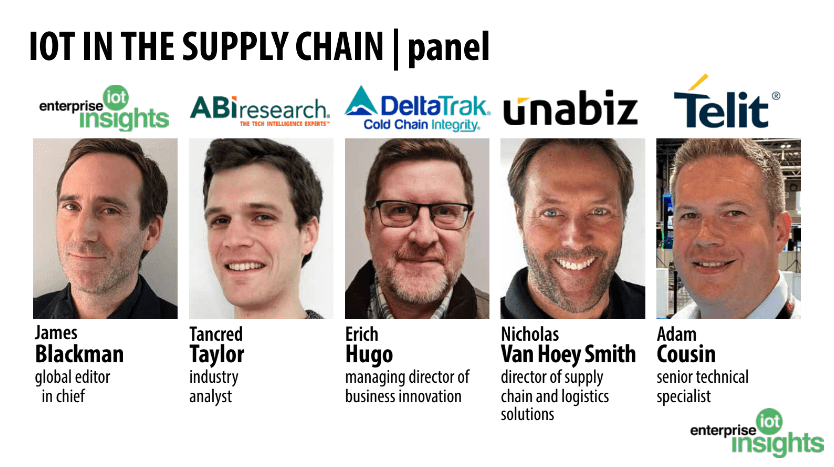

There was a good panel session, yesterday (November 29; see cover image, available on-demand), on IoT tracking in the supply chain, which brought insightful content and commentary from leading IoT outfits DeltaTrak, Telit, and Unabiz, plus from analyst house ABI Research. But even with the breadth of discussion a four-person panel brings, it is difficult to go as deep as you can with a single speaker, arguably, or a couple in conversation, about a straighter narrative.

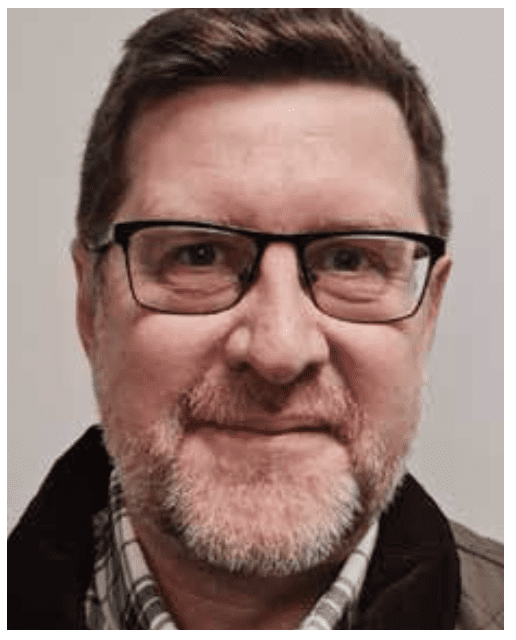

As such, Enterprise IoT Insights is pleased to be able to complement the webinar, plus the upcoming editorial report, with a transcript of a 40-minute interview with Erich Hugo from DeltaTrak, one of the panellists on the webinar. Hugo, in charge of business innovation at the firm, is joined on the call by Warren Chaisatien, senior director for global CSP marketing at Ericsson, ostensibly to discuss their joint work with Deutsche Telekom to track perishable goods in the supply chain.

But the conversation goes beyond this project, actually – and really only brushes over it. DeltaTrak has been in the tracking game for three decades, already, originally supplying manual data loggers to logistics firms for post-analysis of goods in transit – the same ‘things’ now being connected by any number of wireless technologies, by DeltaTrak and others, to get real-time readouts on their position and condition, between first-production and final-sale.

Hugo, an ex-Nokia business development exec, now handling DeltaTrak’s IoT as-a-service game, plus its dealings with Ericsson and others, is worth listening to; he is candid about Industry 4.0 challenges in the logistics sector, and how tech is developed and sold – in a market where margins are slim, interests are obscured, and wastage and pollution are out of control. The figures he quotes are unverified, but the stories they tell are hard to ignore.

