Note, this article follows directly from a previous post (January 24) – about why logistics is the hardest industry of all for the IoT market to crack; both are taken from a new editorial report on the state of IoT in the supply chain sector, released this month (January 2023), and available to download here. The report features additional information, interviews, and case studies.

So we understand the challenge, then; that the supply chain, floored by pandemic lockdowns and broken confidence, is being messed up further by geopolitical and economic factors. And that the ‘little man’ has the most to lose – and, properly equipped, the most to win as well. Which is the cue for IoT, to enter stage-left, as the micro solution for the techno-edge, to be multiplied into masses of tracking apps – and made into a macro solution to a macro problem.

We should consider the idea of ‘the edge’, briefly; US IoT specialist Telit has a useful view of it. “We talk about the ‘first mile’, where all the legacy talk is about the ‘last mile’,” comments Marco Stracuzzi, head of product marketing at the firm. “Telcos think about the end of the network. In IoT, the logic is reversed. IoT starts at the edge, with the ‘things’. So we talk about the first mile – getting data from devices in the field, bringing it to the cloud.”

He adds: “That first mile [of connectivity] bridges the gap between the devices at the edge and the applications in the cloud, to drive business decisions.” There was a time, even 12 months ago, when this report would have descended at this point into a blow-by-blow account of the relevant merits of different IoT connectivity technologies and the attendant trade-off in hardware functionality to bring prices in line with business cases.

But that discussion, particularly about different low-power wide-area (LPWA) network technologies, has already been had; more importantly, its value has eroded as the total solution has improved. Enterprises interested in taking data from rangy logistics operations, particularly as assets go ‘on the road’, are no longer required to start with the tech, just to figure out what it can do. The sense is they can start with the problem, and trust that a solution will be found.

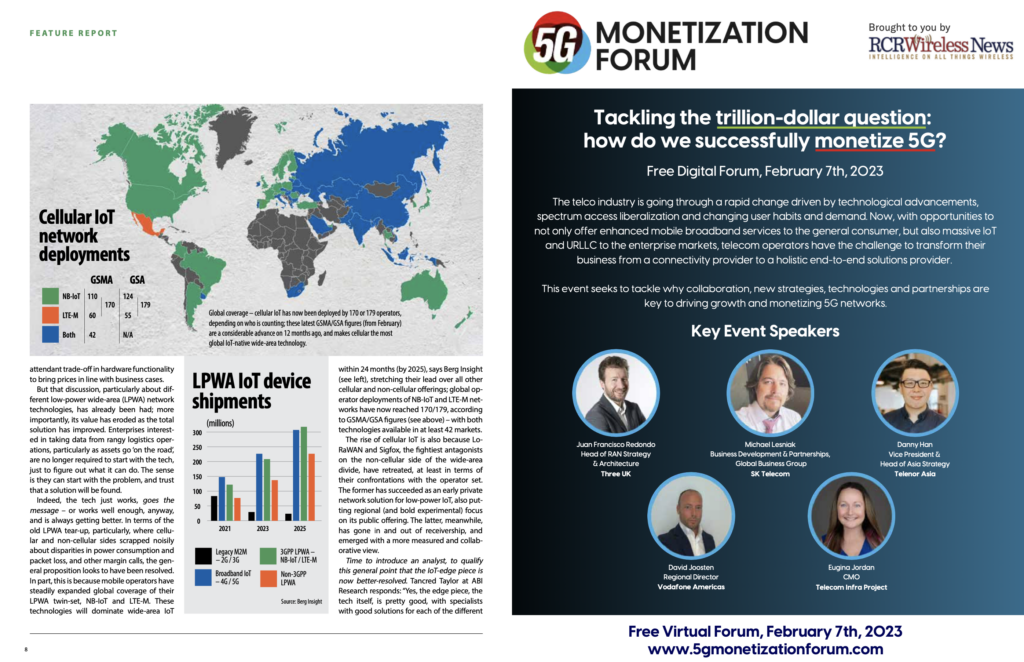

Indeed, the tech just works, goes the message – or works well enough, anyway, and is always getting better. In terms of the old LPWA tear-up, particularly, where cellular and non-cellular sides scrapped noisily about disparities in power consumption and packet loss, and other margin calls, the general proposition looks to have been resolved. In part, this is because mobile operators have steadily expanded global coverage of their LPWA twin-set, NB-IoT and LTE-M.

