| jim@pattersonadvice.com |  Mar 26, 2023, 3:21 PM (16 hours ago) Mar 26, 2023, 3:21 PM (16 hours ago) |   | |

to jim |

Greetings from the Midwest as we slowly turn from winter into Spring. Pictured is the Wayne County (Nebraska) courthouse from the week of March 13. Still a good snowpack even as late as last week.

This week’s Brief is the first of a two-part Brief on Q1 earnings. Rather than perform the typical analysis, we summarize what promises to be a full earnings season through a few questions. This week we tackle postpaid phone market share strategies as well as leadership changes. We will tackle others in the April 15th Brief (taking a break for Easter).

It’s hard to believe, but we are quickly approaching the three-year anniversary of the closing of T-Mobile’s acquisition of Sprint. This New York Times article accurately captures the moment. Kudos to the T-Mobile and Sprint teams for minimizing customer fallout over the past three years while building a strong 5G network.

The fortnight that was

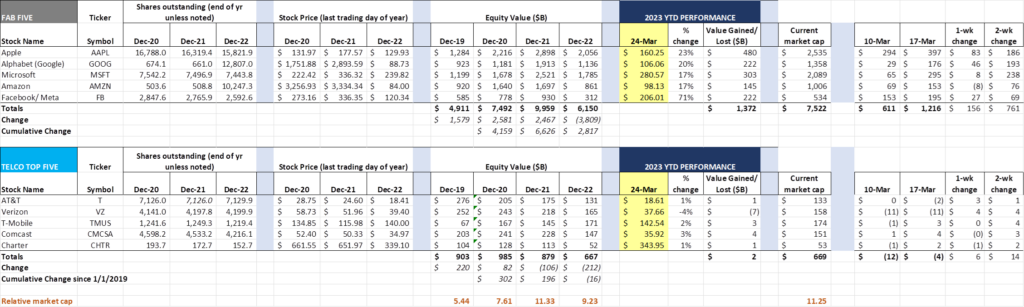

As we discussed in last week’s online-only interim Brief, there was a flight to quality during the height of the recent banking tempest. Over the last two weeks, the Fab Five have gained $761 billion, more than the entire market capitalization of the Telco Top Five. The gains for the week ending March 17 (+$605 billion) rivaled the post midterm-election results last November (+$660 billion for the week ending November 10).

Driving this surge is a high interest in equity stability. Despite the runup each of these stocks (and Meta in particular) enjoyed in January (+$742 billion in value created), when concerns about the global financial system liquidity arose, investors flocked to names which could function as their own banks.

Here’s the net debt picture for the Fab Five as of the end of 2022 (all figures in $millions):

The Fab Five held $489 billion in cash and marketable securities as of the end of the year, with 26% of that as cash (note: not all cash is held in the US – some is distributed for operating cash needs). Each of the Fab Five are in a negative net debt position. Refinancing issues are non-existent. Google had nearly $100 billion more short-term assets than long-term debt. When liquidity is at stake, these stocks are rock solid.

The Telco Top Five are also proving resilient with equity values remaining steady since the beginning of 2023. Each of the Telco Top Five generate strong operating cash flows, more than enough to support near-term debt refinancings.

In fact the biggest news impacting the Fab Five this week came from across the pond when the United Kingdom’s Competition and Markets Authority (CMA) reversed their position that Microsoft must remove Call of Duty from the popular Sony PlayStation system after the Activision Blizzard merger was concluded (announcement here). Here’s why they changed their position:

“The most significant new evidence provided to the CMA relates to Microsoft’s financial incentives to make Activision’s games, including Call of Duty (CoD), exclusive to its own consoles. While the CMA’s original analysis indicated that this strategy would be profitable under most scenarios, new data (which provides better insight into the actual purchasing behaviour of CoD gamers) indicates that this strategy would be significantly loss-making under any plausible scenario. On this basis, the updated analysis now shows that it would not be commercially beneficial to Microsoft to make CoD exclusive to Xbox following the deal, but that Microsoft will instead still have the incentive to continue to make the game available on PlayStation.”