As an introduction to IoT tracking in the supply chain (in “the hardest sector of them all”), Hugo’s account is difficult to beat. But credit should go, upfront, to Ericsson, too, which has the relationship with DeltaTrak, and hosted the original call – and to Chaisatien, in particular, who discussed Hugo’s points about the IoT industry’s failure, at large, to understand its customer market; to get to grips with the complex logistics of complex logistics.

Of course, it is also a classic tale of industrial IoT – which describes an industry picking fluff out of its navel, enamoured by its own wizardry, selling technologies rather than solutions (etc etc, as the cliché goes) – which is being told in manufacturing, mining, and energy markets, as well. Except that all of these hard-nosed Industry 4.0 disciplines are interlinked in the supply chain; their idiosyncrasies are absorbed and multiplied in logistics.

Which is why it is the hardest industry of them all; and why the fourth industrial revolution, as promised, will happen more gradually in logistics than in (self-contained, well-heeled) fields, factories, and plants – as Hugo explains, and Chaisatien also acknowledges. At the same time – as hinted below, as heard on the webinar, as written in the report – the IoT market has also grown up. The tech mostly works, or can be made to work, without conditions.

To the point the tech industry doesn’t want to talk about tech anymore; it just wants to scope the problem and design the solution, from its big bulging bag of IoT tricks. That is the counter narrative, which has been developing in the traditional low-power IoT space for some time – and which has started, more recently, to play out in the high-power IoT (private 5G) among telcos. But try telling that to an orange farmer in Brazil, says Hugo.

Try selling an NB-IoT tracker to a clothes factory in Bangladesh, as the new ‘thing’, for another $30 on a shipment of t-shirts – just because the telecoms industry is switching 2G off. Tech can help, says Hugo, to check that an asset arrives in time and in-condition, and make sure the farm or the factory gets paid – and to reduce wastage and pollution, as well. But the value proposition has to be clear, and technology should not be disruptive, actually.

Anyway; it is a long conversation, with lots to consider. So make a brew, and take a seat – with Erich Hugo, managing director of business innovation at DeltaTrak, alongside Warren Chaisatien, senior director for global CSP marketing at Ericsson. All the answers are theirs; the questions are from Enterprise IoT Insights.

…

Give us a sense of how you see this market – where we are up to with tracking and the supply chain.

Hugo: “We need to take a step back, and think of the [broader] logistics industry. Logistics contributes about a third of the world’s GDP. It is also one of the oldest industries in the world. I mean logistics started 4,000 years BC; we talk about travellers on the Silk Road between Asia and Europe, and so on. So it is not something that just suddenly became relevant in the 20th century, since it was discovered by technology. There is no other industry in the world with the same cultural rules and regulations as logistics.

“I come from the electronics industry and from the web development industry, and I have been involved with unicorns and startups, and I’ve seen how technology has revolutionised industries. But I don’t think it is going to be the same with logistics. I don’t think so. Because it is the most embedded vertical in the world – there is nothing more embedded. There are vested interests that go back generations; there are lots of deep pockets. So innovation will be, and has to be, gradual in the logistics industry.”

I get that this is evolution rather than a revolution. But is it different to manufacturing or to mining, or any other deeply entrenched industrial sector?

Hugo: “It comes down to these vested parties. Because some want a revolution, and some don’t. If you look at mining, say, there is an active interest to save lives. So yes, you need LoRaWAN or private cellular – to save lives. But it is not like that with logistics. With logistics, you save lives indirectly. It is a process. The KPIs that drive change will determine the speed of adoption. And you have to remember, as well, there is a whole group that does not want insight into containers. They don’t – because then they become liable. So for every forward-step, I can tell you there are big organisations pushing back at the same time.

