Greetings from Las Vegas and the Midwest. It has been a full two weeks with news from the Citi conference plus additional industry developments. We will begin with a full market commentary followed by a few CES observations, and end with some thoughts on Q1 earnings.

Speaking of earnings, the fourth quarter conference call schedule (as of Friday) is as follows:

| Verizon | Jan. 24 | before market open |

| Microsoft | Jan. 24 | after market close |

| AT&T | Jan. 25 | before market open |

| Comcast | Jan. 26 | before market open |

| Charter | Jan. 27 | before market open |

| Meta | Feb. 1 | after market close |

| Alphabet | Feb. 2 | after market close |

| Apple | Feb. 2 | after market close |

Finally, for those of you attending Metro Connect in Ft Lauderdale at the end of the month, Jim will be there in his Fastwyre capacity. Please reach out to him directly at jpatterson@fastwyre.com if you want to get together.

The fortnight that was

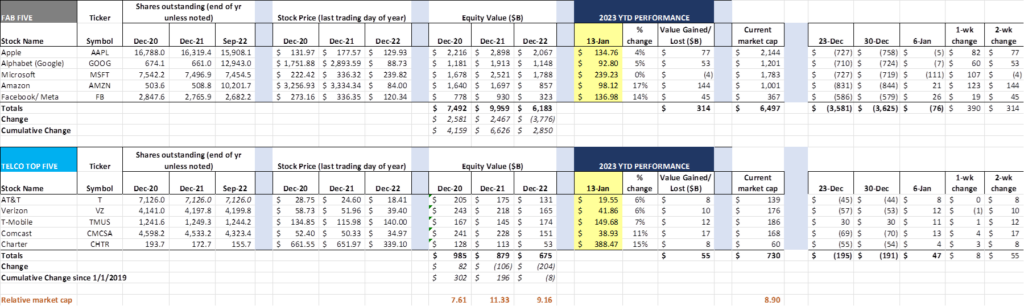

A clean slate was needed after 2022’s losses, and so far, 2023 is in the green. Upcoming earnings announcement impacts aside, both the Fab Five and the Telco Top Five appear to be headed for a positive January. For the first two weeks of the year, the Fab Five are up $314 billion (so roughly one AT&T and one Verizon in market cap gains over the last fortnight) and the Telco Top Five are up $55 billion.

Just under half of the Fab Five gain is from Amazon (+$144 billion) and over 30% of the Telco Top Five gain is from Comcast (+$17 billion). Neither of these are surprising after the substantial losses last year ($844 billion for AMZN and $70 billion for CMCSA), although any mega-cap gaining 17% in two weeks is bound to attract some attention.

Perhaps the biggest news impacting the ten stocks we cover is Microsoft’s rumored $10 billion investment in OpenAI, the creator of everyone’s favorite artificial intelligence bot, ChatGPT. In 2019, Microsoft invested $1 billion into the company. Per this article at Business Insider, Microsoft would receive 75% of OpenAI’s profits until they recovered their investment and would eventually end up with 49% ownership of the company. Other investors would also own 49%, while OpenAI’s nonprofit parent would own the remaining 2%.

With this move, Microsoft gains control of a leading software company without the Activision-esque scrutiny from the FTC. Eventually, however, Redmond will eventually want full control of the company in order to integrate OpenAI’s capabilities into Microsoft’s many product lines (others have assumed that this would replace Bing, but the implications of ChatGPT and successor platforms extend well beyond search).

Acquisition and investment rumors also hit the Telco Top Five with Bloomberg reporting that T-Mobile was looking at acquiring their largest MVNO (behind Tracfone), Mint Mobile. This would increase T-Mobile’s direct exposure to the value segment and give the company an additional alternative brand beyond Metro.

Speaking of Metro, it was reported on Friday by Wave7 Research (Light Reading article here) that T-Mobile laid off 600 territory managers, retail relationship managers, and indirect retail sales employees. In the Light Reading article, there is a link to Jon Frier’s website post last week detailing how T-Mobile’s retail strategy is changing. It’s a very interesting read. As noted, T-Mobile’s desire to control the customer experience through higher direct store ownership contrasts with Verizon’s intent to move toward increased authorized retailers. Regardless of the number, it’s becoming clear that digital investments (specifically those that result in minimal in-store time) are going to increase, while the number of physical stores decreases.

