Holiday greetings from Nebraska, Missouri (recent shot of the Plaza lights pictured), and Georgia. In this Brief, we are going to examine our last key 3Q earnings theme as we exit 2023 (5G’s missed expectations) and also provide a short retrospective on 2022. As a result, our market commentary will be shorter than normal.

We will be attending the Consumer Electronics Show (in a Fastwyre capacity) and will also be hosting the annual TSB dinner at Gordon Ramsay Pub and Grill at Caesar’s at 7:00 p.m. on Thursday, January 5. The reservation is for eight and we have five slots left. Please notify us at sundaybrief@gmail.com if you are interested in joining the discussion.

One final note — the latest iPhone 14 Pro and Pro Max availability charts will be posted to the www.sundaybrief.com website by the start of the Chiefs/Broncos game (3:05 p.m. CT). We started to see some availability of certain color/ storage options at the end of last week, and hope to see continued progress (for an interesting take on the importance of Apple/ Foxconn/ Chinese COVID policy, take a look at this Wall Street Journal article).

The Fortnight That Was

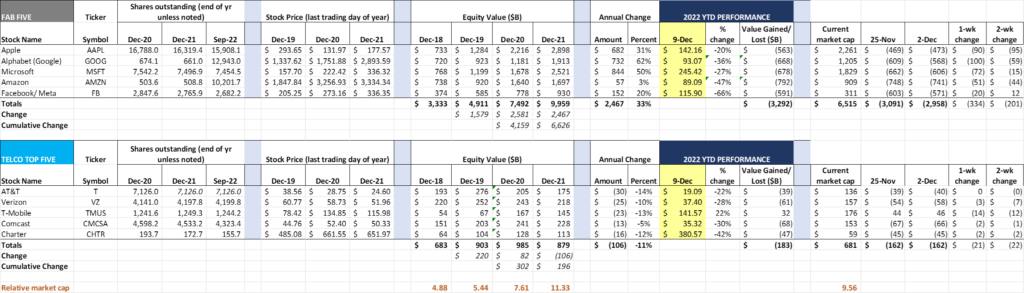

Over the last two weeks there has been continued pressure on all stocks, but particularly on the Fab Five (-$201 billion over the last 2 weeks, and -$334 over the last week). The Telco Top Five have also been impacted, but most of that has been T-Mobile ($12 billion of the overall $22 billion in the last 2 weeks of decline). Our suspicion is that T-Mobile’s pressure comes from institutional investors looking for gains to take against 2022 losses.

The biggest story of the last two weeks broke on Thursday when the Federal Trade Commission filed a lawsuit to block Microsoft’s $69 billion acquisition of Activision Blizzard (New York Times coverage here, Wall Street Journal coverage here, and Bloomberg coverage here). The heart of the argument is that Microsoft will use this acquisition to limit the availability of video games developed by Activision Blizzard to rival console companies (namely Sony and Nintendo). This in turn will also hinder the growth of subscription services tied to these rival console companies.

To combat this argument, Microsoft offered to make Activision’s most popular title, Call of Duty, available to all console providers for ten years following the transaction close (coverage of the Nintendo deal is here). While this is a step in the right direction, it’s likely that the FTC will request that all current and future software developed by the combined companies be released to all rivals.

We think that Microsoft has a good case, but, as one analyst stated, “Winning has a cost.” This goes beyond the attorneys’ fees — the opportunity costs of a multi-year legal battle are significant. If, as Microsoft states, the future comes from gaming networks (as opposed to gaming consoles), then there’s a lot of wood to chop outside of the courtroom as broadband networks improve. Microsoft has plenty of money to do both, but one can only surmise that new titles (even new categories) will emerge as low-latency Gbps speeds to the home take hold. Apple and Amazon (and, to a lesser extent, Google) are farther behind in bringing gaming networks to the world. Microsoft might deliver more shareholder value through accelerated architecture and software investment.

In addition to the headline argument focused on Microsoft’s relationship to console-based game distributors, there’s an important secondary theme — browser integration. Gaming is highly dependent on software efficiency, and integration into Microsoft Edge might give their struggling business line an additional boost. Improving relative efficiency compared to Chrome or Safari (the two most popular mobile browsers in the US) could drive new gamers to Microsoft using the “works best over our hardware and software” argument. For a really good baseline article on the top five browsers by market share, check out last month’s PC Mag review.