“The actual winner in the end is the producer, the farmer. It is important to understand how the industry works, and where the risk lies. Because if I am a regional manager at a big retail chain, in charge of 10 stores in East Anglia, say, I will make a commercial calendar in January that says I am going to sell oranges in August. So I go to my supplier or importer, and say, ‘Listen John, I want three containers of oranges at my distribution centre at 9am on August 2. And the importer finds an exporter, in South America or South Africa or Southeast Asia, who can commit to that date. I am generalising big time, but the point is these goods don’t even exist yet.

“And so the exporter gets a farmer to produce these oranges, and issues a deposit on the supply – and says to the farmer the responsibility is with them to provide the goods for export, to arrive on August 2. And so the farmer starts work, and invests in compost and labour, and tie-ups their finances in the crop. And if all goes well – the weather is good, and the field is good – then they harvest that crop, and a logistics provider carries it to a distribution centre, and loads it into a controlled container on a ship to Europe for six weeks. The importer gets it, all the physio-sanitary documents are checked, and the container makes its way to a distribution centre.

“And at quarter to nine on August 2, the retailer opens the container, takes the oranges, and pays. That’s it, in a nutshell. The problem is that the farmer has taken all financial risk, over six months. The retailer has not had any liability for placing the order. The importer has not had any liability for placing the order. The exporter has had some liability, because they have a relationship with the farmer, and paid a deposit to start the cultivation. But if anything goes wrong in that supply chain, the person that loses the most is the farmer. If the retailer opens that container and rejects the oranges, no one gets paid.

“Up to 40 percent of all perishable products never reach their end destination; up to 40 percent, from one side of the world to the other, perish in transit. And if you really want to see a horrific statistic, check how many farmers in India or Africa commit suicide. I mean, it is the riskiest business there is. The payoff might be fantastic, but the risks are massive. I mean, you either become a gambler in Las Vegas, or a farmer. It is one of the two. That is basically it.”

Just explain the insurance angle – about those that don’t want to track?

Hugo: “An exporter will have insurance, generally, on a shipment of 1,000 or 10,000 containers of a single product, say. But sometimes the cost of insurance is too high, and sometimes they will be fired by the insurer for making a claim. They won’t insure them next season. That is what happens. Because insurance companies do not want to pay out. I mean, we all expect to make a claim if our television falls off a ledge at home. But imagine working in an industry where the insurance company is trying to find every way not to pay you.

“So you have to be very selective about which cases you claim for. I can tell you that over 50 percent of all insurance insurance situations never get claimed – because producers are terrified that they will get fired. That is a clear and present threat for producers in this market.”

So how do you, as a solution provider in this business, go about negotiating with the various parties involved? When the insurance company does not want a proof-point to say something is spoiled, because they like the risk-and-reward that goes on, and the retailer has no interest particularly, because it just pays or does not. So then it is a solution for truck firms and farmers, right, to shore up their end?

Hugo: “That is the thing. It is a 6,000 year-old industry, with companies and individuals you’ve never heard of, living in Lake Como villas. But DeltaTrak is like the Jedi. We can protect people, but we can’t fight their war for them. The producers and logistics providers are the ones that can make use of the data. We just make sure they have it to them to validate their argument. That is super important.

“A container takes six weeks on the ocean, going from Cape Town to Antwerp, and there are great companies out there regulating vessel speeds in order to cut carbon tax. Which is great. But if the cost goods are spoiled, the whole value chain is destroyed. One orange takes 70 litres of water to produce – and maybe a hundred hours of labour, and a thousand dollars of farming materials. If someone opens the door of a container carrying two million oranges, and says, ‘Nope, we don’t want it’, then you’re not just throwing away an orange, you’re throwing away a whole ecosystem.

“To your point; DeltaTrak can’t solve it. Nobody can – until an authoritarian government forces it through. Business needs to solve it. But what we can do, with our tracking devices, is to give the cargo-owner good quality data – to validate their arguments if they decide to go further in a court of law. And we can also give expert witness. So this device; you put it in a container and it collects information. It is certified; we’ve got all the ISO certifications. The network is certified with Ericsson.

“So you can take that data into a court of law, and say, ‘Wait a minute, I was not responsible for the goods going bad inside that container’. Because the container was left on dock in the sun, or whatever. But the action is up to the logistics provider. Which is why I say we are like the Jedi – we can help them, but we can’t fight their war.”

So, are you selling mostly or often to the third-party logistics provider, to the initial exporter? And does the fact they have this solution shore up their relationship with their farmer/supplier, and help in that relationship? Is that the idea?

Hugo: “We sell to anybody that wants to monitor goods. Generally it is third party logistics companies, but some of them are producers. We sell to end retailers, like Walmart and Kroger. All of them realise that knowing the quality of your goods is super important. There is an abstract and a non-abstract push for our devices in the market. The abstract push is that people generally want to save the planet. The fact is the shipping industry, without the goods on the container vessels, accounts for 15 percent of global greenhouse emissions; with the container on top of the ship, that far exceeds 20-to-30 percent. So everybody wants to save the world and wastage is one of the biggest contributors to environmental problems.

“The second thing, the non-abstract thing, is legislation. Governments are waking up to the fact these guys have been flying under the radar for so long, and there’s so many vested interests. But if you throw away a container of food, you’re destroying an ecosystem. And not only are farmers committing suicide because they’re not getting paid, we are contributing to the long term problem with greenhouses emissions. The European Union is leading the way, pushing the rest of the world to validate data. If you are a Peruvian berry manufacturer and you want to export to the EU, you have to adhere to the EU standards. Otherwise your goods won’t get it.

“The EU is very environmental; it is a moral institution par excellence. And it is pushing, with its strength, which then naturally flows into the rest of the market. We want to save the world, and legislation is happening. In the US, FSMA (Food Safety Modernization Act) compliance is coming onto goods right now, which says, basically, you can’t push products out to consumers without the necessary physio-sanitary certifications. This never used to be the case, but it is becoming compliance – so every container will have a set of documents, with valuable data about the health of the product, and how it has been stored.

“There is a big fast food chain in America (Taco Bell) that nearly went bankrupt in the last five years, because consumers got sick after eating its products, and class action lawsuits followed, and they had to find out where the problem was in the supply chain. And it was virtually impossible to track. And what happened? They shut down all the lettuce farms in California, even if they were not guilty – and it led to massive bankruptcies. We can’t let that happen again.”

It sounds like there is a boom time for DeltaTrak in these circumstances. So what has changed with technology? Presumably you weren’t collecting the same data points 30 years ago?

Hugo: “We were. But firstly: a boom time. Absolutely. We are rocking and rolling. The industry has sped up in the last decade with our RTLLs (real time logistics loggers) coming onto the market. But DeltaTrak started 30 years ago, when our founder developed a logger to go in the back of a container. But it wasn’t connected; that is the key thing. You had to open the container to get the logger to validate the information – and in some instances you voided the insurance by opening the container.

“Now, with new technology, we don’t need to open the container, and we can create a digital twin of the condition of the product based on the sensor data delivered to us. We create digital twins on a flying schedule, and predict their condition inside the container. I can create a digital twin of a container of oranges, and know it is probably messed up, or in great condition.

“But the business case is pushing the technology; the technology is not pushing the business case. Which is very important. Traditionally, when technology came into the market, it was like, ‘Great, here’s a technology; let’s look for a market to disrupt’. This is not the case in the logistics industry. There’s such tight iron-grip control that disruption is not going to happen in the way it happened in other industries, and in the way we as modern consumers have gotten used to in the last 30 years. I find it very difficult to see any of that will happen in this industry.

“But there is change, which is happening for two reasons. The technology is evolving, but tech companies are also starting – very slowly – to engage properly with enterprises. I get so frustrated when they just focus on the tech, on connectivity and IoT – and don’t really try to understand the actual business case. Companies like Ericsson are getting involved with enterprises. Because in the end, they can’t be defensive about the future, because they’re just setting themselves up for disruption. Tech vendors have to get more involved in the logistics industry; otherwise they will stay on their own tech islands, which will just be disrupted as well.”

