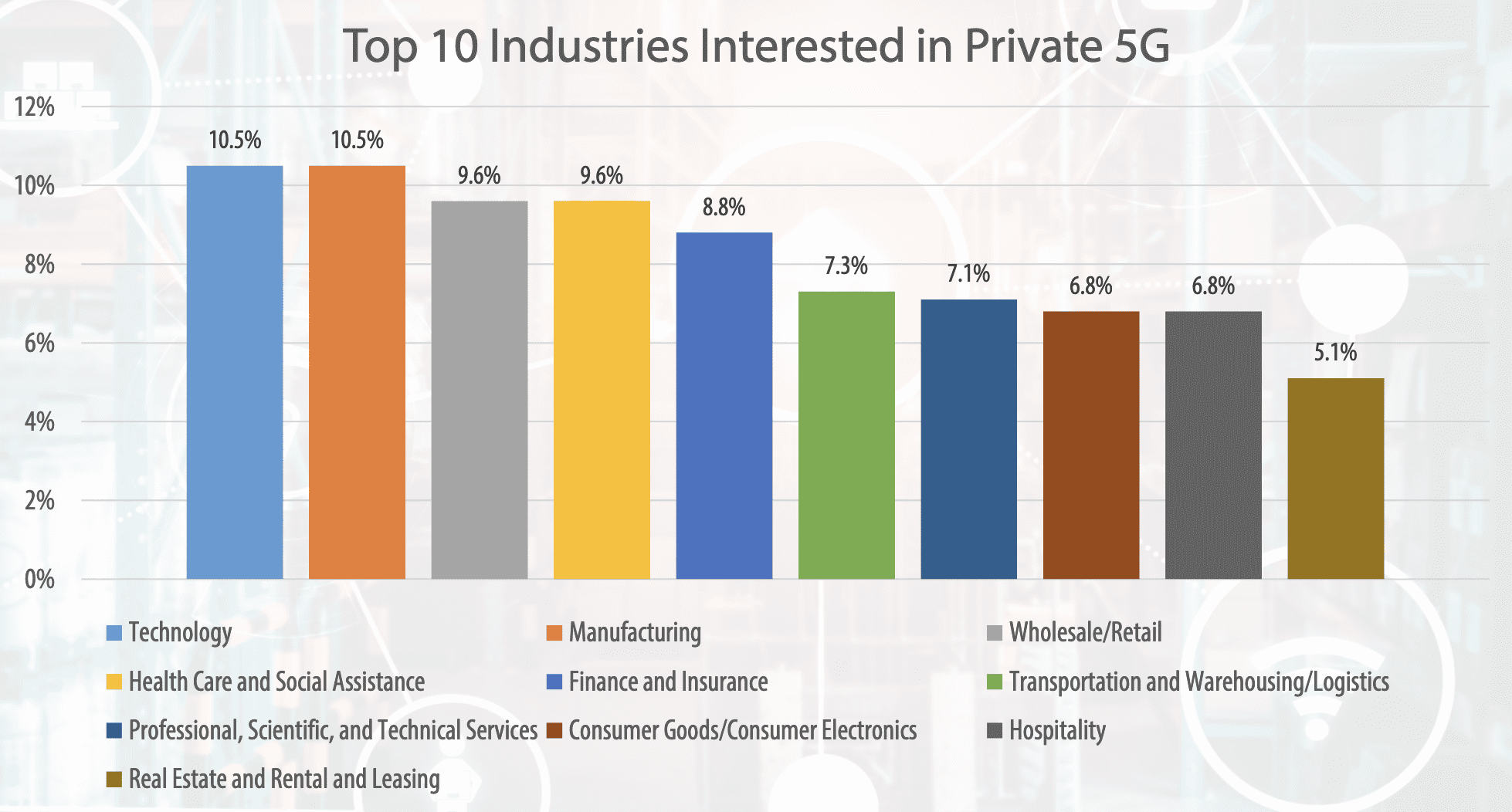

More interesting, perhaps, is the mix of US industries that expressed an interest in private cellular, and private 5G in most cases. Here, manufacturing companies find their feet, it seems; one in 10 (10.5 percent; the same proportion as for ‘tech’) of respondents polled who want their own 5G network are in manufacturing. Other new sectors to feature, given voice by respondents, include finance/insurance and transportation/logistics (which explains that one).

More interesting, perhaps, is the mix of US industries that expressed an interest in private cellular, and private 5G in most cases. Here, manufacturing companies find their feet, it seems; one in 10 (10.5 percent; the same proportion as for ‘tech’) of respondents polled who want their own 5G network are in manufacturing. Other new sectors to feature, given voice by respondents, include finance/insurance and transportation/logistics (which explains that one).

