Greetings from the Southeast and the Midwest as winter transitions into spring. In this Brief, after a full market commentary, we will provide a retrospective on larger macro trends since the 2020 shutdown (pictured is Bossy Beulah’s, a favorite lunch spot during COVID that we also visited last weekend while in Charlotte). Not surprisingly, many lingering effects of COVID drive today’s economic headlines.

The fortnight that was

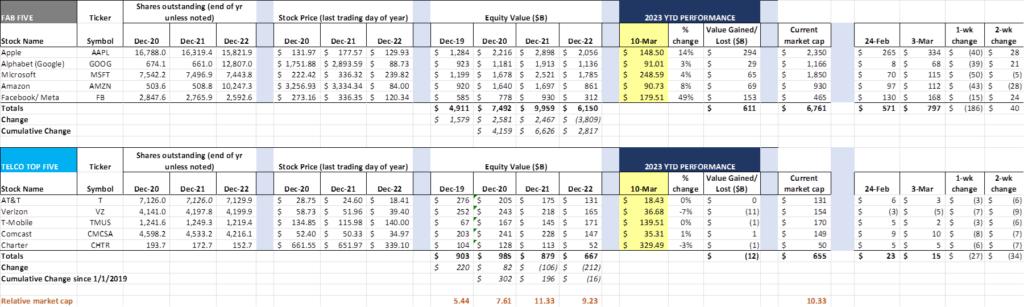

The last couple of weeks were tough for the markets in general and for the Fab Five (-$186 billion last week; +$40 billion last two weeks) and the Telco Top Five (-$27 and -$34 billion) in particular. The market is seemingly grasping at straws, looking for any sign that the Federal Reserve will stop interest rate increases. Yet rates appear to be on the path to rise again this month, likely by 50 basis points.

Even the Silicon Valley Bank’s poor Treasury bond investment decisions documented here by Bloomberg do not seem to be having much of an impact. Next week, we will likely see continued core inflation increases tracking between 5 and 6%, and last week’s jobs report clearly showed that job growth is mirroring the rate prior to the COVID outbreak in March 2020.

At the same time each of the Fab Five is still up for 2023, with the aggregate market capitalization increase at $611 billion. As we have explored in a previous Brief, each of the Fab Five continue to have plenty of cash to weather the most severe economic storm, and each company is pruning projects (and staff) to make sure that cash flows continue to be strong.

One of the Fab Five scored a major victory in late February when the FTC announced that they would not be pursuing a lawsuit to block Amazon’s $3.9 billion acquisition of One Medical (CNET article here). For those of you who are not familiar with One Medical, the company, per the article, “runs a chain of more than 150 primary care clinics in more than a dozen US cities and offers online and mobile services, [which] will greatly expand the primary care services Amazon is already offering through its Amazon Care brand.” Amazon closed their acquisition on February 23rd, and within hours, the One Medical product was prominently featured in Amazon feeds across the US (see nearby picture).

As the Valley copes with the SVB closure, we asked ourselves “Will the FTC/ DOJ allow the larger companies to use their balance sheets to fix the current liquidity crisis?” Specifically, will Apple/ Meta/ Google/ Amazon/ Microsoft be allowed to purchase the convertible debt (loans are assets for banks) of companies that could improve their overall market position? Would a bidding war for the convertible debt of an artificial intelligence start-up that includes the Fab Five, for example, yield more money to depositors than simply selling it to another bank or private equity firm? Microsoft, Apple and Google have a combined $378 billion in cash and marketable securities as of the end of 2022 – will they be allowed to use it to extinguish the financial crisis?

We will certainly learn the answer to these and other questions in the next few days. Without a doubt, every treasurer and CFO (and the investors and audit committees that supervise them) are double checking the quality of their banking relationships and requesting additional details on their Treasury liability “debt ladders.” It’s a problem that the Valley can fix if the government will let them.

Finally, there were some big changes at Verizon since our last Brief (announcement here). Most importantly, their CFO, Matt Ellis, is leaving after nearly seven years in the role (the longest-serving CFO in Verizon’s history). To telecom veterans, having the CFO of Verizon leave is a big deal, given their Finance-led culture.

Days after the announcement, Matt spoke at the Morgan Stanley Technology, Media, and Telecom Conference (full transcript here). While he spoke on a variety of topics (including the personnel changes), his most telling comments concerned the Tracfone acquisition. When asked about using Tracfone as a source of postpaid net additions, he gave the following response:

“…as those customers are ready to move from prepaid to postpaid, we can keep them within the family is an opportunity that we didn’t have in its past that we have now. So I’d say the integration of TracFone has a little more work to do, a little bit more than we initially anticipated. Obviously, some of the things going on with consumer over the past 12 months or so how to carry over to the TracFone integration. But the team in the value segment today has a plan. They’re executing in ’23 and they’ve been good, I think in a good place as the year goes on, you’ll see better performance in the second half of the year than the first half of the year in the value segment.”