Said another way, the PlayStation operating system is popular with gamers, and they would be fools to hold back Call of Duty distribution. With this key objection removed, the probability of merger approval rose significantly. We anticipate that Microsoft and Activision Blizzard could be one company as early as this summer.

Not far behind the Activision news was the launch of Google’s AI platform called Bard (company blog post on availability here). Google provides the following statement about the quality of today’s service:

“While [Large Language Machines] LLMs are an exciting technology, they’re not without their faults. For instance, because they learn from a wide range of information that reflects real-world biases and stereotypes, those sometimes show up in their outputs. And they can provide inaccurate, misleading or false information while presenting it confidently.”

We’ve had discussions with a broad swath of Brief readers in 2023 about ChatGPT, Bard, and other LLMs. Here are two articles that we think summarize the puts and takes of each (MIT Technology Review here and The Wall Street Journal here). We were also tipped off by some local (Kansas City) experts that LLMs have trouble doing basic things like drawing a hand. Given the bias that is a natural part of any algorithm, we suggest that users don’t abandon common sense and continue to develop cognitive skills of their own.

We end the market commentary on a telecom-specific note not directly related to Telco Top Five earnings. Since the last Brief was published, Lumen announced an exchange notes offering (announcement here). These notes have a seven-year duration and carry a coupon rate of 10.5%. The announcement indicates that there will be a $1.1 billion cap on the total exchange consideration. Bondholders who decide to exchange by March 29 will be given a higher price than those who wait until April 13.

Nick Del Deo at SVB MoffettNathanson wrote an intriguing analysis of the offering (MarketWatch summary here), coming to the same conclusion that we did: While EBITDA stability is a critical 2024 objective, this exchange offering undoubtedly sets up 2027 as the “make or break” year for the company. With Lumen unable to raise equity without significant dilution (current price is $2.41/ share, down from $12.50 reached in mid-May 2022) and debt ratios reaching nosebleed levels (mid 4s leverage at the end of last year), a debt exchange seems like Lumen’s last resort. We will be watching Lumen’s ability to gain market share in enterprise and newly fibered markets very closely and wonder aloud how they will compete against competitive technologies with larger balance sheets.

These notes have a seven-year duration and carry a coupon rate of 10.5%. The announcement indicates that there will be a $1.1 billion cap on the total exchange consideration. Bondholders who decide to exchange by March 29 will be given a higher price than those who wait until April 13.

Nick Del Deo at SVB MoffettNathanson wrote an intriguing analysis of the offering (MarketWatch summary here), coming to the same conclusion that we did: While EBITDA stability is a critical 2024 objective, this exchange offering undoubtedly sets up 2027 as the “make or break” year for the company. With Lumen unable to raise equity without significant dilution (current price is $2.41/ share, down from $12.50 reached in mid-May 2022) and debt ratios reaching nosebleed levels (mid 4s leverage at the end of last year), a debt exchange seems like Lumen’s last resort. We will be watching Lumen’s ability to gain market share in enterprise and newly fibered markets very closely and wonder aloud how they will compete against competitive technologies with larger balance sheets.

First quarter earnings questions (Part 1)

The earnings season will quickly be upon us with Verizon kicking off the Q1 earnings reports on April 25th. As we have done in the past, we think there are several questions that, when answered, will begin to reveal 2023’s winners and losers. Some of these questions are company specific, while others cross the entire industry. Here are two critical questions we think need to be covered:

- With T-Mobile’s integration largely realized (billing integration remaining but plan synchronization nearly complete), the opportunity for a merger-related postpaid wireless switching event is remote. How will Verizon and AT&T increase the pool of switchers without igniting destabilizing counteroffers? What is the ramification of a low-switcher pool to their long-term wireless profitability prospects?

