Mid-September greetings from the Midwest. We’re back to doing media interviews for Fastwyre Broadband – his latest appearance with the USDA Missouri Program Director, Kyle Wilkens, is here.

This week, after a full market commentary, we will look back on the impact of a decade of leadership. On September 18, 2012, John Legere was named the CEO of T-Mobile. We will look briefly at several early actions that set the stage for exceptional shareholder returns.

Two programming notes. Next week (and likely for all interim posts through Thanksgiving) there will be two online-only Briefs – one tracking Apple iPhone backlog for the three largest wireless carriers (by model and color), and the other being our traditional interim market commentary. Also, as we mentioned in the last Brief, due to Jim’s moving commitment at the end of the month, Jennifer Fritzsche of Greenhill & Company will be taking the pen. We are grateful for her willingness to step in while Jim is driving a U-Haul halfway across the country.

The fortnight that was

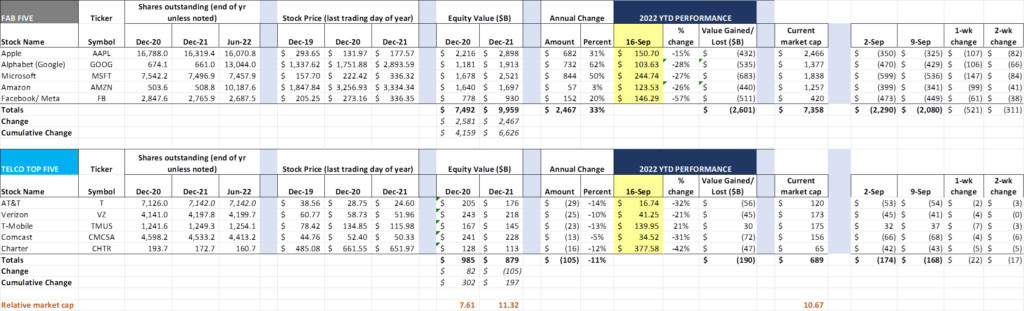

September is proving to live up to its reputation as one of the toughest months for the markets. This week, the Fab Five gave up an additional $521 billion in equity market value, bringing year-to-date losses to $2.6 trillion. Every one of the Fab Five participated in the downturn, with Microsoft leading the pack at $147 billion (almost one Comcast lost this week).

The Telco Top Five also had broad declines, with T-Mobile accounting for the largest single loss. Charter’s share price is now firmly below $400 and at levels not seen since March 2020 (and 2Q 2019). The only comforting news is that they are faring far better than Verizon, who is now down to share price levels not seen for a decade. As we discussed in the previous Brief, the outlier in the Telco Top Five is T-Mobile, now up 21% for the year as Sprint synergies and buyback hopes rise. As of Friday, Magenta was worth about $1.5 billion more than Big Red.

Speaking of Verizon, CEO Hans Vestberg sat down with Brett Feldman at the Goldman Sachs Communacopia Conference this week (transcript and audio here), where he disclosed that consumer postpaid net additions would be down in the third quarter. Total postpaid phone net additions should be mostly offset by increased business phone additions. Given Verizon’s aggressive iPhone 14 promotions (specifically the Verizon One Unlimited Pricing plans – more on them here from Tom’s Guide), the disclosure of negative net additions just before the iPhone hit the store shelves is surprising.

While we are not publishing the iPhone charts until next weekend, we did check backlogs through Saturday evening (Sept 17). There are many factors that impact opening weekend results, but so far, the iPhone 14 launch (specifically the more expensive and profitable iPhone 14 Pro and Pro Max models) seems to have performed slightly ahead of carrier forecasts. T-Mobile appears to have the fewest backlogs (and the shortest monthly payment schedules – 24 months vs. 36 for Verizon and AT&T), and Verizon and AT&T’s backlogs coming out of the first weekend for iPhone Pro and Pro Max appear to be very manageable (early to mid-October ship/ deliver by dates). The verdict is still out, but this year does not seem to have the opening weekend “deep hole” to dig out of, which is good news for everyone.

We also checked the latest RootMetrics RootScore Reports data (39 out of 125 reports for the second half have posted) and there are few surprises there. The top two results (outright Verizon win, or Verizon and AT&T tie) are very similar to previous results – 82% of total. T-Mobile is involved in final results to a greater extent, likely in a tie with AT&T and/or Verizon, but they are not breaking through with outright wins. We expect changes to this metric in 1H 2023 as Verizon and AT&T roll out their C-Band networks and T-Mobile begins to quickly deploy their recently won 2.5 GHz spectrum. While RootMetrics RootScore Reports are one data sample, we find that repeated outright wins across multiple years (e.g., Verizon’s dominance over the Tri-State New York Metro area) cannot be ignored.

