A new survey by global management consulting firm McKinsey & Company says robotics and automation systems will account for 25 percent of capital spending by industrial companies over the next five years, mostly for routine manual tasks in the logistics and fulfillment, retail and consumer goods, and automotive sectors. But enterprises are worried by the cost of hardware, a lack of expertise, and the risk of job losses, as well as about safety and security.

They are also struggling, it seems, to make a clear business case for investment in new Industry 4.0 technologies. Challenges with return-on-investment (ROI) calculations are cited as “particularly difficult hurdles” by McKinsey. The firm conducted an online poll of (only) 65 “leaders” in various industrial sectors in August last year, but the results look sensible and logical. McKinsey finds the logistics sector will be the first mover on commercial-scale Industry 4.0.

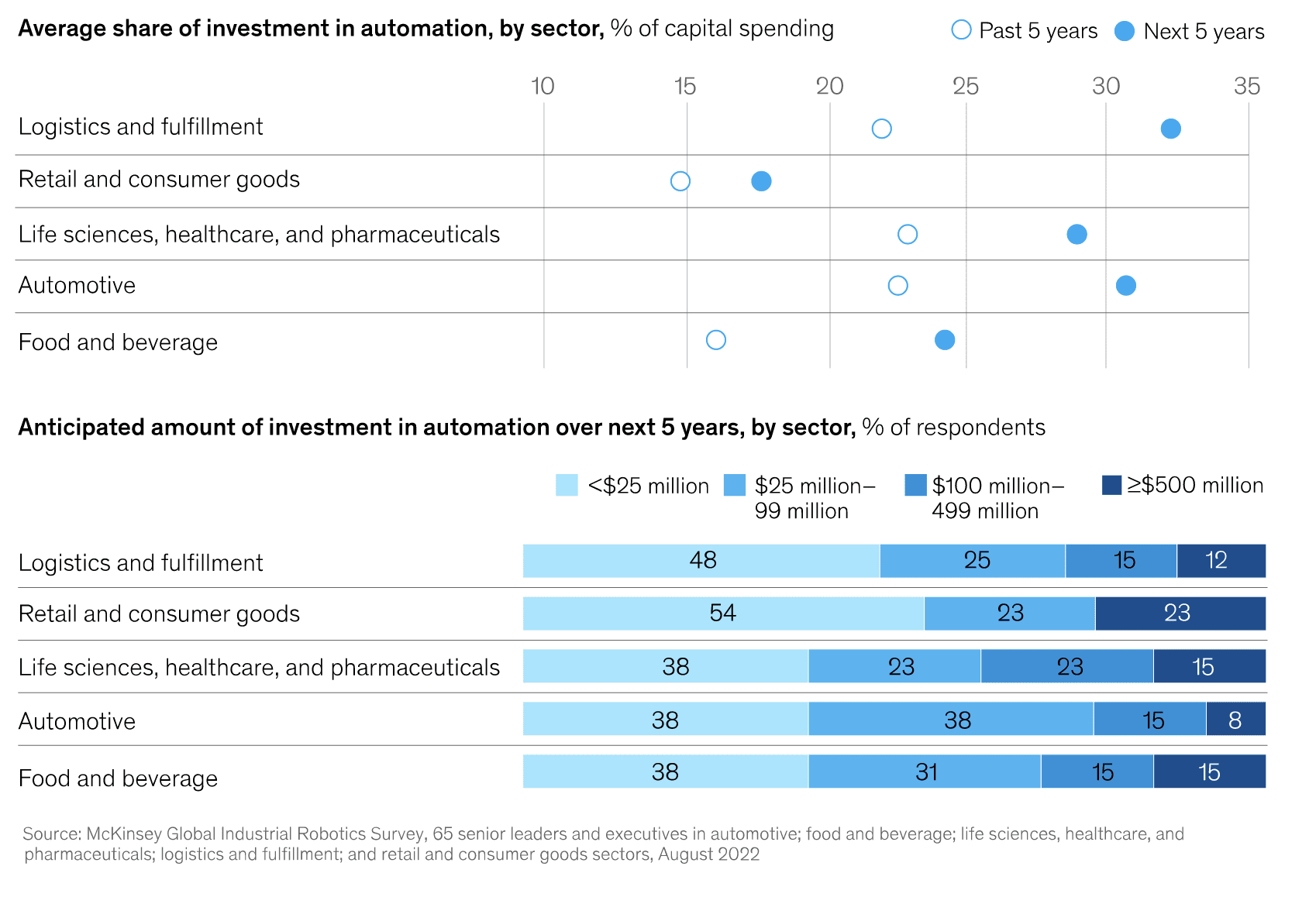

Logistics companies will invest around 32 percent of all their capital spending over the next five years in Industry 4.0 solutions, to automate manual processes and bring intelligence to fulfillment operations. The automotive sector will invest a little over 30 percent, and the life sciences and pharmaceuticals industry will invest a little under 30 percent (see graphic). The average is 25 percent across five focus sectors, according to the McKinsey survey.

Logistics and fulfillment also shows the biggest appetite to increase Industry 4.0 expenditure, with an uplift of around 10 percent on its previous five-year investment cycle. This aligns with observations about the uptick in interest in private 5G in CBRS spectrum in the US warehousing sector, in a recent study by ABI Research and Betacom, and in conversation with private networking specialist Celona, among others.

The (limited) McKinsey study suggests the retail and consumer goods sector will spend the most, with 23 percent of respondents reckoning on Industry 4.0 investments of more than $500,000 over the period. But the cap-ex percentage is a better measure, perhaps – and 54 percent of respondents, higher than elsewhere, in retail say they will spend less than $25,000. This perhaps reflects the range of enterprises polled in the research.

But percentages of enterprises forecasting investments of over $100 million over the period are about equal – 27 percent of logistics companies and 23 percent of automotive firms, for example, while the figure for retail is 23 percent, whether for $500,000-plus or $100,000-plus. The food and beverage sector is higher at 30 percent, and pharmaceuticals higher still at 38 percent. All of which makes the investment-value scores hard to square,

