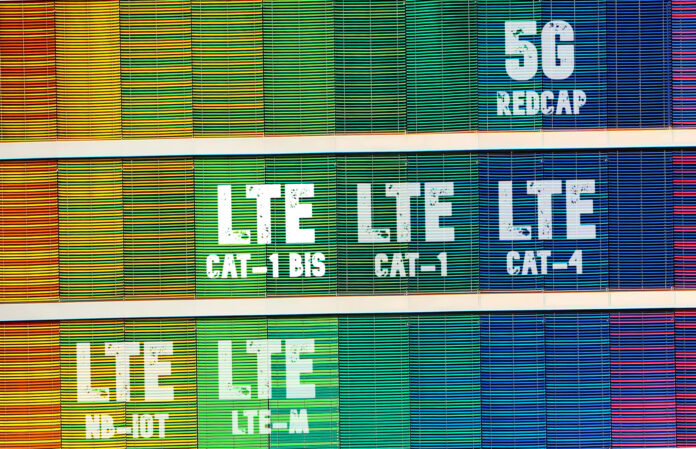

There is a clear dichotomy in the cellular IoT market – high-throughput and high-power IoT applications powered by advanced 4G (LTE) and 5G at one end, and low-throughput and low-power applications powered by cellular IoT technologies like NB-IoT and LTE-M at the other. And as 2G and 3G networks become outdated, device makers and telecom operators are looking for new ways to offer better performing solutions, particularly at the low-power end.

One option that has gained popularity is LTE-based Cat-1 bis, which uses a single antenna to improve power efficiency and allow for use in space-constrained applications. Qualcomm, the leading provider of cellular IoT chipsets, has just launched its first LTE Cat-1 bis chipset, the QCX216, designed for use in massive IoT applications. This low-cost and power-efficient solution is suitable for a variety of IoT applications, including meters, trackers, and wearables.

Though late to the market, Qualcomm should be able to leverage its partnerships and customer relationships.

CAT-1 BIS – PORTFOLIO TECH

LTE-based Cat-1 bis offers similar throughput to LTE Cat-1, but at a lower cost, making it a more attractive option. LTE-M and NB-IoT technologies provide single antenna-based solutions, but their data speeds may not be suitable for all applications. LTE Cat-1 bis has the potential to provide strong competition to these technologies, particularly in situations where operators are unwilling to invest in building LTE-M and NB-IoT infrastructure.

3GPP’s release-17 of the cellular standard introduced a new technology called 5G reduced capability (RedCap). 5G RedCap is expected to replace LTE Cat-4 and Cat-6 based applications, while 5G enhanced RedCap (eRedCap) is expected to replace LTE Cat-1 and Cat-1 bis-based applications.

Despite this, LTE Cat-1 bis shipments have grown at a compound annual growth rate (CAGR) of 150 percent from Q3 2020 to Q3 2022, helping increase its market share from 2.9 percent in Q3 2020 to 9.4 percent in Q3 2022. As the adoption of 5G RedCap and 5G eRedCap is still in the future, Qualcomm and Quectel are looking to maximize revenue generation opportunities during this transition by continuing to focus on LTE Cat-1 bis technology.

CAT-1 BIS – MARKET LEADERS

UNISOC currently dominates the LTE Cat-1 bis chipset market with over 98 percent share. This year, Chinese companies Eigencomm and ASR Microelectronics also started offering LTE Cat-1 bis chipsets.

It will be compelling to see how the LTE Cat-1 bis technology develops in the coming years with the introduction of 5G RedCap and 5G eRedCap. In some cases, NB-IoT is expected to continue to coexist even beyond 2030. According to Counterpoint, LTE Cat-1 bis is expected to grow at a faster pace, with a CAGR of 65 percent between 2020 and 2027. However, it may face strong competition from 5G eRedCap at the end of this decade.

CAT-1 BIS – NEW ENTRANTS

Quectel, the largest cellular IoT module vendor, is launching its first LTE Cat-1 bis module, the EG915Q, which is based on the Qualcomm chipset. Quectel aims to dominate the global IoT market, so it often uses Qualcomm solutions for its modules. In turn, Qualcomm benefits from Quectel’s scale in increasing its share in the low-end IoT module market.

Quectel is likely to face tough competition in the LTE Cat-1 bis market from other domestic companies such as Fibocom, MeiG, China Mobile and Neoway, which already have LTE Cat-1 bis solutions available.

Cavli Wireless is another IoT module brand that is utilizing Qualcomm’s LTE Cat-1 bis chipset in its C16QS module, which is globally available now. This eSIM-supported module, when integrated with Hubble, will be applicable in the North America, APAC, and EMEA regions, allowing Cavli Wireless to expand its target market beyond just the US and India.

MoMAGIC is working with Qualcomm to incorporate 4G-LTE technology into its IoT product portfolio. This partnership will allow MoMAGIC to utilize the small form factor of Qualcomm’s chipsets to add connectivity and computing capabilities to various IoT applications. MoMAGIC already has expertise in working with Wi-Fi, Bluetooth, NB-IoT, and 2G technology. The addition of LTE technology will further diversify its offerings.

CAT-1 BIS – WESTERN POWER

The LTE Cat-1 bis chipset market is largely dominated by Chinese players. Until now, there have been few other options available to international module and device manufacturers. Sequans Communications is the only non-Chinese company that offers a LTE Cat-1 bis chipset.

Now, Qualcomm is entering this space to take advantage of the massive IoT market. Both Qualcomm and Sequans will have an opportunity to assist operators in replacing existing 2G and 3G devices in the international IoT market.

Soumen Mandal is a Senior Research Analyst who is tracking IoT, Automotive and Telecommunication ecosystem at Counterpoint Technology Market Research. He is focused on IoT applications, connections, components, electric vehicles, connected cars, autonomous vehicles, semiconductors, shared mobility, services and emerging technologies.