Warren, tell me about this engagement with DeltaTrak and, more broadly, how Ericsson is going about solving the business case rather than just selling the technology.

Chaisatien: “A couple years ago, we started to become super-active in the enterprise market, especially with the rise of 5G, which has enabled enterprises to take advantage of technologies. 5G is a game changer for industry, as an enabling infrastructure for enterprises to become digitalised. We have been positioning ourselves in the enterprise market. And cellular can help enterprises achieve operational efficiencies, and also contribute to sustainability drives. We have acquired quite a number of enterprise-centric businesses to bolt onto our core radio technology leadership.

“For example, we bought Cradlepoint a couple of years ago to get into the wireless WAN game, with 5G routers for enterprises. And most recently, our acquisition of Vonage has just been approved, to get into the B2C market – because Vonage creates that API layer for enterprises to interact with consumers. When it comes to our engagement with the enterprise market, our IoT business in particular has been conducting a large number of deep-dive studies into various vertical industries.

“Transportation / logistics is one of them; we have covered the micro-mobility market; EV charging is another focus area, and also connected vending machines and coffee machines in the retail / hospitality industry. Those studies are not just qualitative; we have also produced business benefit calculators for enterprises to tweak and play with those parameters around how IoT can save money, and importantly how IoT can make money for enterprises in new revenue generation.”

What about with DeltaTrak, and the broader asset tracking market – and specifically what we’re talking about here, about putting a container on a boat and a truck, from a mine or a field to a warehouse and a retailer. You’ve got this Accelerator program, where you are pooling a bunch of cellular airtime tech, plus an ecosystem play to bring solution providers together. Just explain what is going into this DeltraTrak solution?

Chaisatien: “Our key carrier partner is Deutsche Telekom, which is providing two key components: 4G or 5G connectivity for DataTrak sensor devices; and IoT accelerator platform services. IoT Accelerator is Ericsson’s IoT management that enterprises like DeltaTrak would use. We are not providing those platform services directly to enterprises; we provide them via our operator partners.”

Is the DeltaTrak device an LTE unit, or an NB-IoT unit? I imagine you don’t really care so long as it connects, but the cost matters. So I imagine that it does to an extent depend which kind of radio you’re putting in. Give me a sense of that.

Hugo: “It frustrates the hell out of me. We are focused on the logistics vertical, and every time we speak to a technology provider, they want to explain the difference between Cat-M, NB-IoT, whatever. I don’t care. And it frustrates me that we get into that whirlpool of tech speak.”

But presumably it doesn’t matter in the end, but it matters insofar as one technology delivers longer battery life and another delivers higher performance, and it is important to understand what you’re buying?

Hugo: “Sure. But in 2008, Nokia released the N95, with this incredible tech spec, and Apple launched the iPhone, with a nice screen and some icons. And within four years, the whole industry was changed. We are living in a mature tech society. I just want a tech company to come with a connectivity solution that solves my problems. Period. I can write the spec sheet that says the device needs a 90-day battery, and five sensors, and connectivity per-hour. Make it happen. But I don’t want to get into a discussion that asks me to consider Cat-M or NB-IoT. Come on, guys. That is your problem, not my problem. I don’t want to be a telecoms expert.”

But this conversation needs to happen around technology; it is just that you don’t need to be privy to it. Is that right?

Hugo: “It’s a comfort-environment. Tech providers like to talk about technology. I just want to save plums. I want to save oranges. I want to save farmers in India. I don’t want to have a discussion about technology. Yes, we need a specific skill-set to receive the information, but let’s not talk about problems with the technology – just because you don’t understand about the vertical. Let’s talk about the problem with the vertical, and have the tech providers understand that. And then solve it together. I’m not an Apple fan-boy, but that’s the Apple way. They did it right, and Nokia did it wrong.”

