Thanksgiving weekend greetings from the Midwest. Pictured is a flock of wild turkeys near the farm in Willard celebrating the “day after” (if only we had audio – they are not quiet!). This week, we will continue our discussion of key themes exiting 3Q earnings after s full market commentary.

As a reminder, we will publish two additional Briefs after this weekend in 2022. This first will come as normally scheduled on December 11th. The last Brief of the year will be on December 31st and will be a preview of this year’s Consumer Electronics Show (schedule here).

One final note – the latest iPhone 14 Pro and Pro Max availability charts will be posted to the www.sundaybrief.com website prior to the start of today’s Chiefs-Rams game (4 p.m. ET).

The fortnight that was

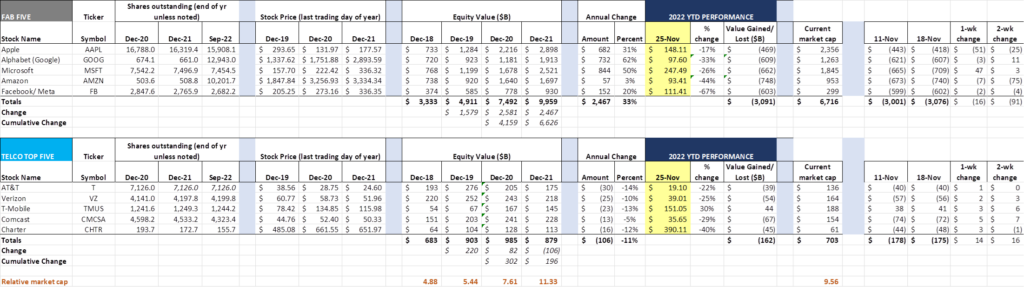

The last two weeks have been very stable for both the Fab Five (down 1.3%) and Telco Top Five (up 2.3%). While there have been some movements within the individual stocks (e.g., the nearly perfect offset between Apple and Microsoft this week), their overall levels have only minimally changed (Amazon being the lone exception). Interest rates are heading higher, albeit at a slower pace than the unprecedented back-to-back-to-back-to-back 75 basis point increments. This will eventually impact business investment levels and slow growth considerably. Great for fixed income yields, but horrid for home buyers and growth-oriented companies who need access to capital.

The relatively miniscule changes in market capitalization doesn’t mean that there hasn’t been plenty of news, however. It appears that the Federal Trade Commission is going to object to Microsoft’s acquisition of Activision Blizzard (Politico report here). Sony, the maker of PlayStation, a competitor to Microsoft’s Xbox, has launched a full-scale campaign to block the merger. To a lesser extent, Google is also pressuring regulators to nix the deal (see the Politico link for the reasoning). As described in this New York Times article, sixteen countries need to approve the deal (vs. six countries that were required for the approval of the LinkedIn acquisition). Even the Communications Workers of America (CWA) is involved (and now a supporter of the merger). This is the first big objection to a large transaction by FTC Chair Lina Khan, but we do not expect it will be the last.

Microsoft was not the only recipient of bad news, however – the knives were also out for Google from London-based hedge fund TCI (who, per their letter, has held shares in Google parent Alphabet since 2017 and has a current holding of $6 billion – more in this Wall Street Journal article which includes a link to the TCI’s letter). They do not mince words in their letter to Alphabet CEO Sundar Pichai:

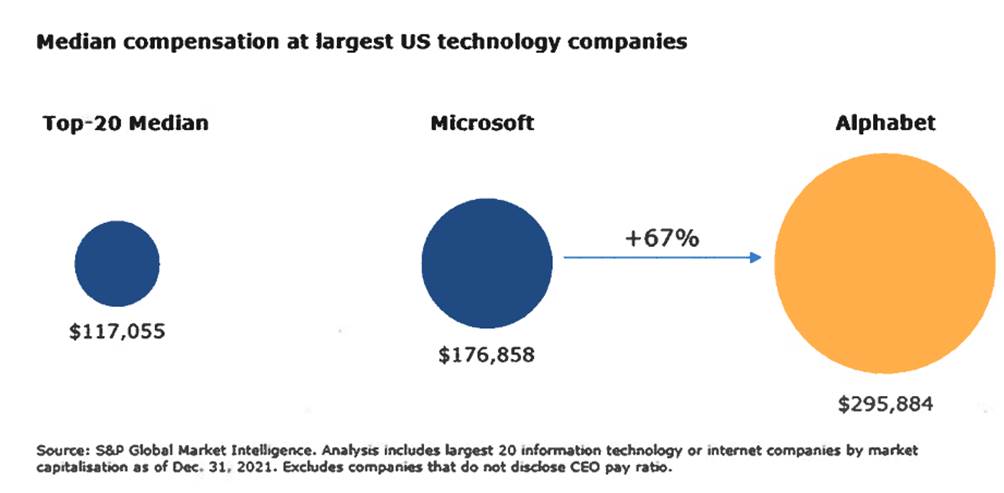

“We are writing to express our view that the cost base of Alphabet is too high and that management needs to take aggressive action. The company has too many employees and the cost per employee is too high. Management should publicly disclose an EBIT margin target, substantially reduce losses in Other Bets and increase share buybacks.”

Their ire initially focuses on the self-driving Waymo project but then expands to the median 2021 employee compensation of $295,884 (see nearby picture). While not calling for a specific reduction in headcount, the letter clearly implies that Meta’s announced reduction of 13% of their workforce would be a very good starting point. A $6 billion position would attract a lot of attention at nearly every other tech company, but it’s unlikely that this will trigger widespread changes in products like YouTube TV or Nest.

Speaking of Meta, with the reductions in workforce come steep reductions in their hardware lineup. Most notably, the Portal product line is being discontinued per this Reuters report. If you are looking for a decent smart display, there are some terrific “while they last” deals available on Amazon.

Finally, The New York Times published a lengthy (10,000+ word) retrospective on Sunday, November 20th, titled “Was This $100 Billion Deal the Worst Merger Ever?” It’s a surprisingly good read which culminates in CEO John Stankey’s decision to fold the WarnerMedia asset into Discovery:

“Mr. Stankey also called Mr. Stephenson just before the deal was made public. “I had zero input,” Mr. Stephenson said. “Had I still been chairman, I would not have advocated taking the business apart.” But Mr. Stephenson didn’t convey his disagreement to Mr. Stankey. “You’re sitting in the chair,” Mr. Stephenson recalled telling him.”

A rare airing of Ma Bell’s executive dirty laundry through the Times. As we chronicled three years ago in the Elliott Memo Sunday Brief (here), AT&T’s strategy was static and tone deaf. The mere assumption that the actions of a single company (and especially AT&T) would dictate the rules of the telecom, media, and technology roads and create a sustained competitive advantage is ludicrous. How long it takes John Stankey to restore the mess left by his predecessor is anyone’s guess.

Cable’s transition from home to hand

Two weeks ago, we identified three notable trends coming out of 3Q 2022 earnings:

- Fiber isn’t a bad investment after all (if it is holistically managed to generate cash flows)

- Cable is coming for the wireless world on their (cable’s) timeline

- The use cases for 5G networks are not compelling for handsets

The fiber “bandwagon” Brief surprisingly attracted a lot of attention and comments (it eclipsed our John Legere 10th anniversary tribute Brief as the most read post of 2022). Frankly, we were refreshing themes that we had expressed for the last decade, specifically that capital-intensive investments require local attention and cultivation: there is no “set it and forget it” when it comes to fiber/ broadband. We have long called for the industry to sharpen their focus on asset turnover (defined here as sales divided by net assets) in addition to margins. Too many companies miss the opportunity to grow shareholder value in this manner.

This week’s focus is different as we seek to answer the question “How Should Cable Transition from Home to Hand?” In short, we are skeptical on the long-term value prospects of the mobile business to Comcast, Charter, Cox, and their smaller colleagues absent significant investment and focus.

