Greetings from Louisiana, Texas, Kansas, Missouri, and Florida (Ft. Lauderdale, the location of this year’s MetroConnect conference, is pictured). It’s been a full week of Telco Top Five earnings, and we will devote most of this Brief to results analysis. For those of you who need the remaining earnings schedule, here are the remaining companies’ earnings report times and dates:

| Company | Date | Time |

| T-Mobile US | Feb. 1 | before market open |

| Meta | Feb. 1 | after market close |

| Alphabet | Feb. 2 | after market close |

| Amazon | Feb. 2 | after market close |

| Apple | Feb. 2 | after market close |

The title of this week’s Brief highlights the variety of ways three companies are trying to create value. This week, we will focus on AT&T, Verizon, and Charter’s different strategies. After T-Mobile announces earnings, we will bring their results (and likely Lumen’s) into the conversation and discuss who is best positioned to generate the most shareholder value.

The fortnight that was

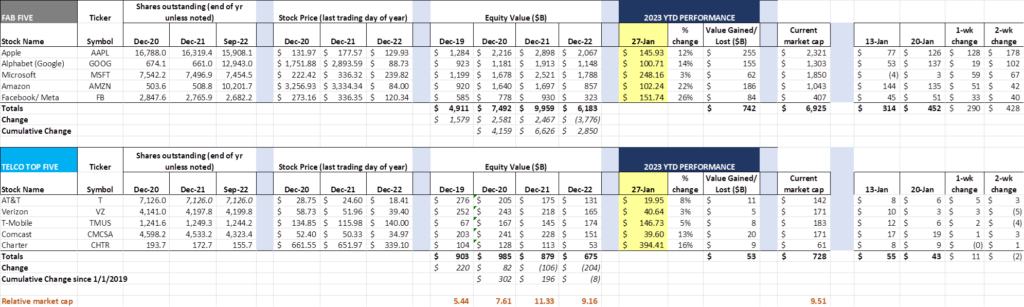

This was another positive week for both the Fab Five (+$290 billion wk/wk) and the Telco Top Five (+$11 billion). Each stock except for Charter rose (and Charter’s loss was minimal). So far in 2023, the market value leaders from each group are Apple (+$255 billion) and Comcast (+$20 billion). On a percentage basis, the leaders are Meta (26% gain) and Charter (16% gain). While these gains only put a small dent in 2022’s losses, the hole is not getting deeper.

The big news comes this week, with each of the Fab Five (less Microsoft, who reported last Tuesday) releasing fourth quarter earnings. Earnings prospects are on everyone’s mind. We will be watching cash and net debt balances and will update each in next Sunday’s interim Brief.

Speaking of which, prior to reporting earnings, Microsoft confirmed that they are making a “multi-billion, multi-year” investment into the parent company of ChatGPT, OpenAI. The New York Times reported (here) that Microsoft made additional investments totaling $2 billion in addition to their original investment in 2015. We suspect that some/ most of this invetment is in the form of Azure computing resources, a fundamental ingredient of an effective AI engine. As we mentioned in previous Briefs, we agree with the Times’ assessment that Microsoft’s use of AI technologies will extend well beyond progamming code snippets and answers to diabolical trivia questions. How the company integrates OpenAI without stifiling continued innovation will determine the impact of the investment on Microsoft shareholders.

Different disciplines

It’s a common theme during earnings season. Share takers celebrate their newfound growth, while share losers tout their ability to make disciplined decisions. Net losses are offset by price increases on the existing base (one industry analyst has called this an “ARPU Band-Aid”). All of the companies reporting earnings over the last week are both share takers and defenders, playing both offense and defense, but usually there’s a theme for one or more dominant lines of business.

This quarter, one company applied discipline yet grew market share. They did not bundle wireless with content, but instead replaced that content partnership with persistent and voluminous advertisements of a store employee rotating an sign touting the consistency of their offers for both existing and new customers. Rather than Apple Music or Netflix, they chose to spend marketing dollars on an old school traditional spokesman endorsement (LeBron James).

AT&T stayed on topic, and that discipline paid off in last week’s earnings announcement (materials here). They grew postpaid wireless phone subscribers while keeping churn flat. They cut costs throughout the business. They reduced the number of (voice and copper-centric) products they sell and support. They focused attention on half of their traditional footprint and, as we discussed exactly a year ago, let the other half of the footprint slowly bleed. On wireless, they stuck to their “current customers get the same deal” knitting. On fiber, they steadily filled in their urban and suburban residential and small business patchwork architecture.