Cable MVNO efforts aside, the vast majority of switching happens between AT&T, Verizon, and T-Mobile. Every once in a while, one of the carriers introduces a technology advantage (e.g., Verizon’s early adoption of 4G LTE) or obtains handset exclusivity on a hot product (e.g., AT&T’s iPhone exclusivity).

Over the last decade, however, Verizon and AT&T have been content to target the higher quality customers of their smaller competitors using a combination of network performance and aggressive “buy one get one” handset deals. Family plans were a particular focus as AT&T and Verizon believed that they could grow Average Revenue Per Account (ARPA) better than other providers.

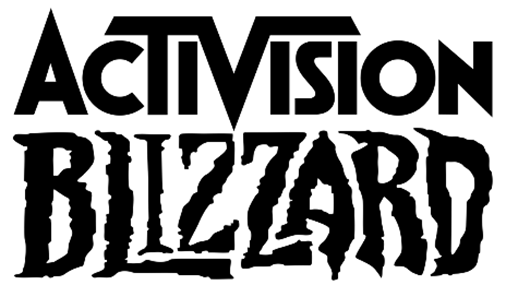

T-Mobile (prior to acquiring Sprint) was able to stem its postpaid churn to other carriers (see nearby graphic which shows the last five quarters of postpaid phone churn prior to Sprint for legacy T-Mobile) by focusing on increasing market share in specific metropolitan centers and developing best-in-class customer service procedures. They quickly incorporated these and other programs into Sprint when their merger completed, and the combined company has been experiencing lower churn for the last two years. Q4 2022 postpaid phone churn for T-Mobile was 0.92%, comparable to T-Mobile’s pre-merger churn levels.

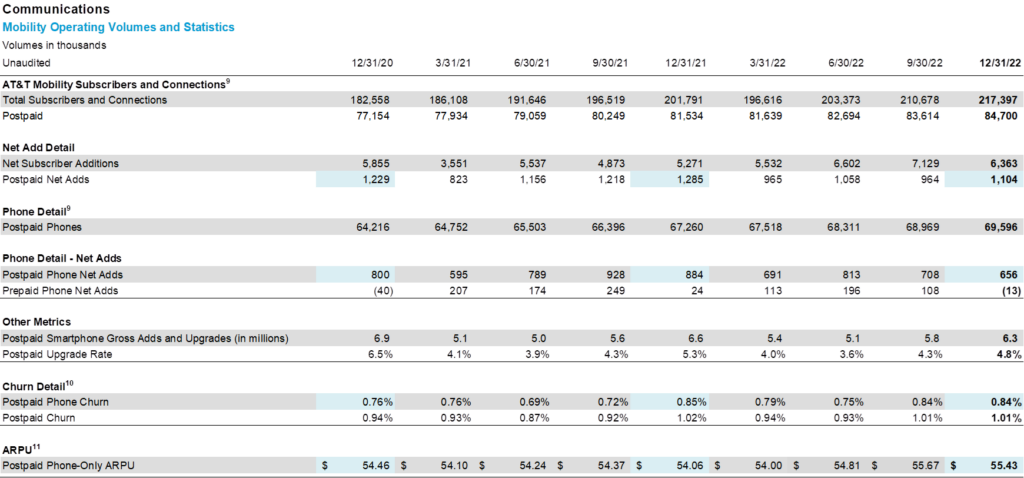

How will AT&T answer this question remains to be seen. Their retention strategy has been terrific, but their acquisition strategy (except for FirstNet) is vague. Here are the latest postpaid phone statistics from AT&T:

Note the churn elevation (likely driven by initial Apple phone offers by competitors in 3Q and 4Q). While it’s a little dangerous to compare anything between 2021 and 2022, a 25% drop in net additions is worrisome, especially when it’s coupled with higher postpaid phone churn.