Understood. But when you say 90 days and five sensors, and the tech company says, 180 days and 10 sensors at half the price, because of this technology, then you are going to go, ‘Well give me that then’. Right?

Hugo: “Of course. But that is the competition between tech companies. Because I am not going to just one of them.”

Warren, just respond to that from an Ericson point of view, and give your take on that.

Chaisatien: “Absolutely. All of that is very valid. We listen to business concerns from customers, and it is our task to translate that into solutions that fit their requirements. With our IoT Accelerator platform, we are now working with leading vendor talents to embed the right modules into the right devices. But things like this happen behind the scenes, and frankly, the enterprise doesn’t always need to hear all that. They just want to go and save oranges. We get that.

“All we need to know is the detail – the conditions under which those oranges are to be transported; the temperature, and longevity. That is what we need – so we can define the battery life and coverage, and ways to make it all work. But there are different discussions with different stakeholders. Details about eSIM and LTE-M will be discussed with the CTO, perhaps. As always, it comes down to the audience – who you are speaking with. Always.”

Would you say Ericsson is better at that now? Has there been a shift? That does seem part of the story here. Because this discussion can very quickly become a menu of tech items. And that discussion is important – for the technology industry to have with itself in order to innovate, and to have with enterprises in order to solve problems. But it just needs to work at the end of the day, in an easy and affordable and scalable way. So, when Erich comes to you and says, ‘I want to save oranges, and I need them tracked at this temperature for six weeks on a container ship into these markets’ – is that an easy solution now? What are the challenges with that today? Are there any major technical challenges left, actually?

Chaisatien: “Different virtual industries have different challenges, obviously. But when it comes to the digitalization of business, there is a lot of commonality. For global tracking, you need seamless global coverage, plus scalability and reliability. And you need network security, as well. Because if the connectivity goes down, and the data gets stuck, then the oranges could spoil. It is our job to educate these industries, as well, to say, ‘If you have these requirements, then cellular is your best bet’.

“Because it operates everywhere, plug-and-play, no password. Sigfox won’t cut it. Wi-Fi will not do. It needs to be cellular, to suit all those requirements, regardless of whether it is on the sea or up a mountain. And that message needs to get through – to educate enterprises to make the right tech choices.”

Erich, can I ask you about the cost of this stuff and at what point it becomes unviable? It will of course depend on what you’re tracking and the size / value of the opportunity. But is there a rule of thumb on this stuff? Is it generally?

Hugo: “No, there’s no rule of thumb. There’s just different goods. A container of televisions from South Korea is more valuable than a container of oranges from South America. The asset margin determines how much I’m prepared to invest in the technology.

“And, incidentally, another problem for supply-chain enterprises is this upgrade path from 2G to 4G and 5G, and to Cat-M and NB-IoT; the idea you have to upgrade your devices because 2G is sun-setting to open up the frequency to new consumer technologies. How much does the farmer know or care about that? I mean, seriously; a farmer in Peru, just trying to survive, living on a tiny margin, is already a hostage to fortune in this supply chain, and all of a sudden I have to double the price of his tracker to go from 2G to 4G.

“Because of some telecoms roadmap set in Europe, which has no clear effect on my farm in Peru. 2G is still very important for the global economy. A normal farmer that produces the oranges you eat in the UK does not have the money to pay for a new LTE chipset. They don’t. But the industry is moving that way, because of rules that are just not in sync with what the market requires.”

How often, when you go put an RFQ out, do you find that what the tech companies return is too expensive?

Hugo: “Ninety percent of the time; they’re not interested in who I sell to.”

Is that just because they haven’t read the brief?

Hugo: “Ericsson has recruited a team into its IoT business specifically to understand the customer’s business model. Which is a step in the right direction. Because there is a massive managed services opportunity here, which nobody is really taking.

