Mid-September greetings from the Midwest, Georgia and Alabama, where we are wrapping up our Moundville Telephone Company acquisition. Pictured is Tuska, a 7-ton elephant statue that was recently moved to the Bryant-Denny stadium in Tuscaloosa. Legend has it that the association with elephants dates back to the 1930s when a fan proclaimed to a sportswriter “Hold your horses, the elephants are coming!”

After a full market commentary, we will dive into several questions that we think need to be covered in upcoming earnings calls. Speaking of which, here’s the earnings calendar as of October 14 (a.m. indicates the conference call will occur prior to the opening of financial markets, usually 8:30 a.m. ET. All other earnings calls will occur after the markets close, with most earnings calls beginning between 4 and 5 p.m. ET):

- AT&T: Thursday, October 20 (a.m.)

- Verizon: Friday, October 21 (a.m.)

- Microsoft: Tuesday, October 25

- Alphabet: Tuesday, October 25

- Meta: Wednesday, October 26

- Comcast: Thursday, October 27 (a.m.)

- T-Mobile: Thursday, October 27

- Apple: Thursday, October 27

- Amazon: Thursday, October 27

- Charter: Friday, October 28 (a.m.)

Note: Because of our efforts to pull inventory data at the same time each week, we will post the Apple iPhone 14 backlog charts on Sunday evening. Any reference to inventory levels in this Brief refers to those analyzed last weekend (link here).

The fortnight that was

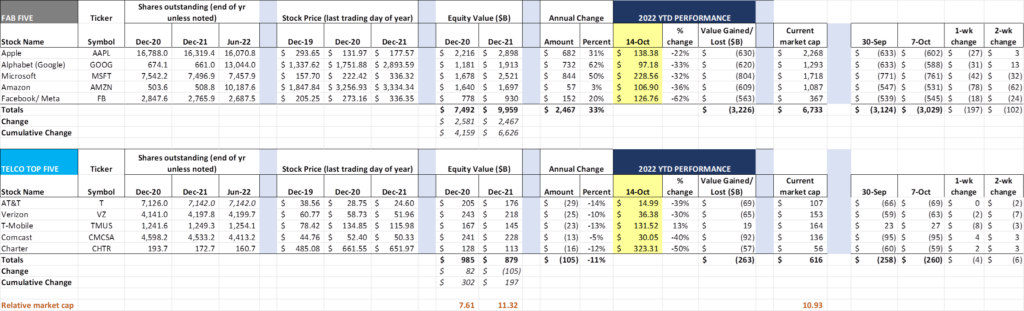

Market capitalization losses from September continued into October, with the Fab Five down $102 billion and the Telco Top Five down $6 billion so far this month. Each Fab Five stock has lost at least $500 billion through the first 9.5 months of 2022, and total losses are firmly above $3 trillion for the year.

