Labor Day weekend greetings from the Midwest. Since there was not a particularly attractive opening picture (most this week were of competitor’s sloppy hole digging), we are including a wonderful shot of a hot air balloon from our Colorado trip in July. Hope your weekend is filled with family and fun (and, if needed, a well-deserved nap). After a full market commentary, we will focus on a handful of August events that flew below the Sunday Brief radar but could be relevent to the telecommunications landscape.

One programming note – at the end of this month, Jennifer Fritzsche of Greenhill & Company has graciously agreed to pick up the Sunday Brief pen as Jim will be moving his parents halfway across the country that weekend. It should be a quarter ending treat!

The fortnight that was

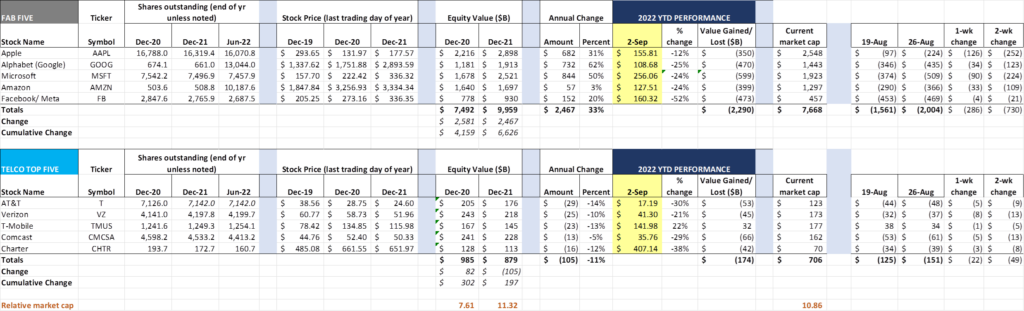

It was a tough week for both the Fab Five (-$286 billion) and the Telco Top Five (-$22 billion). Apple, who was having a decent summer comeback, lost another $126 billion this week (one AT&T) on top of the $126 billion lost two weeks ago. This is not uncommon prior to their September announcements as Apple tends to lower expectations and then easily exceed them.

Meanwhile, something we have discussed in previous Briefs as a potential event came to pass this week with T-Mobile USA (TMUS) surpassing Verizon as the world’s most valuable telecom company (see table here). We commemorated the event with a LinkedIn post (here) but are pretty sure that AT&T (#5 most valuable), Verizon (#2), and Comcast (#3) boards of directors did not pop any corks. As we stated on LinkedIn, this is as much a damning of their (#’s 2, 5, and 7) strategies as it is a success for T-Mobile’s merger-dependent value creation. Next up (assuming no Magenta surprises): T-Mobile replaces Verizon as a Dow Industrials component (Verizon’s performance relative to other Dow stocks from Slickcharts is here and 2021 full year performance from Kiplinger’s is here).

Speaking of T-Mobile’s big league status, since our last Brief, CEO Mike Sievert and SpaceX Chief Engineer Elon Musk made a very interesting announcement at SpaceX’s Starbase in Boca Chica, Texas (full video of their announcement on YouTube here and T-Mobile press release here). T-Mobile customers will soon be able to send and receive texts and multi-media messages from very remote locations using their existing smartphones thanks to satellite connections to the SpaceX fleet. If you think you might have heard of a similar “Low Earth Orbit satellite company partners with large wireless company” announcement, you would be correct: Verizon and Amazon made a similar announcement less than a year ago (press release here). There are real use cases for enterprises, government agencies (e.g., Department of the Interior) and agribusiness here, and there might be a public safety case for having this capability. It will not increase their “want to investigate” metric or decrease postpaid phone churn, however.

One thing that does drive investigation is a favorable Rootmetrics Rootscore Report (especially if Verizon is the winner). As we have discussed in many previous briefs, this is one metric of many that should be considered (and an especially good indicator of your actual performance if you are using the device(s) that RootMetrics uses in their evaluation). We find it to be a decent trend detector of increased capital investment (see our discussion of AT&T’s RootScore improvement in 2020 thanks to increased FirstNet deployments here).

