Fewer than 1.2 billion smartphones were shipped worldwide in 2022

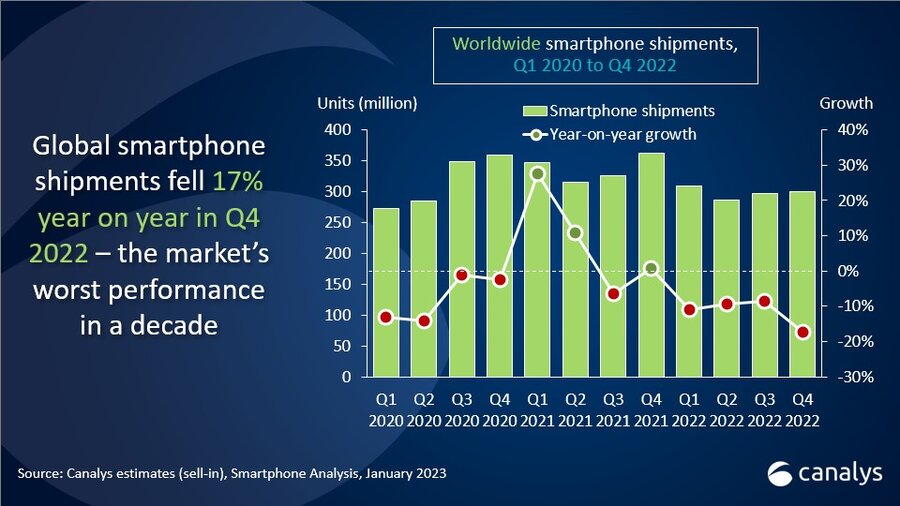

According to a recent report by analyst firm Canalys, 2022 was one of the worst years for global smartphone shipments in nearly a decade, with global shipments dropping roughly 11%. The highest drop was recorded in the final quarter, with worldwide shipments falling 17% from the previous year. All in all, said Canalys, the total number of shipments for the entire year came in under 1.2 billion.

“Smartphone vendors have struggled in a difficult macroeconomic environment throughout 2022. Q4 marks the worst annual and Q4 performance in a decade,” provided Canalys Research Analyst Runar Bjørhovde. “The channel is highly cautious with taking on new inventory, contributing to low shipments in Q4. Backed by strong promotional incentives from vendors and channels, the holiday sales season helped reduce inventory levels.”

He added that in the first three quarters of 2022, low-to-mid-range demand fell fast, but it was high-end demand that began to show weakness in Q4. “The market’s performance in Q4 2022 stands in stark contrast to Q4 2021, which saw surging demand and easing supply issues,” said Bjørhovde.

Despite the shrinking demand and market challenges in China, Apple not only reclaimed the top spot in Q4, but it also achieved its highest quarterly market share ever at 25%. Samsung followed with a 20% market share; however, the Korean vendor snagged the title of top vendor for the full year. Xiaomi, again, came in third, although it experienced a market share decrease down to 11% in Q4, which Canalys said was caused by challenges in India. Completing the top five, OPPO and vivo claimed 10% and 8% market shares, respectively.

“Vendors will approach 2023 cautiously, prioritizing profitability and protecting market share,” said Canalys Research Analyst Le Xuan Chiew. “Vendors are cutting costs to adapt to the new market reality. Building strong partnerships with the channel will be important for protecting market shares as difficult market conditions for both channel partners and vendors can easily lead to strenuous negotiations.”