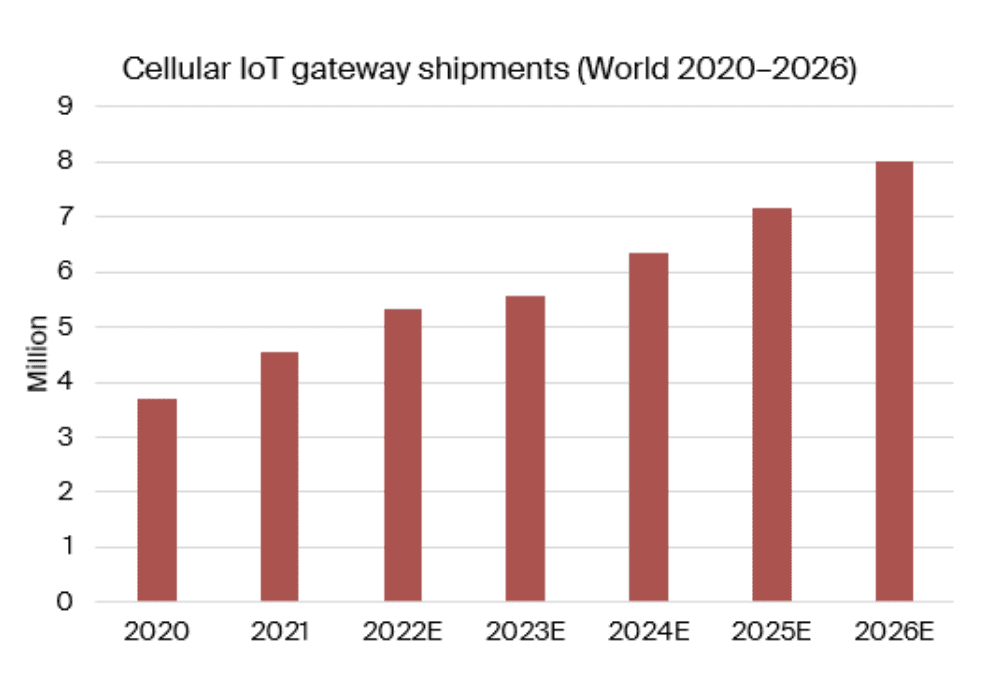

New research from analyst house Berg Insight says the market for cellular IoT gateways and routers was worth $1.15 billion in 2021, with 4.5 million units shipped in the year, representing robust sales growth of 14 percent. Market demand has recovered, and then-some, following disruptions caused by the COVID-19 pandemic, the firm concluded. The IoT market rallied, and rose in the year, despite constrained supply of key components.

In particular, supply of cellular modules and central processing units (CPUs) saw delivery times pushed-out. Berg Insight said sales growth has continued into 2022 but will “likely slow down” in 2023, as “economic conditions tighten across the main regions”. In the period to 2026, annual revenues from cellular IoT gateways will grow at a compound annual rate (CAGR) of 14 percent, to reach $ 2.18 billion, the firm calculates in a new report.

Over several decades, IoT gateways – general-purpose routers, gateways, and modems for primary and secondary (failover) connectivity to devices in a local network – have evolved from simple networking devices to aggregation points for devices, implementing advanced functionality for security and edge computing, it noted. It said: “The market is driven by the growing need to connect assets and work forces in remote and temporary locations.”

Over several decades, IoT gateways – general-purpose routers, gateways, and modems for primary and secondary (failover) connectivity to devices in a local network – have evolved from simple networking devices to aggregation points for devices, implementing advanced functionality for security and edge computing, it noted. It said: “The market is driven by the growing need to connect assets and work forces in remote and temporary locations.”

Berg Insight names Ericsson-owned Cradlepoint as the “clear leader in the space”, distinguished, it says, for selling “routers combined with software and services” on subscription. It is followed by Lithuania-based Teltonika Networks, posting market-leading growth of close to 100 percent in 2021. Cisco, Sierra Wireless, and Digi International round out the top five.

These five vendors generated $625 million in combined annual revenues from the sales of cellular IoT gateways and routers in 2021; they hold a market share of 54 percent. Other “important vendors” include MultiTech, Lantronix, Systech, and Casa Systems in the US; InHand Networks, Peplink, Hongdian, Robustel and Advantech in Asia-Pacific; and HMS Networks, NetModule, Matrix Electrónica, Westermo, and RAD in the EMEA region.

A statement said “The European and Asia Pacific markets are fragmented with a large number of small and medium sized players that generate annual revenues in the range of $5-25 million.”