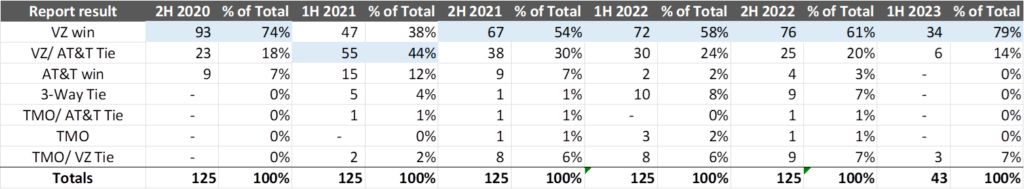

The bigger concern for AT&T is that their network competitiveness appears to be waning in the RootMetrics RootScore Metro reports. Here is the latest tally of wins as of March 24, 2023, and comparison to their performance over the previous two years:

AT&T peaked with 15 outright wins in the first half of 2021 (FirstNet deployments largely complete by then) – the sum of AT&T outright wins and ties were greater than Verizon’s outright wins. By the end of 2022, Verizon was back on top, and from the date the 1H 2023 results that have been released, Verizon’s lead versus AT&T appears to be getting stronger.

In the largest metropolitan centers (some with a considerable amount of AT&T fiber deployed due to their incumbent local exchange carrier status), Verizon holds an even larger lead. Atlanta, Charlotte, Indianapolis, Jacksonville, Los Angeles, Nashville, St. Louis and other prominent AT&T cities are some of the 34 outright wins noted above.

RootMetrics is only one source (with individual handset testing as opposed to crowdsourced data), but other testing sources (Ookla here, Umlaut here) do not bolster AT&T’s case. Bottom line: We aren’t sure how AT&T answers this question, and see Ma Bell (and Cricket prepaid) vulnerable to both T-Mobile and Verizon’s local marketing machines. AT&T needs to aggressively bundle with fiber, and soon, if they are going to have meaningful market share gains.

- There have been many management changes over the last year at Verizon, Comcast, Charter, and, to a lesser extent, AT&T. How are these changes impacting the velocity of strategy execution?

Getting a new boss is never a dull event. Each change triggers a reevaluation of processes, products, and competitiveness, which in turn triggers subsequent reorganizations. The resulting uncertainty (“should I continue to be working on ______”) can lead to lower productivity. This in turn can lead to missing opportunities and, even worse, downturns in performance. Competitive vulnerability increases.

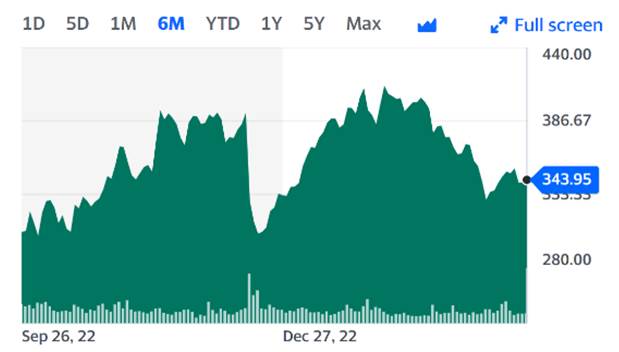

With Charter’s change in leadership came the announcement of an acceleration of rural builds (held December 13, 2022 – comments in the January 1, 2023 Brief here). The next day, Charter suffered its single largest daily loss since it emerged from bankruptcy (see nearby 6-month stock price chart). This transition occurred when a seasoned veteran and former CFO, Chris Winfrey, took the helm. What could happen when a transition from one business unit to another occurs (as is the case with Verizon’s Sampath Sowmyanarayan making the move from Verizon Business), or a new CFO replaces Matt Ellis, who has a different view of the cable MVNO relationship (or the capital budget)?

One that still has us scratching our heads is the movement of Kyle Malady from President of Global Networks and Technology to CEO of Verizon Business. Kyle is an excellent technology leader who can speak to Fortune 100 CEOs with authority. His long-time lieutenant, Joe Russo, is taking his place running the network organization. Continuity of vision and execution could not be greater. Why, then are we scratching our heads?