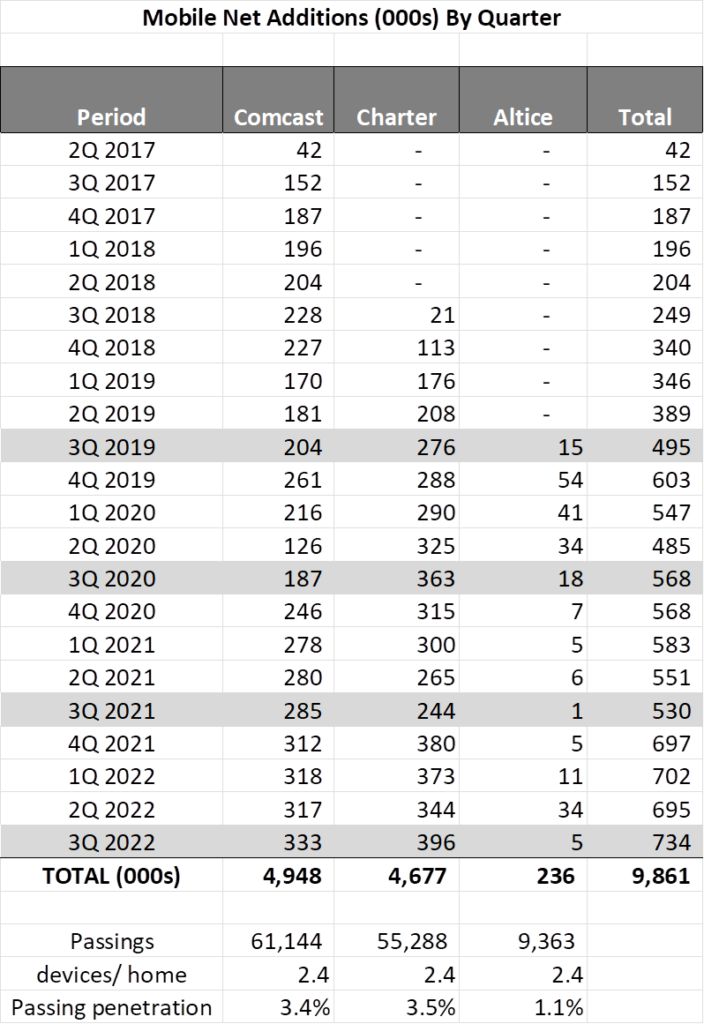

Nearby are the latest net addition figures from their earnings releases. While touted as collectively “leading” the industry in terms of market share gain, a more careful analysis of their progress indicates that cable is stuck in low gear in a relatively cemented industry.

Using the data in the nearby table, at their current annual trajectory (1.4 million net additions for Comcast, and 1.6 million for Charter), it will take 5-7 years to reach a ten percent penetration of homes passed (assuming there are 2.4 devices/ per home). Even if they achieve this milestone, wireless will only have penetrated 20% of the existing broadband base (assuming cable maintains a roughly 50% market share in home internet). Will the wireless industry (including MVNOs such as Straight Talk from Walmart) wait around for cable to catch up? We don’t think so.

How did cable get in this position, and why are we dim on their prospects to meaningfully shift market share? One very important aid to answering this question is outgoing Charter CEO Tom Rutledge’s interview with CNBC’s Alex Sherman. While we do not have time to parse every word of Tom’s 41-minute conversation, he provides an historical assessment that helps frame cable’s perspective.

First, cable’s investment focus has been the home. One wire to the home, one cable modem, one set top box (with video), one Wi-Fi router (if separate from the modem) and one analog telephone adapter or ATA (with digital phone). Many homes will take more than one set top box (although that is diminishing with the proliferation of cable apps and cloud DVR), and a very few homes will need mesh Wi-Fi extenders. Generally, however, the focus has been home broadband enablement, and not on the devices that use the broadband service.

Moving from home to hand is not as easy as it sounds. No technician can or will opine on Android device compatibility, provide consistent and accurate advice on unlocking handsets or facilitating SIM card swaps, or speak with authority on the benefits of Roku versus Fire TV, Apple TV, or Chromecast. Customers are directed online (service, videos, etc.) or to a store for help. Technology and products are improving to make the transition from one mobile provider to another easier, but moving wireless carriers is still tricky. Number porting is not a point a click exercise, and the incumbent carriers like it that way.

The process of trying another Internet service provider (moving from hand to home) is far easier. No number porting, no appointment (at least for fixed wireless alternatives), and no compatibility issues (except, in a true parallel network test, a new Wi-Fi SSID and password might have to be entered). Simply put, extending cable’s reach throughout the home to include mobile devices and TVs introduces a level of multi-channel complexity that requires significant customer rewards.

Second, cable’s current value equation is suspect. We were reminded of this on Wednesday when T-Mobile trotted out their Black Friday “four for $100/ month” special. As Tom Rutledge recounts in the interview linked above, when Time Warner Cable introduced their Digital Phone product in New York City, customers received $30-40/ mo. savings on their phone bills for a service that was as good as (or better than) Verizon’s decades-old analog telephony product. Any pricing advantage is temporary in the wireless world with competitors like T-Mobile and AT&T fighting to retain customers. And that’s before we get to aggressive trade-in promotions which commit customers to 24 or 36 months to receive their full trade-in promotional benefit.

