Halloween weekend greetings from the Midwest, where fall colors are in full show and temperatures are still above freezing. Pictured is my neighbor’s Trick-or-Treat Treehouse moments before a dozen costumed boys showed up for their annual party.

With each of the Fab Five and Telco Top Five reporting earnings over the last ten days, we have a lot to cover. This report will focus on earnings news. The Apple iPhone 14 backlog information will be posted to the Sunday Brief website later on Sunday.

The fortnight that was

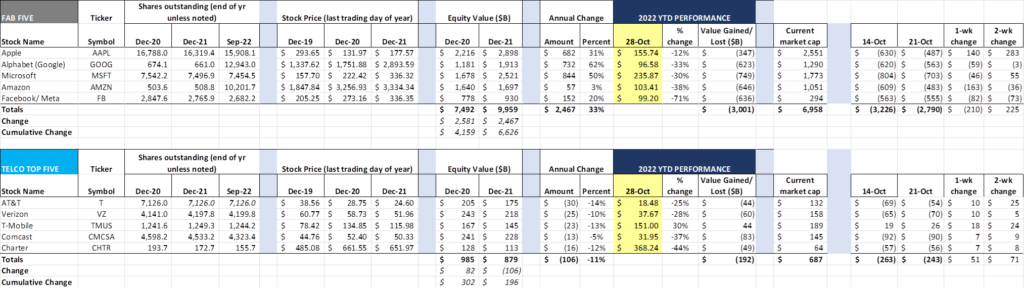

Since our last Brief, the Fab Five has increased their total market capitalization by $228 billion and the Telco Top Five has grown by $71 billion (note – with the exception of AT&T and Facebook/Meta, the share totals reflect those shown on their latest SEC quarterly filings). But, as the 1-wk change column shows, there was a lot of movement over the fortnight for the Fab Five.

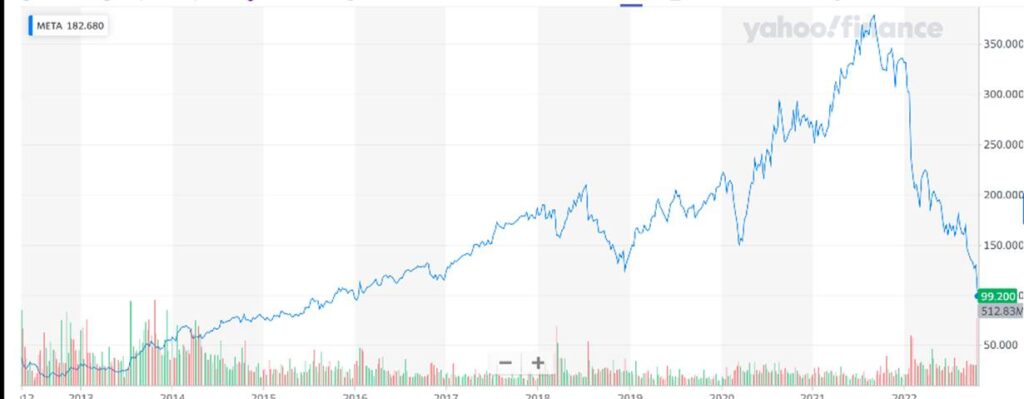

Meta is still down significantly, hitting a price level on Thursday not seen since the end of 2015 ($97/ share – see nearby chart). While their 70%+ decline in market capitalization this year is very concerning to investors, it also could hinder Meta’s ability to retain key employees, especially those who have joined in the last five years and seen their options wealth vanish. 2023 grants will certainly appear attractive, provided the stock does not fall further, but the sting of multi-year wealth vanishing in such a short amount of time (while other Fab Five stocks have not deteriorated to that extent) will not heal overnight.

On top of the impact on employee retention and (possibly) recruitment, Meta’s deflated stock price significantly reduces their ability to make acquisitions. Given the current FTC and DOJ scrutiny, a larger acquisition was probably not in the works regardless, but that environment will change sometime in the next decade, and this could place a higher dependence on cash (vs stock) as the payment source.