RootMetrics has posted about a quarter (31) of their 125 RootScore reports, and to no one’s surprise, Verizon continues to be the outright winner in just over half (16) of them. Verizon was the outright winner in several major markets including Denver, Nashville, Portland (OR) and Salt Lake City (these cities all happen to be Xfinity Mobile/ Comcast major markets as well). We continue to be surprised to see how few outright wins (just 3) AT&T and T-Mobile received. (AT&T moved from outright win to a tie with Verizon in Baltimore, but picked up an outright win in Youngstown, Ohio; T-Mobile picked up Tulsa). Eventually, we should see the impact of increased C-Band implementations on overall scores – if Verizon does not win “bigly” we question the rationale of their $53 billion license purchase. As of 2H 2022, little has changed.

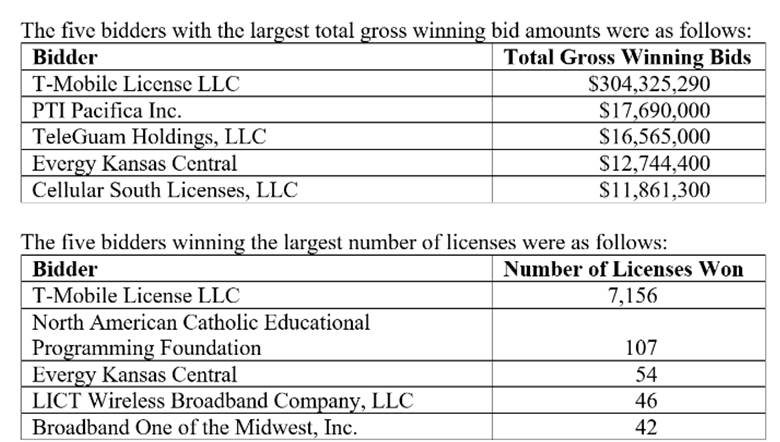

Speaking of spectrum, the latest auction completed, and, to no one’s surprise, T-Mobile was the big winner. Here are the results included in the FCC’s news release last Friday:

With most analysts expecting at least $1-2 billion in proceeds from the auction, it appears that T-Mobile walked away with a pretty good price on spectrum. However, it’s important to note that most of the licenses are in rural areas of the country. How hard T-Mobile pushes a fixed-wireless centric strategy at the same time regulators are awarding $42+ billion in infrastructure grants remains to be seen.

Two weeks ago, we commented on the FCC’s rejection of the RDOF long forms for LTD Broadband and SpaceX. Last week, they announced that both Nextlink and Starry’s long forms would be approved with some additional considerations (see public notice here). This is good news for both companies, and still leaves open the approval of Resound Networks (one of the big winners in Texas). Diana Goovaerts has a good summary of each company’s reaction in this Fierce Telecom article. We still question the efficacy of some RDOF bids made in October 2000 given the inflationary pressures that have hit fiber deployments since then and believe that many RDOF winners will choose to pay the (low) penalty rather than undertake remote builds. This leaves state broadband officials in a pickle as they decide how to distribute the infrastructure grants mentioned above.

Finally, we come back to Apple’s announcement this coming Wednesday. Mark Gurman at Bloomberg attempts to answer the question “What will be announced?” in this article. Rather than summarize his analysis here, have a read of the article and decide for yourself whether the “Far Out” theme relates to potential satellite connectivity (which we think will be terrific news for Globalstar), improved camera functionality, or both. Due to popular demand, we will be posting the sales by carrier by model starting the first weekend of sales. We do not think that recent shutdowns in China will dramatically impact sales but will be listening carefully for any clues.

Things that caught our eye during and after second quarter earnings

We have a number of news items that didn’t quite fit the level (or timing) of market commentary or one of the four questions we have posed over the last month of Briefs. We feel these events are noteworthy, however, and should be on the radar of industry followers and analysts. Here a handful of eye-catchers (in no particular order):

- Cox Communications finally introduces their mobile offerings (August 29). We don’t do a lot of analysis on Cox, the nation’s third largest cable provider, primarily because they are a private company. In a short but sweet announcement, Cox indicated that they will be offering by-the-Gig and unlimited plans in Omaha (where Lumen/ CenturyLink and Verizon fixed wireless are broadband competitors), Las Vegas (Lumen, Verizon) and Hampton Roads (Verizon) “on a pilot basis.” From our review of their plans, they appear to mirror those of their cable peers ($15 for the first GB, $15 per GB thereafter, and a $45 unlimited plan). However, our eye was caught by this footnote at the bottom of the Cox Mobile webpage: “Speed restrictions apply after 5 GB usage per line. Unused data does not rollover. Other restrictions apply.” We can only assume that applies to a yet to be announced plan, as a 5 GB cap on unlimited would be a deal killer for most. For a full chronology of the Cox launch, Mike Dano of Light Reading has an interesting article here.

- Cox Enterprises announces the purchase of Axios for $525 million (August 8) – announcement from Cox here and from Axios here. Cox Enterprises is the parent/ holding company of Cox Communications, Cox Automotive, and other entities such as The Atlanta Journal-Constitution. In an era where public communications companies are spinning off their media entities, it’s interesting to see Cox’s acquisition of this iconic digital property. From the news release, it looks like Axios will have its own separate equity which will include “substantial stakes” from each of the founders (Jim VandeHei, Mike Allen, and Roy Schwartz). Having a separate equity will enable Cox to acquire additional digital properties. We were subscribers to the Axios local service in Charlotte and found it to be an excellent source of news. It will be interesting to see where Cox takes the “local” wing of their newly acquired business; specifically to see how they apply greater advertising expertise to the Axios platform.

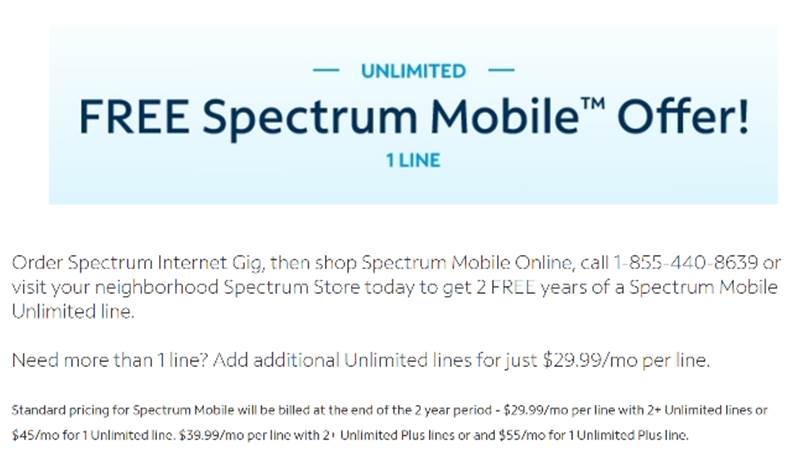

3. The big Spectrum Mobile bundle offer is out (August)! As we covered in a previous Brief, Charter (d.b.a Spectrum) Vice Chairman Chris Winfrey hinted that a new mobile/ Internet bundling plan was just around the corner on their second quarter earnings call. Starting in August, Charter began to show banner ads and also began limited advertising of a “Buy our 1Gbps plan, get two years of Unlimited Spectrum Mobile for free” offer. As we have discussed in previous Briefs, Charter’s base is over-indexed to their baseline plan (which is now up to 300 Mbps download/ 10 Mbps upload). The standard Spectrum promotional rate ($89.99/ month for the first year; $119.99 after that) still applies.

We cannot tell from the material we reviewed whether this promotion was also available to existing customers who upgrade from an existing 100 Mbps package to the higher speed (we think it would make a lot of sense to do this). Spectrum’s everyday low pricing is a good value, but we are not sure that this upgrade strategy will be effective in “head-to-head” competitions with AT&T and Verizon. It would make more sense to offer 1 Gbps speeds for the price of 300 Mbps to every Spectrum Mobile customer (new or existing).