We expect to see more amplification of the value of the Tracfone base as they seek to address the value segment. It’s interesting to hear Verizon admit that they underestimated the level of effort to integrate Tracfone into the core Verizon Consumer organization. Given the growing pressures for the Consumer organization to perform, it’s going to be interesting to see how the prepaid-to-postpaid migration is handled (Note: for a more lengthy and historically-based view of the Verizon transition, have a listen to this “Week with Roger” podcast featuring Recon Analytics’ Roger Entner).

The dust settles—telecom after COVID

To many of us, 2020 seems like a long time ago. Essential worker designation, mask/shield mandates, safe distances, quarantines/ quarantinis, “take out” everything and family Zoom calls quickly became a part of our COVID routine. For those of us who had the opportunity to go to an office, the commutes were extra short and the offices extra sparse. It was surreal, frightening, and challenging.

During this time, we began to think about the impact of the pandemic on the telecom industry. On one hand, Verizon’s announcement to give away a free year of Disney+ in 2019 (announcement here) seemed like a stroke of genius – customers received a pandemic perk simply for being a postpaid customer. This was quickly followed (Aug 2020) by the incorporation of the full bundle of Disney+/ Hulu/ ESPN+ into select plans. As one Verizon senior executive told us at the time “We had no idea how important the bundle would be in 2020.”

Despite eviction moratoriums, stimulus checks, student loan payment deferrals and SNAP/EBT enhancements, cracks began to show in many parts of the US economy in mid-2020. Jobs were plentiful and paid well if one was willing to take the risk of potential COVID infection. Most Americans, however, were confined to their homes, fearful of mass transit infections and unable to afford a used car (and parking) in an urban environment.

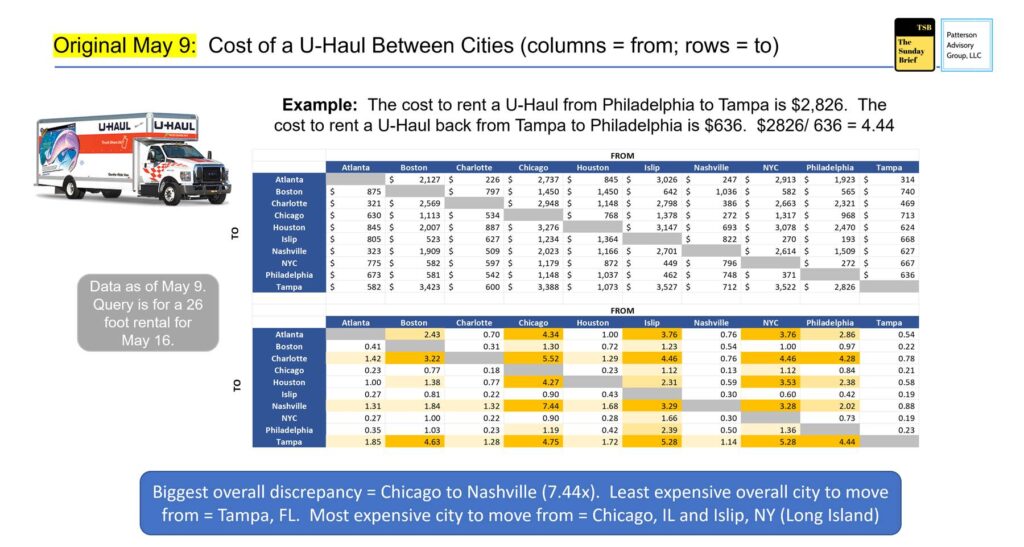

Those who could quickly leave metropolitan areas for other locales, either the suburbs or states that had fewer restrictions. We tracked the U-Haul rates to and from various markets during the pandemic as a proxy. Here was the chart from May 2020:

Today, the cost for the same van from Philadelphia to Tampa is $4,270 (+50% in three years) while the return trip is $1,374 (+116%). More details can be found here. The ratio is still above 3x today, despite significant inflation across the moving industry. The post-pandemic pace slowed from an outright panic to a significant concern.

Job creation followed those moves. Our focus at the time (and it continues today) is not the unemployment rate but rather the total number of employed workers in a particular state. This provides an indication of the rate base health in a particular state (more employed workers paying property, corporate, or personal income taxes is better than the alternative). Population and disposable income growth today drives more wireless and fiber infrastructure tomorrow.