Another CEO transition was announced this week, with Kate Johnson, previously head of Microsoft’s US operations, taking over for Jeff Storey at Lumen (announcement here). We salute the Lumen Board of Directors for hiring someone who will bring a fresh perspective. Ms. Johnson is a relationship management veteran with deep enterprise/ business experience. What she lacks in consumer know-how she can certainly (and will need to) hire. With Lumen’s stock sagging, capital expenditures rising, and market shares flattening (more fiber/ less copper), the company needs someone who can manage a difficult turnaround. Lumen’s consumer problems have not gone away, they simply are more focused on a smaller footprint. Kudos to Jeff Storey on his telecommunications legacy and perseverance through decades of choppy waters.

Finally, Cogent went to the telecom Dollar Tree store and found Sprint’s legacy wireline network available on aisle four. Yes, T-Mobile sold the Pindrop network to Cogent for $1 (see September 7th SEC filing here). Many of you have asked for an explanation of T-Mobile’s motivations. Here’s our take on the transaction:

- Sprint’s domestic US long distance network was built prior to the advent of the Internet. It is largely built along railroad rights of way. Most of the original network is over 30 years old.

- Network architectures have changed a lot over the last three decades. Routing infrastructure today depends as much on wireless tower and cable infrastructure location as it does on business offices. Most business service providers (especially cable) bypass the central office locations common to network architectures in the 1990s and 2000s. Connectivity matters, but middle mile networks such as Conterra, Bluebird, OPTK, Fiberlight, KsFiberNet and others have built intercity fiber networks and actively court wireless carriers.

- Sprint faced a choice in 2004/2005 to either spend limited systems capital on building out VoIP network capabilities for cable companies (leveraging decades of experience in managing voice networks as both a long-distance and a local phone provider) or extending its IP services directly into buildings (the Metropolitan Area Network or MAN network architecture depended on last mile TDM and later Ethernet loops from Verizon, AT&T, and Lumen). The company made the right decision to invest in cable, and Sprint generated material profits from their wholesale VoIP business from 2005-2011.

- Sprint made another decision in 2005 – Nextel (vs. Alltel). The myriad of challenges integrating systems and networks that followed the Nextel merger shifted attention away from wireline to wireless. In contrast, Verizon, fresh off of their MCI/ WorldCom acquisition, was able to quickly integrate Alltel’s wireless assets and also enable what is now Windstream Enterprise. Had Sprint purchased Alltel instead of Nextel, portions of the legacy Sprint/ Embarq backbone would have been materially upgraded and the value of the wireline network would have been extended.

- It’s no surprise that T-Mobile would have high interest in the enterprise and government customer relationships that Sprint had fostered over the years but not the current wireline network business. Cogent was a logical network buyer because they can migrate most if not all of the customer traffic to their network. Cogent also picks up a very large global IP network, one of the original Tier I backbones of the Internet.

What is not clear from the transaction is whether T-Mobile believes that it should ever own local fiber assets. We have discussed this conundrum in several Briefs over the last three years. A strong relationship with Cogent (and perhaps eventual acquisition of the company) will be good, but we think that other approaches will be pursued as $40+ billion of fiber is being deployed through each state. Bottom line: T-Mobile remains focused on wireless revenues. This leaves them highly dependent on third parties for enterprise connectivity. At some point in the future (we probably think sooner than the company does), this is going to hurt their overall competitiveness.

T-Mobile is not throwing out the multi-gigabit per second baby with the Sprint legacy bathwater. There’s another chapter to be written here, and the Sprint network had to be jettisoned prior to the fulfillment of the larger strategy. We think it’s a brilliant move, and, while nostalgic for the glory days of Sprint’s frame relay and dedicated IP service leadership, they simply could not keep up with the times.

Why did John Legere succeed? A decade in retrospective

As we mentioned in the last Brief, we are taking a pause from normal industry analysis to commemorate the 10th anniversary of John Legere’s appointment as CEO of T-Mobile USA. Hard to believe, but that happened only 10 years ago today (announcement here). Since then, T-Mobile has grown – a lot – recently overtaking Verizon as the most valuable telecommunications company in the world.

John’s initial hand in 2012 was weak: no AT&T merger, no iPhone, no national LTE network, no scale, and no separate equity currency. This translated into low confidence, not only on the part of T-Mobile’s customers and employees, but also on the part of their German parent. T-Mobile was viewed (and rightly so) as a value leader, a place where budget-focused customers in some metropolitan areas went to get their wireless service.