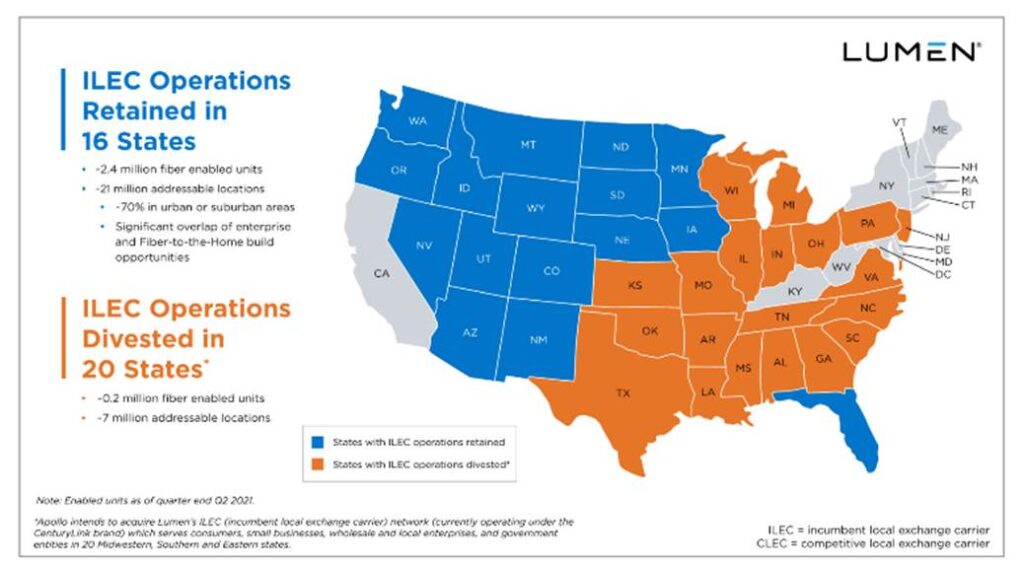

4. Lumen’s sale of certain local properties to Apollo is approved by the FCC (Aug 22 – announcement here). This transaction separates the existing Lumen/ CenturyLink footprint into “East/ West” regions as the nearby picture shows (Florida is the exception, which we think Lumen will likely divest at some point in the future). Brightspeed, the asset being separated from Lumen, will have its headquarters in Charlotte. While this is a very promising development (and roughly delivered in the timeframe announced in August 2021), we think the transition is going to be more challenging than either party envisions. This will result in continued deterioration of legacy copper operations for Brightspeed (hence their aggressive announcement of new fiber deployments) and a rocky 2023 and 2024 for the newly formed company. Fortunately, they are privately held and have patient investors. We do not think that Apollo or Brightspeed will aggressively seek additional legacy copper exchanges (e.g., purchasing some rural exchanges that have been deselected by AT&T for fiber) unless they help to create meaningful operating synergies (e.g., consolidated transport or field operations efficiencies).

5. Comcast to sell their Washington, D.C. regional sports network to team owners (Aug 23 – CNBC article here). Regional sports networks are largely the domain of traditional cable or private companies and are very important to avid sports fans. However, the costs of programming, especially on a per subscriber basis, have steadily increased, limiting their ability to affordably reach the masses. Streaming has also become a new form of monetization. With this backdrop, it’s not too much of a surprise to see Comcast sell it’s NBC Sports Washington stake to their minority shareholder (Monumental). We assume it was an attractive price and return for Comcast. This begs the question “How many more RSN transactions will follow?” even though Comcast has explicitly stated that none of the remaining six RSNs are for sale. We see ownership + event production and broadcast to be a very attractive integration, especially in the wake of an expanded addressable market for streaming (or, in the case of the largest markets, perhaps an exclusive deal with Apple and/or Amazon and/or Disney/ESPN). Given the long relationship and continued technical support that NBC will be providing to Monumental, it does not appear that this will turn out to be detrimental to Comcast video customers, but it opens up options that could make the Xfinity lineup less valuable.

There are many more that caught our ear, but the Labor Day weekend is for rest and reflection. In two weeks, we will cover reaction to Apple’s announcement, talk about some interesting supply chain developments impacting the telecom world, and properly celebrate the 10th anniversary of John Legere being named as T-Mobile’s CEO (original release here and YouTube video of the announcement here – pic from the video). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy the rest of your Holiday weekend and go Royals, Chiefs, and Sporting KC!