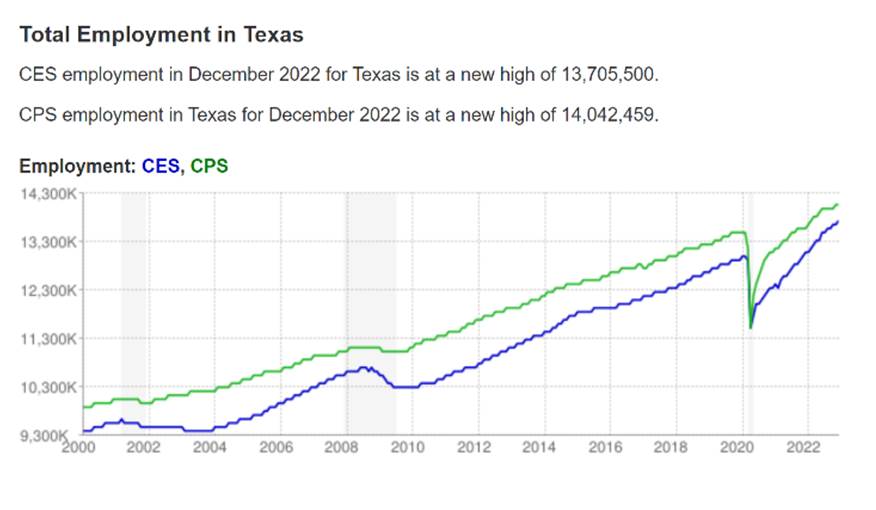

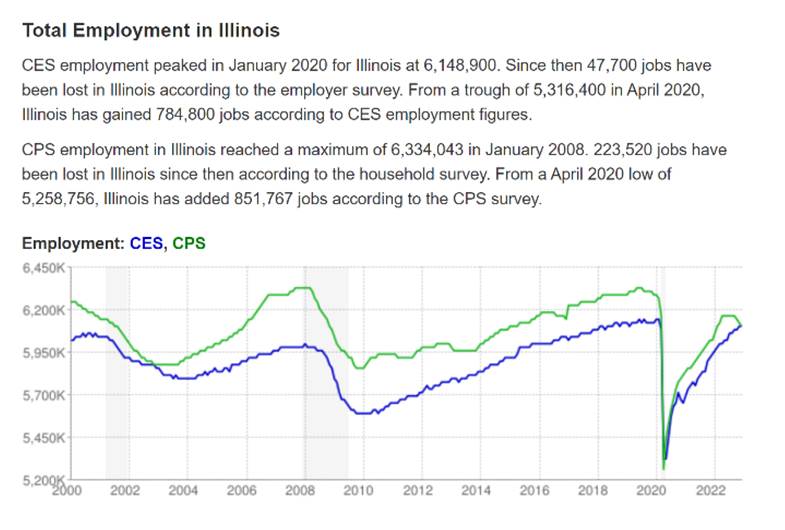

Nearby are the long-term (20+ year) employment charts from the Department of Numbers (data here) for Texas and Illinois. As a reminder, the Current Population Survey (CPS) and Current Employment Statistics (CES) are the broadest and most consistent measures of historical employment levels. While there are differences in their methodology and sample sizes (CES, also known as the payroll survey, is comprised of several hundred thousand businesses), they usually display the same trend.

These two charts clearly show the migration from North to South (and West). Texas employment levels are at record highs, up 33% since the end of 2010. While 2-2.5% annual growth of employment over the last decade seems like a small number, it’s significantly higher than the 1.5-1.7% annual growth rate for the US in total. When one state grows employment 25-35% more than the national average every year for a long period of time, it inevitably will come from other states.

Two of those losing states are Illinois and New York (Illinois chart nearby – New York chart here). While the bounce back from the depths of the COVID pandemic are impressive, they merely get the “Land of Lincoln” back to pre-pandemic levels (New York’s employment had not achieved that goal as of December 2022).

Employment growth prospects mean everything to states. Highway planning and construction (a Texas core competency for those of us who have lived there) closely follows population projections. Nearly all municipal projects (new schools, new sewers, new water towers) are based on population and employment projections. Growth confidence (based on current evidence) begets new infrastructure construction. It is occurring across Texas, Colorado, Florida, and other states. It’s a lot harder to make that case for New York and Illinois right now.

As COVID-relief programs sunset (student loans being a hot topic, but also eviction relief and COVID-linked additional SNAP benefits ending), the probability that emigration back to metropolitan areas will occur in 2023 and 2024 is diminishing. Cities and states are now learning to cope with permanent taxpayer shortfalls.