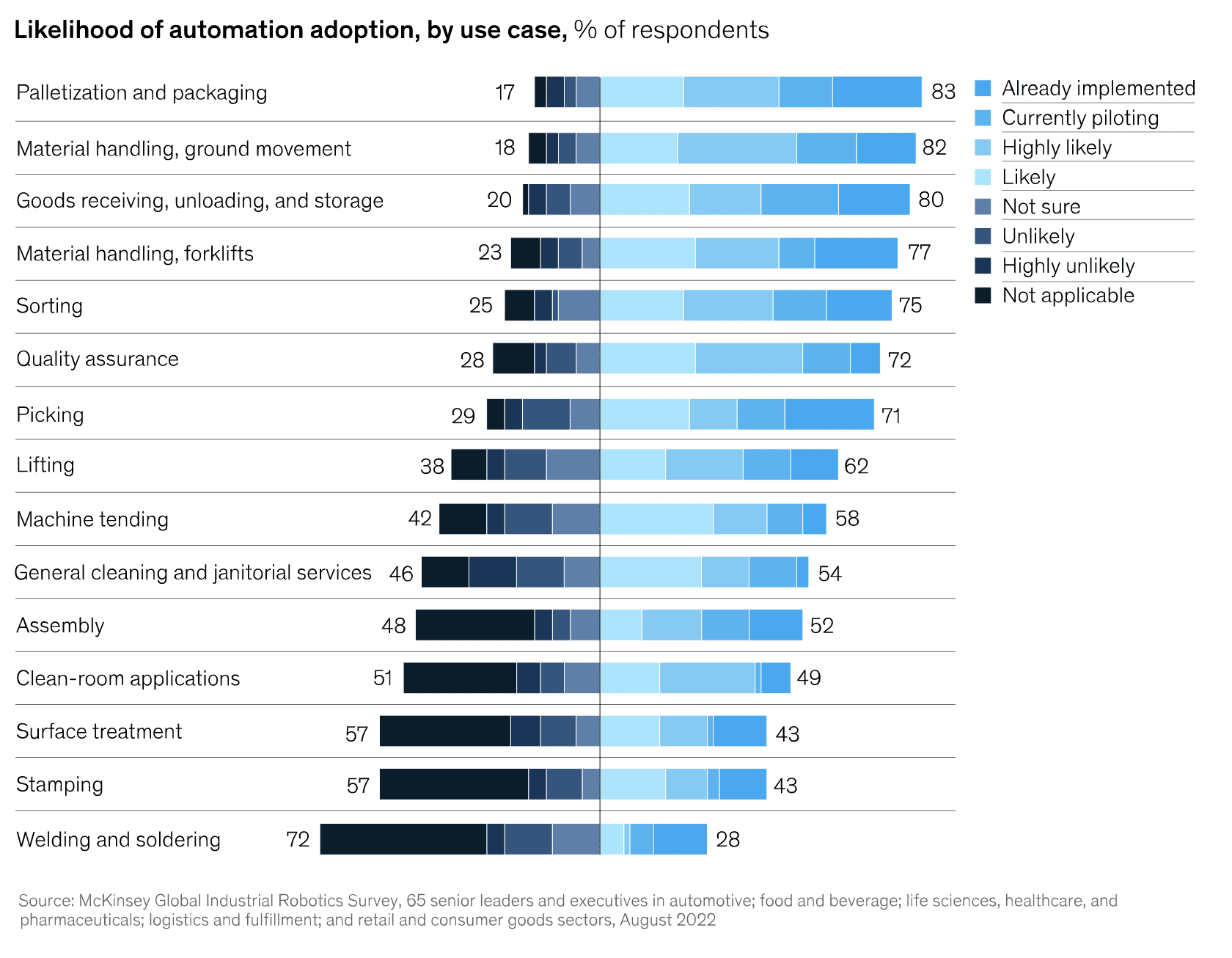

More clearly, the results say that enterprises will seek to automate simple manual tasks, rather than complex ones. Again, this puts sorting, packing, palletizing, storage, and general material handling (see graphic), notably in the logistics space into the picture – and consequently tech investments in private cellular, IoT sensors, automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), and well-worked AI-based machine vision controls.

McKinsey states: “Activities such as picking, packing, sorting, movement from point to point, and quality assurance are already automated to some extent, and these will continue to see heavy investment over the coming years. Conversely, activities such as assembly, stamping, surface treatment, and welding, all of which require high levels of human input, are less likely to be automated in the short to medium terms.”

Enterprises expect to work faster and at higher capacity, with higher quality controls, as well. They cite upsides in terms of production costs, operational uptime, and safety. They do not see so much impact on environmental and sustainability factors (see graphic). But enterprises exhibit major concerns, as well. “A standout message from the survey is that automation is not easy,” notes McKinsey.

