Nokia hailed “notable strength in private wireless” for sending enterprise sales spiralling upwards by 22 percent during the third quarter of 2022. The firm’s enterprise unit outperformed the rest of the business, with overall sales rising six percent over the same period a year ago, finishing at €6.24 billion, as well as every individual business unit. The company reported 515 ‘large customers’ for private networks, claiming “strong order intake”.

The Finnish network vendor added 30 new private wireless customers in the quarter, it said. It also restated a mission “to invest to build on early market leadership” in private LTE and 5G space, crossing into the broader “industrial edge ecosystem”. Its enterprise performance was classified as part of its “faster than the market” growth mission, which includes a stated strategy to “grow beyond [the] CSP” sector.

Meanwhile, Nokia’s premier mobile networks division claimed a 12 percent rise in sales in the quarter; sales of network infrastructure (IP, optical, fixed, submarine) were up by five percent, while its services (cloud and network) and technologies (patent licensing) units were down three by percent and 19 percent, respectively. Its private networks business cuts across its networks and services divisions.

Meanwhile, Nokia’s premier mobile networks division claimed a 12 percent rise in sales in the quarter; sales of network infrastructure (IP, optical, fixed, submarine) were up by five percent, while its services (cloud and network) and technologies (patent licensing) units were down three by percent and 19 percent, respectively. Its private networks business cuts across its networks and services divisions.