There was one reasonably valuable card, however. As a result of the AT&T merger failure, the company was paid $3.0 billion and received attractive roaming rates from Ma Bell valued at an additional $3.0 billion. This proved to be an effective band aid as the company transitioned from acquired to acquiror.

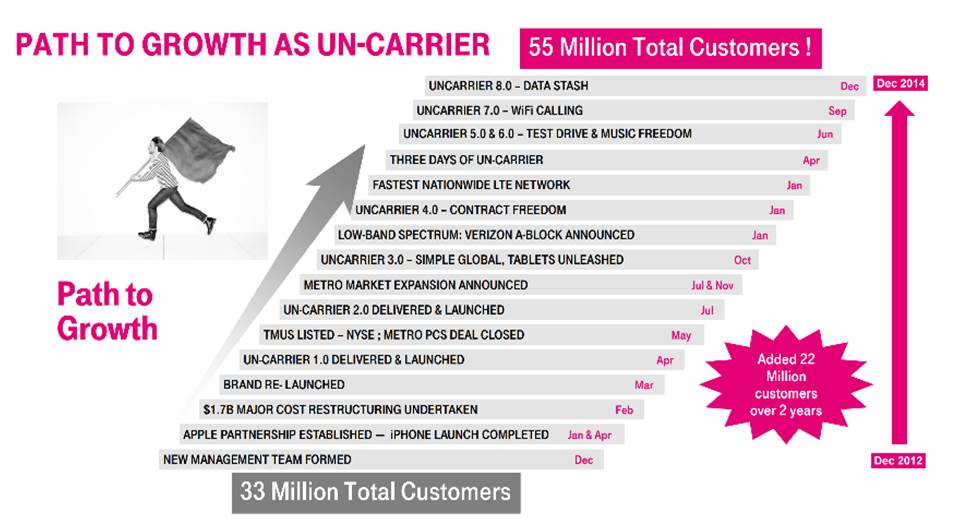

John and the team relaunched T-Mobile in 2013 as a challenger in conjunction with the acquisition of Metro PCS (see nearby list of achievements from the 2015 Deutsche Telekom Capital Markets presentation). After May 2013, the company initiated a complete upsizing of the previously instituted challenger program.

Frontline focus took center stage as the company prepared for the iPhone launch (the iPhone 5s and 5C were announced later in 2013). T-Mobile’s investments in training, customer experience, and retail allowed the company to handle growth with efficiency. The company also moved quickly to integrate the Metro PCS (CDMA) network into T-Mobile (GSM/ LTE). While things weren’t perfect, their ability to quickly merge the companies and achieve synergy values surprised many industry analysts. As a result of their early success, by the end of 2013, TMUS stock had doubled from its May 1, 2013 debut (the closing of the MetroPCS merger).

T-Mobile’s frontline focus produced a lot of data. Network quality gaps, billing plan confusion, device shortcomings (driven by the “Bring Your Own Device” mantra of the previous leadership team) and several other pain points birthed subsequent Uncarrier initiatives. From 2013 on, executives knew the port ratios for each major carrier and the company enjoyed a long string of monthly successes (ratios > 1.0) as a result. John turned a few critical data points into headlines as proof points for employees and investors.

John Legere also maintained an active presence on social media, particularly Twitter. He brought customer service into his Twitter account and addressed many customer pain points through the platform. While known for his famous “Slow Cooker Sunday” series on Facebook Live (cookbook available here on Amazon), John was also an early user of Twitter’s Periscope app. He experimented with nearly every social media outlet, unlike his larger competitor CEOs (AT&T’s Randall Stephenson or Verizon’s Lowell McAdam, to our knowledge, never used Periscope or Facebook Live). He was a social media telecom CEO pioneer who was accessible to the masses.

From the formation of TMUS in May 2013 to John’s departure in April 2020, T-Mobile’s stock price increased by ~6x or about 30% per year. Over that same period, Verizon’s equity declined less than 1% and AT&T’s declined 22%, although both paid high dividends. Only Charter (who was able to quickly integrate Charter and Brighthouse networks into a broadband powerhouse) performed better than T-Mobile over that period.

Bottom line: There are a few times in the history of US business when we had a “right time/ right place” CEO who was not a founder or primary shareholder. While history focuses on the ultimate outcome, the seeds of change were borne from customer pain point focus (accompanied by easy-to-understand metrics), a multi-layered network architecture, front line empowerment, a strong relationship with their German parent, and unabashed use of social media to reinforce and create additional brand equity. While John will be missed, his legacy will not be forgotten.

Next week, Jennifer has the pen and we will return in earnings season. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy the rest of September and go Royals, Chiefs, and Sporting KC!