What does this mean to telecom? First and foremost, new infrastructure will follow population growth. Here is a chart of the 25 fastest growing areas in 2022 according to US News & World Report:

- Florida – 11 markets: Lakeland, Sarasota, Ft Myers, Ocala, Port St. Lucie, Daytona Beach, Naples, Melbourne, Jacksonville, Tampa, Orlando

- Carolinas – Five markets: Myrtle Beach, Spartanburg, Charleston, Raleigh/ Durham, Charlotte

- West – Five markets: Boise, Phoenix, Spokane, Las Vegas, Reno

- South – Two markets: Huntsville, Austin

- Everywhere Else – Two markets: Fayetteville (Arkansas) and Salisbury (Maryland)

There’s little doubt that fiber and wireless deployments will proliferate in Florida over the next decade (good news for AT&T, Comcast, and Spectrum (Tampa/ Lakeland/ Orlando). It’s a lot harder to make that statement about other areas of the country.

Second, the value segment is going to become even more important to the largest wireless providers. As we mentioned in our 2020 Briefs, things were already getting tight for lower-income families prior to the pandemic. Inflation (particularly food, fuel, transportation, shelter and insurance – see latest report here) has worsened their standard of living. Next week’s Consumer Price Index report will likely show that stubbornly high prices persisted on many necessities.

We think that the value segment focus is already becoming a higher priority for Verizon given the comment above from their outgoing CFO. Given cable’s market share (which extends across many segments), we think that their wireless-broadband bundle (particularly Charter’s Spectrum One product) is going to be increasingly embraced.

But this offers new opportunities for MVNOs such as Mint Mobile, Boost, and Straight Talk (and maybe segment-specific providers like Consumer Cellular) to partner with smaller fiber providers and cable companies who do not currently have an MVNO offering. Given the tenuous nature of the Affordable Connectivity Program (ACP) funding status – see Light Reading article here – more cooperation between providers is likely needed.

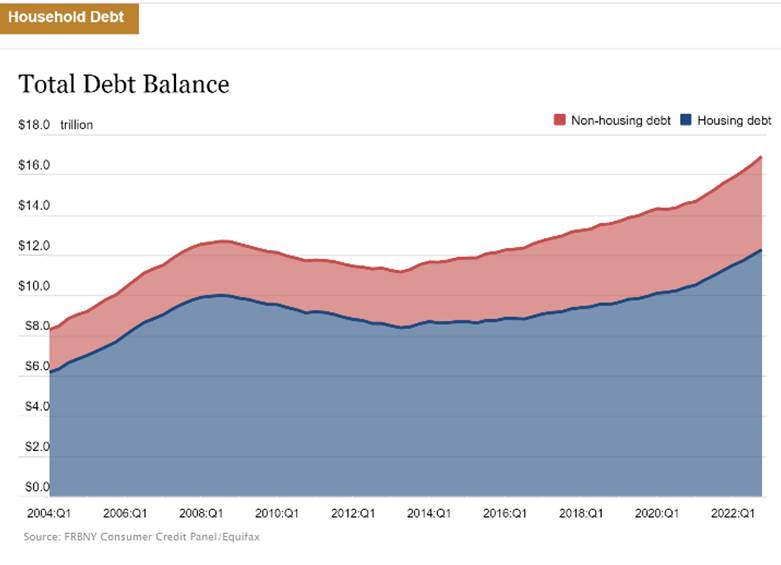

Lastly, it’s important to understand the impact of higher interest rates. As we mentioned in the last Brief, fewer moving events is a notable headwind to cable gross additions. Credit card usage continues to grow (see article from the New York Fed here and nearby picture) and delinquencies are on the rise, albeit from historically low rates (see chart here). As more of the middle class slips into “paycheck to paycheck” mode, economizing takes hold. With this comes lower family plan wireless and streaming services spending, and potentially fewer broadband upgrades.

Bottom line: The dust is beginning to settle nearly three years after the COVID shutdowns began. More aftershocks will follow heightening anxiety levels, and personal and corporate budgets are going to become tighter, not looser, due to lower confidence in future economic conditions. Many more people will stay where they are and not rejoin the city/ metro lifestyle, leaving very difficult choices for some urban areas. While deteriorating economic conditions initially favor well-heeled incumbents with strong cash flow, we should also see many new innovative companies emerge. Many areas will boom, while others will face an economic jolt. The telecom industry’s future will likely follow these trends with size and scale increasing in importance along with innovation. We survived COVID, but the resulting world changed – a lot.

In our next Brief, we will attempt to frame the first quarter earnings picture (there are a lot of variables). Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a terrific remainder of February and Go Royals, Sporting Kansas City, and Davidson Wildcat Baseball!

*Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband