Greetings from New York City (pictured), Lake Charles (Louisiana), Nevada (Missouri), and other points across the Midwest. It’s been great being out on the road and seeing fiber deployments finally coming into shape (Fastwyre’s recent 9-area fiber expansion coverage from Diana Goovaerts at Fierce Telecom is here – more announcements coming very soon).

This week, we begin our “third quarter themes” segment with a discussion of broad interest in fiber (even from T-Mobile). We attempt to distinguish the broad-based fiber strategy of AT&T from that of purpose-built fiber providers (e.g., E-Rate or fiber-to-the-tower) and try to position T-Mobile and Verizon’s deployments/ announcements in perspective.

We are going to publish three additional Briefs in 2022. The first will be a continuation of the third quarter themes which you can read as you are eating turkey leftovers. We will publish the final two briefs on December 10th and the 31st (taking a break for the Christmas holiday).

The Apple iPhone 14 availability charts will be published after the Chiefs-Jaguars game tomorrow. In case you missed it, Apple confirmed iPhone 14 Pro and Pro Max backlog issues last Sunday.

The fortnight that was

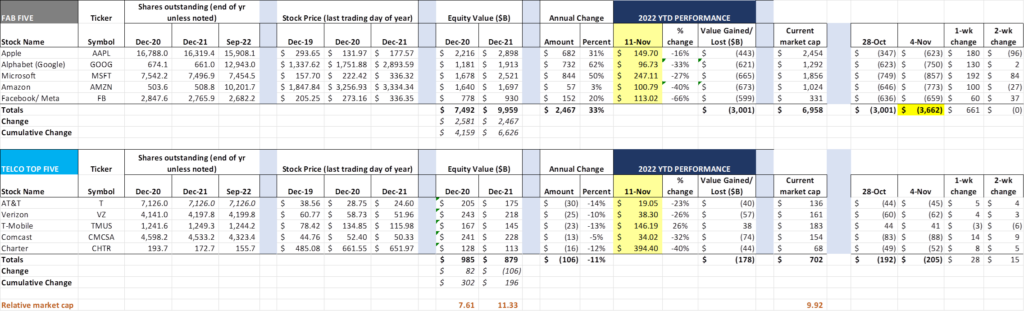

“If you don’t like the weather, just wait a minute” is a common saying in many parts of the country. This could be applied to stock prices over the last two weeks. Gloomy momentum, led by prospects of higher inflation and interest rates, led stocks down the week ending November 4. As a result, the Fab Five set a new 2022 market capitalization loss of $3.66 trillion. Everyone was down, prospects were dim, and bonds were beginning to look like an attractive alternative.

In the last five trading sessions, each Fab Five stock was up (four of the five up $100 billion each), thanks to the prevailing wisdom that inflation will continue to decline, the dollar will weaken from recent record highs, and that the Federal Reserve will carefully deliberate before raising interest rates another 75 basis points. The glass was half full again (note the “round trip” nature of cumulative value change over the last two weeks for the Fab Five: Lose $661 billion the first week and gain it all back this week).

- Risk-free interest rates are not returning to 1-2% anytime soon

- Credit card rates are going to continue to increase (currently 19.04% – see Bankrate info here)

- Unemployment rates are not going to mirror typical recessions (5-7% traditional peak, now 3-4%)

- Rates will vary widely by region of the country (see latest state-by-state unemployment rates here)

- Government spending (real dollars) is going to increase, but thankfully not at COVID pandemic levels

- Housing affordability is going to continue to be a challenge. “Convenience moving” slows down

- A $300,000, 30 yr. fixed mortgage costs $790 more per month than it did a year ago.

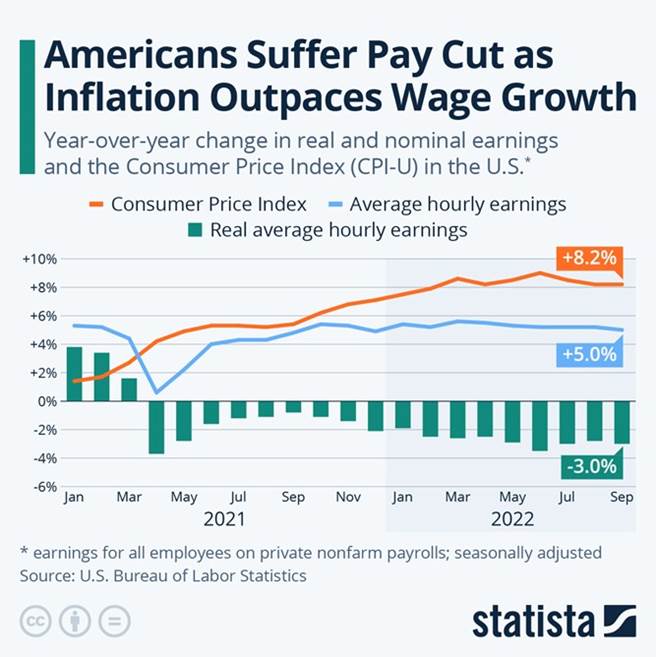

- Incomes are going to continue to grow more slowly than inflation (see nearby chart from Statista)