“It used to be you would just buy one of our loggers and just throw it in the back of a container, and extract the data via USB when the container arrived. And that was it. But now we’ve got connectivity, all of a sudden the exporter needs to consider whether there is a 2G or a 4G network in Morocco, and the same in the Netherlands – because they need to work both sides of the supply chain. They need to think about data laws in the European Union and in the African Union.

“DeltaTrak is starting to address this. Everybody is talking about the Global South and the Global North, but there is massive trade between Bangladesh and South Africa, say, and they’re not going away from 2G anytime soon. If they go away from 2G, 70 percent of their populations will lose connectivity. Because they can’t afford 4G and 5G. And so these 2G network can’t just be switched off. It is a luxury problem most of the world doesn’t have.”

Warren, my understanding of that issue is that it has been largely resolved – that you can put a SIM into a device and switch dynamically via global multi-IMSI and eUICC carrier IoT roaming arrangements. You have cloud solutions that allow you to set parameters so the SIM switches between networks according to prescribed performance or cost or battery life. That this is no longer an issue. Presumably this stuff is resolved in your Accelerator platform – that you can get global connectivity wherever it’s available, and optimise for Cat-M or 2G or LTE, or whatever. Is that right?

Chaisatien: “Correct. In the DeltaTrak case, Deutsche Telekom is providing the connectivity and the Accelerator platform, which is access agnostic. It doesn’t matter. As long as it is a cellular IoT device, it will manage it. No problem. But on the access, if you have a legacy 2G SIM from decades ago, then it will not switch to LTE, or whatever. But newer SIMs are backwards compatible. But as a supplier, our role is also to educate enterprises with legacy IoT products – that they need to start to migrate from 2G to more up-to-date NB-IoT, Cat-M, LTE, and 5G, depending on use case.

“For sensors that do not require lots of data or lots of transmissions, NB-IoT is perfect; for a public safety project, running 50 body-cams for video streaming for a police force, then 5G is more suitable. There are different upgrade paths. It is our job, in conjunction with our carrier partners, to start educating enterprises so this transition process is smooth.”

Hugo: “But who carries the cost? It is not us. It is the producer, the farmer, living on slim margins – who has to all of a sudden go to NB-IoT because that’s what the industry says. And he goes, ‘But I’m making $2 per container and you want me to buy a product for $50 that I used to pay $30 for?’ The enterprise customer doesn’t see the value of it. This is not a Tesla, pumping out gigabytes of data. Our devices are transmitting just kilobytes of data. So there is a disconnect between the technology evolution and the market’s needs, right now.”

So Erich, you’re not arguing against the march of technology, you’re against the march of tech-selling into legacy markets for which existing technology already works. If it ain’t broke, type-of-thing? Legacy networks need to continue to be supported.

Hugo: “Absolutely. Bangladesh exports tens of millions of tons of clothing each year to South Africa, and to the rest of the world as well. It is not going away from 2G. But soon I will not be able to produce a 2G device because the cost of components is increasing and they are shutting down production of 2G devices. So what is going to happen all of a sudden, in 10 years time? They can’t afford to shut down 2G networks because it will bring economies to collapse. So there will be countries with legacy systems that are 15 years old, and they will make sure they continue to work. Because the cost is just too constricted for those markets to upgrade.

“Ericsson is aware of this, which is why we’re working very well together. But our customers produce food in the Global South that gets consumed in the Global North, so we need a product that can be bought in the Global South. That is super important. Seventy percent of the food in the cold chain is produced in very poor countries and eaten in very rich ones. But those poor countries do not have the capacity to pay for these technologies.”

For more on IoT tracking ain the supply chain, check out the recent editorial webinar – IoT in the Supply Chain and Logistics Industry: how IoT grew up and got real, in the hardest industry of them all – on-demand, here. The session features Erich Hugo from DeltaTrak, plus panellists from ABI Research, Telit, and UnaBiz Group. Also, look out for the upcoming editorial report on the same subject.