These technologies will dominate wide-area IoT within 24 months (by 2025), says Berg Insight (see report), stretching their lead over all other cellular and non-cellular offerings; global operator deployments of NB-IoT and LTE-M networks have now reached 170/179, according to GSMA/GSA figures (see report) – with both technologies available in at least 42 markets.

The rise of cellular IoT is also because LoRaWAN and Sigfox, the fightiest antagonists on the non-cellular side of the wide-area divide, have retreated, at least in terms of their confrontations with the operator set. The former has succeeded as an early private network solution for low-power IoT, also putting regional (and bold experimental) focus on its public offering. The latter, meanwhile, has gone in and out of receivership, and emerged with a more measured and collaborative view.

Time to introduce an analyst, to qualify this general point that the IoT-edge piece is now better-resolved. Tancred Taylor at ABI Research responds: “Yes, the edge piece, the tech itself, is pretty good, with specialists with good solutions for each of the different parts – offering good wide-area capabilities, good short-range capabilities, and now satellite as well. All these give you an IoT device with the right battery for lots of supply-chain use cases.”

For the record, ABI Research has its own neat-looking forecasts about logistics-tech to consider; revenues generated by various digital-type solutions in the global supply-chain industry will jump at a compound annual rate of 11 per cent over the coming years, it reckons, reaching $440 billion by the end of 2023. In sum, the supply chain will generate $4.6 trillion in 2023 by combining technologies and services, an increase of 29 per cent from 2018.

ABI Research perceives “three primary tenets” of a successful change strategy for supply-chain companies: visibility, intelligence, and efficiency. These are spurred by a bunch of different tech items, including IoT, robotics, blockchain, augmented reality (AR), “and especially AI”, it says. Indeed, AI is the key delivery mechanism for business change (intelligence, begetting efficiency). By contrast, IoT is one of the first staples (to extend visibility).

We will stick with IoT, for now, to further consider how it has come of age in the logistics sector and broader Industry 4.0 landscape – a look at the state of ‘things’, if you like. (Later sections will look at the analytics to turn visibility into intelligence.) In particular, cellular IoT is worth a second pass, as a global solution – and to hear more from Telit, which has ratcheted together a hardware, connectivity, and software bundle to cover the whole cellular IoT stack.

An aside; the short-range piece has been around longer (and will be addressed shortly in this report as an adjunct to the wide-area focus), and the super long-range satellite piece is more nascent (and is the subject of a separate report in 2023); satellite IoT is also more niche, notes Stracuzzi, responding to a prompt about the PR line from satellite operators that most of the planet (75-99 percent, depending on who says) is not covered by terrestrial IoT.

He says: “Yes, but it is like saying 80 or 90 percent, or whatever, of the world is water. It is true. But people don’t live on the ocean. Yes, with satellite, you can get coverage on the ocean as well – which is useful for container tracking – and in remote areas like deserts and forests. In those scenarios, satellite connectivity is complementary, for sure. But, today, it is a lot more expensive than cellular – so it only makes sense where cellular is unavailable.”

Back to cellular, then; ABI Research reckons cellular-based LPWA networks (LTE-M and NB-IoT) will account for three-quarters of asset trackers in 2023. Stracuzzi’s colleague, Noam Shany, connectivity product marketing director at Telit, picks up the company’s story about global IoT airtime for global IoT tracking. “A major part… is to support mobility between continents – with the right technology at the right price in global markets,” he says.

“That [combination] is a game-changer in the tracking market. Our MVNO proposition is pretty much perfect for markets like that.” It is worth reviewing the technical minutiae of its virtual network (MVNO) offer. Telit offers both multi-IMSI and eUICC roaming, where the first (Telit NExT) relies on deals with global partners (IMSI donors; mostly operators) to support different cellular technologies on a single SIM profile, and the second (Telit NExTPlus) introduces a second software-defined (eSIM) profile in the same SIM to authenticate subscribers on roaming-restricted networks in certain geographies.

Telit has “four-to-five” different IMSI donors, explains Shany; the mix provides extended coverage, he says, and access to different prices in different regions. “It is a perfect blend, providing cost efficiency and coverage support – in case one has strong coverage on NB-IoT, and another on LTE-M, for example. The solution is always customised according to the technology, the cost, and the deployment area,” he says.

“The multi-IMSI solution assigns multiple SIM identifications, which rely on roaming with IMSI donors, and provide continuous support for multiple cellular technologies. But some countries – the US, China, Turkey, some others (see right) – impose restrictions on permanent roaming, which relate specifically to IoT because you are not in the country for a week as a tourist, but often for the long term. And roaming is supported in these places with the eUICC solution.”

He adds, by way of explanation of the auxiliary eUICC software switch for restricted markets: “[The] eUICC [solution] provides two different profiles, typically, so you have another alongside the multi-IMSI profile with a specific carrier in a restricted market, such as in the US. This second profile is in sleep mode until it is woken in-market, with that carrier. If the solution is deployed in Europe, say, we engage the multi-IMSI profile on the Telit bootstrap profile.

“If it goes into restricted markets like the US or China, for example, then the local carrier profile can be activated. The eUICC solution provides the ability to switch between profiles; it is a mix-and-match between the multi-IMSI and eUICC solutions, customised per use case and customer demand.” A second SIM profile brings additional cost, he notes – so the eUICC provision “should be relevant to the use case”.

As a fix for global IoT airtime, it looks comprehensive; but the MVNO space is crowded, right? “You can say that again,” answers Shany. “There are over a hundred that we know of.” NTT-owned Transatel, also quoted in this piece (see report), is one, it might be noted; its profile is somewhat different insofar as it has been largely focused on broadband for automotive apps, with a developing line as a public 5G appendage for private 5G apps, as well.

There are countless others, too, most with different profiles. This is not the forum to compare them all, but the brand chaos in the IoT airtime market begs a question about further differentiation, and the answer from Telit sounds reasonable. “We have been in the IoT space for more than 20 years; we are one of the three biggest module vendors in the world, and the biggest western one, for sure,” says Shany, before getting to a point about timing and intimacy.

“So we have an early advantage against all of our straight MVNO rivals – because we are already engaged with customers at the hardware level. Which initiates a discussion around connectivity and everything else. You don’t just buy hardware one day, order connectivity the next day, and then deploy a solution in the field. Hardware takes time; normally about a year. So we know about the project and its demands, and what is needed in the way of connectivity.

“It means we also know what is needed to connect the whole thing together. Because you need the right connectivity management platform (CMP), as well. That is the sweet spot for us – we know the project from the start, we know the hardware because it’s ours, and we have the CMP to bring it all together.” The Telit NExT platform is interesting, as a facility to eke out more coverage, power, and money from cellular-based LPWA solutions.

Enterprises can switch IoT devices in-market dynamically from one operator to another, “depending on the best signal in a specific location,” says Stracuzzi. The point is to get the data from the edge to the cloud in an efficient manner; signal efficiency saves battery power, he notes, and therefore extends life and saves money. Meanwhile, its module-embedded OneEdge software offers flexibility to use LwM2M as the main protocol channel for IoT tasks.

The alternative is to specify a secondary channel to link data directly to third-party cloud services, typically using IP-native HTTP and MQTT protocols. Again, the point is efficiency, adds Stracuzzi. “Most cloud systems have not been designed for IoT; the de-facto IoT standard is LwM2M, which can transport data over a cellular network the same as MQTT, but with much smaller overheads. Which makes the communication more efficient.”

Can logic be implemented to automatically switch between network and transport protocols, to achieve the longest battery or the lowest cost, for example? “Absolutely,” says Stracuzzi. “You can do that in the SIM so it selects… the best rate, or the best signal, or gives priority to NB-IoT. You can do that in the device, as part of the configuration, and you can do it in the portal. It is the same dashboard – a single pane of glass for SIM and module management.”

The rest of this article appears in a new editorial report, available to download for free here.