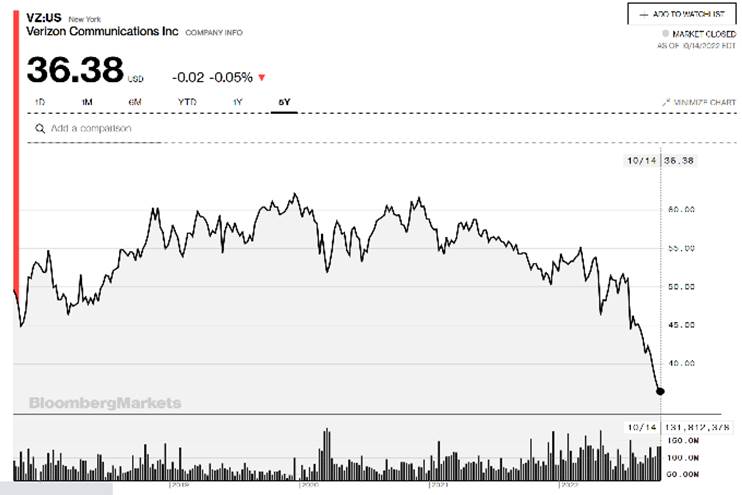

As bad as those accumulated totals look for the Fab Five (this price level on Apple stock has not been seen since June 2021, Microsoft and Google since January 2021, and Amazon since April 2020), the Telco Top Five (except for T-Mobile) are plumbing depths not seen in several years if not over a decade. With the exception of the March 2020 dip, Charter’s stock is at 2019 levels, Comcast at early 2016 levels, Verizon at late 2011 and AT&T (adjusted for many divestitures) at 2003 levels. Yes, excluding the impact of dividends (and nearly 20 years of dividends cannot be ignored), AT&T has roughly the same market capitalization as they did when Worldcom went bankrupt. And, with Warner Brothers Discovery (WBD ticker here) down 50% since it was spun off from AT&T in April (versus down 24% for T), that hasn’t gone well either. Here’s hoping for a DirecTV renaissance.

With the telecom industry struggling to create value, it’s not surprising to see management changes. Since our last report, Comcast announced that their current CFO, Mike Cavanagh (picture nearby), would assume an additional role as President (press release here). It’s a big announcement for the company given the longer Comcast tenures of Dave Watson (31+ years), Jeff Shell (16+ years), and Dana Strong (14+ years). Portfolio management will take a front seat as the company charts the waters of technological change (streaming vs. linear TV, migration to DOCSIS 4.0) and increased competitive threats. This leads us to think that company structural changes (namely divestitures) will drive value creation at least in the short to medium-term.

The Cavanagh announcement marks three major changes in the telecom industry. Kate Johnson will be replacing Jeff Storey at Lumen (down over 45% over the last year; current dividend yield of 15%), Chris Winfrey will be replacing Tom Rutledge at Charter (stock down a little over 50% over the last year but still at 2019 levels), and now Mike Cavanaugh likely replacing/ heavily supporting Brian Roberts in his quest to unlock value. One can only wonder when the next “retirement” will occur in the industry.

Speaking of structural changes, we could not help but raise an eyebrow to Dish’s request of the Conx shareholders to extend the time for their special purpose acquisition company (SPAC) to complete a transaction to acquire Dish’s retail business (press release here). For those of you who don’t remember, Dish purchased Boost from Sprint for $1.4 billion. Since then, Boost has lost slightly more than 1 million customers. On top of the Conx SPAC shareholder approval, the sale will need DOJ approval as well. According to this Bloomberg article, the SPAC will also have to raise additional monies from institutional shareholders. While the separation of retail and wholesale businesses makes sense, who will fund the additional SPAC investments required and at what cost of capital? The capital markets are stretched, and adding in additional DOJ approval requirements only makes it more complex and risky.

Speaking of risky investments and poor financing timing, it’s worth chronicling what happened with the Apollo/ Brightspeed financing (Reuters article here and Bloomberg article here). Brightspeed is the portion of the legacy CenturyLink/ Lumen network that the company decided to sell to fund a fiber to the home effort in what is mostly the legacy US West network. Faced with a lack of interest even at junk bond rates, Apollo’s banks (Bank of America and Barclays) pulled the plug on the debt offering, leaving Apollo to fund the remainder (through debt issued through the private equity firm). This is a bet that the financing environment gets better in a few years, but also leaves Brightspeed with higher uncertainty when they are applying for state monies. One person close to Apollo’s actions in Missouri put it bluntly: “If no savvy investors showed up to fund Brightspeed’s fiber to the home activities, why should our state issue them grants?” Food for thought.

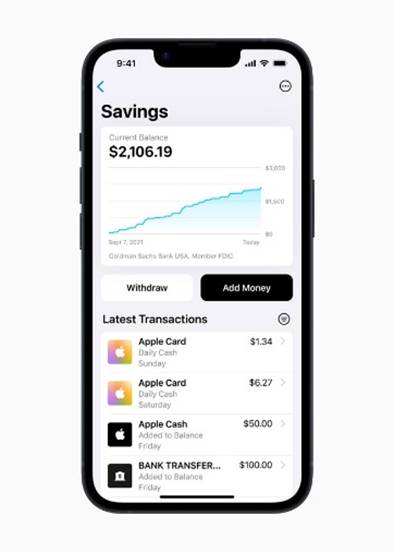

Uncertain times heighten risks, but they also breed opportunities. Interest rates rising? Then let’s launch the Apple Card high-yield savings account, a white-labeling of the Marcus brand Goldman Sachs created six years ago and an extension of the Apple Card that was introduced just over three years ago. According to the press release (here), customers can go beyond earning interest on their Apple Cash to transferring other balances to their Apple Card savings account. Per the release:

“To expand Savings even further, users can also deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance. Users can also withdraw funds at any time by transferring them to a linked bank account or to their Apple Cash card, with no fees.”

We liked the Apple Card when it was launched (Brief here) and saw it as a potential means to increase Apple’s presence as a replacement for Verizon, AT&T, or T-Mobile stores. Apple seems to have shifted from outright control of the retail experience to device financing (since there’s very little discounting between Apple and the carriers, this makes a lot of sense) and now to savings. This is a very wise move with an aligned financial services partner (despite this CNBC article from last month questioning the credit risk of Apple Card customers).

So many questions for third-quarter earnings…

Next Thursday and Friday, the earnings parade starts with AT&T and Verizon. Here’s what we expect to hear:

- Business trends are strong with no signs of abating (if we were creating the earnings bingo cards of the past, we would certainly include Multi Edge Compute or MEC on the list).

- Consumer spending is still strong, especially on the latest iPhone (an “affordable premium product” was the way it was described to me last summer by a carrier executive)

- Miniscule increases to bad debt. No signs that consumers are downgrading plans.

- C-Band deployment is continuing to meet or exceed previous guidance (and they will cite the latest Opensignal report which shows how often is it being used)

We will also see some notable trends for each company/ sector:

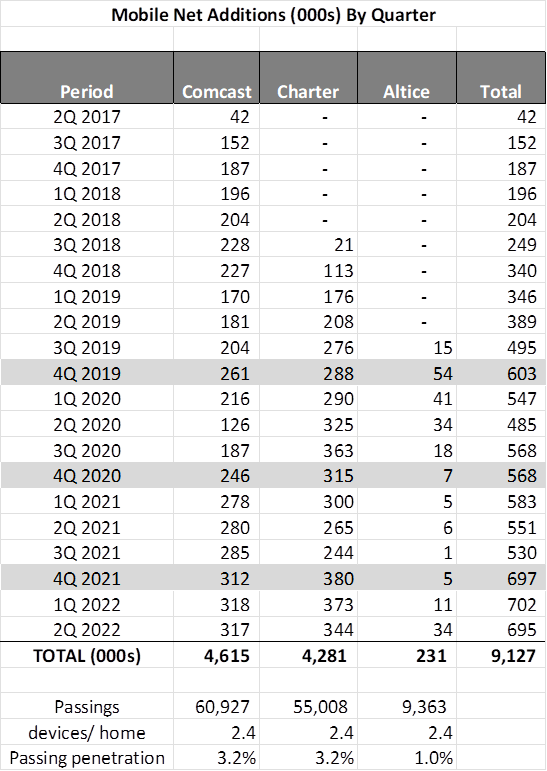

- Cable will have their best quarter ever for their MVNO net additions (see nearby chart as reference)

- Cable will have their (nearly) worst quarter ever for both video and telephony revenue generating unit (RGU) losses

- T-Mobile will surprise even their most bullish fans with significant synergy savings. Versus the cost of acquiring C-Band licenses, this will clearly be the deal of the 2020s decade