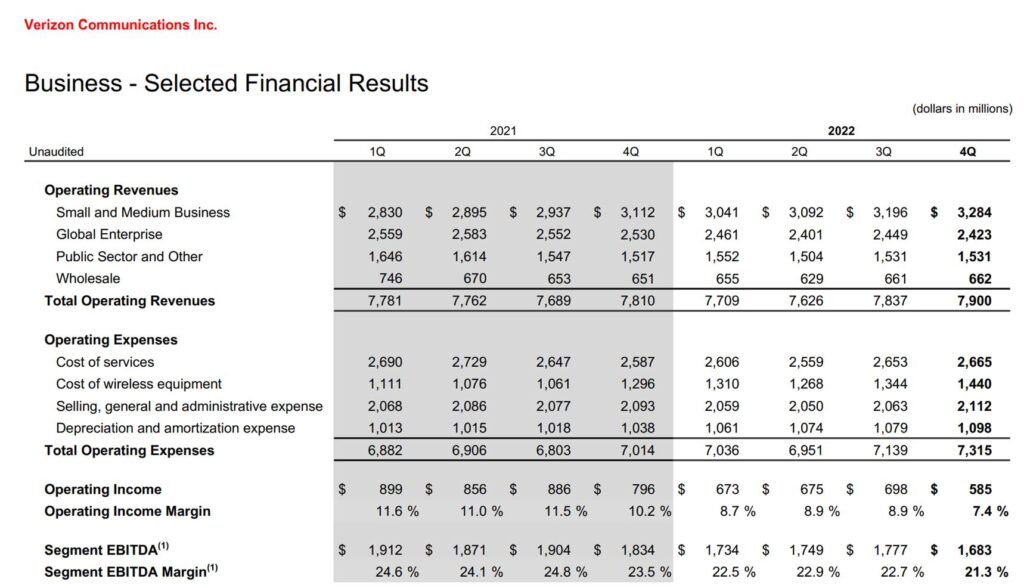

To summarize our thinking, here are the last nine quarters of Verizon Business results from their latest earnings release:

Revenues are up, driven by the recovery of small and medium businesses (which is supported by the strong wireless network results cited earlier). But the cost of services (most of which consists of the cost centers that Kyle managed or influenced in his previous role) is growing even faster (we are assuming that the impact to Verizon’s internal gross margin is likely over 100 basis points on a year-over-year basis).

No doubt that Kyle can drive a good conversation with other CEOs and accelerate Verizon’s efforts to make edge computing a reality. But can he reduce network costs and continue to drive sales productivity? Can he make sales personnel changes that grow Verizon’s addressable market? Can he drive new channel partnerships that might prove to be a more profitable alternative to hiring more sales associates? Verizon Business is bleeding badly and needs a transfusion, not physical therapy. As we noted in the previous Brief, for more on this topic, check out “The Week with Roger” podcast featuring a long-time friend of the Brief, Roger Entner of Recon Analytics – it’s a slightly different take, but very relevant points about the changes occurring at Big Red.

Some transitions will be easier than others (e.g., the rise of Mike Cavanagh to be Comcast’s President and Jason Armstrong to be CFO), but every change has the potential to increase competitive vulnerability. We think that AT&T and T-Mobile have the most stable leadership teams and have the ability to keep their respective organizations focused.

That’s it for this week. In our next Brief, we will continue our “Questions” theme and address the thorny issues of broadband demand (fixed wireless vs. wireline) and the increasing role prepaid wireless will play as a result of recent Tracfone and Mint Mobile acquisitions. Until then, if you have friends who would like to be on the email distribution, please have them send an email to sundaybrief@gmail.com and we will include them on the list (or they can sign up directly through the website). Have a terrific end to the quarter and Go Royals, Sporting Kansas City, and Davidson Wildcat Baseball!

*Note: The opinions and projections in this Brief are solely those of the Patterson Advisory Group and may not reflect those of Fastwyre Broadband.