Spectrum is doing their best to fight back with their “Spectrum One” offer (here) that reduces the first-year cost of Internet + one line of mobile to $49.99/ mo. After the first year, however, the cost of that service more than doubles to $115/ mo. ($80/mo. for Internet + $5/mo. for Wi-Fi + $30/ mo. for one line of unlimited). The power of a 12 or even 24-month promotion has diminished thanks to providers like T-Mobile, their largest MVNO Mint Mobile and even Verizon retail (especially with bundled content). $30/ mo. has less allure than their Digital Phone offer.

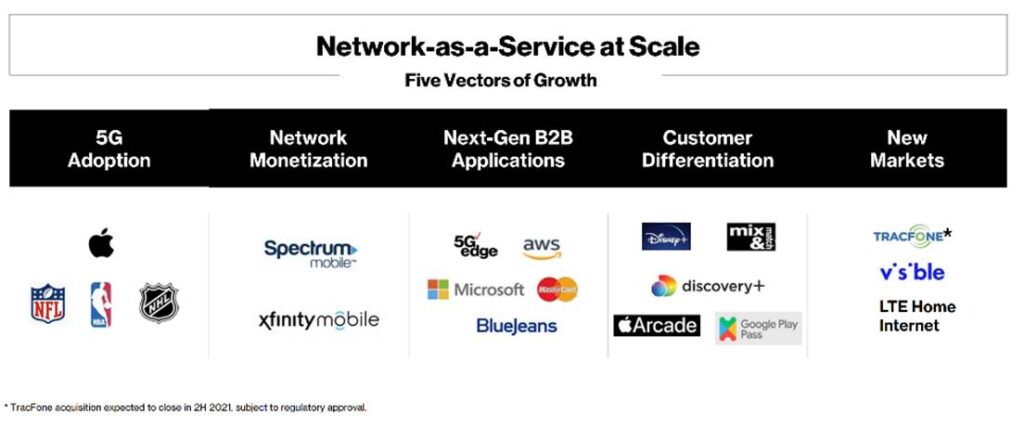

Finally, cable’s success depends heavily on Verizon’s commitment to this growth vector (see slide from 2Q 2021 earnings nearby). Every day that Hans Vestberg remains as CEO buys cable time to engineer alternatives. Someday, however (perhaps very soon), cable is going to lose their executive champion. When that happens, things could change. New management could be retail-focused and “do the contractual minimum” to keep the relationship intact. Conversely, Verizon’s Board of Directors could select a financially oriented CEO who looks at the gross profit generated by the relationship and pursues more wholesale business. The probability, however, that each succeeding relationship will be increasingly generous toward the cable industry, especially as C-Band fixed wireless permeates the country, is low. We think there’s a single vendor risk here that Comcast and Charter should rectify before they lose their leverage.

We have been doing a lot of thinking about the potential impact of Xumo, the joint venture announced by Comcast and Charter (we are assuming Cox, Altice and Cable One will also participate in some manner). The mission of that organization may hold the key to solving the “home to hand” problem (see November 2nd naming news release from Charter and Comcast here). If they can reinvent the TV operating system, creating a “connection manager” between different peripheral outputs (including off-air TV channels – see Tom Rutledge’s interview for comments on the future of broadcast TV) and integrate them into one electronic programming guide format… that would create a material experience (and likely cost) advantage.

Solving that “Apollo 13 – Square Peg in a Round Hole” level problem will not happen overnight. If any single organization can do it, however, it’s Xumo. Perfecting the electronic programming guide (specifically combining scheduled content with deep libraries) will be Task #1, and there is no best-in-class benchmark (just ask YouTube TV, Amazon Prime, and HBO Max). Task #2 is the reinvention of the TV operating system (see previous paragraph). Then there are issues of production, distribution, and extending portions of the technology to mobile devices (another application of “home to hand”). Many JVs die in cable – this one cannot if the industry is to thrive.

Bottom line: Cable’s first 5% penetration of homes passed took a long time. Billing systems needed to evolve, the financial equation needed to improve with Verizon, and finding a resonating bundle needed to precede rapid growth. Growing at current rates will not offset lost profits from new broadband competitors – more innovation is needed. Mobile is not cable’s only shot at a brighter future – we believe that Xumo, while still a long shot, could transform the content viewing experience and create a material competitive advantage for cable (including their mobile offering).

Our final discussion on 3Q trends will be in two weeks. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy the rest of October and Go Chiefs and Davidson Wildcat basketball!