Ericsson breaks down the current (and future) market for FWA, and outlines how operators can effectively monetize the service

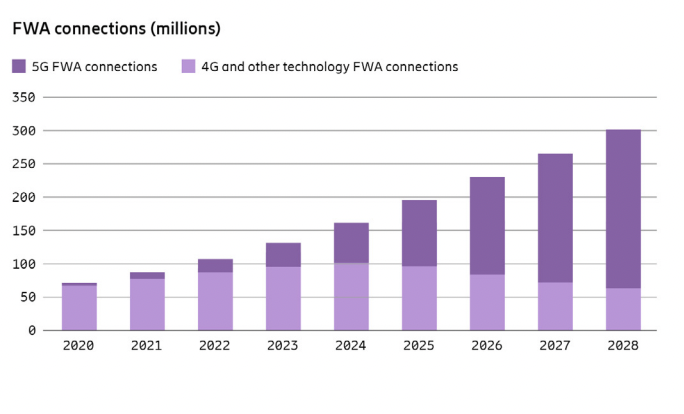

Ericsson conducts ongoing research and monitoring of major developments impacting the global ICT industry, its customers, and itself. With regard to fixed wireless access (FWA), the network infrastructure vendor wrote in a 2023 handbook it published that more than 75% of all operators offer some kind of FWA services. 5G accounts for around 33% of those FWA services, a 50% increase compared to a year earlier.

The handbook identifies two variants: “best-effort” service and a service with a speed-based quality of service, which guarantees specific performance metrics, and comes with higher ARPU compared to a “best-effort.” Some 25% of current offerings are sold against specific QoS metrics.

If you look at the U.S. market, AT&T and Verizon both build fiber, but Verizon has placed much more emphasis on using its cellular network to offer home internet services. T-Mobile US doesn’t do much in terms of building its own fiber, but, like Verizon, is going big on FWA. While the strategy differences can be chalked up to a number of factors ranging from total network capacity to execution ability, Ericsson makes the case for FWA in comparison to fiber by playing up the latter’s faster time to market, lower cost, and ability to re-use existing infrastructure.

Ericsson divides the fixed wireless access market into three segments:

- A “wireless fiber” segment positioned to compete with fiber; “typical sold data rates are 100 – 1,000+ Mbps, and typical ARPU” is $50 to $100.

- The “build with precision” segment competes against DSL; data rates are between 50 and 200 Mbps with ARPU between $20 and $60.

- The “connect the unconnected” segment focuses on rural areas with little to no fixed options; data rates are between 10 and 100 Mbps with ARPU between $10 and $20.

A “surgical approach” for fixed wireless access success

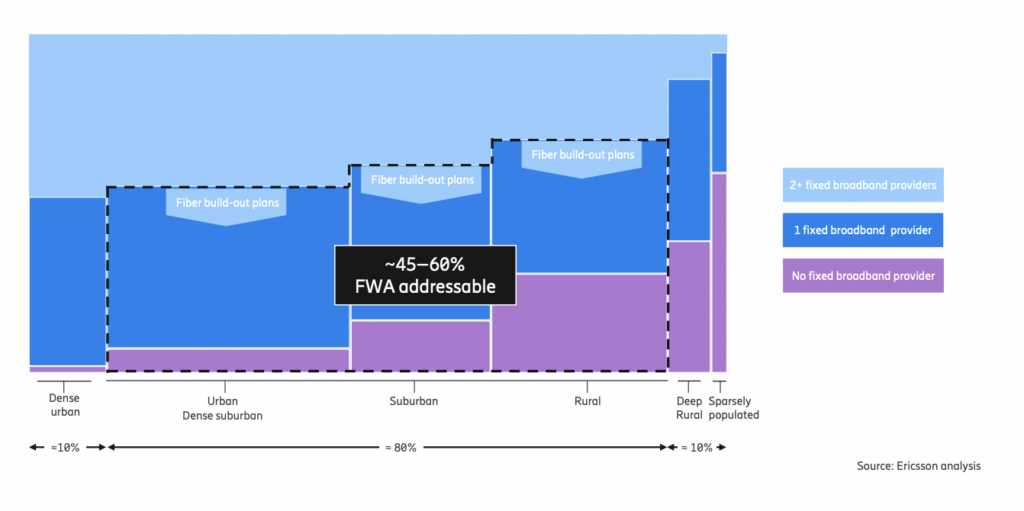

In its handbook, Ericsson said operators should “adopt a surgical approach to selecting areas for” deployment…”A surgical FWA approach starts from the exclusion of less attractive areas based on household density.” In its example, homes in dense urban areas and “deeply rural areas” are excluded, and account for around 20% of households.

“This means that around 80% of households remain addressable, in urban and dense suburban, suburban and rural areas. Next, the attractive areas for FWA deployment are filtered further by analyzing fixed broadband competition and estimated fiber build-out.”

Another factor is the competitive landscape. Ericsson found that, in a hypothetical example, a further 20% of households are excluded given access to two or more providers, leaving a 60% addressable market for fixed wireless access. One more exclusionary pass, based on projected fiber deployments, could potentially exclude another 15% of the market. “Operators who act fast could grab areas for FWA and render competitors’ fiber build-out plans uneconomical.”

Looking ahead, Ericsson sees fixed wireless access connections around 100 million by the end of last year, growing to 300 million by 2028. Further splicing that, the number of 5G-enabled fixed wireless access connection could hit 235 million (of 300 million total) by 2028.

Read an abridged version of Ericsson’s “Fixed wireless access handbook—2023 edition.”