All of this is beginning to pay off. While shareholders are still recovering from the near-fatal wounds of previous management decisions (which left a “spare tire” of debt on the current AT&T), John Stankey and his team are disciplined, and that should concern Comcast, Cox, and Charter.

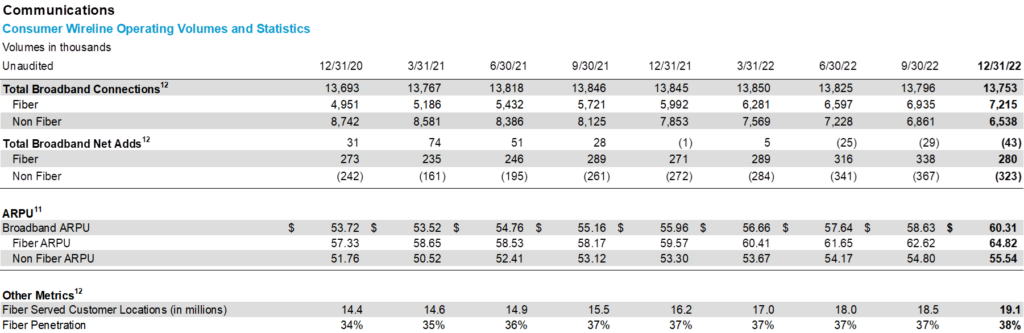

The table above (from AT&T’s earnings report) details the subscriber movement to newly deployed fiber areas. In the past, we have described this as a “one for one” swap, and, while that is largely true on the bottom line, the deeper reality is likely this:

- AT&T deployed fiber in a suburb and signed up a subscriber. Cost of new drop install, any meaningful marketing expense including promotions are booked.

- AT&T churns off a customer in a legacy copper market (likely to cable, T-Mobile fixed wireless, an RDOF overbuilder or a rural fiber overbuilder). Revenues and profits from that customer are lost, but there is likely no material depreciation expense given the age of the copper in the ground. There are some operating overhead costs that continue but are offset by higher gross margins from the fiber gross add.

With AT&T indicating that new fiber subscribers were loading in at $70 ARPU and existing copper customers are churning off at $50-55, there’s a bottom-line impact to their strategy. While this may impact their ability to compete with wireless services in several years (due to lower network volumes), it’s a wise yet painful decision.

We will have some additional comments on the Gigapower transaction as the deal is finalized and the terms released. However, one of the opening comments by John Stankey caught our ear: “If I were to draw parallel to this partnership approach, I’m reminded [of] the early days of wireless where the race to grow footprint was somewhat

time-bound and facilitated by a similar approach ultimately culminating in today’s national networks.” Stankey goes back later on in the Q&A and reiterates this comment in a reply to Phil Cusick. We are sure that many of the Sunday Brief faithful also caught that comment. More in the next Brief.

Bottom line: AT&T exercised discipline in 2022. They held/ gained share in wireless, and grew local share where they are deploying fiber. They are not out of the woods yet, but their plan is beginning to impact their competitors.

Charter Communications reported earnings last Friday (materials here). Like Comcast, the conversation emphasized mobile growth (although Charter’s eye-popping 600K net additions in the quarter dwarfed their cable peer). This is particularly amazing given the lack of iPhone 14 Pro and Pro Max supply (and may also provide some hints into the overall customer demographics at this point in Charter’s mobile lifecycle).

As was characterized on the call by Charter Chairman Tom Rutledge, the gross margin for mobile is not as good as High-Speed Internet, but much better than video services. New CEO Chris Winfrey also characterized the Spectrum One product as “early on” in the lifecycle and stated that the “second/third line free” offer to the existing High Speed Internet base was a bigger driver of the gains. The jury is out on the long-term effectiveness of Spectrum One as a blockbuster (it does not appear to be in the Triple Play category of the mid-2000s, at least yet). When the $49.99 promotional price point jumps to $114.99 at the end of next year, we will learn.

With such a strong mobile quarter, we wonder what that number could have been achieved had a) iPhone supplies been more plentiful; and b) Verizon not responded with their bare bones/ Bring Your Own Device offer of $25/ line late in December. They definitely attracted the attention of T-Mobile and Verizon, and set the stage for a more competitive 2023.

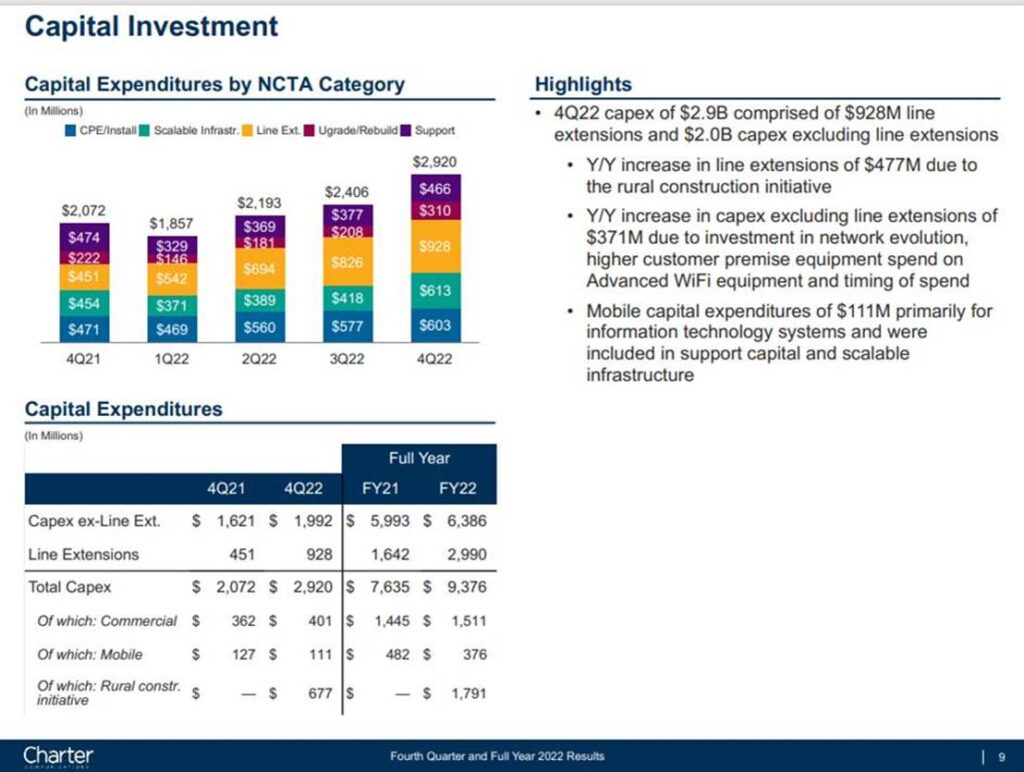

The slide causing the most angst on the call centered around capital, driven by rural builds (see nearby). Charter indicated on the call that they will exceed the minimum 40% threshold (RDOF requires that Charter complete at least 40% of the buildout in a given state by the end of 2024) and, in fact, accelerate completion. We presume this is not only to prove their build capabilities to state regulators, but also to pave the way for additional state funding (commonly referred to as BEAD). In addition to accelerating their builds, Charter disclosed that their early take rate in these rural areas was “around 40%.” We can only assume that there’s some additional video revenue attachment as well with that immediate share. Great for Charter, but not good for the legacy satellite Internet and video providers, telco DSL and local Wireless Internet Service Providers (WISPs).

Charter’s focus will continue to be rural construction and market launches for the foreseeable future, but they will also be fighting AT&T’s broadband expansions in Dallas/ Ft Worth, Los Angeles, San Antonio, St. Louis, San Diego (with Cox) and Austin (and, to a much lesser extent, the effects of a reinvigorated Fios and 5G Ultra Wideband product from Verizon).

They are also experiencing some fallout in broadband with lower-demographic customers, with the company citing a small segment of customers “returning to mobile-only service.” This, plus Charter’s additional comments about MDU mover churn, provides additional insight into the fragility of some of their COVID-related additions. The company also cited some losses to fixed wireless providers (presumably T-Mobile) but views these losses as temporary. We aren’t entirely confident this is the case, but one successful “win back” campaign could prove us wrong.

Bottom line: Charter’s leverage tightrope walk continues, with debt to EBITDA ratios increasing to 4.47x and ~$12 billion of their debt to be refinanced or paid off in the next 36 months. Their mobile and rural strategies are the most aggressive of any of their cable peers, and they continue to hold the line on revenues per household. Disciplined evolution with respect to mobile promotions, disciplined expansion into low density markets, and disciplined execution to defend against fiber and fixed wireless competitors is a good summary of their 2023 and 2024 plan.

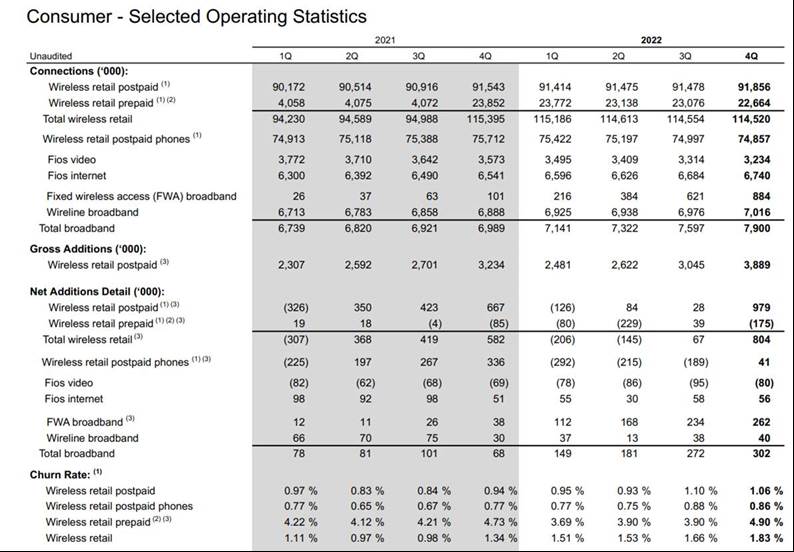

Finally, Verizon announced earnings last Tuesday (materials here). As we presumed, Verizon walked the “consumer postpaid phone net additions” tightrope up to the last week of December. In one of their YouTube videos (here) posted early last month, Hans Vestberg emphasized the importance of every front-line employee “focus and finish strong.” We did not understand the importance of that comment until seeing the 41K net additions figure (as well as the significant drop in inventories to $2.39 billion). As we said in the previous Brief, kudos to the team – positive net adds delivered.

Based on our Apple iPhone 14 Pro and Pro Max tracking, we assume that T-Mobile and AT&T had more Q1 2023 backlog carryover than Verizon. To the extent that the iPhone 14 backlog was driven by new additions as opposed to upgrades, Verizon’s competitors could have a slight net additions advantage in the first quarter.

The bigger story for us is not the consumer postpaid phone recovery, or the introduction of their less frilly Welcome Unlimited plan in December, or even their robust gains in fixed wireless – it’s Tracfone. We expected a volatile first year (driven by different demographics and distribution) and it did not materialize. Here is the relevant Prepaid material from their earnings release:

Between the time that Verizon announced the Tracfone acquisition (September 2020) and its actual closing (in November 2021), Tracfone lost ~1 million subs. In the five full quarters since the acquisition closed, they have lost 530K subscribers. Churn is down below 4% (and, with a mix that includes more Internet and less handset-focused revenues, that figure could go lower), a 20 to 30 basis point reduction. We assume that the 4Q percentage increase results from the 3G network shutdown at T-Mobile as well as some increased acquisition activity from cable and Boost. Based on recent comments at analyst conferences, we do not assume that Tracfone harvesting (prepaid to postpaid conversions) had a material impact on either Tracfone churn or the retail postpaid phone net additions. That opportunity will emerge as a postpaid phone driver in 2023.

Bottom line: While the financial efficacy of the Tracfone acquisition was never in doubt, we wondered how Verizon would handle a transaction of this magnitude. So far, so good.

We will have more commentary on the wireless and broadband market in the next Brief (after T-Mobile and Lumen report results) but would like to conclude with a “Why this time it’s different” thought: The new T-Mobile is a less attractive source of gross additions for Verizon and AT&T today than either Sprint or T-Mobile were over the previous fifteen years. The well of dissatisfied, under-covered, yet creditworthy postpaid opportunities is drying up – quickly – as T-Mobile launches and expands their three-tiered “layer cake” network and delivers a differentiated customer experience. We aren’t sure that this point has been emphasized enough in the post-COVID world and think that it warrants more analysis. Barring any unusual industry news, we will make this the centerpiece of the mid-February Brief.

Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a terrific February and Go Chiefs and Davidson Wildcat basketball!