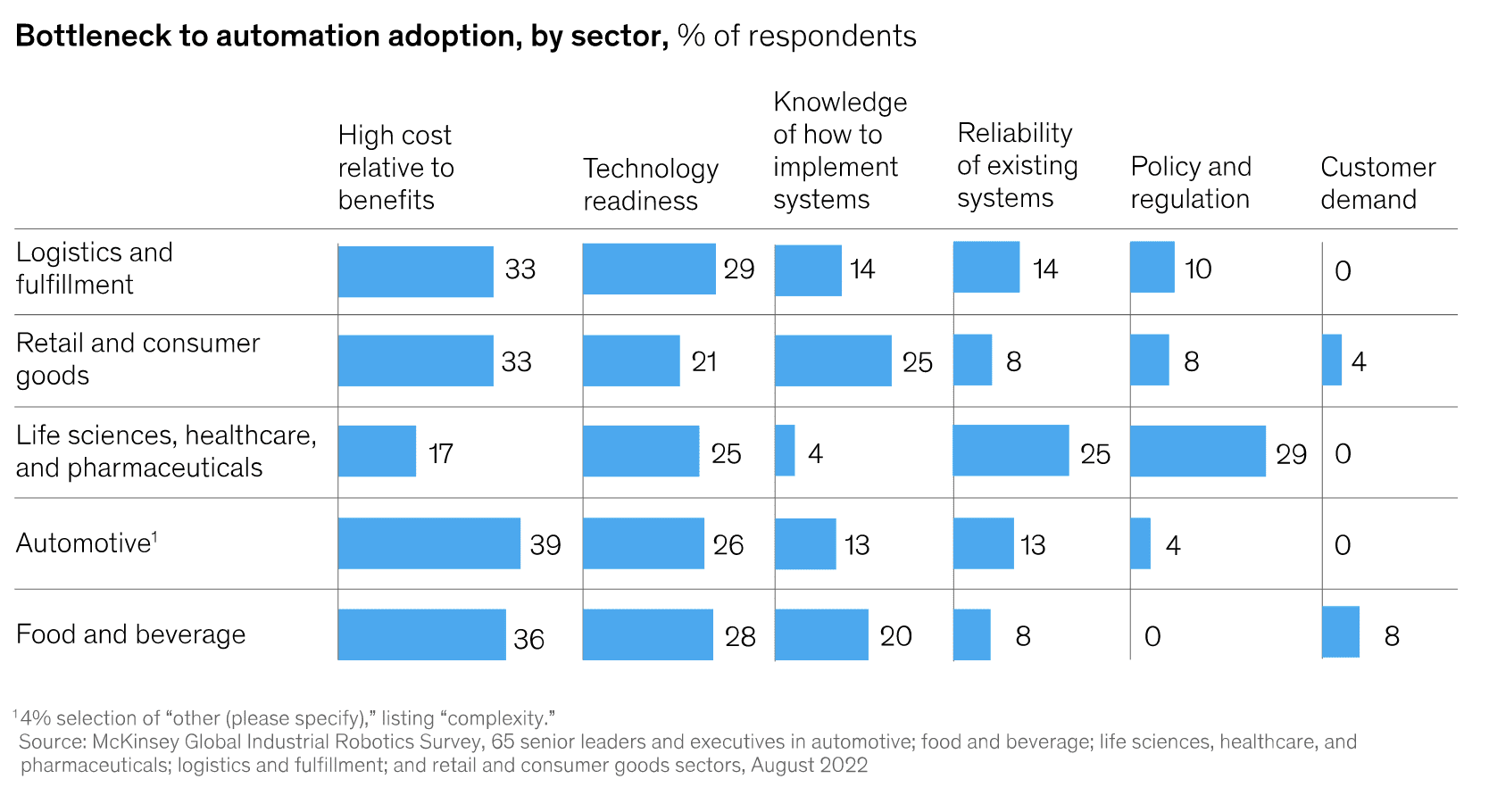

The primary challenges to adoption include capital costs and inexperience, cited by 71 percent and 61 percent of respondents, says McKinsey. Drilling down, it finds the automotive industry is most concerned about the ROI (cost relative to benefit), with 39 percent putting it as their biggest barrier to adoption; the figure falls to 33 percent in logistics and retail, and to 17 percent in pharmaceuticals – suggesting it perceives the easiest boost from new tech.

All of this expectation and uncertainty lends itself to good tech providers and consultants, reckons McKinsey, of course. It states: “The challenges… present robotics and automation providers with a significant opportunity to help build the capabilities required to automate at scale or provide support for this effort. However, [they] will need to provide convincing answers to the questions raised by customers and work hard to differentiate themselves.”

One answer to this supplier-side challenge of differentiation, it suggests, is to offer Industry 4.0 as-a-service, covering service management on subscription. “Such models would offer not only installation and integration but also maintenance and support through the product life-cycle. Sixty-two percent of respondents agree that most customers favour robotics and automation providers that can provide full-service models for implementation,” it says.