With each new year comes executive changes, and 2023 proved to be no exception. Stephen Bye, a long-time friend of the Brief, announced that he was leaving Dish Network as their wireless division’s Chief Commercial Officer but would remain involved as a Board member (he’s headed over to lead the Connectivity division of Ziff Davis, owner of Ookla and RootMetrics). In an unsurprising development, Comcast also promoted former Goldman Sachs managing director (and terrific telecom analyst) Jason Armstrong to CFO, replacing Michael Cavanagh, who was recently named President. We wish both well in their new roles.

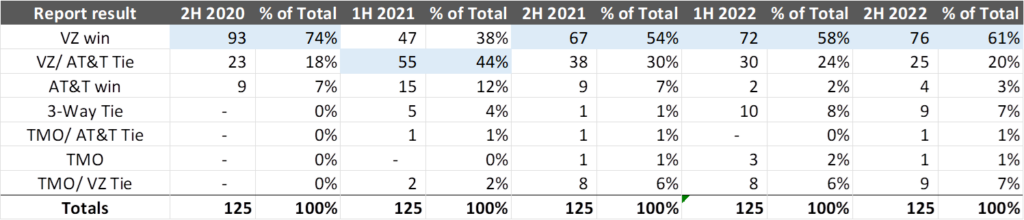

Speaking of Ziff Davis and specifically RootMetrics, the results of the 2H 2022 RootScore Metro reports are as follows:

Not surprisingly, Verizon was the overall winner with 76 outright wins. Verizon has slowly been clawing back to their dominance of 2019 and early 2020 (pre-AT&T FirstNet and pre-TMO/Sprint merger). New York City/ Tri-state, Los Angeles and Phoenix are three metro areas where Verizon has consistently won the overall RootScore award.

The second highest frequency remains a Verizon/AT&T tie, with about one in five markets achieving this designation. This category has been anything but static, with AT&T and T-Mobile flipping traditional Verizon strongholds like Chicago (now Verizon/ T-Mobile tie), Philadelphia (now Verizon/ AT&T tie), Atlanta (now Verizon/ AT&T tie), Boston (now Verizon/ AT&T tie) and Washington DC (now Verizon AT&T tie) all moving away from outright Verizon wins. AT&T appears to be aiming for market tie quality (vs. quantity), and interestingly is achieving it in many traditional Verizon incumbent telephone territories.

T-Mobile started to make their move in the RootMetrics rankings in the first half of 2022, with 21 of 125 markets naming T-Mobile as a winner (most in a tie). That number held in the second half of 2022 even as both AT&T and Verizon began to deploy C-Band spectrum. Overall, it’s still a Verizon world according to RootMetrics, but their counterparts at Ookla might see it as less clear cut (see here for their latest US results).

CES – still worth attending? Absolutely.

We spent two full days at CES to start the year, and this year’s show had the feel of pre-pandemic years. Yes, there were a few empty booth spaces, and a smattering of mask wearers, but each of the themes we discussed in the last Brief were on full display in Las Vegas. Every year the logistics get better, and, with a new West Hall, there are more opportunities than ever to achieve a 30,000-step day.

The John Deere keynote (here – starts at minute 52) highlighted the role of hardware development in the future of agriculture. They tackle a big problem many farmers face in 2023 – a doubling/tripling of the cost of fertilizer – through the implementation of leaf recognition. Specifically, the distinction of a corn or soy leaf from everything else (which, by definition, is a weed). The ability to distinguish and immediately act (and save farmers a lot of money) separates the concept of precision herbicides from other products and services presented at the show. It also got us thinking about how this large-scale product could be “consumerized” and improve the highly inefficient home fertilizer process used by millions of homeowners today.