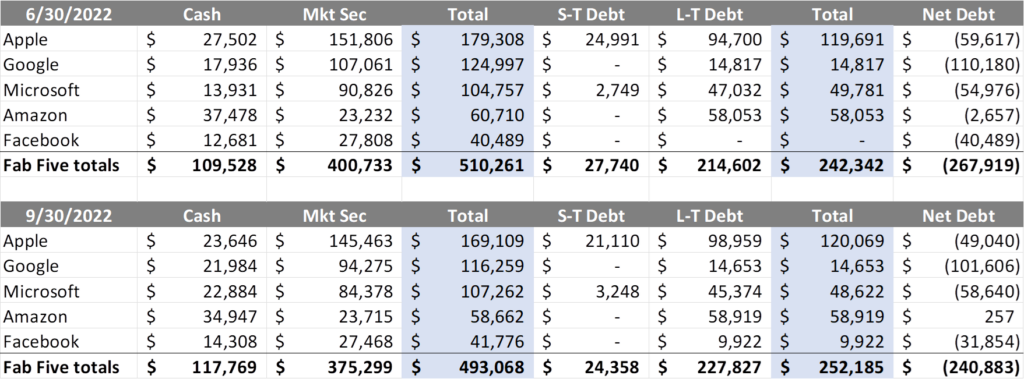

We typically wait for a post-earnings Brief to talk about Fab Five cash and net debt balances, but thought this schedule showing quarter-to-quarter changes would provide some insights on how each company is handling the pressures of a strong dollar, inflation, lower stock markets and slow macroeconomic growth (note – a negative net debt indicates that the company has more cash and marketable securities than short or long-term debt. These numbers are positive and high for the telecommunications industry).

With the exception of Amazon (who now actually has a fractional amount of net debt) and Facebook/Meta (who issued approximately $10 billion of debt in 3Q), the biggest change over the last 90 days was in the value of marketable securities (down $25 billion, or roughly the entirety of the decrease in negative net debt).

The net debt balances as of the end of September show us three things:

- The Fab Five (including Facebook/Meta, at least for now) can weather a long financial storm

- Facebook/ Meta consumed most of their $10 billion of debt issuance in the quarter (that’s a lot of burn)

- Holding cash in a higher inflation environment makes no sense and we think that buybacks will accelerate, especially for Google/Alphabet and Apple (at least and until the regulatory environment changes)

It’s important to note that cloud services growth still drives the quarterly headlines (and investor expectations) at Amazon, Microsoft, and Google. On a constant currency basis, Microsoft Cloud services were up 31% year-over-year (24% reported with 7% constant currency impact per their earnings release). AWS was up 28% for the same period (27% reported with 1% constant currency impact – release here), and Google Cloud was up 38% (release here) which included the impact of an acquisition (Mandiant). Demand may be slowing given global recession fears (and the cumulative base of revenues makes it more difficult to keep a 30+% growth pace), but it’s still very robust, and, excluding Google, a major contributor to overall company operating income growth.

Finally, we thought it would be useful to mention Warner Bros. Discovery’s SEC filing (here – Oct 24 link) in which they delineated their current estimated total write-off levels due to the AT&T acquisition:

“The Company estimates it will incur approximately $3.2 – $4.3 billion in pre-tax restructuring charges comprised of:

- Strategic content programming assessments, leading to content impairment and development write-offs, of approximately $2.0 – $2.5 billion;

- Organization restructuring costs, including severance, retention, relocation, and other related costs: $800 million – $1.1 billion; and

- Facility consolidation activities and other contract termination costs: $400 – $700 million.”

Excluding Comcast, it’s been very difficult for telecommunications companies to create, distribute, and manage content. $2.5 billion in write-offs is no laughing matter for WBD shareholders. For those Brief readers in executive positions, should content creation suddenly pop up as a reasonable diversification strategy from some blue chip consultant, keep the release linked above as a reminder of just how bad it can get for shareholders (purchase for $85 billion, spin into Discovery for $43 billion, and now another several billion in write-offs). More on the titles cut and overall reaction in this Reuters article and this Wall Street Journal article.

Competitive Responses Matter (Reflections on 3Q Earnings)

Determining a thematic response when each of the Telco Top Five announce earnings in a short period is tricky. The quality (or lack thereof) of each Telco Top Five balance sheet could be one angle, but we would simply conclude that the Fab Five have a long-term competitive advantage due to their negative net debt positions (except for Amazon – see above chart). AT&T and Verizon levered up to pay for C-Band spectrum, and T-Mobile is currently shedding debt associated with their Sprint acquisition. The cable industry has historically been the poster child for high-yield debt. None of Telco Top Five are over-levered, but there’s an amazing contrast in the use of debt between them and the Fab Five.

We could talk about the differences between local operating companies (or divisions thereof) and national wireless carriers (who have local retail operations that are increasingly handled by third parties), potentially coming to the conclusion that the cable industry might have an advantage. But Verizon is getting more aggressive with their concierge service trials, and AT&T has been trying to figure out local distribution for over two decades; no company has cracked that code and created distinct differentiation. No communications company can claim local leadership.

We settled on competitive response as our focus because, from our read of earnings, there’s a big variance between each Telco Top Five company. There are many components to developing a competitive response, including:

- Determining the problem and associated root cause. For example, if one carrier offers Netflix in their premium wireless bundle and is successful with gross/net additions and nothing else changed in the product mix, the problem and response should center around content bundling, not headline price or the inclusion/ exclusion of another less important feature

- Understanding the consequences of each alternative. A few years ago, many wireless carriers offered unlimited plans for the first 15-20-22-50 Gigabytes of data traffic per month. Everyone hated the throttle experience. Rather than increase the Gigabyte limit and minimize the throttling pain, one of the carriers (our recollection was that it was Verizon, not T-Mobile) introduced bit prioritization in their primary plans. Soon, deprioritized data became an alternative for family plan lines, and eventually became the network basis for many MVNOs (including Xfinity Mobile and Spectrum Mobile). Depending on when customers use data through their smartphones, the experience could still be painful, but there were customer-driven alternatives that could solve a congestion problem (e.g., leave work later, take a different route with better cell coverage, etc.)

- Understanding tradeoffs and linked decisions. In the cable industry, the tradeoff several years ago was between high margin home phone revenue generating units (RGUs) and wireless voice revenues and margins. How hard should the cable industry push wireless voice? Can the industry stem the flow of wireless substitution?

- Interpreting competitive signals. This happens often with price changes. If Comcast raises their base speed on their Connect More plan to 200 Mbps down/ 10 Mbps up but does not change their promotional ($40/ mo.) or post-promotional ($60/ mo.) price, that sends one message to AT&T. If Comcast were to suddenly do away with their speed tiers and offer 500 Mbps for $30/$50 per month, that would send an entirely different message. Many competitors misinterpret pricing and product signals, and this can lead to extensive value destruction in the process.

Too many times, carriers do not correctly respond to competition. They think that a new promotion or discount will assuage disgruntled customers. They focus on their “Would you recommend our service to your friends or family?” score results versus “Would you try another service if you could save $x/ month and the conversion costs were minimal?” (some contented customers will try an alternative to their current broadband connection, especially since the pain of number porting is not a part of the process).

On their earnings call (link here – comment cited below at roughly 7:20), incoming Charter CEO Chris Winfrey brushed aside any long-term threat from fixed wireless providers (we assume this includes Verizon’s 5G Ultra Wideband product) citing bandwidth inconsistencies. We are not as confident as he is that Verizon or T-Mobile will go away in a few quarters and that customers will flock back to Spectrum, especially at Verizon’s $25/ mo. price point. Chris’ perspective mirrors the view that many local phone companies (ILECs) took with respect to Time Warner Cable’s phone product in 2005 and beyond, and they were eventually surprised that the call quality was as good and, in some cases, better than the legacy TDM network. What if customers like the Verizon or T-Mobile products so much that they don’t return to Charter?