- Fixed Wireless Access (FWA) will dominate the discussion of 5G use cases for Verizon and T-Mobile. Net additions will surprise all but the most bullish analysts

- AT&T wireless postpaid churn will tick lower. Verizon will likely tick higher (business offsetting consumer a bit)

- AT&T will have net consumer wired broadband net additions (by a comfortable margin) but will not set 2023 goals quite yet due to some “slight” fiber deployment delays. They will proclaim that their everyday low pricing (ELP) strategy is working, and will shed some light on how many AT&T wireless customers are signing up for home broadband services

After 30-40 minutes of generally upbeat talk, the analysts get to ask questions. Here are some we think are worth raising:

- To Verizon: How will you restore the value of the company to pre-pandemic/ 2019 levels (roughly a share price between $55 and $60 with a corresponding 3-4% dividend)? What’s the plan? Note – this would involve restoring $90-100 billion in market capitalization. We actually think this should be the #1 concern of management and that the solution lies in improving asset utilization (and therefore asset turns or revenue per dollar of assets). Reducing business last mile costs for enterprise customers through fixed wireless technology is great, but where’s the expanded salesforce to grow share against Lumen, AT&T, and cable in their respective territories?

- To AT&T: How will everyday low prices (ELP) for fiber broadband compete against a $25/ month plan for 5G Home Internet Verizon customers (plan here)? How will everyday low prices compete against the latest $49.99/ month Spectrum One bundle for new customers (important for Dallas, San Antonio, Austin, and Los Angeles markets)? Do customers who are pinching pennies today see the value of AT&T’s fiber offering?

- To AT&T: What is your anticipated investment in fiber initiatives outside of the traditional AT&T territories? Is there enough unutilized fiber in the legacy AT&T Business (TCG) network to grow in markets like Denver, Phoenix, Seattle, Philadelphia, Pittsburgh, Boston and New York? Are there specific segments (e.g., Multi-Dwelling Units) that present low-cost, high value opportunities for improving returns in these markets?

- To Cable: It’s been nearly six months since the Joint Venture announcement with Charter to compete against Roku, Apple TV, ad Amazon Fire. When do you anticipate rolling out first products to customers? Will 80-inch TVs become the newest Equipment Installment Plan (EIP) product? Is this the best way to create differentiation against national competitors? What are the learnings from selling XClass TVs in Walmart (see online offering here)?

- To Cable: How do increased mortgage rates impact new housing starts in your territories? If move activity slows, how does that impact gross additions? How low would growth need to be to move to AT&T’s everyday low pricing strategy (no 12 or 24-month promotions)?

- To Charter: At the end of 2020, the company won Rural Development Opportunity Funds (RDOF) covering $1.22 billion for just over 1 million subscribers. This equates to ~$1,200 per home passed. Since the bidding ended, the costs of labor and supplies have increased by double digits yet the penalties the company would pay for non-compliance/default have remained the same. If costs were to rise by another 10-15-20%, is there a point where the company trims back their builds and just pays the penalty? What’s the breakeven point? (Separately, it might be worth getting an update on where they are against their 40% buildout requirement required in the next 24 months).

- To T-Mobile: TMUS currency is as strong as it’s ever been, especially on a relative basis. While others are contemplating significant buybacks while their stock prices are at multi-year lows, this would appear to be the time for T-Mobile to use their stock to purchase other companies. Having just demonstrated success with Sprint, what type of the transaction (how big, how adjacent) can the company get through the FTC and DOJ?

- To T-Mobile: The Lumen relationship (see announcement here) seems to be producing minimal market share gains for either company after 18 months. How important is this relationship to enterprise market share gains? Do you think incoming CEO Kate Johnson will be more receptive to a more robust T-Mobile partnership?

There are many more questions to think about, but our space is limited. In two weeks, we will try to make sense of what was said (and not discussed) to see who is sitting pretty and who is on the run. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy the rest of October and Go Chiefs!