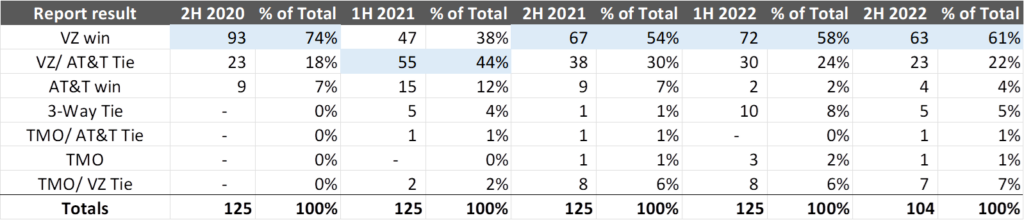

Finally, it’s been a while since we have looked at the RootMetrics RootScore reports. With many C-Band spectrum deployments occurring for Verizon and AT&T, one might expect some shifts in performance. Here is the latest trend chart for the carriers:

Twenty-one reports remain to be posted (including some fairly large metro markets like Dallas/ Ft Worth), but we expect the headline ultimately to read “Verizon’s network lead increases.” T-Mobile continues to make inroads in a few markets (most notably Chicago, where they shared the overall performance award with Verizon). AT&T also picked up an outright win in Austin (where they are upgrading their fiber network). While RootMetrics should be viewed in conjunction with other sources (OpenSignal is our other favorite), it appears that Verizon is on its way to another 70+ outright wins, coming largely from markets they had previously tied with AT&T. 2023 should reflect more C-Band (and 2.5 GHz) deployments, and we expect Verizon’s leadership to continue.

5G’s Missed Expectations

Four weeks ago, we identified three notable trends coming out of 3Q 2022 earnings:

- Fiber isn’t a bad investment after all (if it is holistically managed to generate cash flows)

- Cable is coming for the wireless world on their (cable’s) timeline

- The use cases for 5G networks are not compelling for handsets

While we have been a broken record on the last bullet point for many years (here’s our 2019 post on the topic), it’s worth reiterating that while 5G brings a lot of benefits to network capacity management, it’s not producing the transformational benefits of 4G. 5G’s supporting cast, namely Mobile Edge Computing and private 5G networks, are also not making up for the handset miss.

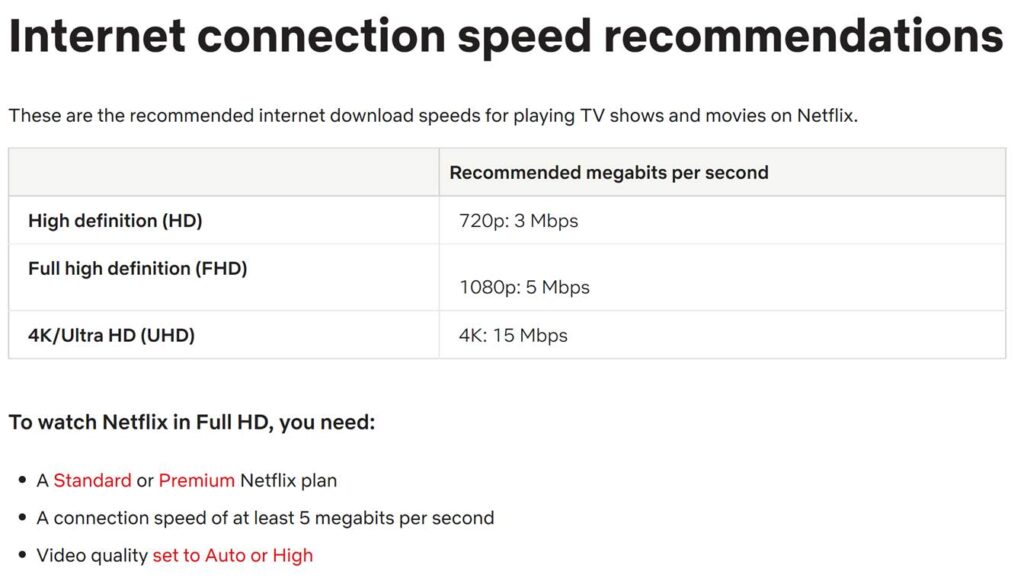

This table from Netflix (link here) provides a good summary of the 5G handset dilemma:

Full HD is usually defined as having 1920 (horizontal) x 1080 (vertical) pixels per screen. The most powerful handsets offered by the largest US wireless carriers are the Samsung Galaxy S22 Ultra with 3088 x 1440 pixels (500 pixels per inch or ppi density) and the OnePlus 10 Pro with 3216 x 1440 pixels (526 ppi). They might need 8-9 Mbps to display a high-quality video on a device. These are highest-quality handset screen resolutions available today.

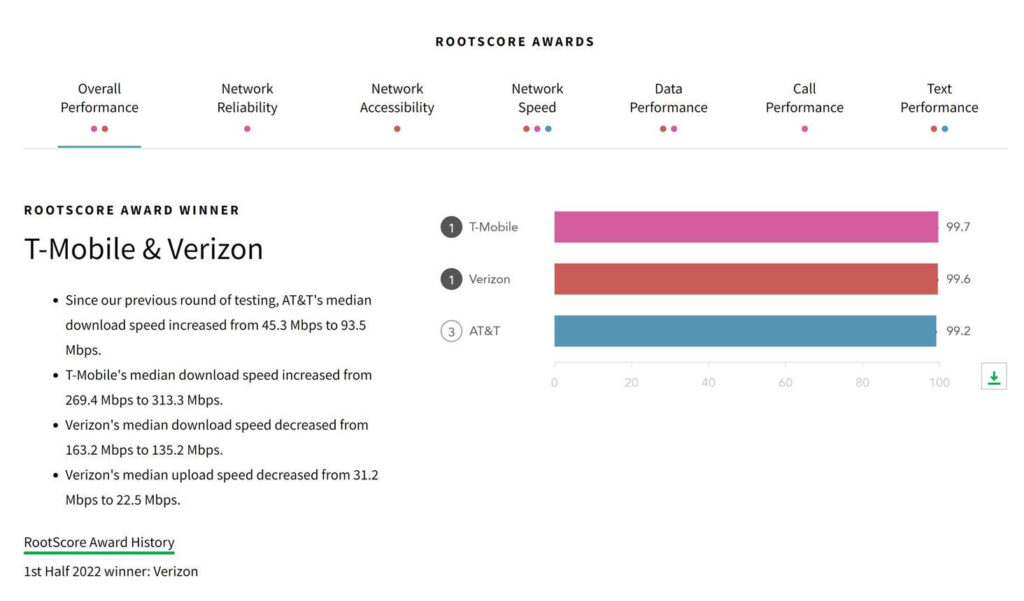

Let’s overlay that with one of the RootMetrics RootScore reports mentioned above. Here are the average speeds (per handset) for the Chicagoland area (link here):

T-Mobile delivers over 300 Mbps on average to a handset today across Chicago. That would technically accommodate 30-35 devices simultaneously streaming HD content (which would require a very powerful hotspot). Multiply that by the number of mobile devices in a home, and you can see where this is headed: Unlike the LTE revolution where the network finally caught up to content and applications and produced trillions of dollars in the process (largely for the fab Five), the 5G revolution has a minimal impact on the handset experience.

As many of us have discussed over the last three years, when the only app that proves the value of 5G to handset is a speed test, wireless carriers should worry. When revenues become dependent on content bundles and other perks, and not on ever-increasing value of the network, carriers become subject to price pressures. We are starting to see that in 4Q 2022 with T-Mobile’s “Four for $100” offer, and also with cable lowering the rate on the first line for all unlimited mobile subscribers to $30 (effectively cannibalizing profits from their “by the Gig” plans).

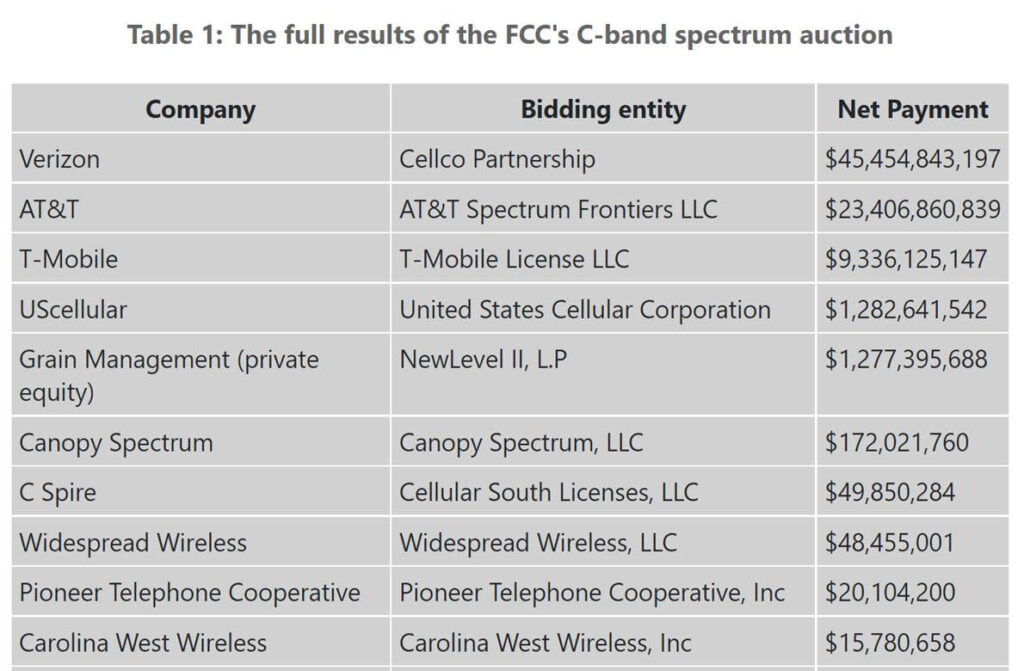

This is vitally important for Verizon and AT&T because they spent heavily on spectrum in the 2020 auction. Here’s a table of the top “winners” courtesy of Light Reading (article here):

It’s safe to say that Verizon will likely spend at least $60 billion on their 5G network including the spectrum payment shown above. That equates to about $650 per postpaid (phone + other) connection in capital. While $65 in post-tax profitability for net ten years seems like a small number, it represents a 12% increase in the average profit in every account starting today.

Verizon has slightly less than 91.5 million wireless postpaid connections as of September 30 with 82% of these being handsets. If there’s no value to handset owners, where will the incremental $650 per connection ($1,788 per account) come from?

We do not have enough space in this Brief to discuss Multi-Access Edge Computing (MEC) and private networks, but for a deeper discussion of the business benefits, see this interview with Sowmyanarayan Sampath, CEO of Verizon Business. It’s chock full of information on the breadth and depth of Verizon’s customers, view of private networks and MEC. Verizon also has a MEC challenger in Equinix — Light reading captured their comments in this article. Private networking is needed and will grow, but competition is increasing from other spectrum-license solution providers.

If traditional wireless handsets are not the solution, and business applications are developing more slowly than expected, then what makes up the difference? You guessed it – fixed wireless access, multi-hundred Gigabyte consuming components of Verizon accounts paying $25 month for very good bandwidth. As nearly every Verizon engineer we have talked to over the last three years will attest, that was a tiny component of the 5G use cases when $45 billion was spent on licenses.

Where does this end? Verizon enters hyperdrive with fixed wireless for consumers over the next three years to be able to earn a return on their 5G investment. This frays the relationship with cable (see here for Verizon’s latest retail message to employees — they are clearly coming after cable broadband), potentially weakening cable’s bundle value proposition. Meanwhile, AT&T meets their 30 million fiber to the household (FTTH) goal on schedule and challenges Charter and Comcast in large metro markets like Chicago, Dallas/ Ft Worth, Houston, Los Angeles, Atlanta, and Miami. Great for consumers, but a challenge for the telecommunications industry.

What 5G’s missed expectations means to 6G is also interesting. Balance sheets are stretched (fiber deployments are not cheap, in or out of Verizon’s or AT&T’s local exchange regions), and interest rates are no longer below 4%. With short-term interest rates headed above 5% and long-term rates eventually reaching that level, costs of capital are materially increasing. Use case scrutiny will increase, and more carrier and equipment supplier inter-operability will be needed. Our view is that adoption of anything beyond 5G will be delayed at least 2-3 years from original predictions.

Some Closing Thoughts on 2022

Retrospectives are always easier to make than predictions. The country came out of COVID disruptions in 2022, AT&T completed the spinoff of WarnerMedia in April and launched an unprecedented fiber initiative (we have called this AT&T’s “FWA-free” transformation — Briefs here and here), and T-Mobile proved once again that they can execute merger synergies and deploy “layer cake” networks that drive subscriber additions. It is likely that T-Mobile will end 2022 with a $20 billion equity market value lead over Comcast or Verizon, roughly a $100 billion shift in one year.

Telecom M&A was muted, and the most memorable stories were Apollo’s struggle to fund their Brightspeed purchase from Lumen and Altice’s decision to keep Suddenlink (Fierce Telecom article here). CEO and executive transition were not muted, with Jeff Storey (Lumen), Tom Rutledge (Charter), Dexter Goei (Altice), Dow Draper (T-Mobile), Tami Erwin (Verizon) and, most recently, Manon Brouillette (Verizon) all leaving their respective positions. On top of this, Mike Cavanagh appears to have been tapped as the heir apparent to Comcast. We expect more executive changes in 2023.

As we have discussed in previous Briefs (here), the fiber frenzy is in full bloom, although muted by higher interest rates. There were fewer shrieks than expected from the recently updated FCC Broadband Map, although we fully expect that the first awards of any BEAD monies will not be until (very) late 2023 (Senator Thune’s oversight requests should also not go unnoticed — more from Fierce Telecom here).

2023 brings increased competition, higher interest rates/ costs of capital, continued labor shortages, and rising input prices (see November’s wholesale Producer Price Index (PPI) report here). Home prices will likely decrease (how much depends on which region of the United States) as inventories of unsold homes continue to rise, and “convenience moves” will be replaced by “stay in place.” More than most, next year will be one of “heads down” execution. Buckle up.

Our annual CES Preview will be published on Saturday, December 31 (a rare Saturday Brief). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Enjoy the rest of the year and Go Chiefs and Davidson Wildcat basketball!