Each of these likely trends creates issues for the value of equities in general, and tamper growth prospects for the Fab Five (and other growth-dependent equities). Realignment between growth and income equities will occur, and utilities and other cash-intensive stocks should provide some safety to anxious investors.

The exception to this rule is the Telco Top Five. The “bounce” that a utility-driven shift generates should drive stocks like AT&T and Verizon (and to a lesser extent, Comcast) much higher than the $3-4 billion that AT&T and Verizon each experienced over the last two weeks. The reason for the small increase is that Ma Bell and Big Red have a recent history of destroying the value of their underlying equities (Verizon down $82 billion over the past 22 months, and AT&T down $100 billion since the beginning of 2020). The dividend isn’t attractive if the value of the underlying stock decreases rapidly. Other utilities like Southern Company and Duke Energy are down 5% for the year but are paying a 4.0-4.5% dividend. Not so for AT&T and Verizon.

While times are tough for the Telco Top Five, they would argue, they are still stronger than the second-tier carriers. Lumen, for example, cut their dividend entirely and replaced it with a $1.5 billion stock buyback. Their stock price dropped 15% the day after the announcement and is down 54% in 2022. As we discussed in a previous Brief, no investors showed up to fund Apollo’s acquisition of part of Lumen’s assets and the parent company had to fund the acquisition. Despite their recent bounce, Altice is down 68% in 2022 and down 86% from their December 2020 record high. Even Cable One (doing business as Sparklight) is down more than 50% this year. Things are tough all over.

There are a lot of parallels to be drawn between today’s market and where we were in the 1993-1994 timeframe. Interest rates were rising (30-yr mortgage rates were 6.5-8.0%), unemployment was falling (7.3% to 5.4% over the 24 months), and political changes were afoot (the Republicans retook the House of Representatives after the 1994 midterm elections). However, inflation was tamed (dropping to a 2-3% annualized rate for the 24-month period) largely in part due to steady if not dropping oil prices ($42.34 entering 1993, and $35.36 exiting 1994).

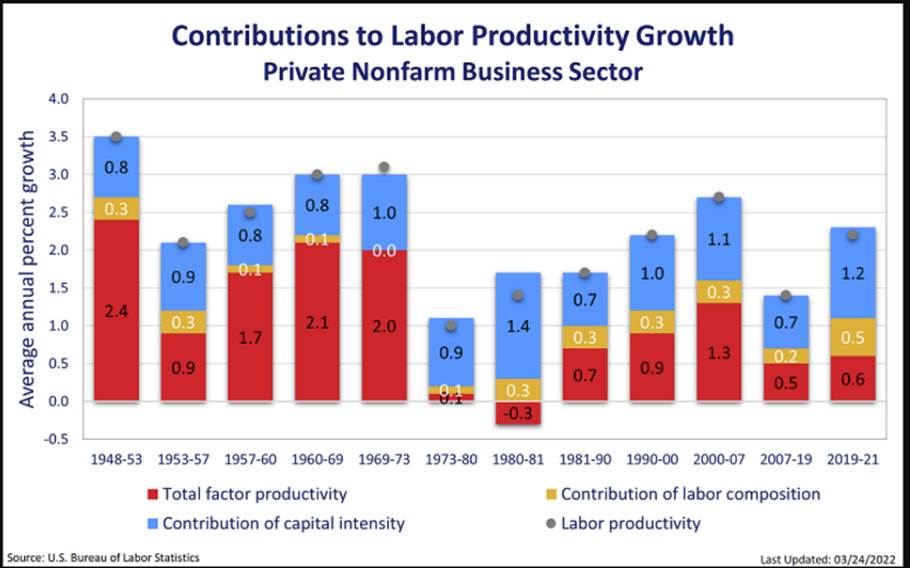

Interestingly, during 1993 and 1994, increasing productivity was a key concern. As this archived New York Times article notes, manufacturing productivity was driving overall productivity gains of 2.2% in 1994, up from 1.5% in 1993. This concern is echoed in the most recent productivity figures (3Q productivity in the US was up a mere 0.3% after negative figures in Q1 and Q2).

1993 and 1994 were the final years before the “Internet Age” which is generally agreed to have started in 1995. With the advent of more fiber, faster wireless, and additional edge computing resources, the opportunity to duplicate the productivity gains of 1995-2005 is present (and, in industries like telecom, desperately needed). Nearby is a chart showing the contributors of productivity (more hours worked, more capital employed, etc) and the 1990-2000 and 2000-2007 periods clearly ushered in more production for less labor). The productivity challenge remains for the remainder of this decade, and why we continue to be bullish on technology and innovation.

We close the market commentary with this sign of the times. Dish, who is disrupting the wireless capacity and network models, raised $2 billion this week at a coupon rate of 11.75% (announcement here). This follows a previous $2 billion debt raise in December 2020 which was convertible into equity. According to November’s announcement, the debt will be secured by “certain assets of certain DISH network subsidiaries.” Using their latest 10-Q filing as a basis (use link above to access), the company is likely to end 2022 with slightly more than $21.4 billion in short and long-term debt and EBITDA of approximately $2.8 billion, resulting in 7.6x projected leverage. Technology accomplishments aside, cash flow generation is the most pressing innovation needed at Dish right now. Time is running out.

Biggest themes coming out of 3Q earnings

As we stated in the last Brief, there are many headlines coming out of earnings: C-Band spectrum deployments are in full swing, Sprint synergies are accruing, new entrants are challenging incumbent broadband providers, and video cord-cutting continues unabated. On top of this, Apple announced that some iPhone models are going to be backlogged weeks/ months (see link above) and executive management is changing (Lumen, Comcast, Charter, Altice among others).

Boiling it all down, we come to the following themes:

- Fiber isn’t a bad investment after all (if it is holistically managed to generate cash flows)

- Cable is coming for the wireless world on their (cable’s) timeline

- The use cases for 5G networks are not compelling for handsets

In the interests of being brief, we will focus on fiber in this week’s Brief and talk about cable and 5G for handsets in the Thanksgiving edition of the Brief.

- All Aboard the Fiber Bandwagon

Fiber has certainly received a lot of attention over the last 30 months. We use Q1 2020 as a starting point not because of the onset of “from home” activities driven by the pandemic, but because of incoming CEO John Stankey’s reprioritization of capital to fiber. After some assumption validation, Stankey led AT&T’s fiber foray (his predecessor was dragged into fiber deployments as a condition of the DirecTV acquisition) with a very holistic approach (quote is from the 3Q 2020 earnings call):

“And what I am trying to drive this business forward on is getting much more artful in our engineering to ensure that every trench foot of fiber that we’re putting in, we are serving every segment we can serve as effectively as we can, and we’re not looking at our investment on a customer segment by customer segment basis, but we’re looking at it as a trench foot of fiber that we put in that has a bunch of different access technologies that hang off the end of it. Sometimes it happens to be a millimeter wave site. Sometimes, it happens to be a big cell tower with 4 occupants on it that we sell wholesale into. Sometimes it happens to be a strip mall, where some of those customers want to be served with a fixed connection, and some can get by with simply having a credit card reader attached to a wireless network. And sometimes it’s a single-family household.”

It’s important to remember that this comment predates the Infrastructure Bill – Stankey’s allocation is from AT&T’s current free cash flow, not from a $40 billion taxpayer-funded, state-administered source. AT&T followed this up with an announcement that they were going to deploy fiber to half of their 60-million-homes-passed footprint and use 5G Fixed Wireless and other solutions for another 15 million homes passed. The remaining 15 million homes we categorized in the title of a Brief called “Let it Bleed.”

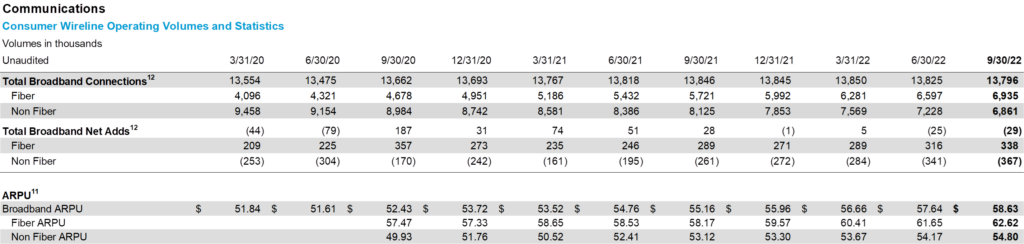

How’s it turning out for AT&T? Here’s their recent 11-quarter chart for broadband and fiber gains:

3Q 2022 represented a turning point for the company’s broadband efforts with more fiber customers than non-fiber. However, that’s largely due to their inability to retain non-fiber customers to cable and other entrants. Since the beginning of 2021, AT&T has added nearly 2 million fiber customers, but they have also lost 1.9 million non-fiber customers. It’s clear that cable has awakened over the last four quarters and is fighting for share (1.3 of the 1.9 million non-fiber losses – roughly 2/3rds – have occurred in the last four quarters).