If CES 2023 is a predictor of future health trends, we are going to be expanding consumer health care to include urine analysis. Withings, one of the leaders in consumer health care electronics in the home, introduced their U-Scan product (see nearby picture from the show floor). Rather than attempt to define all of the medical benefits (or potential abuses) of urine analysis, I’ll defer to this article from Daniel Cooper at Engadget – worth a read if you are interested. As shown by the picture, there was a lot of interest in the technology and, as the article suggests, other companies are jumping into the problem head on.

In addition to the Withings booth, there was a throng of folks around the latest temporary tattoo technology called Prinker. They were offering free samples (we did not partake but many did) and the finished product was very professional. Each set of cartridges has enough ink for 1,000 tattoos, perfect for your next tailgate (what could go wrong?) or even corporate kickoff. More on the Prinker technology here and it’s available on Amazon (limited supplies) here.

As we mentioned at the beginning of this section, things felt more like past CES shows. The off-floor conversations were no different, and the buzz around virtual reality (VR) and artificial intelligence (AI) was real. Smartphone presence is diminishing (Samsung’s unboxing event is coming up Feb 1), and laptops and gaming developments failed to excite as much as past shows. Smarter, more electrified (if that’s possible), and data rich electronics are headed our way – how they will contribute to everyday productivity and efficiency remains anyone’s guess.

Q1 earnings hints from the Citi conference

Concurrent with the start of CES, Citi held a conference in Scottsdale where AT&T, Verizon, T-Mobile and others spoke. For those of you who missed it, here’s a summary of the information gleaned from their presentations:

Verizon led off the conference speakers with Hans Vestberg and Kyle Malady. The headline of “positive consumer postpaid phone net adds” was encouraging enough to make the stock pop. Additional headlines include:

- 2023 is the year of mobile edge compute and 5G private networks

- Fixed Wireless Access is going to continue 3Q 2022’s strength

- Core Capex is going to come down for Verizon in 2024 to $17.0-$17.5 billion

- Verizon will pass 200 million C-Band POPs (the magic number for being able to tout “nationwide”) in 2023

- Consumer and network business units are going to be more harmonized

- Verizon Business continues its momentum

- Promotions are going to have more of a short-term impact (vs. long-term amortized impacts like “free phones”)

- Net additions are less important than base value creation. Hans: “We are going to preserve our premium, and we are going to preserve the growth of our service revenue.”

- No sign of payment issues in the consumer or business base

- By end of 2025, Verizon will have 4-5 million fixed wireless customers

- $47.5-48.0 billion total EBITDA guide for 2022 remains intact and will be the basis for 2023 EBITDA growth

That’s a lot to say in one conference, and it leaves a lot of questions about profitability and cash flow. Our view is that Tracfone integration/ segmentation will be an important part of 2023 (Wave7 already reported in October that Walmart’s StraightTalk has launched a fixed wireless product) and a key source of EBITDA improvement.

The biggest question from Verizon’s Citi presentation is “How will the consumer promotional environment change?” and specifically “How will front-end loaded promotions work with handsets?” The hangover from previous promotional activities is going to take years to amortize, and Verizon just completed a “Free iPhone 14 Pro on Us” promotion. Verizon’s promotional strategy for consumer is going to undergo change – will others follow?

It’s important to note that from the end of 2019 (pre-pandemic) to last Friday, Verizon’s equity market capitalization has declined by $76 billion. During that same period (pre-pandemic, pre-Sprint merger approval), T-Mobile’s market capitalization has increased $119 billion. Nearly $200 billion in relative market capitalization changes since Jan 1, 2020 is hard to swallow for Verizon’s shareholders and Board. There’s a lot to correct – more will be required than better segmentation and increased harmonization.

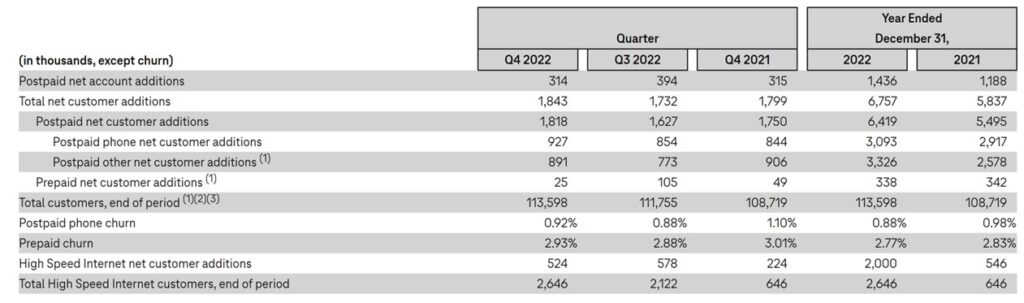

Speaking of T-Mobile, their CFO Peter Ozvaldik took yet another verbal victory lap in his Citi presentation. Here are their pre-released results (link here):

Account additions slowed even as net customer additions improved, implying that customers either a) upgraded to multiple RGUs per account from a single RGU – think adding phone accounts to a High Speed Internet account, or b) added family-style accounts out of the gate, perhaps as a result of T-Mobile’s “Four for $100” promotion. We think that the second option might have been a bigger driver, as Peter disclosed that less than 1% of the gross additions for the quarter actually came from that offer (in-store upsells worked).

Also of note is the slowdown in High Speed Internet customer additions, likely driven by seasonality (fewer movers during the winter). T-Mobile’s addition of 2 million High Speed Internet customers is nothing short of phenomenal considering the discipline they are exercising in limiting growth to excess capacity.

Peter also disclosed that T-Mobile for Business continues to grow but also implied that there is plenty of room for further growth in 2023. He also indicated that they would be updating shareholders on their share buyback program when they announce earnings.

T-Mobile’s focus on growth sets up a battle with cable (specifically Charter and Comcast) and the Tracfone division within Verizon. Purchasing Mint Mobile adds a brand, but their largest MVNO will do just fine on their own in a strong, exclusive relationship. Besides the T-Mobile for Business integration (and an update on their Lumen strategic partnership), our biggest question centers around how their soon-to-be majority German owners will change T-Mobile USA’s current growth-focused strategy. We do not see any evidence yet, but Deutsche Telekom may have a different view once they are in full control.

Finally, CFO Pascal Desroches updated shareholders on AT&T’s progress. Details were very light. Besides the use of the word “disciplined” four times in his opening statement, Pascal stated the following with respect to wireless: “AT&T will no longer be the share donor in the industry. We’re going to grow, commensurate with industry growth.” This seems to indicate that the fourth quarter, absent some iPhone 14 Pro and iPhone 14 Pro Max backlog issues, will largely continue the churn and the cost trends of previous quarters.

On fiber, Pascal’s statement was equally as telling: “We have been surprised just how favorably fiber has been received. The long pole tent is getting fiber to the home. Once it’s there, it’s a product that sells itself.” Quite frankly, this is a real headscratcher to us. AT&T has been in the broadband connectivity business for at least two decades – why are they surprised at the demand for well-engineered, well-deployed, well-branded new fiber? It will be interesting to see the full P&L here including non-fiber net losses, but this also portends some good news when they announce results.

Finally, on the AT&T Business front, Pascal said the company was “hit more significantly than we expected by higher access costs where we are using third-party carriers for some of our enterprise traffic and also some of the public sector business that we have done historically because of the timing of the budget cycle didn’t come through in the timing we expected.” There’s a lot to parse here, but it adds to the theory we discussed in the last Brief (link above) that part of the BlackRock Gigapower venture is to address these third-party access costs (including those for wireless) and, by doing so, improve long-term margins.

As Pascal stated, AT&T is still cleaning up from the tens of billions of excess debt left over from DirecTV and WarnerMedia purchases. The company is not out of the woods yet, and in-region fiber initiatives will not deliver full discounted cash flow returns for several years (although EBITDA growth will occur, especially when the legacy copper networks are fully shut down). AT&T is as much a story about deleveraging as it is about fiber and 5G transformations.

That’s all the time and space we have for this week. On January 29, we will be in the thick of earnings calls and we are sure that they will raise additional questions. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Until then, Go Chiefs and Davidson Wildcat basketball!