Early Valentine’s Day greetings from Louisiana, Texas, Kansas, Missouri, and Florida. Hard to believe that two weeks ago we were basking in the glory of another Chiefs AFC Championship win. Today’s game will be tough, but, like the 2022-2023 season, Coach Reid and the team always seem to find a way.

This week, after a longer than normal market commentary, we will look at T-Mobile’s earnings in detail. They remain the most valuable telecom company for a reason (which we detail below), but there are questions about whether their high metabolism can endure.

We will also explore the theme we discussed in the last Brief – after a decade of vulnerable, weaker, financially-strapped competitors, AT&T and Verizon face post-COVID reality of a much stronger, financially stronger global powerhouse named Deutsche Telekom. No more family, no more leasing tricks, no more coverage gaps, and no more soft (yellow) underbelly of postpaid individuals and families to plunder. The gross addition game has new rules, and we posit on where it ends up.

The fortnight that was

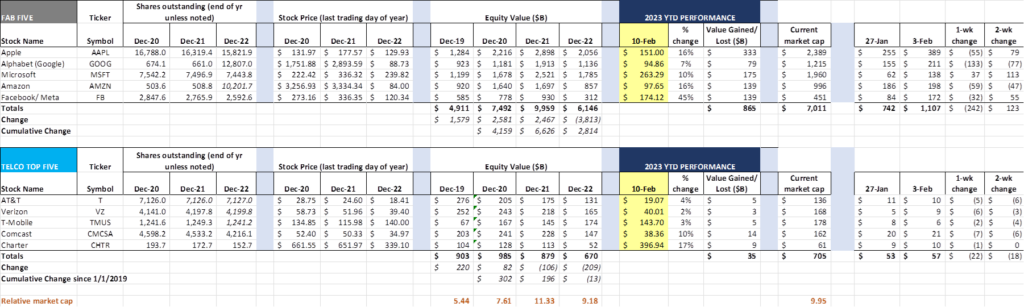

Who needs to wait until May to stay away (origins of that famous phrase are here)? The Fab Five gained over $1.1 trillion at our last report (through January 27th trading), and, as another oft quoted phrase about January as an indicator of full-year market performance, 2023 should be a golden year.

That thesis is being tested in February, and last week’s Fab Five dip of $242 billion, led by Google’s $133 billion loss, have many on edge. While articles about ChatGPT’s impact on search are relevant and important, this week’s volatility is more about the ability of companies like Google and Microsoft to manage a widening range of global technological and competitive challenges as opposed to their ability to get their telescope facts straight (more on Google’s snafu in this Reuters article).

Apple made some headlines last week as their CEO stoked speculation that they could be working on an “Ultra” model lineup. “I think people are willing to really stretch to get the best they can afford in that category” was Tim Cook’s response to a question about the iPhone 14 price increase (earnings webcast here). This strategy is not new to Apple (see the Ultra Apple Watch model specs here) and Samsung recently introduced the $1,199 Galaxy S23 Ultra (specs here). More from Bloomberg’s Mark Gurman here as well as this article from CNET posted yesterday describing Samsung’s and Apple’s ultra-high end strategies.

Disney also made some headlines (beyond their layoff announcement) concerning Hulu’s future. Here’s an exerpt from CEO Bob Iger’s recent interview with CNBC’s David Faber (transcript here):

IGER: Hulu, by the way, is a very successful platform and I think a good consumer proposition. But we’re – everything’s on the table right now. So I’m not going to speculate about whether we’re a buyer or seller of it, but I obviously have suggested that I’m concerned about undifferentiated general entertainment, and particularly in the competitive landscape that we’re operating in. And we’re going to look at it very objectively and expansively.

FABER: If there’s an opportunity, for example, then to potentially sell your interest to Comcast if Brian Roberts were interested, that’s a conversation you would have?

IGER: You’re leading the witness there a little bit. I said we’re open – we will be open minded.

FABER: I just want to make sure because I think the assumption has been that you guys will buy what you don’t already own of Hulu.

IGER: And I think I’m suggesting that isn’t necessarily the case.

FABER: Okay. It’s not that far away from kind of starting to make a decision, right?

IGER: Why it’s on my mind.

Needless to say, the potential sale or spinoff of Hulu made some headlines. Simply put, Disney is either trying to negotiate a lower price to take control (a good negotiating tactic) or really wants nothing to do with the brand (with or without live TV). This would be a very big development and could even lead to Google actions with their wildly successful YouTube TV.

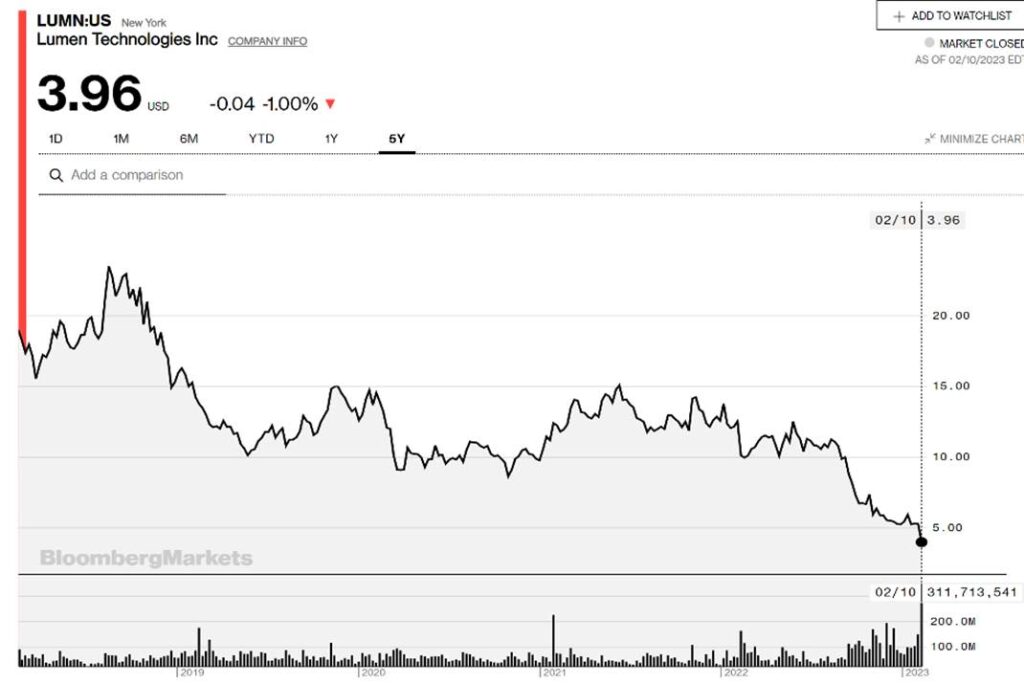

Finally, one of the “Telco Next Five” (Lumen) had a troubling earnings call last week that sent its stock price down 20% in one day. Nearby is a five-year chart from Bloomberg on the company (hard to believe, but the Level 3 acquisition closed in November 2017, just over five years ago). It’s down over 83% since its August 2018 recent high and down more than 90% over the last ten years.

We have commented frequently about CenturyLink over the last decade and not been shy about the questionable decisions of Jeff Storey’s predecessor, Glenn Post III (see our February 2016 Brief here and our February 2013 Brief here). Transformational change is needed, and Kate Johnson will have her hands full for several quarters. Here’s the earnings package – the webcast deserves a listen, and we will come back to it in a future Brief. As (tiny) shareholders in the company, we are disappointed in the results, but think that the company’s strategy could work. It also makes us wonder what’s to come of Brightspeed (assets recently purchased by Apollo) if Lumen made up the more valuabe exchanges. John Stankey’s comment about fiber consolidation (see the January 29 Brief) might be coming true sooner than we think.

T-Mobile’s “grown up” problem

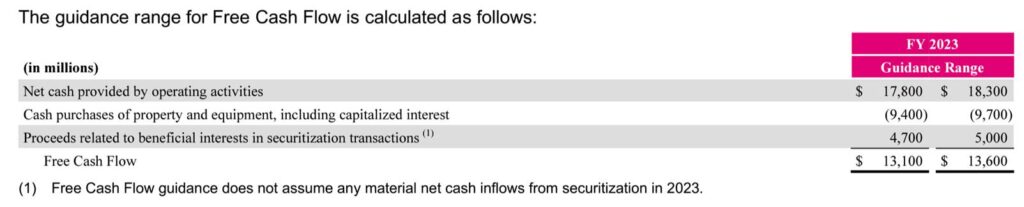

T-Mobile was the last of the Telco Top Five to announce earnings, and they did not disappoint (link to full 4Q 2022 earnings package here). Most importantly, the company generated $16.8 billion of cash from operations in 2022 (inclusive of all synergy-related costs), up from $13.9 billion in 2021 (the 2023 range is $17.8-$18.3 billion).

Capital spending, which peaked in 2021 at $21.7 billion when C-Band and other spectrum licenses are included, is projected to be in the $9.4-9.7 billion range in 2023. Magenta is projecting that they will generate $13.1-$13.6 billion in free cash flow (see chart above).

If all of the free cash flow were applied to current net debt ($69.98 billion as of 12/31/2022), and T-Mobile hits their low end of 2023 EBITDA guidance ($28.7 billion), they would have a leverage ratio of ~ 2.0x, down from 2.5x at the end of 2022 – that’s the impact of a well executed acquisition. Given their existing refinancing rate announcements, however (much of the merger was financed below 5.0% fixed rates), this might not be a good use of excess funds.

With some debt redemption on the table, the question now becomes “What to do with the excess cash?” It appears from comments made by T-Mobile’s CFO, Peter Osvaldik, that at least a portion of the proceeds will go to buybacks:

“I think the important thing is that the strategy hasn’t changed other than, of course, the ability with the financial performance of the company to initiate those earlier. And so we couldn’t have been more excited to get that first $14 billion through Q3 approved, and you saw we delivered $3 billion of that in 2022. We continue to have line of sight to the up to $60 billion. And so nothing’s changed with regards to the strategy. We’re very excited about the cash flow generation of the business and the flexibility that [FCF] provides.”

Assuming that Deutche Telekom, the German-based parent company of T-Mobile USA, does not redeem their shares, majority control of the company will quickly translate to a single shareholder. Everyone knew that this was coming when the terms of the Sprint merger were disclosed, but now reality sets in.

Will anything change with German-controlled investors? Not likely. But it also likely means no “moonshots.” As a global holding company of international assets, it’s possible that investments could be diverted elsewhere (if opportunities to acquire and transform mobile providers exist abroad) in a diversification play. Both T-Mobile USA and parent Deutsche Telekom stocks have appreciated in value over the last five years (53% for DT and 134% for T-Mobile USA). Both have limited opportunities to pay down debt.

Another alternative is that T-Mobile begins to pay a dividend. We consider this to be a “carrier” move, and only one that the company would consider if it wanted to have a dividend mechanism in place (so pay a nominal dividend of 2-2.5%). This would broaden the attractiveness of the stock to include more income-oriented funds. It’s a possibility, but, seeing the pain AT&T went through changing their dividend level in 2022, it’s highly unlikely that T-Mobile’s dividend will be a major reason for investors to purchase the stock.

This leaves two additional options:

- Look at acquisitions that would enhance the current T-Mobile USA business (not a lot left in wireless except perhaps Mint Mobile, and CEO Mike Sievert did not leave a wide door opening for fiber-related acquisitions), or;

- Hold the cash for future opportunities (a la Google, Apple, and other Fab Five companies). Nearby is the 1-Year treasury rate trend, now at 4.89%. The impetus to spend cash is lower than it was a year ago when short-term yields were hovering around 1%.

Bottom line: T-Mobile has a “grown up” problem – how to invest excess cash. We are interpreting from the earnings call comments that the company will likely buy back shares, might initiate a small dividend, and perhaps build up savings for a rainy day (or an upcoming spectrum auction). They are unlikely to go hog wild on additional acquisitions or aim for a materially higher debt rating.

What this “grown up” problem means to AT&T and Verizon

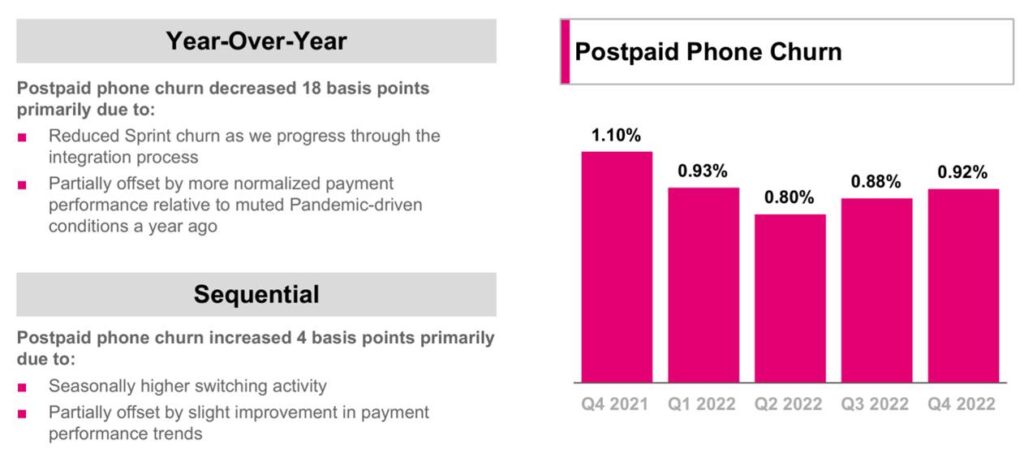

This goes to our fundamental thesis for AT&T and Verizon: T-Mobile has the liquidity to defend their base and launch plans that could dislodge some of the Verizon and AT&T base (T-Mobile postpaid phone churn shown in the chart above). They can steer the industry’s promotional rudder as opposed to being steered by Verizon and AT&T if the resulting action can build additional scale and total value.

How this could play out: We know from recent comments made by Verizon’s CEO, Hans Vestberg, that Verizon is planning on spending less on trade-in promotions and other costs that need to be amortized over long lives (see quote from Hans here on page 8 of their 4Q 2022 earnings transcript – it’s clear that they would like more ad-related or period promotional expenses as opposed to long-duration or trade-in expenses).

T-Mobile launches a free device (and perhaps free Home Internet?) promotion next Holdiay season focused on families, showering switchers with premium devices and a money-back guarantee (like MCI promoted in the long distance days – “we’ll switch you back for free”). This forces the hand of Verizon to match that promotion to retain those customers.

T-Mobile also co-opts AT&T’s existing customer strategy to a tee, eliminating any opportunity for family switchers to be enticed by Ma Bell’s offers (re: If Hans’ comments are to be believed, Verizon is not going to initiate aggressive trade-in promotions).

Bottom line: T-Mobile has more flexibility than ever to play offense and defense. Our guess is that they will find willing customers across several segments, including rural. Dislodging the AT&T and Verizon loyal bases will be difficult, but free upgrades could do the trick. T-Mobile (and Sprint) move from the hunted to the cash-rich hunter, and that’s the largest change in wireless in 2023.

In our next Brief, we will discuss Comcast’s outlook and assess the overall state of the cable MVNO business (Altice, the last of the large publicly traded cable companies, releases their 4Q 2022 earnings on February 22). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a terrific remainder of February and Go Chiefs and Davidson Wildcat basketball!