The day before 3Q earnings were released, AT&T teased a story through Bloomberg highlighting something we have been talking about for years – how AT&T will address fiber needs on a national basis (as Verizon is poorly attempting to do). What will be most interesting about this venture (and we think that it will be announced in 2023) is that AT&T may not be the sole ringleader (or the partner may not necessarily be financial only). This could remedy AT&T’s previous out-of-region fiber deficiencies in underserved areas.

Not to be outdone, T-Mobile announced that they too are interested in fiber (see this November 7 Bloomberg article). While their targeted fund size is smaller ($4 billion vs $10-15 billion for AT&T), their focus according to Bloomberg is different – home broadband. This would allow T-Mobile to fill in certain areas where more 5G is needed with wireless or fiber-to-the-premise (FttP) solutions.

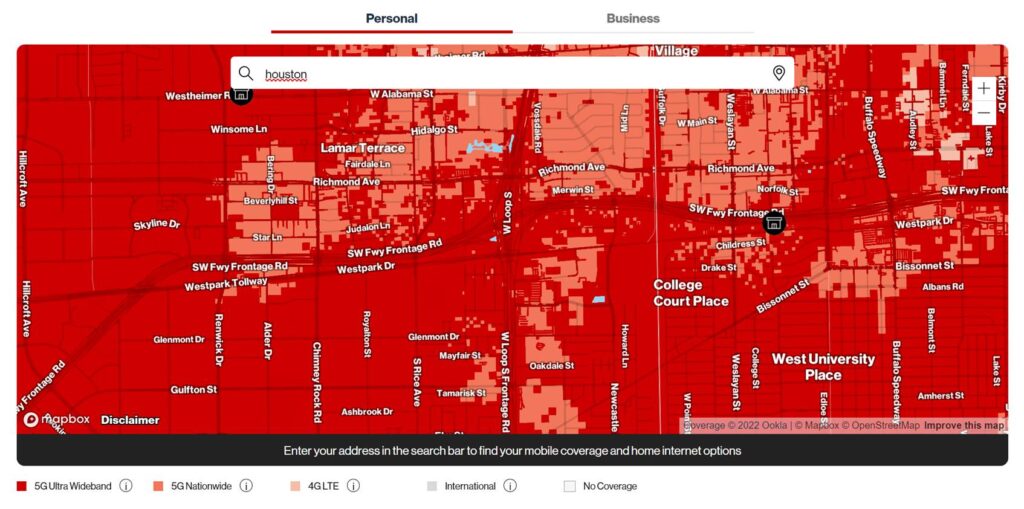

Verizon, meanwhile, has been deploying fiber throughout each 5G Ultra Wideband network. Here’s a good example of their deployment in Houston, Texas (Rice University area shown):

Two years ago, only a few streets were capable of Ultra Wideband speeds (call it hundreds of Mbps per second). Now coverage reaches entire neighborhoods. But this is Comcast and AT&T territory, and Ma Bell and the cable giant do not go down without a fight. We don’t know Verizon’s precise investment in out-of-region fiber, but it’s likely $8-10 billion in total over the last five years based on our analysis of their earnings releases.

Until 2022 earnings, Verizon has had very little to show for their investment. Over the last four quarters, however, they have built consumer fixed wireless (using a $55/ ARPU) into a $400 million+ business with a trajectory to cross the $1 billion mark early in 1H 2023. Business is doing relatively better, eclipsing the Fios business Internet base in 3Q (we frequently wrote that 5G would make an excellent out-of-region access replacement for Verizon vs. cable – it’s finally starting to happen). The cash flow generation potential is significant, and all but the connection to the premises (pole to prem) is fiber.

Bottom line: As we have said since our first column on the topic in 2019, fiber always wins – until it doesn’t. Upstream, long-haul, and purpose-driven fiber efforts have been around for decades. Now comes the hard part – connecting to the home/business, especially when they are not in major metro areas.

More to come on cable’s methodical mobile market share march as well as 5G applications in the next Brief. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy the rest of October and Go Chiefs and Davidson Wildcat basketball!