Additionally buried in the current broadband pricing structures of the cable industry is the thought that after XX months (usually 12, but increasingly becoming 24), broadband customers will become so enamored with their cable+wireless bundle that they will pay more. For example, per CNET (here), Cox Communications offers their 500 Mbps down/ 10 Mbps up plan for $70 for the first 12 mos, but that rate goes to $100/ mo. starting in month 13. Verizon offers similar bandwidth speeds for $25/ mo. to their customers in Ultra Wideband markets (for Cox, this would include Omaha, Phoenix, Tucson, Las Vegas and several other markets). This pricing structure makes sense for movers, but when that activity slows (and with mortgage rates hovering at 7% we think a rebound is a few years away), maybe it makes sense to reconsider that structure.

Is the customer’s problem statement “My broadband pricing is not a good value” or “My family plan wireless pricing is too high” or something entirely different (like “I want to switch broadband carriers every five years” or even “I wish I had one bill for all of my streaming content”)? Can the cable industry create a streaming solution that is more attractive than Roku, Chromecast, Apple TV or the Amazon Fire Stick (one of the objectives of the JV between Comcast and Charter announced earlier this year)? If so, can it be effectively bundled into a broadband + mobile product? Is content bundling really a pain point?

Comcast CEO Brian Roberts addressed its competitive position by redefining the broadband provider territory (except from their earnings transcript here – emphasis added):

“My confidence stems from the fact that we have always been able to strike the right balance between units and profitability. We compete aggressively while also staying focused on investing in and managing the business to deliver long-term profitable growth, which is exactly what this quarter has shown. We have a distinct competitive advantage that goes beyond just fast and consistent speeds. We provide a differentiated and superior experience within the home, which is the foundation of our ARPU growth. For example, we offer reliable WiFi coverage in every room, device control and cybersecurity features and a world-class entertainment platform as well as other complementary solutions like Xfinity Mobile that increase the value and utility of our broadband product even more.”

Comcast has gone beyond the issue of “to the home” connectivity by offering “throughout the home” solutions. We are not sure that the sustainability of Wi-Fi coverage lasts against AT&T in Dallas or Atlanta, and certainly do not believe that Comcast can write better connection manager code (that’s what connects a mobile device to Wi-Fi versus the macro wireless network) than AT&T or a device manufacturer, but his answer clearly indicates that Comcast’s solution depth is greater than many/ most of his competitors.

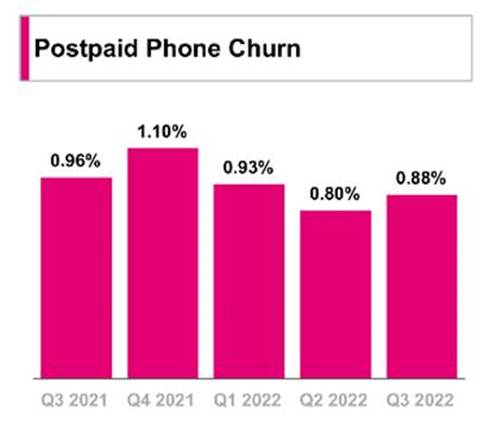

The wireless industry is also not immune from blunders. AT&T and Verizon had a number of legacy wireless customers who had not moved to their unlimited product. They raised price on these customers in May (article here), and the full effect of that price hike was felt in 3Q earnings. But churn also returned to Verizon and AT&T as a result, and it appears that T-Mobile picked up some/ most of this base. T-Mobile’s competitive response was to tout their Price Lock program (details here) introduced last May, and the effect was positive for the company. As a result, T-Mobile now has the second lowest postpaid phone churn in the industry even with the expected Sprint conversion churn (see nearby chart) while leading the industry in postpaid phone net additions.

Bottom line: Views of the severity and impact of any competitive response will differ, but understanding the problem that needs to be solved for the customer is paramount to value creation. We think that T-Mobile and AT&T have the healthiest understanding of the four components described above.

There are many more earnings items to discuss, and we have folks like Lumen, Altice, Frontier, and Dish remaining to fill in some of the earnings narrative. More to come in the next Brief. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy the rest of October and Go Chiefs!