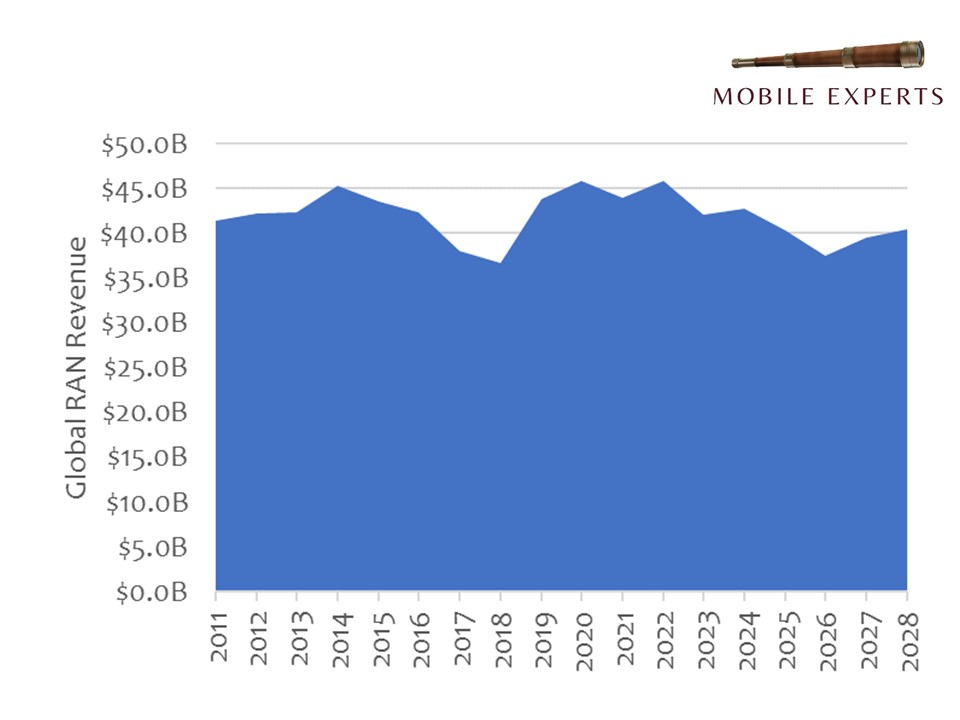

Yes, the market for Macro and Massive MIMO infrastructure will drop dramatically through 2027. But that drop will be offset by small cells, software, millimeter wave, and private cellular investments. In fact, with a rebound expected from new spectrum bands in 2028, our new report is showing an overall CAGR in the mobile infrastructure market of -2% through 2028. Not so scary after all.

At the end of every year, we collect data on base station and small cell shipments, as well as data on antennas, software revenue, and several other areas that affect the Radio Access Network market. Basically, we have 12 detailed segments of the market that we track and we put them all together in one place. Now that we’ve compiled the results for 2022, our conclusion is clear: the 5G wave is peaking and shifting this year.

On one hand, the industry is simply following the natural ‘waves’ of deployment for each “G”. We’ve been deploying 5G globally for 4 years and there’s an established pattern of about 4-5 years of growth followed by 4 years of decline. But the interesting part of this story is how the market is shifting. Instead of simply buying fewer base stations, operators are demanding changes to the architecture (such as Open RAN and vRAN), and they’re focusing more on software upgrades instead of new hardware.

As we break down the results, we expect to see a -6% CAGR drop in the “Macro” segment (including massive MIMO, hardware and software for high power systems below 20 GHz) in the global market. Consistent with previous “G” waves, the drop will be most pronounced in China, where the market typically drops in half after government goals are met. Outside of China, the RAN market will remain smoother, but will shift from high-performance, high-value applications to the cost-sensitive segment of the market.

The second half of every “G” is the painful part of the cycle. The major surge of deployment is finished in the high-value markets where premium prices can be paid for performance. Developing countries come late to each “G”, and their low-ARPU cost pressures force everyone to consider very low prices for the RAN equipment.

For 2023, we’re seeing a painful 35% drop in pricing for 5G base stations in India. Fortunately, the OEMs are ready for the price shift and have established a low-cost manufacturing basis for 5G where the ASICs and software are already basically paid down.

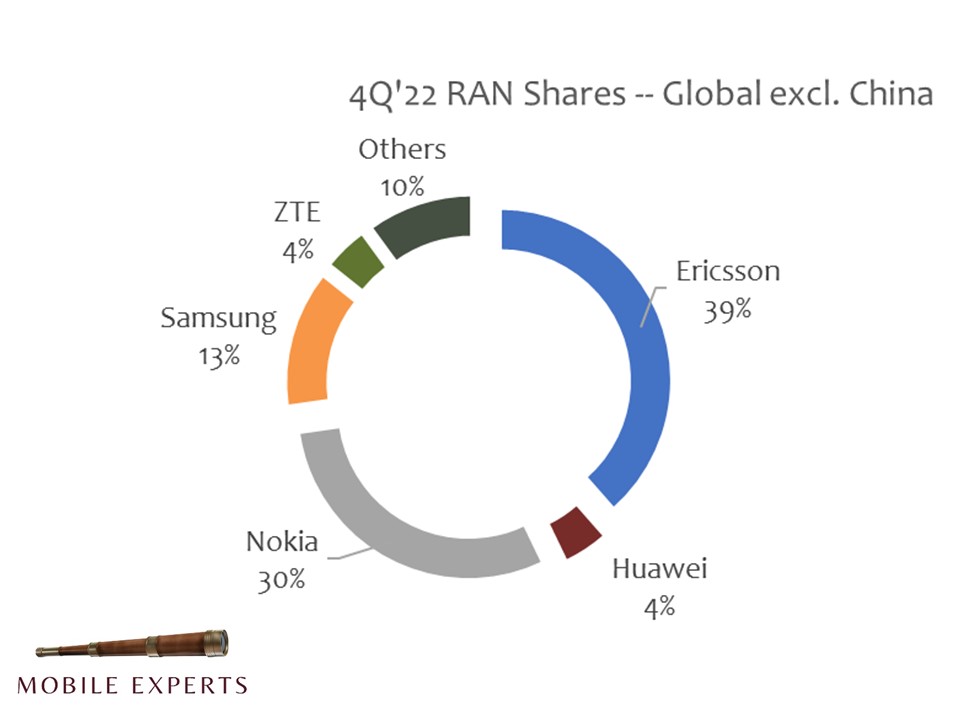

Because the big RAN OEMs are prepared for the market shift, we see them holding on to their market share quite well. Ericsson hit 39% market share in 4Q’22 for the RAN outside of China. Nokia and Samsung also posted great numbers. We’re tracking 25 other RAN vendors that are rising, but these top three vendors are solid so far.

The best part of our outlook comes from the private wireless market. Even though RAN sales for public telco networks will drop by 3% CAGR through 2028, the Private LTE/Private 5G opportunity will grow by an average of 14%. In other words, the mainstream market will lose $8B over the next five years but the private market will add almost $3B.

In my old life, making equipment in the RAN market, the crash of 2000/2001 was bloody. The market dropped by 18% in one year. The next crash in 2008 was shorter but almost as bloody. Today, it appears that the market is richer and more diverse, and I’m looking forward to a market with software upgrades and private 5G opportunities that can offset the ups and downs of the equipment market long into the future.