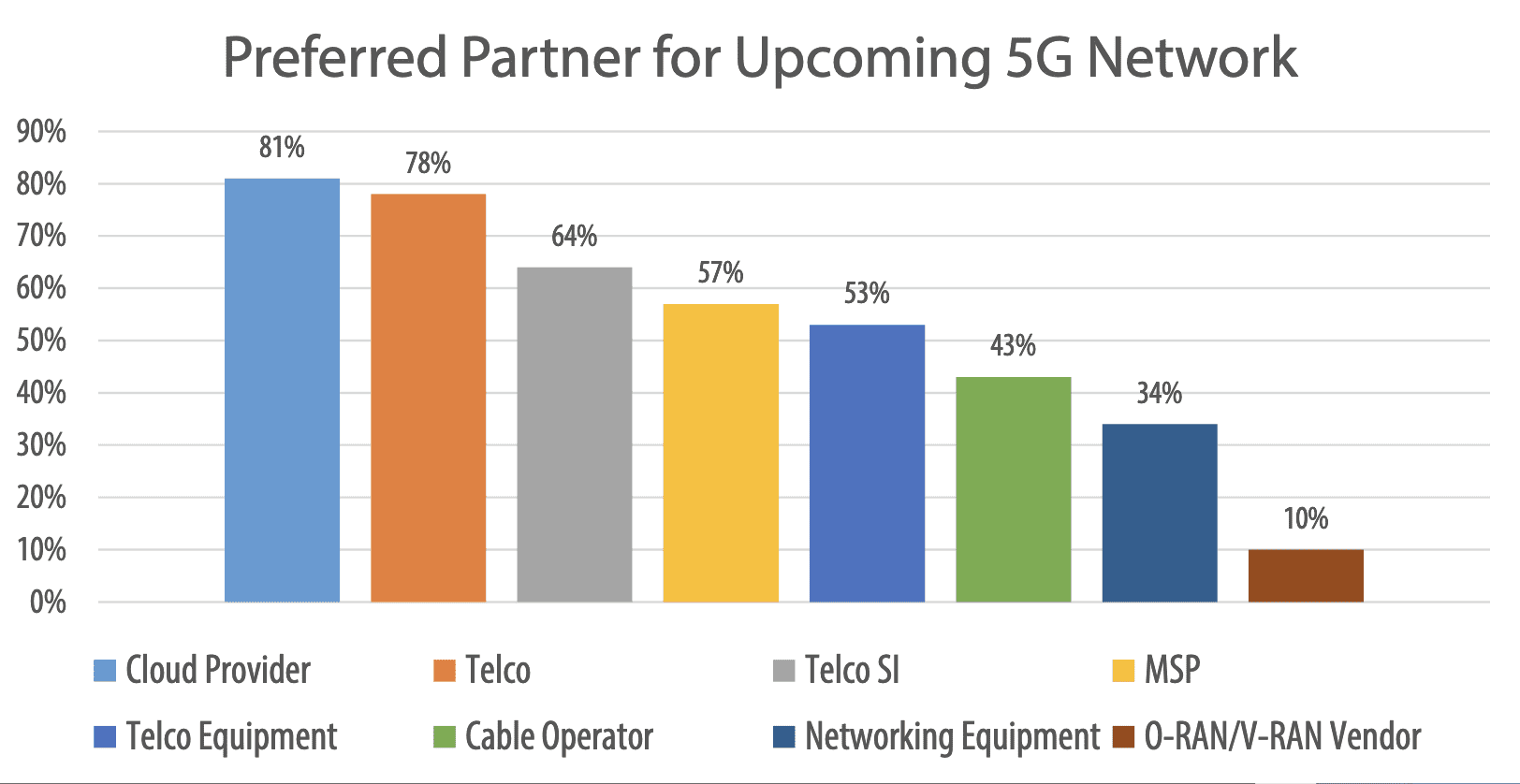

Other pro-5G respondents emerge from the woodwork, also, in: professional, scientific, and technical services; consumer goods/electronics; hospitality, and the real estate industry. It is a kind of loose study, but it skips around some important points, including about how (and with whom) these industries will partner for their private 5G rollouts. On this, cloud providers come top, favoured as potential providers in four in five (81 percent) of responses.

Telcos, to be fair, do well, too; they feature in 78 percent of responses, ahead of ‘telco-SIs’, managed service providers (MSPs), telco equipment vendors, cable operators, and sundry others. Check out the graphics, variously through this piece; check out the original slides, here. And check out, also, a blog post on the subject from Keysight, here, which (full disclosure) prompted this yarn in the first place.

Telcos, to be fair, do well, too; they feature in 78 percent of responses, ahead of ‘telco-SIs’, managed service providers (MSPs), telco equipment vendors, cable operators, and sundry others. Check out the graphics, variously through this piece; check out the original slides, here. And check out, also, a blog post on the subject from Keysight, here, which (full disclosure) prompted this yarn in the first place.