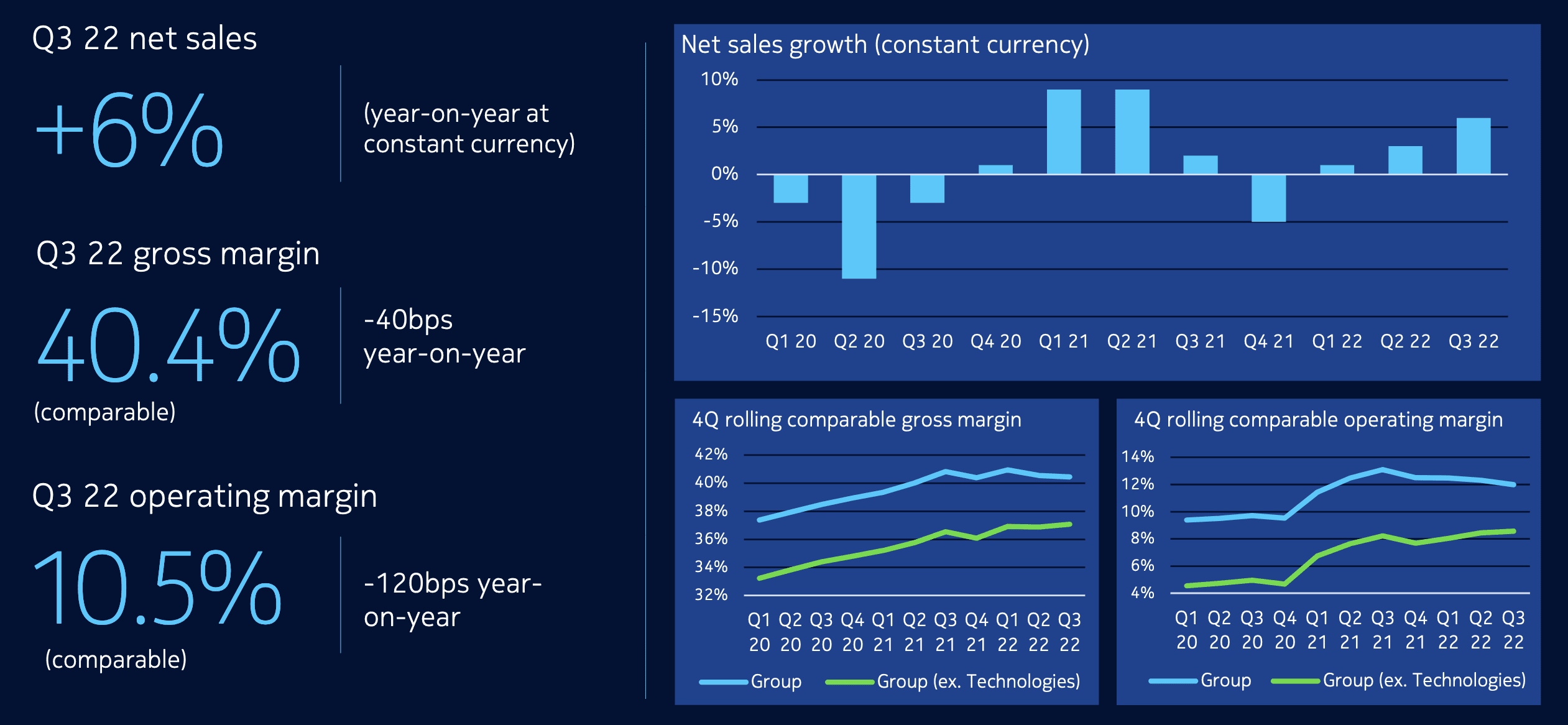

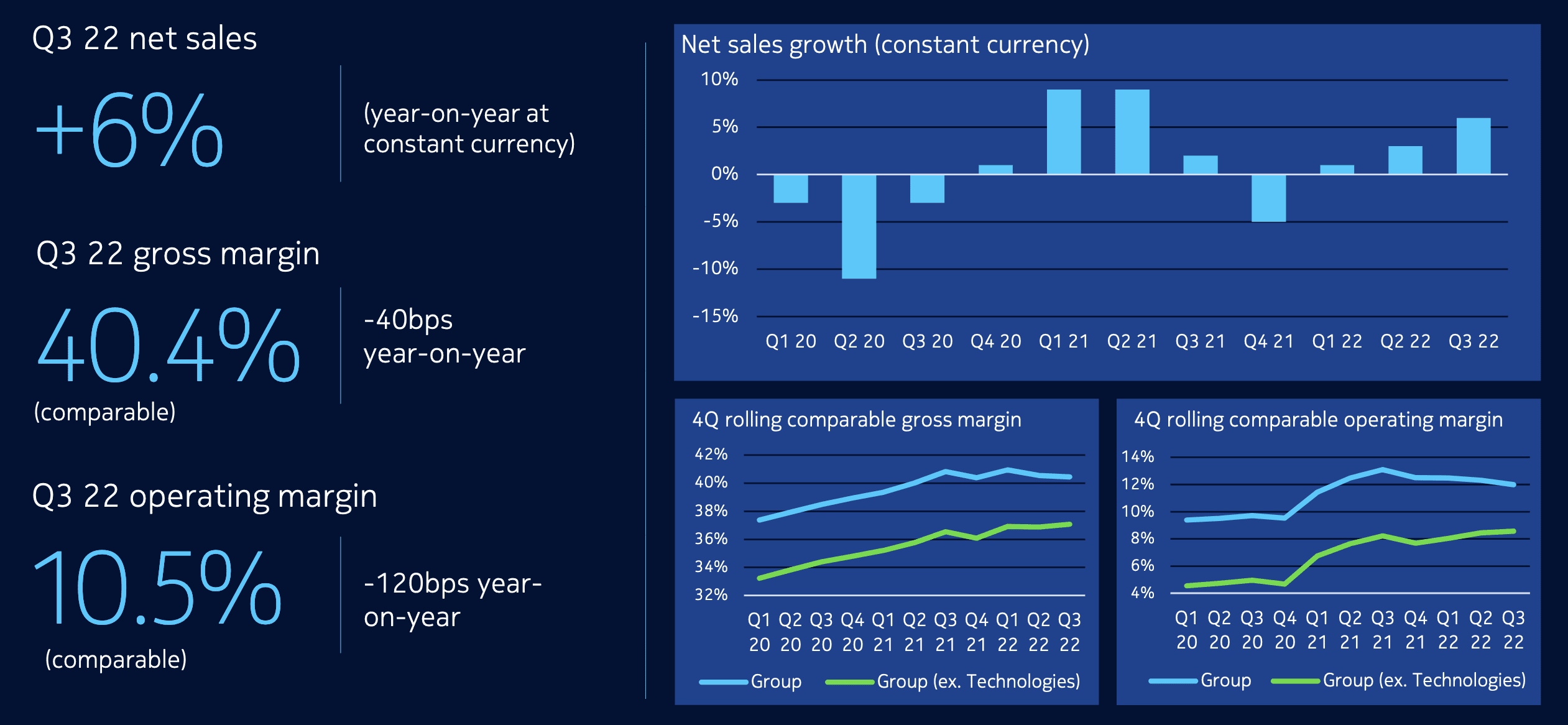

Nokia’s biggest reverse – sending gross and operating margins down by 40 and 120 base points, respectively, to 40.4 percent and 10.5 percent – was in its technologies unit, and was explained away by the “timing of ongoing contract renewals” and “expired licences… in litigation/pending renewal” – despite “strong momentum in expansion areas”. Margins were up everywhere else.

Pekka Lundmark, president and chief executive at Nokia, said: “Improving profitability in mobile networks and network infrastructure was offset by timing effects of contract renewals in technologies… We have strong momentum in enterprise including adding 30 new private wireless customers in the quarter… We expect enterprise to remain our fastest growing customer segment.”

Nokia’s full-year sales are expected to be in the range of €23.9 billion to €25.1 billion. It warned of potential challenges and market headwinds, variously, from “competitive intensity, additional R&D investments, disturbance in the global supply chain, accelerating inflation and global macro-uncertainty, the COVID-19 pandemic, and war or other geopolitical conflicts”.